Good portfolio starts with the right goal. Everyone’s goal is different, so the approach to creating and managing a portfolio will also differ.

For example:

– Lower Risks

– Increase Profits

– Track your moves

– Improve your skills

That’s why firstly decide what your goal is.

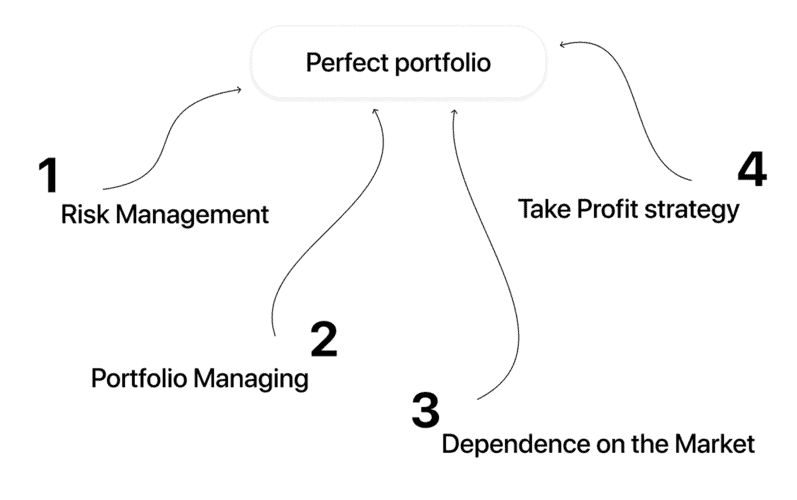

Overall, an ideal portfolio consists of the following three components:

– Risk Management

– Portfolio Managing

– Dependence on the Market

– Take Profit strategy

Precisely these 4 properly executed elements will make you a crypto millionaire. Let’s dive into each one.

Risk Management

Proper risk management is essentially good diversification. You lower and increase risk with different plays, keeping it within the same range. While covering your bad trades with one good one. So it’s like a team with different classes that help each other.

The idea is that you should treat losses as part of the journey and understand that, in the end, you will still be in profit. This approach will instantly eliminate FOMO and allow you to cut losses promptly. The main thing is to avoid over- or under-diversification.

Let’s look at 4 basic ways to diversify your portfolio based on the level of risk you want to take

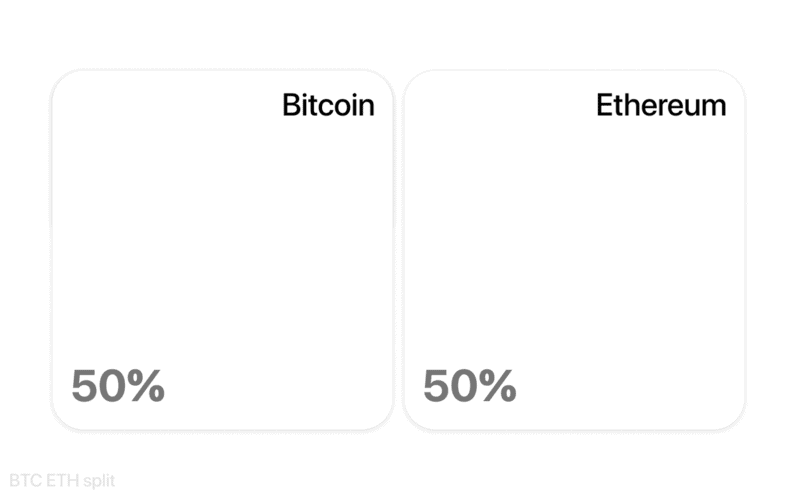

BTC ETH split strategy

The simplest strategy for someone who doesn’t follow crypto 24/7. At the same time, it’s the best method for long-term investing. Quite simple, safe, and profitable.

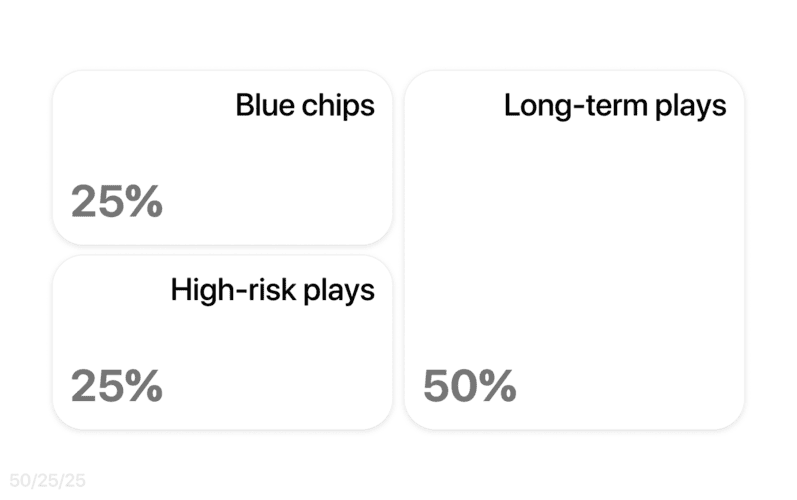

50/25/25 strategy

A mid-risk portfolio, where half of your portfolio consists of long-term plays. Part of this portfolio includes blue chips as long- to mid-term plays + small % high-risk plays. This type of portfolio suits me the most but it also requires more attention to crypto.

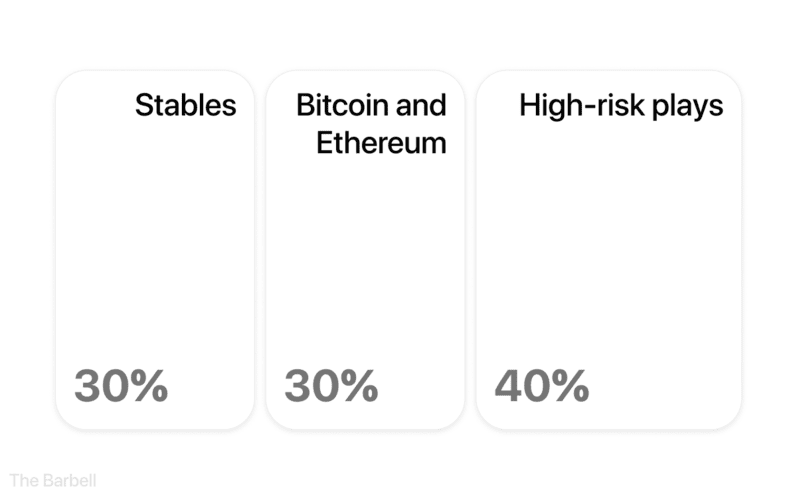

The Barbell Strategy

The idea of the strategy is that we skip mid-risk plays and build a portfolio purely from low and high-risk plays. Thereby balancing the risk in the middle

The portfolio is made up of:

– 30% in stables

– 40% in $BTC, $ETH

– 30% in high-risk plays

Max Diversifying strategy

A portfolio for those who are in crypto 24/7 and keep an eye on narrative rotations, etc. This way, you can catch early narratives and achieve the highest profits.

But such a portfolio is difficult to manage:

– 20% in Stables

– 20% in $BTC/$ETH

– 10% in memes

– 10% in AI

– 20% in GameFi/RWA/any other strong sectors u like

– 20% in High-risk plays

Remember that % may vary.

Portfolio Managing

Properly diversifying your portfolio and just watching it won’t give you any results either. You need to know how to manage it correctly

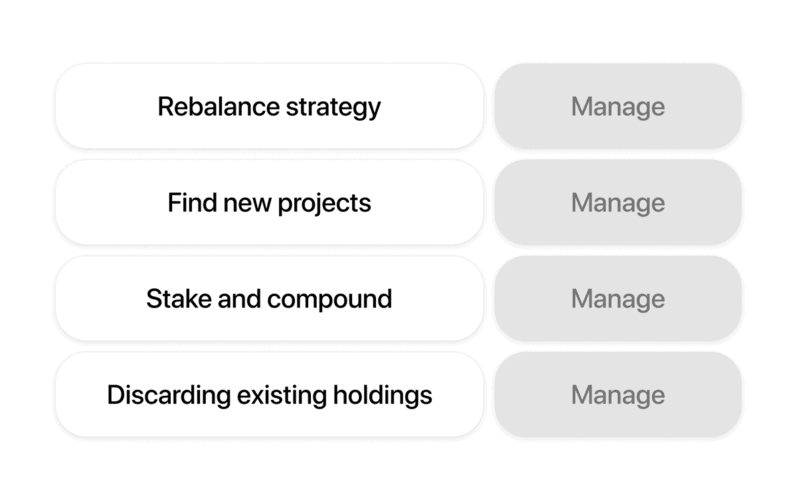

This includes:

– Rebalance strategy

– Find new projects

– Stake and compound

– Discarding existing holdings

Rebalance strategy

The most complex aspect of a successful portfolio is rebalancing.

Let me explain with an example:

You bought 2 coins for $100 each. One grew to $1k, while the other dropped to $10, and now the risk of your portfolio has changed significantly. To bring it back, you need to rebalance.

At the same time, there are situations where you can leave everything as it is to decide what to do, you can use the following rule: Ask yourself if you would buy this coin now. For example, if you are holding $SOL at $200, it’s the same as being willing to buy it now at $200.

Stake and Compound

If crypto is your main activity, staking is a must to find good staking options, monitor Twitter, YT, etc. Remember, staking requires time to manage fluctuating rates, manage your LPs and farms to ensure you’re compounding.

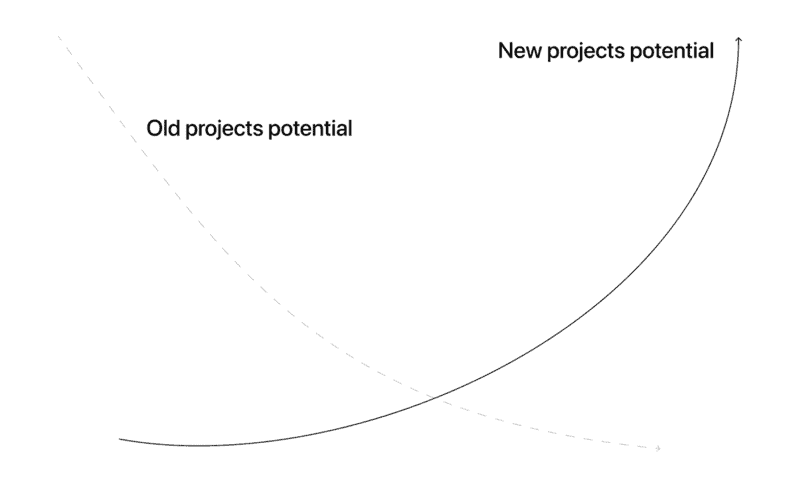

Discarding Existing holdings

Regularly check if there are any tokens in your portfolio that are losing relevance or have already lost it. Be realistic, and if the narrative has passed, don’t hope for a miracle. It’s better to discard your holdings and look for the next play with more upside.

Find new projects

Again, if crypto is your main activity, you must be in constant search of new plays. Every day, dozens of projects are released that could give 100x-200x returns. Your task is to research new narratives daily.

Dependence on the Market

Remember that risk management & diversification depend on market. Bull run is more about risk plays, while in a sideways market, it’s better to invest in projects u’re confident in. So make sure u consider market stage.

Take Profit Strategy

Probably the most important thing is to take profit correctly. Many try to predict the market peak, but that’s not what you should be doing. By doing so, you’re risking your 200%-300% profit for an extra 10%-20%.

If this concerns high-risk plays, then every 2x, I take out the initial capital and gradually take profits after that. For $ETH, $BTC, or other long-term plays, the strategy is similar, except it’s only the percentage of profit. The main idea is gradual profit-taking.

Conclusion

My advice – don’t copy anyone’s portfolio, create your own strategy, and look for different plays from different PPL. Also, always take on high risk initially and then reduce it, not the other way around. And invest only what you’re ready to lose, especially in high-risk plays.