In this article we’ll get information about market cycles in crypto and NFT world and how to analize them.

This is about the crypto market cycle, but the NFT market cycle follows the same rules. Except I believe that the NFT market cycle is much shorter, to be confirmed in the following months/years.

Takeaways

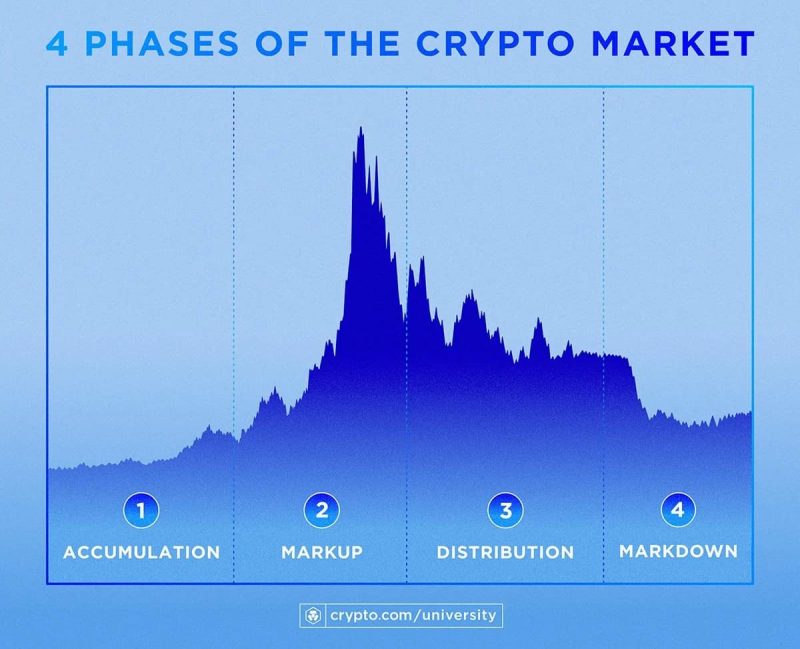

A crypto market cycle consists of four phases — accumulation, markup, distribution, and markdown.

Each crypto market cycle lasts four years on average.

The main factors that affect a crypto market cycle include its correlation with Bitcoin, the halving of Bitcoin, and social metrics.

What Does the Crypto Market Cycle Look Like?

At a high level, market cycles are specific patterns that typically emerge from the psychology of market participants and the greater economic environment. This is a natural phenomenon that occurs in every market, and the crypto market is no exception.

Crypto market cycles start with little to no interest in the market. However, as more interest and demand arise, asset prices generally rise to keep up with the increasing demand. At some point, prices reach a peak and eventually start to drop, as interest declines and supply outweighs the demand. At the end of each cycle, a new cycle begins.

Although it is difficult to pinpoint the start or the end of a market cycle, most cryptocurrencies (excluding stablecoins) go through similar stages. Understanding the characteristics of each stage and how a typical user may approach each of these stages can help you to participate in the market in a more informed way.

1. The Accumulation Phase

Accumulation is the first phase of every market cycle. It starts after the end of the previous cycle when sellers have exited the market and prices are perceived to begin stabilizing.

In this phase, the market volume is typically lower than average, as interest in the market remains low. Therefore, no clear trend emerges, and assets typically trade within a tight range.

Characteristics:

- Market sentiment is dominated by disbelief and uncertainty

- Low price volatility

- Low trading volume

The accumulation phase is also known as a consolidation phase, which generally marks the end of the downtrend. Some market participants may still consider it an uncertain time to enter the market, as it can be hard to deduce whether the asset will continue trending lower. But from another perspective, longer-term holders often look at the accumulation phase as the precursor to what they hope will be the start of a bull market.

This period is especially attractive for long-term users who are looking to buy and hold. For short-term traders, however, patience is key, as this phase can last anywhere from weeks to months or even years. At this point, positive news relating to the market circumstances at large can capture market participants’ attention and potentially push the market into the next phase — the markup phase.

2. The Markup Phase

Commonly referred to as the bull market phase, the markup phase is when the market moves higher in price at an increasing rate. During the markup phase, new groups of market participants enter the market, and with that generally comes a notable increase in volume at the beginning of this phase.

From a market sentiment standpoint, despite still being cautious, market participants start becoming optimistic about the outlook, as companies and press begin publishing positive headlines.

The demand for an asset begins to outweigh the supply, causing prices to appreciate in value as a result.

Characteristics:

- Market sentiment is dominated by optimism and excitement

- An uptrending price chart

- Increase in trading volume

- Favourable economic conditions

The markup phase may be a good time for new participants to enter the market, as the upward price movement is much easier to recognize. Additionally, dips or pullbacks in the markup phase are mostly considered by many as an opportunity to buy, rather than a caution signal.

However, despite the overall optimism in the markup phase, assets will not necessarily increase in price. Not all assets follow the overall trend, and some may still be affected by negative news particular to them, which may cause their price to go against the general trend.

3. The Distribution Phase

At some point, after a bull run, some buyers become sellers. This is the distribution phase, where the buyers and sellers in the market are at equilibrium.

On one side, there are market participants who are still looking to buy, as they have confidence that the bull market is not over. On the other side are sellers, who are looking to lock in their profits. This creates tension between the bulls and bears. While this phase of the market still sees high trading volume, asset prices generally fluctuate within a limited range until either the bulls or bears surrender.

As a result, this phase may cause the overall market sentiment to turn from optimistic to a separation between greed and fear, with the prevailing uncertainty of whether the uptrend will continue or if a bear market is coming. The fear and greed index is a common indicator used by analysts to gauge this change in overall market sentiment.

Characteristics:

- Market sentiment is simultaneously coloured by overconfidence, greed, and uncertainty

- Low price volatility

- Elevated trading volume, but without an increase in price

The distribution phase is also the first sign of weakness after a bull market. In turn, this can lead some to deduce that a further downtrend might be coming.

During this time, some participants who bought an asset prior to or at the beginning of the markup phase may begin liquidating their positions in preparation for what they perceive to be an upcoming bear market, also known as the markdown phase.

4. The Markdown Phase

The markdown phase, or the bear market, is the scariest phase for most market participants. It starts as soon as the supply exceeds the demand in the distribution phase, and is a period that’s fuelled by fear in the market, as the outlook becomes increasingly negative.

The more that participants begin fearing the upcoming state of the market, the more the selling pressure builds. In some situations, this cascading effect can send prices of an asset to levels not seen since the markup phase.

From a technical perspective, the markdown phase is defined by a downtrending chart and a high volume price decline. From a market sentiment perspective, it begins when news articles turn negative, with words like ‘recession’ in their title.

Characteristics:

- Market sentiment is dominated by anxiety and panic

- Downtrending price chart

- Elevated trading volume

- Unfavourable economic conditions

The markdown phase is a short seller’s dream, and the period where they stand to gain from the market drawdown. In this period, even good news can have trouble pulling an asset out of a downtrend, as participants adopt a cautious approach to avoid losses in the current harsh market climate.

But there is light at the end of the tunnel because markdown phases don’t last forever. At the end of this phase generally comes the new crypto market cycle. What lies around the corner might be yet another markup phase.