What is NFT?

NFT or Non-Fungible Token is a unique non-interchangeable token, which is created on a particular blockchain (ETH, Solana, Wax, etc.).

The main point of NFT is that it can’t be replaced, it is unique, like a snowflake, it can’t be changed without being noticed.

The main purpose of NFT is to confirm the possession of the active. Now this model is beginning to be actively used in different areas of our lives. Music, games, text, screenshots and more.

The first NFT appeared back in 2012, at that time they were “Colored Coins”. At the time, these coins had several uses, including the ability to be used as collectibles. Popularity to NFTs came with CryptoPunks, which were created in 2017. By the way, they brought such a meta as 10k collections.

Types of NFTs

LLet’s get a sense of what NFTs are, who takes them at all, and how they are used.

I divide all NFTs into conditional groups. NFTs are bought for different purposes. Someone wants to support the artist, someone wants to have unique skins or game items, someone wants to make money, that’s why they can be divided into different groups.

For example:

1) NFT with art.

2) NFT with utilities

2.1) NFT game projects and meta universes

2.2) NFT of musicians, athletes, etc.

3) NFT HYPE

4) Other NFT

Now let’s break down each group individually.

NFT as art

This group includes the works of famous and not only artists. These NFTs create value through their aesthetic benefit to society, as well as bringing other spiritual joy. I have, of course, described it as crudely as possible, but it is enough to understand it.

If you look at pricing, in this segment the price is proportional to the weight of the artist’s name. You can be incredibly talented, but your work no one will buy if Banksy spit on the canvas and sell it as NFT, the price will be cosmic.

If you decide to sell this category, always look at the name of the artist, as well as the platform on which it is presented.

A vivid illustration of the influence of the site can be seen when referring to Art Blocks. This is the most popular NFT platform where digital art is primarily housed. Works that are sold there consistently yield X’s, regardless of the author’s name. Of course, you can highlight the auction houses, such as Sotheby’s, but that would be superfluous, because NFT is there more for the hype.

NFT with utility

These NFTs have a practical basis that helps them increase their value.

Such NFTs can give:

1) Access to a closed alpha community (e.g. Mirror Pass)

2) Access to a gated community (e.g. Alpha Sharks)

3) Opportunity to receive royalties (e.g. Kataro Sharks)

4) Access to software (e.g. Trait Sniper)

5) Other bonuses (PreMint Pass, etc.)

The main essence of these NFT – the ability to use what is available only to the holders.

Game projects and metaverses

There is nothing much to describe here. A good example that even your grandmother knows is the sneakers in StepN. These NFTs are needed to work with their M2E project.

If you consider a classic game project, you can take SplinterLands. There NFTs are presented as game maps that we use on the battlefield.

Taking meta universes, the first thing we look at is SandBox. There NFTs are also used in the game. These include avatars, various buildings, lands, and more.

NFT musicians, athletes, etc.

The NFT data comes from the faces of famous personalities. It’s mostly a kind of merchandise. These NFTs are not very popular, so I won’t focus on them.

Of course, there are exceptions in such projects, for example CryptoBatz by Ozzy Osbourne. In them, the creators did the right thing and mixed NFT project with a big name, which in the peak led to a flurry of several airs!

How make money at NFT?

The main question that everyone is interested in. Here I will describe the general points, the specific ways will be below.

1) White List

Using WL in any plane:

– Knocking out followed by selling or minting NFT,

– Buying WL and NFT mints,

– Buying WL and reselling it.

All these options are great for beginners, because getting WL’a no risk, here is spent your time, not money.

2) Mint

It’s also all clear, when yo mint NFT, sell it more expensive at the secondary. Of course, there is a pitfall, which I will describe further.

3) Flips.

Buy low, sell high. That’s it in brief. Generally flips are different. These are flips of hype projects, flips of rare NFT, classical flips and so on. I will tell about it in details further.

4) Investments

Buying NFT on a long term hold. It’s mostly about Blue chip collections, because it’s almost impossible to guess which NFT will go up from 0.001 ETH to at least 1 ETH.

What is Mint, its types, ways, stages, problems

Mint is the process of creating an NFT. Mint comes in two varieties:

– Free.

A free mint is a mint in which we do not pay the maker of the collection, but only pay a transaction fee.

– Paid

A paid mint is a mint where we pay not only the transaction fee but also the price that the creator of the collection set.

Ways to mint

There are two ways to mine NFTs:

1) Through the website that the creators represent.

We go to the page and click the “Mint” button, a contract opens, we sign it and get the NFT. This is the easiest and most common option.

2) Through the contract.

In this case we go to ethscan, look for a contract and mint through it. What are the advantages of this method? We don’t have to wait for the opening of the site.

Having a contract, we can start minting before everyone else, because before the opening of the mint and the public disclosure page where the minting takes place, the time passes, during which ordinary people will not be able to start minting. All of this will help us to mint the right amount of NFTs unhindered.

Mint Stages

Generally speaking, mint stages are an optional thing that depends on the creators of the collection. Their number is not regulated anywhere, but there are two standard stages that many developers use:

1) White List sale

The WL mint stage is different in that the mint goes to a separate group of people who are guaranteed a mint. Typically this includes individuals who have actively interacted with the project, win raffles, etc.

The main advantage of this stage is that you are guaranteed a mint, which is why the price of popular WL projects can be several thousands and sometimes tens of thousands of dollars.

2) Public sale

At this stage anyone can mint NFT.

There are times when there is only public sale or sale only for WL, there are times when there are several stages of mint. For example, WL category 1, WL category 2, public sale.

It’s also worth mentioning the restrictions on the number of NFTs you can mint. These limits are needed so that a skilled fraction of people don’t mint all at once. Usually it’s a few NFT per wallet or per transaction.

The problem with mint

The main problem with mines on ETH is the price of transactions. They can range from $0.5 to $3k+.

And the price of gas doesn’t depend on whether it’s free mints or not. The main catalyst for the growth of commission prices is the number of transactions. The more of them, the higher the price.

That’s why the cost of free mint can exceed any reasonable standard, all because of gas prices.

There’s also a side problem that states from the mint through the contract. With the latter in place, craftsmen with bots can start attacking the contract and start minting even before the official announcement, thereby taking away liquidity and shedding the market.

There is no upside to this, except for one thing, which is the profit for the bots.

If anyone does not understand, when significant part of NFT is redeemed, botted go to drain everything on flur, thereby increasing supply, with which the current demand can not cope. This point leads to the influx of floor on the bottom and fading interest in the collection.

What is GAS and how much is needed?

Each transaction is accompanied by a commission. This commission is called Gas.

What you need to know:

– Every transaction is accompanied by Gas.

– You can change the inputs, thereby changing the speed of your transaction

– You have two main factors to watch: Priority and Max Gwei

– If you are going to enter a high drop on a public sale, you should always count on gas war

What is Priority fee?

Priority fee is a fee to miners. The higher the priority, the faster your transaction will go through.

Important point – Do not change this value if you are not going to pay the full amount. I.e. if you set Priority fee to 100, you will pay at least 100 gwei.

What is the Max Gas Fee?

The Max Gas Fee is the total fee you are willing to pay for a transaction. With this graph you can play more, because it is only a limit of the amount you are willing to pay.

Why would you put a high maximum price on a mint?

If you set a low amount that you are willing to spend and gas will occur at the minte, your transaction will be delayed until the gas goes down.

Gas limit better not touch, because if you screw up there, your transaction will fail and you will lose money.

How much gas?

A very popular question, which you can see at any hype scale on ETH.

I’ll start with what to pay attention to when you’re gassing.

– General supply.

– Allocation for WL and Public sealing.

– Hype near the project

– Is it possible to mint through the contract.

If it is possible, most likely most of it will be taken out by bots.

– At projected or existing price

– How much are you willing to pay

– How much are you willing to lose

– Do you have a chance to take

If you have free mint public sale coming, where NFT is trading at 2 Ether, but you have 0.1 ETH for gas. Then you should think about losing and probably skip.

What should you pay attention to when bidding for gas?

– Is the contract available?

– Has WL already minted?

– If so, look at how much they paid for gas

– Current NFT price.

Tips

– Priority Gas is a key factor in minting

– Miners give priority to people who have the highest priority gwei

– Private nodes are your friend

– Set gwei not a multiple of 10 / 5. I.e. it is better to set 1001 than 1000

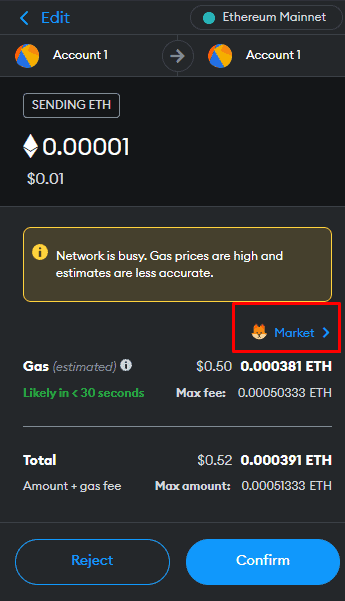

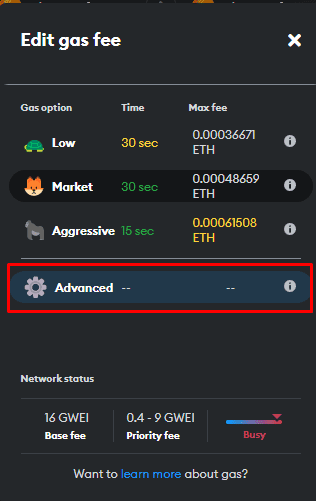

How preset the gas?

– Go to settings and click “Experimental”.

– Turn on Enhanced Gas Fee UI

– Now send yourself a transaction with zero ether (0.00001)

– Press Market and go to Advanced

– Set up the gas you want and click “Save”

At the end don’t forget to change the gas back, otherwise you will give a higher amount for an ordinary transfer.

How make contract mint?

Why we need to mint with contract? I have already described, but I’ll say it again. There are different occasions, the site where mint are on heavy load, may lie, the administration hesitates and send the link later than planned, but the mint will open in time, etc. In all these cases, you can not get th NFT, unlike those who minted on the contract.

So how do you mine through a contract?

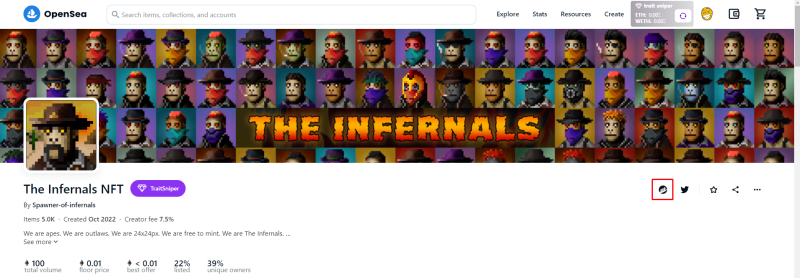

First, you need to find a contract. Usually it can be found through the OS or social networks – twitter / discord.

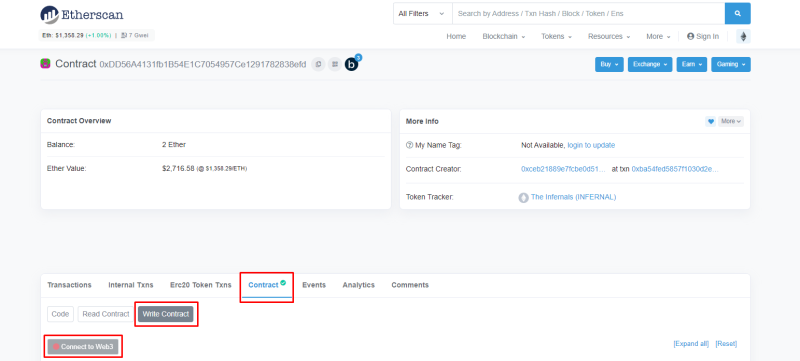

Now that you have a contract, go to Ethetscan and go to the tab “Contract”, “Write Contract”

Do not forget to connect your MetaMask, using the “Connect to Web3” button.

Now look for something similar to “mint” / “public mint”. In this case, the mint was located in the tab “spawnInfernal”.

In this line we need to put the data, namely the price of the mint, as well as the number of NFT that we plan to buy.

PayableAmount (ether) – ether, which we will spend on the mint. If the cost of a mint is higher than zero and you are going to mint several pieces, then multiply the cost of the minte.

Example: the price of a mint is 0.1 ETH, you are minting 2 NFT. 0.1*2=0.2 ETH. Write 0.2 or .2 (to your taste)

numberOfTokens (uint256) – this is number of nft, you are going to take. There is no need to be clever here, so just put the number you are going to mince.

These data we find out in advance on the site or in social networks.

Press “Write”, if you have done everything correctly, the window MetaMask will appear. There are two options here. If you get inadequate gas (several thousand dollars), it means that the mint has not yet started and you need to wait. If the price is adequate, then we confirm the contract and wait for the coveted NFT in your inventory.

Sometimes it happens that the developers put protection in the form of “signature”, it means that ordinary mortals through the contract can not mint.

Marketplaces

There are several main marketplaces that are used when working with the secondary market.

OpenSea

It’s worth starting with the largest secondary NFT marketplace, OpenSea. This site was the first to successfully start providing NFT marketplace services. Due to the fact that it used to be the only marketplace, the site allowed itself a lot of bad things.

Frequent complaints about bugs, server outages, deleting collections for no reason, poor support, as well as a bunch of other problems were simply not solved, because they were the only one.

Now they have started to move and updated the design, added support for other networks, but the problem of monopoly is still there.

LooksRare

A marketplace that tried to dethrone OS, but it didn’t work. The main problem was that the site could only use WETH, ETH was not quoted. The site also tried to lure with their token, but it didn’t work out because people simply abused the coin scheme, which led to the collapse.

Now the site remains an outsider, giving way to popularity and convenience.

X2Y2

Marketplace, the distinguishing feature of which, are low commissions, as well as the presence of their token, which is issued for the use of their site.

The low commissions are not an empty sound. The site takes itself 0.5% of the value, and the royalty of the author on the HYIP collections is often 0%, which makes the site ideal for flips.

What to choose?

It all depends on you and your goals, if you want to flip fast, then choose OS, if you want to get more profits, then choose LR or X2Y2. For buying cheap NFTs, it’s also best to go for them.

Useful tools

No matter how experienced you are in the NFT field, it’s almost impossible to do anything without tools. I’m talking about flips now. Looking for projects on Twitter and farming WL in them, no one is still stopping you.

What useful tools are there?

1) Minter bots

These are bots whose main purpose is to minte NFT. No matter how fast your are, bots will always make it faster. Below is the interface of one such bot. There you set the minimum and maximum gas, the amount of NFT and the purchase price.

2) Analytical services

This is something without which a successful flip is maximally difficult to do. Such tools show all the information that might come in handy. This includes sales charts, sales walls, current listings and their correlation to sales and more. Find an example of a breakdown of one of these utilities below.

3) Sniper Bots.

Snipers are bots that help redeem rare NFTs very first. These bots are popular during collection revivals, when you need to quickly find the top rank at a cheap price.

4) Wallet Trackers.

This is one of my favorite tools lately. This bot helps you keep track of the wallets you are interested in. Such tools are useful because it is quite often that degens and whales buy this or that collection on insider information.

Also, quite often it happens that the owners of such wallets take advantage of their position and make a dump of the collection.

About earnings on this I’ll tell further.

5) Other Tools

Above were described tools that help with flips. In addition to the above, there are third-party tools that make life easier. For example, Twitter tracker. It helps to track activity on wallets. We can see which account is popular now. This is useful for buying HYPE projects or for tracking interesting projects or personalities.

WhiteList and what to do with it?

Many people start earning their first money thanks to white lists.

The ways of earning I have already described, they are:

– Knocking out followed by selling, or mining NFT,

– Buying WL and NFT mint,

– Buying WL and reselling it.

No one has a problem with this.

So how do you get these wythe sheets?

Here I can only give you a general outline:

Be active in chat, don’t spam, and participate in the dialogue. Of course, in eng chats, because in the other to get much harder

Show initiative, arrange games, events, etc.

Draw or buy art, make figurines, make stickers and hang them around town, etc.

Communicate with moderators or admins

Participate in draws, held on Twitter and other platforms (Premint, etc.)

Once again, these are general provisions that can help you get WL. Each project needs to come up with something different.

Safety in buying

An important factor is safety when buying / selling WL’s. Often scammers like to make a profit on inexperienced participants in this relationship. Below I will give a list of popular scams that can lead to loss of money or WL’s.

Fake garants

You make an agreement with someone to buy/sell and he offers his garant. There are two ways to scam:

1) You are offered a garant of some MNO site, with a cheated audience.

2) Creates a group with fake guarantor verified sites.

They ask for a nickname to verify.

In this case, people will be asking nickname account, which received the WL, to send information about the sale of administration and to get loyalty and WL. In this case you get banned and you are left with empty pockets.

After the purchase, the data is leaked to the administration

This happens rarely, but it still happens. After the sale, the account information is leaked to the administration and you get a ban, and the abuser returns his WL and remains with the money.

To avoid this, you must always be careful, as well as use a proven site. I also recommend working with garants who are over the age of 18, because underage people like to make up rules and leave their account and money with them.

Below are a couple of sites that you can use with peace of mind.

Where to sell whitelists?

It’s easier to do it all on OTC sites. These channels are designed to place ads to buy / sell WL’s, services, etc.

An example is the OTC:

https://t.me/TVS_OTC

https://t.me/terncrypto_otc

How do I make money with Mint?

In fact, this is the easiest way to make money on NFT and there is nothing to tell about it.

You can participate in both paid and free mints, it all depends on your bank. When participating in any mint you should consider the interest of the public, because if you underestimate it, you can spend on commission more than you get when selling.

Also, if you’re going to minft, with purchased WL, then calculate the minimum value of NFT, which can get you a profit, otherwise you risk losing money.

In general, any ultimatum advice is not, for here everything is simple, the price of mint should not exceed the current value of NFT on the secondary market or its projected value, if this happens, then skip the mint.

Earnings on the flip

There are many kinds of flips, here I will try to describe in detail all the types that I know.

The main essence of flip – buy cheap and sell expensive, ie classic speculation, only in WEB3

Flip Rare NFT

Many people know about flip and often practice it, but often everything is limited to buying NFTs for cheap and selling them for more. There’s nothing wrong with that, but in order to increase your earnings you need to grasp new heights.

Now I’m going to talk about rare nft flips. Where to look for rare nft, at what price and where to buy, how to buy, etc.

I’ll start with the basics, namely why do we flip on rare nfts and who is it good for?

Flips on rare nft is one of the easiest ways to farm money. This is due to the fact that working with a collection where the floor does not move for a long time, you can still make money on it. This way of flipping is suitable for people of different bank. It doesn’t matter if you have $100 or $10,000 in your wallet. You’ll always be able to find a collection that works for you.

What is the essence?

We will buy rare nft cheap and sell more expensive.

Where to look for flip collections?

It all depends on your bank. If you have enough money, then go to the OS and see what’s in the top, choose the right collection and start conjuring.

If you don’t have a lot of money or there’s nothing at the top of OS, then go to AlphaShark and look for options there. I wrote about the utility in detail here.

What collection is suitable for us?

The most important thing – the presence of activity, because it is our main weapon. The more active the collection, the easier it is to catch rare NFTs on the cheap, and also easier to sell them at a higher price.

How to catch rare NFTs?

You can use separate utilities, like “HowRare”, which show the rarity of NFTs, but it’s all masochism. The easiest way is to use TraitSniper.

There you can set up settings that will show you nfts with the top 10% rank, as well as the minimum price.

But there is one problem, the free version does not automatically update the table and we have to reload it every time. Since this is quite a nuisance, we will use another option.

On the right side we have another table with the latest sales / listings. This will help us.

We select the tab “Listing” and start watching.

At what price to take and sell?

There is no universal formula for all groups of nft, so I’ll take type2 – type3 categories and show by their example.

I will parse on the example of this teer3 collection and my flip on it.

I was monitoring AlphaShark and saw high activity on this collection. Having entered OS, I found a segment from 0.006 to 0.01 Eth in which the flur was fluctuating, with the price of rare nft starting at 0.015. I immediately decided to take advantage of this opportunity.

Collections like this are always worth taking at floor, or with a minimal markup, of course, taking into account the floor on rare nft.

As a result, using AlphaSharks + TraitSniper, I was able to raise a few dozen dollars, minting my own business and occasionally glancing at the second monitor.

The time/reward ratio is excellent.

Of course, there’s a risk involved, because if you get into a questionable collection at over-price you might end up with a loss, so always count on the possibility of a rakt.

But if you did everything right, and you took it at flurry, then the chance to rektan will be minimal, because in the worst case you sell at 0 or – a couple of dollars.

Conclusion

Here I did not delve into flips expensive collections, because most of my people sit with the bank, which does not yet allow to flip the same BAYC.

But the provided information is enough to loot your profits on tir2 – tir3 collections.

Earnings on pump

We are going to talk about Pump and dump. You’ve definitely heard of some Influencer who’s been pumping this or that coin and then unloading it on other people. We’ll be doing about the same thing.

Only we will act as vultures who eat up after others.

Let me tell you right away that this is a very risky topic, because it is as easy to lose as to make money.

Let me get to the point. We ourselves will not pump anything, because the audience we have no, and in general, we are nobody. Our goal – to enter with other popular pumpers. How do we do this?

We will use wallet trackers. As a free alternative I can offer this option:

The link changes periodically, so we’re looking for current ones on Twitter.

We need to keep track of the mass purchase of this or that collection.

What are the principles of the pump and how do you define it?

1) Low supply.

Mostly use low-saple projects, up to 1k, rarely up to 2k.

2) Small wall.

This means FP is very flimsy and for a conditional x2 it is enough to sell 10 NFT

3) Small volumes.

It’s simple here, the lower the sales volumes, the easier it will be for the instigators to unload.

4) Low price

Usually select projects with a price of up to 0.01 ETH.

When we see a match on these points, you can think about the fly-in. I advise to do it if the price is not higher than 20% of pumper price.

This is due to the fact that usually pump is made to x2 and then it is unloaded.

An example of such a pamp is “A FIRE BURNS (https://opensea.io/collection/a-fire-burns/activity)”. Pamped by mikesnft.eth.

At that time it was possible to buy at 0.02 and sell in 10 minutes at 0.04.

If you’re going to do it, always consider the OS commission and gas prices. By the way, you can bypass the OS commission by using x2y2.

Buying on orders

The OS has an option to buy NFTs not only at market price, but also on demand. For each NFT, you can make an offer at which you are willing to buy the NFT.

For example, the market price of an NFT is 1 ETH, you make an order that you are willing to buy for 0.8 ETH. The person agrees, thus you obtain the cherished asset 20% cheaper, after which you sell it on floor and obtain your profit.

The scheme itself is simple, but it works.

How it can be upgraded? Here it’s up to you. One of the most obvious ways is speculation on a collection of hype.. You can place orders on OS at 20% below the market value and sell at X2Y2 without commission.

Flips on the news

One of the safest ways to flip. The idea is that on the basis of some news we buy some asset and sell it at the flip.

The news can be anything, it can be a collaboration with a major project, it can be an investment attraction, it can be the purchase of a collection by a major company, etc., etc.

The difficulty is that you need to keep track of the collection or other projects, but it always pays off.

Flips on correction

It will not be a secret to you that no asset can grow forever, someday the moment of correction will come. This is due to the dominance of supply over demand.

This method is risky and will not suit everyone, because many collections after the first peak, roll back to the bottom and it is quite difficult to catch the necessary iks.

The essence is simple as hell. When we start to observe a local decline in interest in the collection, and consequently the flurry, we begin to think about buying NFT. How properly the price drops by 30% to 50%.

If you see a similar drawdown and are confident in the project, then you can repurchase, do not forget to look for a better price on other sites.

General Flip Rules

The main points you should look at when flipping:

– General supply.

The higher the supply, the more risk has the flip.

– Hype and its quality near the project

By quality hype, I mean its origins. There is a hype that is formed due to the fact that the collection cooperates with a fundamental project or blue chip, and there is a hype that is derived from a huge amount of advertising and scooping.

– % Unique Holders.

The higher the % of unique holders, the better, because the concentration of a large number of NFT in the hands of a small number of people, can lead to a rapid dumping of the collection.

– Total amount of sales per day

– Total commission

– Wall of sales

– Number of listings for a certain period

Tips

– Don’t flip projects if you have little experience and a small bank. It’s fraught with the risk of losing money.

– Use a fictitious balance.

By this I mean that you will mentally buy a particular asset and then look at the result.

It will not replace real experience, because the moment of ruin of transaction, that you won’t buy NFT for a long time can’t be predicted, but it will help to improve skills.

– Allocate to the flip that sum you are ready to lose.

This will help you to lose and not to lose all your money, as well as easier to handle defeats on the flipper’s field.

Final advices

To begin with, all the advice presented here is written in blood. If there is advice here, it is for a reason. Either I or someone I know has fallen for it and gone negative.

That is why I strongly advise you to read this part, because it will help you save the bank in times of need.

And everyone knows from childhood that fools learn from their mistakes, and smart from others.

Also, let me remind you that 99% of the time, the flip is a fool’s game, where every buyer thinks there will be a new hamster who will buy their NFT at a higher price.

Always think for yourself

A rule that many people neglect, even though they realize that they make a mistake by flying into another topic on the advice of another crypto. It has to do with the same fomo and desire to make quick money. This is often seen in flips on Solana.

Some channel drops information about the collection and the stake to buy it. The person, going to the market, sees that the floor has increased by a few percent since the post was dropped. With the desire to earn more, he does not hesitate to buy nft. As a result, 10 minutes later the floor has increased by several dozen percents and the hamster would run to fix the negative profit.

To avoid such situations, you should ALWAYS use your head. No matter how unrealistic the dealer may be in telling you about the purchase, you must first recheck the project yourself, make sure it is good, recheck it again and only then decide to buy.

Don’t flip in a tilt

A basic rule of thumb that people score on anyway. Being in a tilt, the flip turns into a casino, not a way to make money. You start flying into everything, thinking that you’re sure to flip in the plus, but in fact it turns out that you become that last fool and everyone closes about you.

Remember, I wrote about how all advice is written in blood. I realized this on myself, when I bought C-01 for 2 ether, and next day I sold it for 1.44 ETH and lost about 3$. By that time I lost a lot of money and was not only in tilt, I had a desire to go to casino and bet on red.

At that point I thought my best bet would be to buy NFT for overpriced. Even though I knew it was a horrible collection and would sell out in a matter of days, I understood that and told others, but I didn’t listen to myself and bought it.

If there had been someone to tell me not to do that, I would have had money and nerve cells, but what happened is what happened.

Set sales limits

What kind of limits? We’re not in the futures market. That’s right, we’re not in futures, but we’re still in a market where you have to put limits. Let me explain what I mean by that.

Before you buy an NFT (or other asset) you must set a limit, beyond which you will liquidate your position. You should know in advance what price of elimination is appropriate for you, that is how much in the red you are ready to go. Calculate the maximum price you are ready to lose.

Also put a profit limit. No matter how it sounds. Why set some profit limits, if you can catch the high? That’s one of the main mistakes flippers make – they go down in losses, even though they could have fixed x’s. Such limits should be set in order to find oneself in the plus. The most important thing is to follow your LIMITS!

Before you buy an NFT, you choose the approximate profit you want to make. After reaching and exceeding that goal, you begin to have thoughts in your head: “Maybe we should wait a little longer. I wanted x2, and I already have x2.2, now I’ll wait for x3 and I’ll definitely sell. This is where you fall into the trap. Often, I would even say in most cases, this leads to a zero or negative flip.

This is due to your greed, while you’re watching your unfixed x’s, there will be a turning point, when the floor starts to fall, but you can’t sell anymore, because FOMO. A couple of minutes you had x2.3 from your investment, and now it’s only x1.8. You start to screw yourself up and think your asset will grow, but in the end you sell your NFT at 0 or minus.

Again, this is not taken from my head. I myself have fallen into this trap many times, most of the time it was on SOL, as there are most of these instant flips. As a recent example, I may take Saudis, when I set 1.5, maximum 1.6 ETH. I missed it and flopped 1.7 ETH. I decided to be greedy and wait for 2 ether, as a result saud flew below my goal.

I believe that limits and following them is one of the most important, if not the most important advice you can take away from this article. If you follow your goals, neither your psyche nor your balance will fly off into tatters.

Don’t give in to vanity

I got burned on this, and very badly, so this point should be read very carefully.

Inspired by your successes, you may start to fly into everything, thinking that it will be another easy profit, but something unimaginable happens and the project is requited or even crashed.

But you do not pay attention to this and continue to fly into everything, this is not your fault, but the project is bad. Finishing a month, you realize that you have lost a significant part of the bank. Well, after that you start to flip in the tilt and that’s it.

Again, these are not made up stories. I myself fell into such a trap and lost a significant portion of the pot.

If you’re starting to see things like that, sit down and analyze the situation. Analyze the projects you’ve already lost, and find the red flags that were there, but you didn’t pay attention to them. Work on your mistakes and you’ll be happy.

Use other venues

Many people who flip use only the main platforms. If air, only OpenSea, if Solana, MagicEden, old-timers go to Solanart.

Although most have a clue about the other platforms. For example, there is x2y2 on ether network (We managed to get free money from them) with zero commissions. And there is CoralCube on solanart, where nft list earlier than on ME. Also, they show the best price there, considering the listings on ME.

Using other sites makes it as easy as possible to increase your profits. When selling or buying nft all you have to do is compare prices on all popular sites and choose the best price. I have made more than a thousand dollars by doing this.

A prime example is selling HypeBears. At flor 1.3 ETH on OS, I was able to sell for 2 ETH on LooksRare.

This can be used not only when selling, but also when buying. Essentially you can arbitrage NFT. Buying on conditional ME for x $SOL, and selling on OS for floor and get your profits.

Working from my bank

This is a universal rule that applies to many areas related to finance.

But if you take the nft field specifically, you should always consider your bank and choose your flip network based on that. Let me explain what I mean by that in a moment.

If your bank is less than a thousand dollars, it is better to stay on Solana, for there small gas prices and also nft is not so expensive. I don’t take into account the dash 1 collections like DeGods. If you take the average projects that are coming out now, the price of a mint rarely gets to 2 Solana. On average, it’s $1SOL or $30. If a bad flip or mint, you’ll lose a couple dozen % (If you didn’t take an outright scam) or a few $.

If you go to the ether, then immediately count on commissions equal to $20-50 per mint (if the collection has a HYIP) and $5-10 per listing. If you want to accept an offer, it’s another $5-10.

That’s not so rosy anymore, is it? And that’s just gas prices. Factor in the fact that your flip might not work out. And if you buy an NFT for $300, not only will you go into debt and sell it at – but you’ll also lose 2.5% to the marketplace and 5-10% royalties to the creator.

In the end, you may end up putting the nft for the same amount you were buying it for, you’ll lose $30-50.

It’s also worth mentioning a trivial point. If your bank is $500, then you don’t need to buy nft for $400, because you will lose a huge part of your bank in case of a rekt, and you obviously don’t need it.

Useful links and tools

Marketplaces

OpenSea: https://opensea.io/

LooksRare: https://looksrare.org/ru

X2Y2: https://x2y2.io/

Gem: https://www.gem.xyz/

MagicEden: https://magiceden.io

ArtBlocks: https://www.artblocks.io/

Analytical Tools

AlphaSharks: https://vue.alphasharks.io/trends

Mintify: https://mintify.xyz/

NFT Flip: https://review.nftflip.ai/

Flips.finance: https://www.flips.finance/

NFT Nerds: https://nftnerds.ai/

icy.tools: https://icy.tools/collections

moby: https://moby.gg/

TraitSniper: https://app.traitsniper.com/

Other tools

Mint Price Calculator: https://www.nonfungible.bot/calculator

Allows you to calculate potential profit

Degenmint: https://degenmint.xyz/

Allows you to track current popular mints

Flips.watch: https://flips.watch/

Helps you keep track of your flipping results

DegenScan: https://degenscan.pro/