In this guide we’ll cover everything to help you make your 1st million this cycle: tools, patterns, strategies, and key insights.

New pair hunting

There are too many deploys per day here; sitting through each one is exhausting. Most deploys quickly rug, with 95% not even reaching a $50k mcap.

To improve your chances of finding a successful launch, you need to:

➬ Verify the contract’s security

➬ Ensure the coin aligns with typical SOL meme standards

For spotting new pairs on Solana, I rely on the Dexscreener Telegram bot. Check it out here: https://t.me/DSNewPairsSolana.

To verify if a token’s contract is safe, you can use several tools. But for me @solanasniffer is enough.

➬ Visit: https://solsniffer.com

➬ Paste the token’s address

➬ Check for any contract vulnerabilities

If you find a high-risk token keep searching! As mentioned, 95% of tokens are complete garbage.

Take a look at the holders section

The easiest and most common method is to use our favorite Solscan. Initially, the top 20 will typically hold the majority of the supply for new pairs because the coin was just released. So it’s usually fine.

If an individual holds a significant amount, like 10%, it looks suspicious. Could they be insiders? When the dev holds over 15%, it’s a red flag – proceed with caution.

Quick note on how to spot an insider launch:

· High volume at launch (very high first candle, around $300k)

· Airdropped wallets (sometimes 20-30% of the total supply)

· Run to $1M-$3M, hit the ceiling, and then get sold off to $0

It’s worth mentioning that as the token grows in market cap over time, a significant portion of the supply might be held by various decentralized and centralized exchanges. And that’s completely acceptable.

There’s actually a great bot available to monitor if dev/airdropped wallets are offloading tokens. Check it out here: https://t.me/aisolanatokenchecker_bot

How to identify what is worth your money and time

What we’ve discussed above primarily shields you from potential scams or devs dump on you. But what do you really want to look for when trading meme coins?

In an ideal scenario:

• Opt for something secure

• Seek options with a market cap under $20k

• Look for a fun meme with great visuals and active socials

Here’s a piece of advice that many people overlook: Join the official Telegram of a token and observe the team’s behavior and the overall mood. For a memecoin to thrive on Solana, the key ingredients are engaging graphics, creative memes, and a lively community atmosphere.

If you manage to find and buy a coin with seemingly well-done socials and a good meme in general under $10k-$20k market cap, you’ll likely cash in a solid win. But after how many hours of sitting and monitoring new deployments you will discover this – I don’t know.

To sum it up, the best advice I’ve ever received regarding meme coins is: Look for interesting, viral, or famous memes that truly amuse you and grab your attention. Make sure they are effectively managing socials. When a meme goes viral and is widely admired, its growth can be limitless (take $WIF for example).

Just avoid jumping into the tokens with a $500k market cap first candle you see when opening the chart. As mentioned, meme coins are like the Hunger Games, with many potential pump and dump schemes.

Knowing when to cash out

Catching a meme token early is great, but you must be wary of holding too long. I’ve seen many meme coins hitting $250-500k or even millions without a single dip, only to plummet to zero in a matter of minutes.

Remember this: Downtrends in new launches are extremely risky. You could easily lose significant gains, like 5-10x returns or more, if you hold on, thinking you’ve found the next big thing.

Playing the patterns

Armed with patience, some lines, and numbers, you can craft some impressive trades by leveraging common chart patterns, breakouts, and key levels. It’s ideal for someone with a small portfolio, as you can compound gains quickly here.

Here are the 3 most common setups and patterns of a meme coins

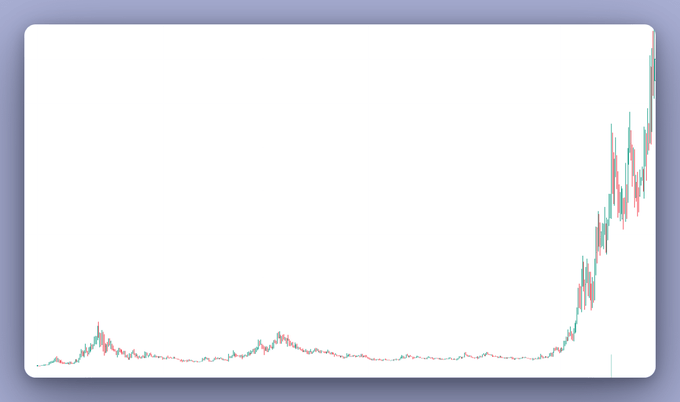

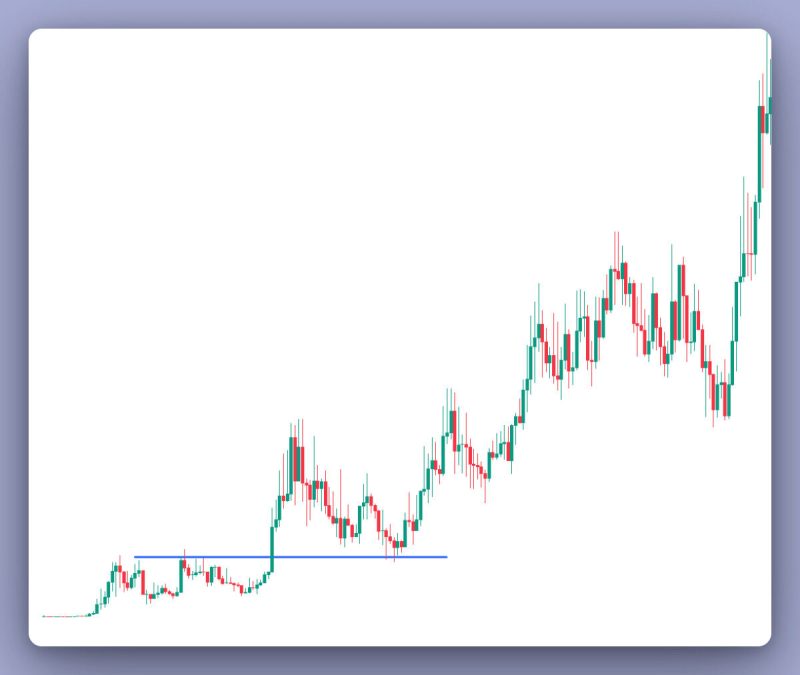

“New hope” pattern

When a coin hovers above its initial spike for a while or shows repeated strength at the lows, it might be a bigger runner. It’s very important that the meme is good and has an active, engaged community.

Position yourself near the lows and wait for the run-up. Sell at the highs if the momentum feels weak and there’s resistance.

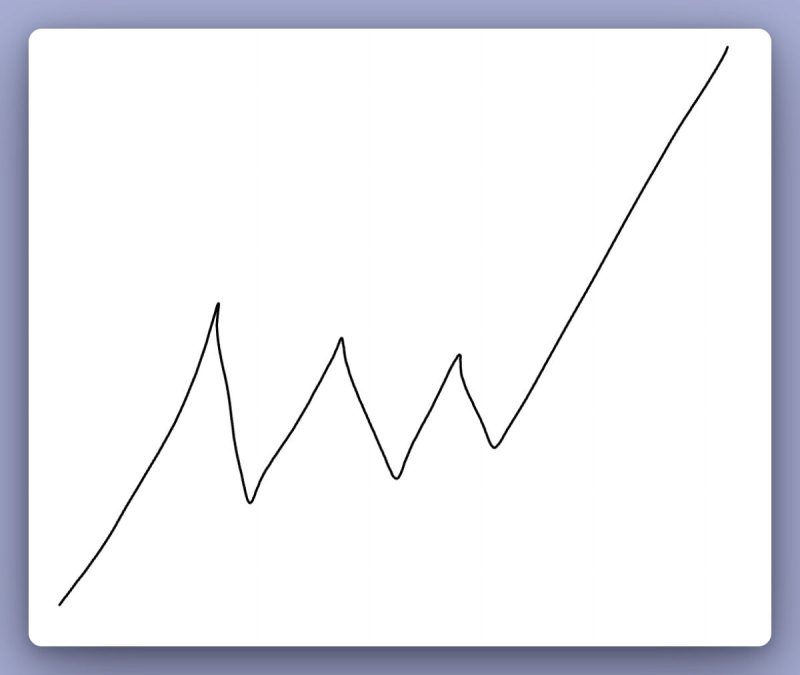

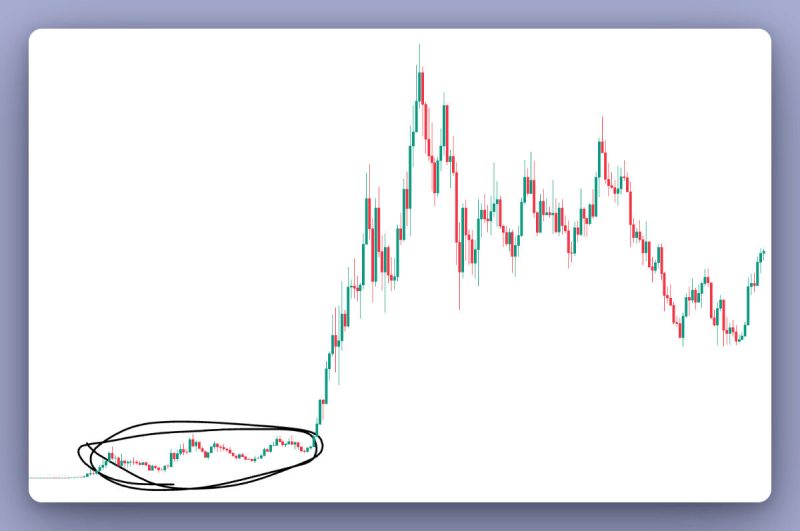

“Jigsaw” pattern

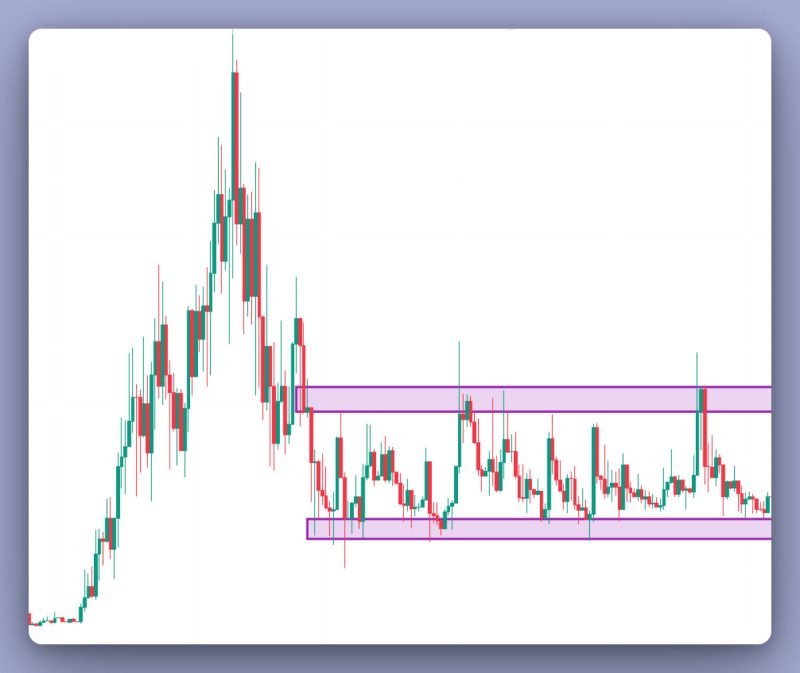

The price consolidates within a wide range, bouncing around 2-3 times before finally making a big move. Usually spotted on meme coins below $20M or so before they really take off toward 9-figure territory.

Such a pattern was even printed on $WIF in the beginning. It’s safe to say that if all CT are onto something and the graph shows a similar pattern, it will likely go parabolic.

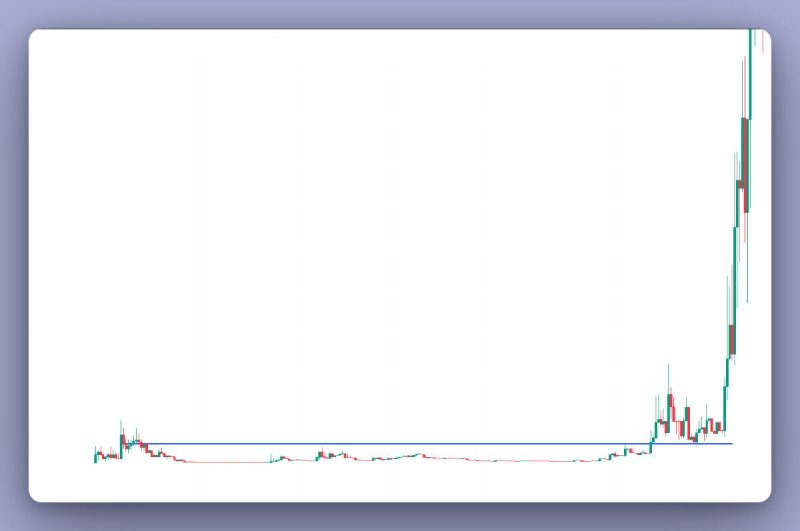

Retest of previous peaks

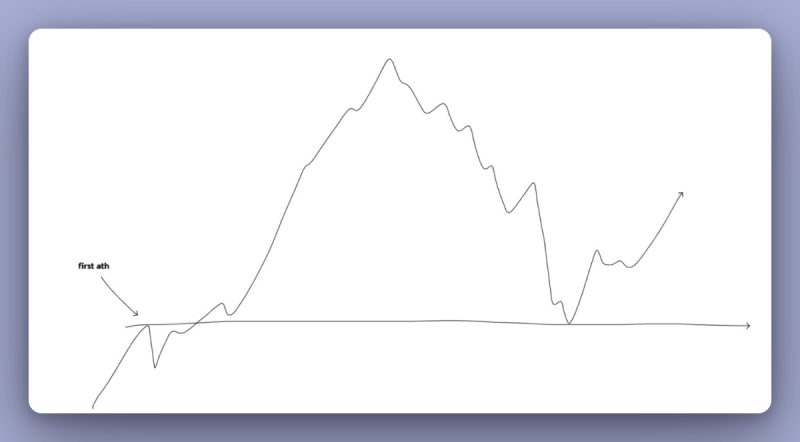

Coins long trapped in the abyss but now resurging to challenge their former ATH – often take off.

How to identify scalping opportunities with meme coins

Locate trending memecoins post-rally and trade within the set ranges. Identify peaks and dips, map out the range, start trading.

Reversal guide

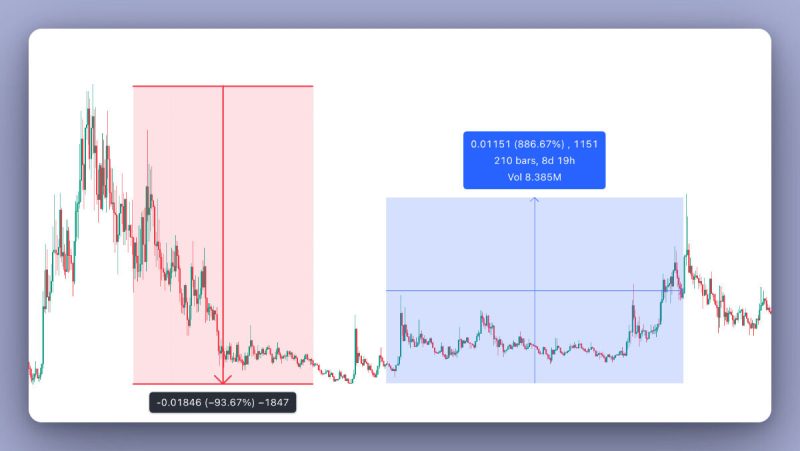

Typically, memes that experience a 90-95% drawdown from their all-time high tend to bounce back a few times. Usually it is the case if the project hasn’t been abandoned and there are still believers holding on.

How to buy breakouts and key levels

Focus on the “mooners of the day” coins if you want to quickly flip money. Buying key levels (where the price consistently holds or bounces) will work most of the time if:

➬ The coin is the mooner of the day

➬ It is not too new (avoid 5-minute-old pairs; they’re too random)

➬ It has a clean previous structure

Here’s how this pattern often plays out:

· Huge pump

· During the pump, occasional dips of 30-40%

· Sharp drop back to initial peak level

· That level then triggers a significant rebound

The key levels to watch for include:

· Areas where the price has repeatedly bounced or accumulated and ranged above

· Previous ATH

· Range lows

· Range highs

I’d suggest experimenting with the well-known memes using a modest investment to get comfortable and conquer the fear of market dips. When you understand Solana memes price movements, you’ll find that most charts exhibit similar patterns.

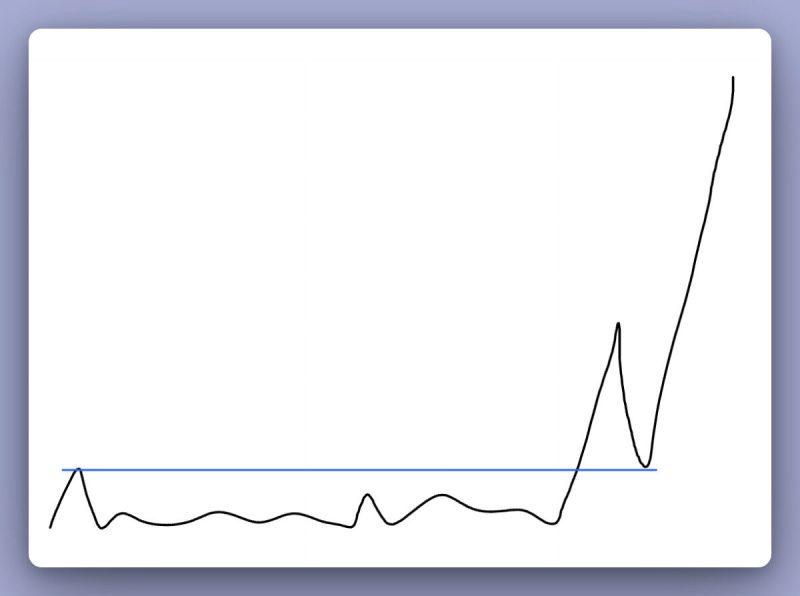

Master the art of selling near tops

While nobody (except insiders maybe) can predict the exact top of a token, we can try to exit at potential local tops or derisk to avoid drawdowns. One helpful tool for this is volume.

One of my best tactics for cashing out at peaks is:

➬ When a coin tries to hit a new all-time high with LOWER volume than the previous one, I decide to sell.

Sure, it might achieve another all-time high briefly, but it seldom maintains that level and typically pulls back soon after.