What is the concept of risk management in NFT?

Let’s start with the concept of risk management. Risk management is analytics, the purpose of which is to determine the amount of allowable losses and the amount of profit, to correlate the probability of losses and profits.

Risk management allows us to estimate the probable losses, the probable profit and make a conclusion about the advisability of a deal.

For example in trading a good risk management is 1 to 3. Let’s see an example, let’s say you entered into a trade with 100$, according to your analytics in the worst case scenario you will lose 10$, and if everything goes according to plan, you will gain 30$. That is, you risk losing $10, but there is a chance of earning $30.

In the case of NFT, this case doesn’t always apply, by the way these concepts come from trading. When we write you about risk tolerance, we mean a little differently. We’re rather talking about not going into a trade with your entire deposit.

So risk management for us is more like a percentage of the deposit to enter into a trade. But 1 to 3 has not been canceled.

Ideally, it would be 5-15% of the deposit to enter the trade according to the signal, but we realize that not everyone has a huge capital to keep the risks properly. On this basis, we recommend you to further analyze the situation, we will tell you about it in the next section of the article.

What to pay attention twhen analyzing alpha call?

You should understand that the NFT flip is quite risky, but you can make good money on flips, but do not forget that where good earnings are found, there are serious losses. So you need to be confident in making a trade, and for that you need to gather analytics and some arguments for entry.

Let’s start with how to react to the alpha calls.

You saw the signal, your actions:

– Check the flor price, it may happen that you do not have time to enter at the price that is listed in the post. This may be due to high activity on the secondary, or you just did not have time to react to the release of the post.

If your post specifies the entry range, then the higher you enter, the more risks, if we wrote that it is better to try to enter at bid, then it is safer, if you have failed and the flip flew away after a while, do not get upset, because if you have not lost, then you have earned. Remember! Your main goal is to save the deposit, and then earn.

– Find out the reason for entering. Here the question arises, why the price should go up? Usually the answer to this question can be found in the alpha call, but sometimes there are situations when we can not give a clear justification, because we see that the activity is growing and there is no time to understand the reason, in this case, the deal is at higher risk.

The more information you have, the better. The more growth factors, the better. It will add confidence in the transaction and give more understanding of why it is necessary to enter. If there is little information, then the risks are maximum. Be sure to find out the reason for the growth, if you want to minimize the risk.

The growth factor can be: an active tweet from famous collectors, an upcoming high-profile announcement or collab, a new utility or a bonus for the holders, which were previously unknown, and so on. The more factors a collection has in its piggy bank, the better. The stronger the factor, the better. By strength, we mean hype and the prospect of an announcement. In this point the analysis of social networks will help us: twitter, discord.

– Conduct additional analytics on the market. We have already said that we do all this, but you should agree to check the information additionally. Check the activity, the more NFT buy per minute the better, and in general buying every minute is very good, it happens less often, but it’s not bad.

All again it depends on the situation, is such that is not the best activity at the moment, let’s say NFT buy every 15 minutes or 30 minutes, then it is necessary to be guided by the situation, but the more asset, the better, it means that your goal to sell faster.

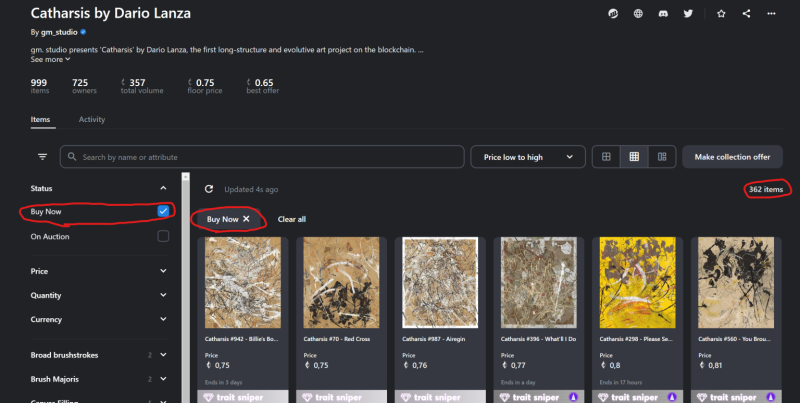

Be sure to look at how much NFT is exposed to sell and how much NFT to your exit point. The screenshots show you how to do this. “Buy Now” – will show you the NFTs you’ve poured in. Then put in the maximum price the exit value, in this case x2. And you can see that 107 out of 362 items are below the exit price.

The fewer the number of items before release, the better, look at the ratio. And do not forget to put Buy Now, because we are looking only at those NFTs that are now on the listing. In addition, you can look at the minimum price values for the collection, you can do this on the OS chart, but you can also use other tools that are more accurate, such as coniun.

– Take a look at the whole picture. Once you have all the cards in hand, take into account all the points we have passed and make an entry decision. Important: The more positive points, the less risky the trade.

If there is a positive news backdrop, great activity, a small number of listings to the target, your deposit allows you to enter the trade at a small percentage of it, it’s a great trade. But that doesn’t happen very often, so the risks increase and everyone has to take them.

A little bit of psychology

We’re all human, we all want to make money on the flip side. But let’s not forget that emotions and fomo do not lead to good. Be sure to enter into trades with a cool head, even if you missed a profit, do not despair, the main rule is to save the deposit.

Assess the risks every time you enter the trade, you should not fly into the secondary market just because someone says so. Analytics should always be available, this is not a casino (although in some places…).

The events and signals are always enough, you have not earned this time, flip the next, no big deal.

Regarding the hold on an unsuccessful trade. Yes, there are times when you did not get out in time and remained with NFT on the purse, here everyone’s choice and it all depends on the situation. In some situations, it will be better to be fixed in a loss, in some situations, you can hold a little.

In high-risk trading, be prepared for the fact that there is a probability of selling NFT at a loss, so we urge you to respect the risks and not to fly into the whole deposit. Only enter a trade if it is acceptable for you in terms of risk.