What is FDV and why is it important?

FDV (Fully Diluted Valuation) is a statistical representation of the maximum value of a cryptocurrency project, assuming all of its tokens are already in circulation.

In recent years, startups have often issued a small fraction of their total coin supply. The small volume of tokens in circulation makes them scarce, keeping the price relatively high initially. This can also be fuelled by bullish market sentiment, hype surrounding the project and news of large investments by well-known companies.

In line with the cryptocurrency platform’s monetary policy, an increasing number of tokens will gradually enter the market. If there is no corresponding increase in demand, the price of the asset falls.

Investors who do not take into account future changes in the supply of tokens may suffer losses.

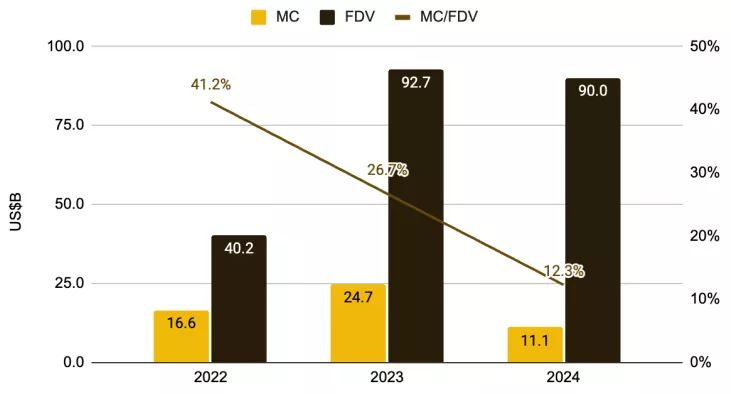

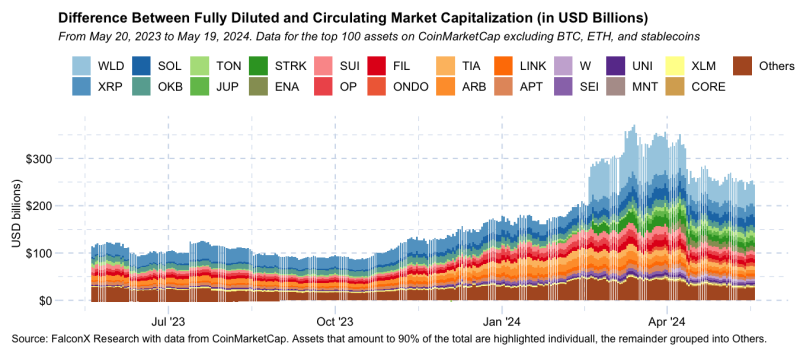

The chart below illustrates the rapid decline in MC/FDV – the ratio of market capitalisation to fully diluted valuation.

Over the past three years, the imbalance has worsened significantly. The value of 12.3% of the indicator means that a huge number of tokens from new projects will flood the market in the future. According to the calculations of the researchers at Binance Research, in order to maintain the price stability of these coins, the growing supply will have to be absorbed by the volume of demand for about $80 billion.

According to an expert nicknamed Flow, over the past six months, 80 per cent of tokens from new listings on Binance have lost value compared to the day they started trading on the exchange.

How is FDV calculated?

The indicator takes into account the total supply, not just the assets in circulation. Information about the monetary policy can be found in the project documentation, in the Tokenomics tab of the CoinGecko website pages, in the Etherscan service, in the details of smart contracts of issued tokens, etc.

The metric is calculated by multiplying the current price of a cryptoasset by the total (or maximum – total supply) supply. The latter figure includes tokens awaiting distribution through unlocks (“unlocks”), but excludes coins removed from circulation through burning. To better understand this, we can draw a parallel with the total number of shares of traditional companies outstanding on the stock market.

Essentially, FDV is a hypothetical measure of an asset’s market capitalisation, assuming that all tokens (excluding burned tokens) are in circulation in the cryptocurrency ecosystem.

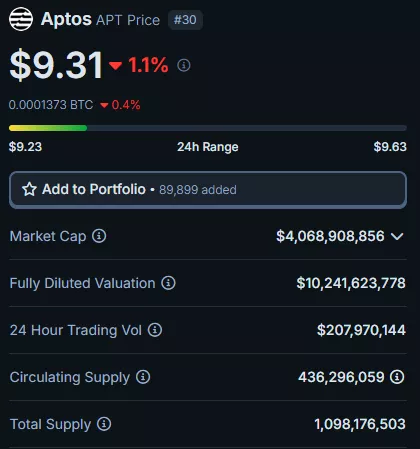

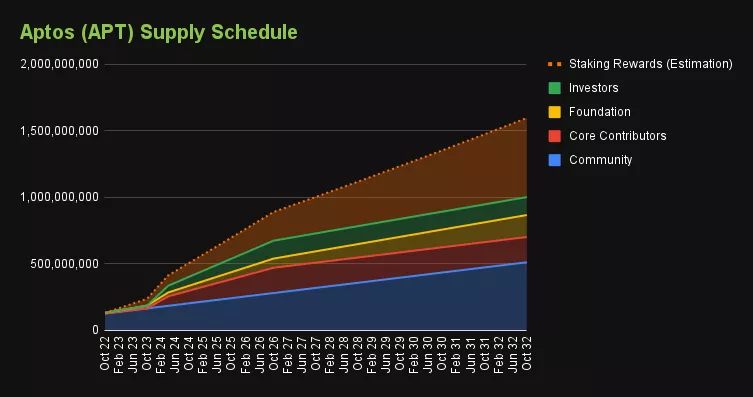

For example, on 29 May 2024, the price of Aptos is $9.3 and the total supply is 1,098,176,503.

APT token FDV = $9.3 * 1,098,176,503 = ~$10.2 billion, with a capitalisation of $4.06 billion.

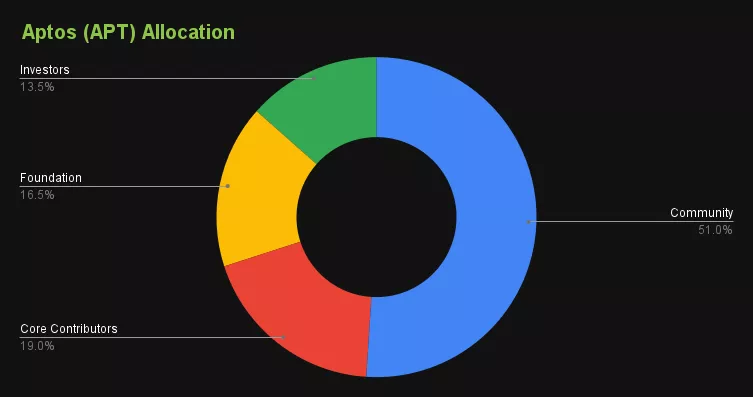

For a more in-depth analysis, on the same page of the CoinGecko service, under the Tokenomics tab, you can explore the Aptos allocation.

Below is a graph of the distribution of APTs among the various ecosystem participants.

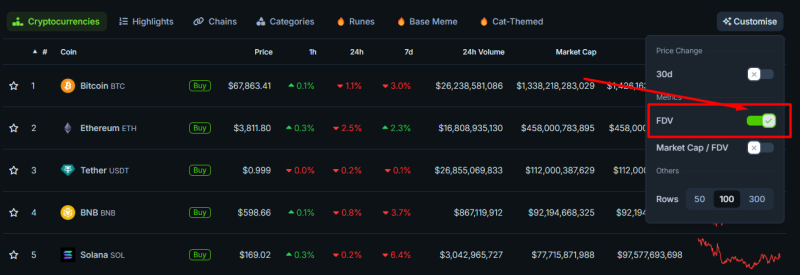

On the main page of the Analytics service, you can select Customise and enable the FDV option. The rating will then display the fully diluted asset valuation alongside prices, capitalisation, trading volumes and other data.

For some coins, FDV data is not available as they have no issuance limits.

The service also supports the Market Cap/FDV metric. This shows how close the market capitalisation figure is to the fully diluted valuation. For example, if Market Cap/FDV is 1 or close to it, then all or almost all of the coins are already on the market (this is typical for most meme tokens).

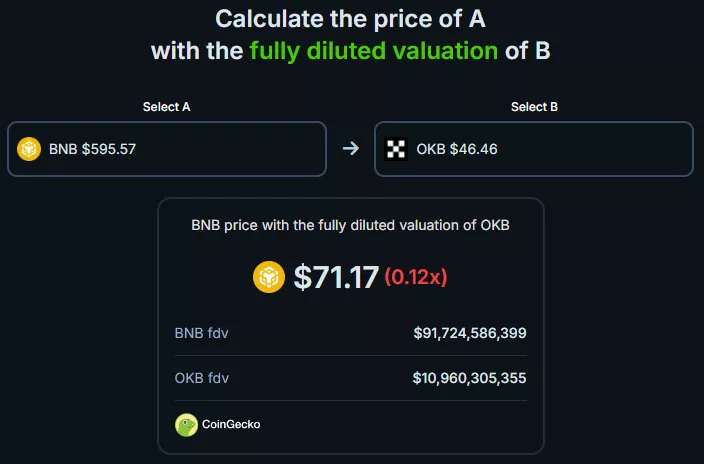

How do assets compare on FDV and other important parameters?

CoinGecko offers a handy feature to compare coins by FDV and market capitalisation.

To assess the potential of crypto projects, it is advisable to compare coins from the same sector or related categories.

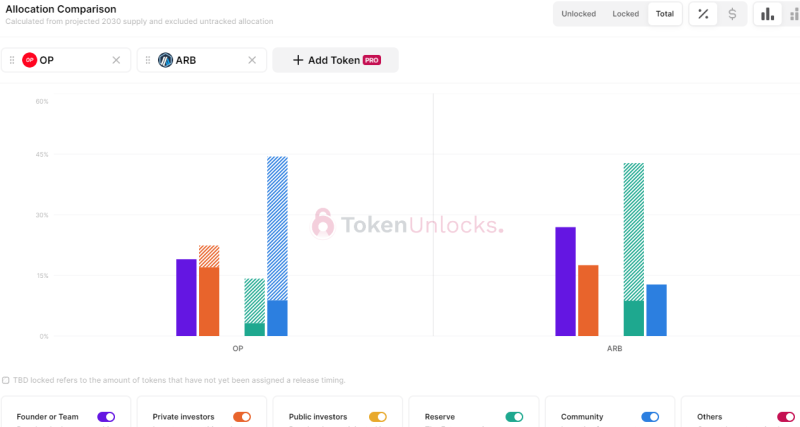

If you need a more in-depth analysis, you can use the TokenUnlocks tool. It shows future coin inflows into the market by different categories of ecosystem participants.

Future coin unlocks of different projects can be viewed on the corresponding page of the DeFi Llama service.

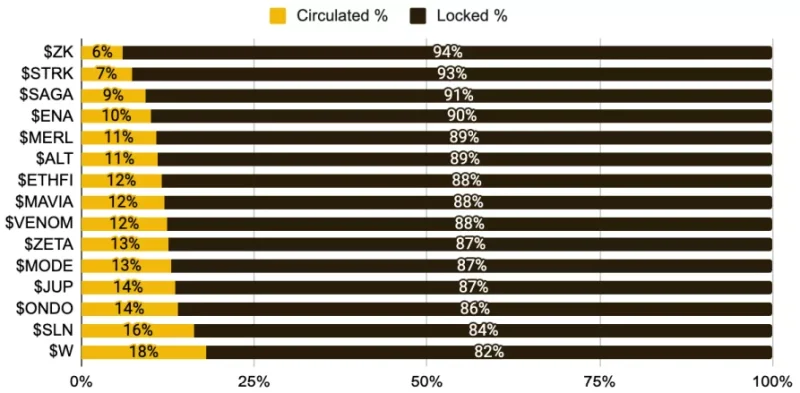

Many useful insights can be gleaned from various analytical reports. In one such document, Binance Research researchers presented a number of recently launched coins with extremely high FDVs relative to the actual market supply.

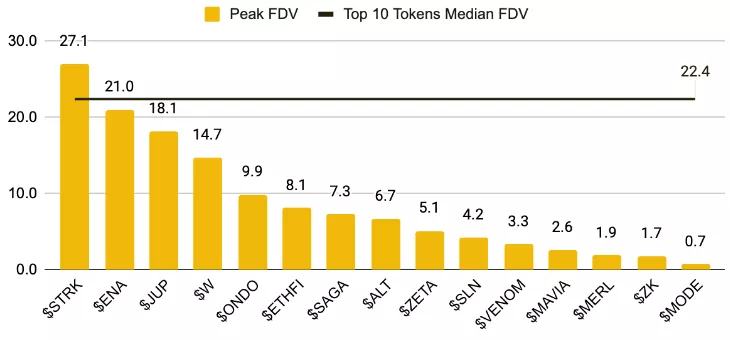

Limited market supply of new assets creates a shortage, fuelling price and FDV growth. Peak performance can equal the metrics of leading, long-established projects.

The chart below illustrates how, at one point, the fully diluted valuation of the STRK token exceeded the corresponding median of the top 10 tokens (excluding BTC, ETH and stablecoins).

The gap between FDV and the market capitalisation of the top 100 projects in CoinMarketCap’s ranking is significant – $250 billion. 90% of this amount is accounted for by 22 tokens; Worldcoin (WLD) alone accounts for 19%.

How does FDV differ from market capitalisation?

Market capitalisation and fully diluted valuation are similar but not at all identical metrics.

The first metric is the product of the project’s outstanding tokens by the coin price. The growth of the latter directly affects the market capitalisation.

FDV is the product of the token price by the total supply of coins, including those not yet released to the market.

If all of the project’s coins are already in circulation, the market capitalisation and fully diluted valuation will be equal to each other.

Some projects with a small “marketcap” may unlock a significant portion of tokens in the near future. In such cases, FDV and issuance parameters become key factors in the future price of the asset.

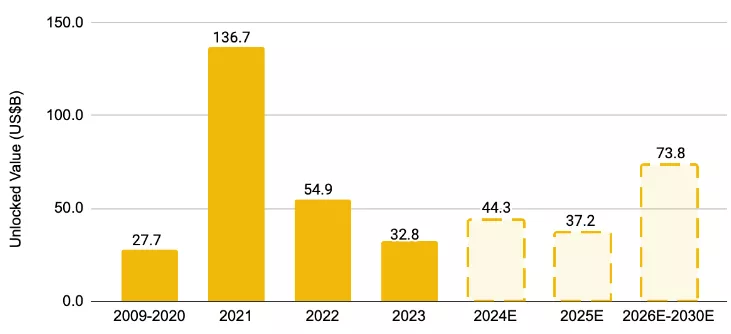

According to the Token Unlocks report, the total value of token unlocks will be around $155bn by 2030.

Why do many new crypto projects have high FDV?

With the current bull market, investor activity has increased significantly. However, a significant influx of capital has also led to a corresponding increase in the influence of venture capital funds in shaping the valuation of new crypto projects. As a result, tokens are often overvalued by the time they reach the public market. The hype around the next “Ethereum killers” is also fuelled by large funding rounds involving well-known industry players.

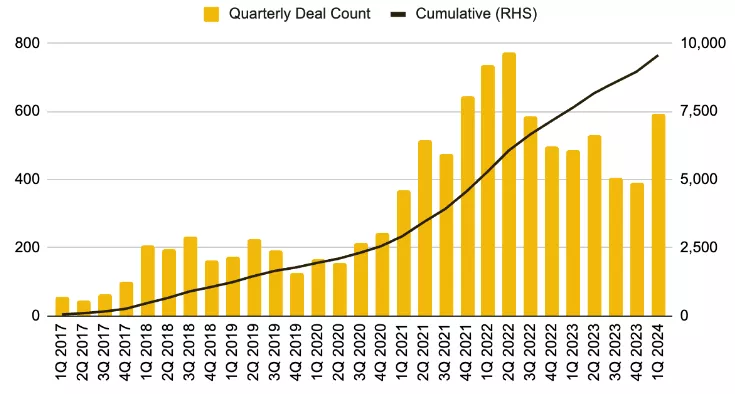

Another factor is that market sentiment is improving as the bull phase develops. This, in turn, is contributing to a revival in deal activity and an increase in forecasts of potential investment returns.

The chart below illustrates a 52% year-on-year increase in the number of venture deals in the first quarter of 2024.

The increasing influx of funds into the industry inevitably increases the valuation of many projects. As a result, tokens are already overvalued by the time they reach the public market. In fact, large funding rounds in the private market lead to multi-billion dollar valuations of projects at the outset, making it difficult for most public market players to benefit from future growth.

Binance Research believes that investors should prefer to continue to invest during a bull rally – higher valuations boost the performance of venture capital funds. Projects themselves also benefit from raising significant funds, as it provides them with working capital without significant dilution.

Why is fundamental analysis important?

In the current market conditions, it is crucial for investors to be selective. The likelihood of generating sustainable returns by buying ‘hot’ tokens is low, as many projects are already highly valued at launch. However, most of the potential gains are likely to have already been distributed to early adopters.

Market participants should carefully analyse projects and develop their own investment strategies, taking into account their individual risk appetite.

Key issues to watch:

Tokenomics: Unlock schedules and vesting periods have a direct impact on the supply of tokens in the market. Without a corresponding increase in demand, excessive selling pressure drives prices down;

Valuation: the FDV metric alone is of little value. It is more useful to compare ratios (e.g. market cap/FDV, FDV/TVL), taking into account the time factor;

Product: it is important to consider the stage of the product lifecycle and its product/market fit. It is also important to observe user activity, address and transaction dynamics;

Project team and community: experience of the founders and their contribution, community involvement.

Projects should take a long-term view when making decisions.

Tokenomics

Launching a project with a low number of tokens in circulation and a high FDV can initially create a price pump due to limited supply. However, subsequent unlocks are associated with significant selling pressure, hurting loyal token holders. Poor performance could also deter new entrants to the ecosystem.

Token distribution and unlocking schedules should be carefully considered. To mitigate inflationary risks, teams can consider burn-in mechanisms, aligning vesting schedules with set milestones, and increasing the initial number of tokens in circulation during the TGE.

Product

A viable product is key to value creation, user retention and sustainable growth. Having at least an MVP before releasing a token to the market helps investors and users understand the project’s value proposition and product/market fit.

A significant user base can contribute to a successful TGE, build trust and attract investors. In the long run, a quality product will increase the intrinsic value of the token and contribute to its market price.

What other ways are there to deal with high FDV?

Binance Research’s study on the consequences of high FDV of many new tokens has caused quite a stir in the community. In response to several publications criticising the new trend, the largest cryptocurrency exchange has slightly changed the criteria for selecting projects for listing, including through the Launchpool and Megadrop platforms.

The main theses of Binance’s decision:

Small and medium capitalisation projects from all sectors will be selected;

Moderate volume of tokens in free float at the time of the TGE;

Relatively low allocation to non-community users;

Focus on projects with a good product-market fit, a self-sustaining business model and a growing user base;

Prioritise innovative start-ups with MVPs that meet regulatory standards.

Dragonfly General Partner Rob Hadik recommended that projects increase the percentage of liquid tokens at launch, using a “variable supply volume” approach for healthier dynamics and efficient pricing.

A market participant nicknamed Wassielawyer offered an innovative idea:

“Perhaps coins with low market supply volume and high FDV should switch to price-based unlocking instead of time-based unlocking.”

Davo, who describes himself as the “head caretaker” of Solana’s Drift platform, presented another possible solution: issuing tokens against the backdrop of the latest private funding round, based on an appropriate valuation.

“A project that starts with a low FDV and allows the community to buy [tokens] at reasonable prices will be much more anti-fragile and sustainable,” he said.

He added that such an approach avoids artificially inflated prices and can ensure that early adopters benefit if the project is successful.