Vocabulary

Launch – launching a collection that is available for mint.

Mint – turning a jpeg into an NFT. An NFT magically materializes in your wallet when you mint.

PREMINT – the right to mint an NFT before the other participants of a mint and avoid Gas wars.

WL (White List) – a guarantor for participation in the premint. Usually it is a role in Discord or a special NFT, which confirms the right for the premint.

Public Sale – a stage of project launch, when the NFT is available to anyone. It begins immediately after the pre-mint.

Gas – the commission required to complete a transaction on the network.

Gas war (gas war) – if there is a large number of people, participants increase the chance of success by increasing the amount of gas, which will be spent for the minte. Increasing the gas you pay more commission to the miner for the right to get into the block and mint NFT.

PFP (profile picture) – avatar. Now most NFT in space are PFP projects, NFT of which can be used as avatars in social networks.

Secondary market – the purchase of NFTs second-hand on the NFT marketplace.

Marketplace – marketplaces for NFT trading (OS, Rarible, FND, etc.).

Listing – putting NFT for sale on the marketplace.

Delisting – removal of NFT from marketplace.

Floor – the lowest price at which you can buy an NFT in a collection on the secondary market.

Floor sweeping – Active buying of NFT collection at the lowest price, driving up the price.

Reveal – often, after a mint on an NFT, a stub with a conditional picture appears, which is displayed on all NFTs in the collection. After some time, with a metadata update, the NFT is opened. Only after revealing will you know which NFT has been minted.

Rarity – the degree of rarity of the NFT in the collection. The rarer the NFT, the more expensive it is.

Trait – some characteristic element in the NFT. Can add rarity. As an example: a laser from the eyes on a pfp might be worth more, since it gives a reference to bitcoin.

Wen is derived from when, which literally means “when.” This is a rhetorical question for devs (developers / funders) in discords, trying to find out when the project will be the next blue-chip. Wen moon? Wen lambo?

Gem is a project that is highly likely to be profitable.

Flip – selling the NFT immediately after the mint. Short-term.

Ape in – you get into a new collection by buying NFTs.

Degenerate (more often degen) – in NFT degen has a positive connotation. This is a person who plays at high stakes and makes rush decisions.

Paperhands – to sell NFT much earlier than the peak price to a mini-plus. Or even a minus. A big minus.

Hold – holding an NFT in hopes of making a profit in the future. Long term.

Diamond hands – a confident Holder who will not sell to the last.

Shill – PR for the project on Discord or Twitter in hopes of finding a buyer.

Raffle – a givaway held in discord or Twitter, which gives a chance to win WL or NFT project.

Scam – Cheating to get your NFT, coins or other cryptocurrency assets.

Rug pull – after a mint devs drop their collection. They get in their lambas and drive off into the California sunset to Rick Astley – Never Gonna Give You Up.

Dox is the disclosure of personal information. In NFT, this is when, for example, they reveal the anonymity of the project devs.

No brainer – when the project is so good that you don’t even need to analyze whether it will make profit or not.

Blue chip – a project in which it is safe to invest for the long term in almost all market conditions. For example: CryptoPunks, BAYC, etc.

FOMO (fear of missing out) – understanding at moral level, that you could earn a lot of X’s, if you bought that NFT. But you didn’t. At first it hurts, but then you don’t care.

DYOR (do your own research) – before you buy something, analyze and study the project yourself (do your own research).

AMA (ask me anything) – sessions where the creators of the project (devs) answer any questions of the community. Held in a space on Twitter or collection discords.

WTT (willing to trade) – ready to trade this NFT for this. This is what they write in the discord channels dedicated to trade.

OTS / WTS (open to sell / want to sell) – I want to sell this NFT as an example. Often this abbreviation can be found at sites that sell WL-sales.

OTB / WTB (open to buy / willing to buy) – want to buy. The same sale WL-sov.

Escrow (guarantor) – a person who acts as an independent third party in transactions for the sale or purchase of WL, thereby making the transaction safe.

FUD (fear, uncertainty, and doubt) – after the mint some people are dissatisfied with the result for various reasons. They start throwing mud at the project and behaving in a very toxic way.

WAGMI (we are gonna make it) – we’re gonna make it.

Influencers list

SOL :

1) https://twitter.com/kingfud

2) https://twitter.com/jpeggler

3) https://twitter.com/atitty_

4)https://twitter.com/icedknife

5) https://twitter.com/rizaar_

6) https://twitter.com/prattynft

7) https://twitter.com/solbuckets

8) https://twitter.com/solanalegend

9) https://twitter.com/gloom_sol

10) https://twitter.com/solplayboy

11) https://twitter.com/solsniperr

12) https://twitter.com/kenpa420

13) https://twitter.com/general_sol

14) https://twitter.com/wagmibeach

15) https://twitter.com/jan1kkk

16) https://twitter.com/mintoftheday

17) https://twitter.com/kurrylicioussol

18) https://twitter.com/jerzynft

19) https://twitter.com/howl33333

20) https://twitter.com/0xjems

21) https://twitter.com/degenswings

22) https://twitter.com/jagoecapital

23) https://twitter.com/sol_chapito

24) https://twitter.com/doppelnfts

25) https://twitter.com/chartfumonkey

26) https://twitter.com/kaelenwere

27) https://twitter.com/earlyishadopter

28) https://twitter.com/badluckzulp

29) https://twitter.com/linkkzyy

30) https://twitter.com/the__solstice

31) https://twitter.com/commenstar

32) https://twitter.com/nftsonsolana

33) https://twitter.com/0xgabriele

35) https://twitter.com/mr_george

36) https://twitter.com/solmintdaily

37) https://twitter.com/0xskellymode

38) https://twitter.com/t_h_nft

ETH :

1) https://twitter.com/garyvee

2) https://twitter.com/steveaoki

3) https://twitter.com/ohhshiny

5) https://twitter.com/MaisonGhost

6) https://twitter.com/zachxbt

7) https://twitter.com/AmeerHussainn

8) https://twitter.com/nassyweazy

10) https://twitter.com/shanicucic96

11) https://twitter.com/BentoBoiNFT

13) https://twitter.com/_jeffnicholas_

14) https://twitter.com/ryandcrypto

15) https://twitter.com/0xjaime

16) https://twitter.com/CryptoGorillaYT

17) https://twitter.com/9gagceo/

18) https://twitter.com/BlockchainGavin

19) https://twitter.com/SneakyninjaNFTs

20) https://twitter.com/THEGOONEEZ

21) https://twitter.com/TheHaQa

22) https://twitter.com/DonteCrypto

23) https://twitter.com/TienChauLe

24) https://twitter.com/nftboi_

26) https://twitter.com/PyroNFT

27) https://twitter.com/kingfxyo

28) https://twitter.com/BAYC2745

29) https://twitter.com/bryanbrinkman

30) https://twitter.com/allnick

31) https://twitter.com/kevinrose

32) https://twitter.com/2yeahyeah

33) https://twitter.com/anonymoux2311

34) https://twitter.com/andy8052

35) https://twitter.com/tayl0rwtf

36) https://twitter.com/garyvee

37) https://twitter.com/markdaniel94

38) https://twitter.com/ohhshiny

39) https://twitter.com/henrythegrape

40) https://twitter.com/cyberkongz

41) https://twitter.com/ogdfarmer

42) https://twitter.com/rahim_mahtab

43) https://twitter.com/bobbyhundreds

44) https://twitter.com/lucanetz

45) https://twitter.com/nickygee44

46) https://twitter.com/cryptogorillayt

47) https://twitter.com/deezefi

48) https://twitter.com/ameerhussainn

49) https://twitter.com/hunterorrell

50) https://twitter.com/cr0sseth

51) https://twitter.com/natealexnft

52) https://twitter.com/farokh

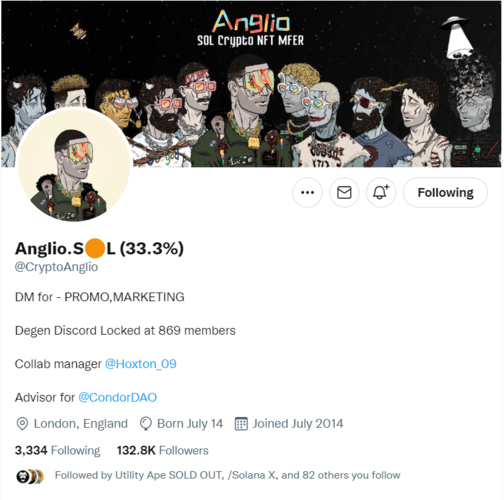

DAO’s LIST

SOL :

- https://twitter.com/CryptoAnglio

- https://twitter.com/ThomasDAO_

- https://twitter.com/LevisAlphaDAO

- https://twitter.com/degendummies

- https://twitter.com/SniperDAO

- https://twitter.com/jarpixDAO

- https://twitter.com/TheDegenDAO

- https://twitter.com/Broccoli_DAO

- https://twitter.com/OakParadiseNFT

- https://twitter.com/PrimalDAO_

- https://twitter.com/LinkedDao

- https://twitter.com/MaskedApeDAO

- https://twitter.com/Duckish_

How to make research of the project and define its type?

Let’s start with the basics: When you are creating any NFT project or NFT collection, one of the most important factors of its development and future success is to attract the audience of observers and create a buzz around it. Social media is an ideal tool for this.

TWITTER is one of them. Why Twitter?

The answer is as simple as possible: All over the world Twitter is perceived and implies a purely infocommunicative social network, where the posts of major companies, projects, world and political leaders and much more are published.

What is it based on?

The main purpose of the posts in most accounts is to entice the audience to some kind of product or project for its further use as an end user.

That is why the way of development of NFT project/collection is ideal for the social network Twitter.

Types of projects

Type of project is the most important indicator, in relation to which the full analysis of the project takes place. So, what types of projects are:

Degen projects are projects whose main purpose is based on earning money

Features of Degen project:

- The lack of well-developed and active social networks (Twitter, Discord, etc.).

- Often poor quality,or even stolen (for example, from the same ETH) NFT.

- Unfriendly (little usable) utilities or their complete absence.

- Similarly with roadmap (project roadmap) – unstable or completely absent.

- Often the price of a mint (mint price) = 0 (free mint), those pay only for gas.

- Degen projects may have 0 royalty (payment to the author).

- Build projects – projects whose main goal – to create a strong community, actively involved in the fate of the project and directly taking an active part in its development.

Features (signs) Build project:

1. Well-developed and actively engaged in social networks (Twitter, Discord).

2. Unique art (the quality depends on the artist, but often well developed).

3. Sophisticated and usable utilities.

4. Similarly with the roadmap – high-quality, well-developed, interesting.

5. An active project team (founders, developers, administrators, moderators, colab managers).

Now without any unnecessary distraction to the basic concepts (theory), you can move directly to the RESERCH (practice).

How to make Twitter reseach?

The first thing you need to know and understand is that a project review can be based on several sources of information.

Here are the 3 main sources of information:

1. Project review for influencers.

2. DAO project review.

3. Reserch for projects that other projects are interested in.

Influencers research

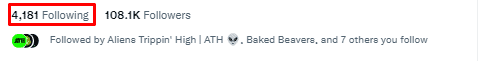

The first thing we start the resurvey with is the choice of influencers. Take for example – https://twitter.com/solplayboy.

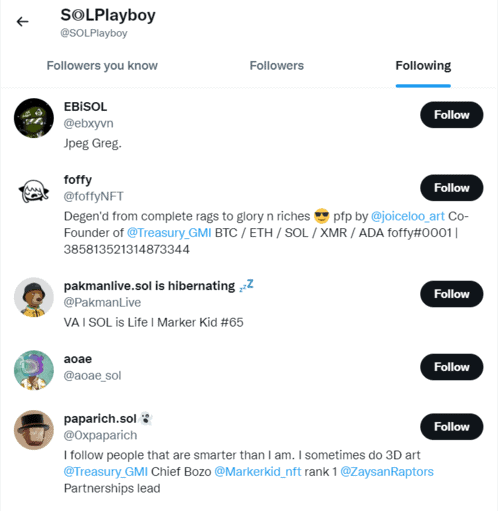

Go to the Following tab:

Next:

In the Following tab, we see all the accounts to which influencers is subscribed. It’s worth clearly understanding and being able to distinguish between personal user accounts and project accounts.

Examples of project accounts:

Examples of user accounts:

Distinctive features of the project account :

1. It often happens that projects specify a supply in the description of their profile.

2. If the project already has Discord, you can also see it in the profile description.

3. Projects never put the ending “.sol”, “.eth”, “33.3%”, “{313}”, etc. in their name.

Sometimes projects specify a mint date in their names. For example: “(Oct. 12-13)”, “10/21 19:00 UTC”.

5. In the profile description can be a brief information about the project.

6. In the description of some projects may occur the words: “produced by @…”, “powered by @…”, “created by @…”, “mint TBA”, “discord coming soon…”, “NFT project”.

7. Sometimes it can happen that in the description of the project can be empty. Such accounts also need to be reviewed.

Here we have found some project:

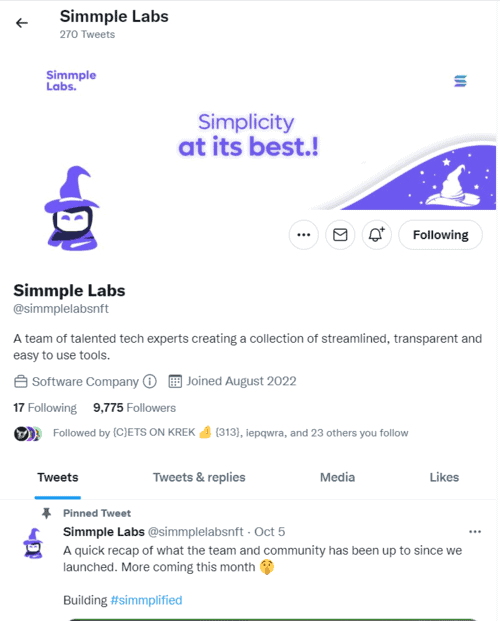

We enter it and see a picture like this.

1. It is understandable that our eyes are diverted. The first thing we look at is the brief description of the project. Why do I need it? You may be able to + – understand the subject and focus of the project.

2. The second step is to look at recruiting subscribers. To do this, go to this site – https://botometer.osome.iu.edu/. The higher the scale goes up, the more bots, which is not good.

3. Look at the ratio of the number of subscribers to the average number of reactions to posts. Acceptable values are 1/10 to 1/50. (Recently, the activity on Twitter, even in the top projects has decreased markedly, so the tolerance can be increased to 1/100).

4. one of the most important things : informative content of the posts. What do I mean by these words ?!

The ratio of the number of info-containing posts to the number of advertising or FCFS posts.

What we should consider?

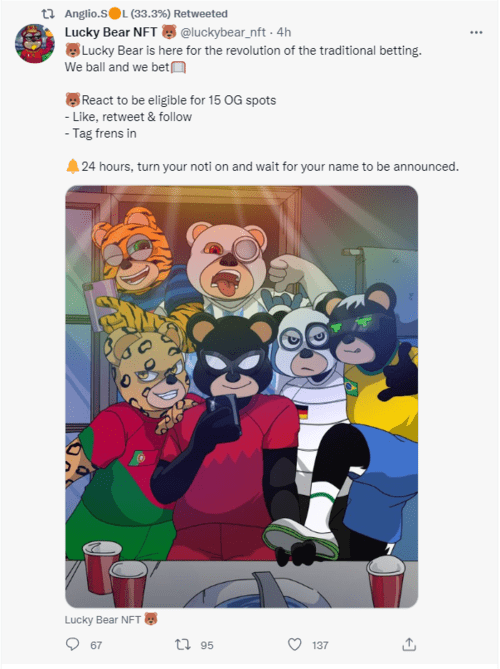

1. If at the early stage, the project has a lot of advertising / FCFS posts, it is not the best effect on the personal perception and positioning of the project.

2. because of advertising / FCFS posts can directly increase the number of subscribers (in organic growth or subscriptions through inflows). It can be treated differently: on the one hand, the project thus gathers the necessary coverage and audience, but on the other hand, the quality and interest of the audience can greatly decrease, because one of the conditions of participation in the FCFS give – is the subscription to the channel and setting reactions.

3. you often see that at the very beginning of the journey of developing projects on Twitter, there are posts with a few letters to 2-3 sentences, which do not carry any weighty information. Personally, I take this as a good indicator, especially if a lot of reactions and sensible (meaningful) comments are gathered under the posts + begin to add subscribers.

4. Drawings and giveaways WL’s project at an early stage also adversely affect the personal perception and positioning of the project (a really strong and competent project in very rare cases, can conduct such actions, but the draw there will be a small number of WL’s, and competent selection).

5. Sometimes there are posts with a general message of collaboration. You need to clearly distinguish between direct collaboration and secondary collaboration.

**Direct collaboration is based on the creation of some joint “product.

**Secondary collaborations are based on giving out WLs from a given collection to holders of another in order to attract interest in that collection and create a semblance of collaboration.

Look at the activity under the posts

1. pay attention to purely informational posts and activity under them, because in advertising or FCFS posts one of the conditions is to put a “like” under this post and mark a friend/friends in the comments.

2. Look at the comments under the informational posts. They also have to be meaningful and preferably not in 1-2 words. The more comments there will be big and meaningful, the better.

The smaller the difference between the number of likes and the number of comments under the post, the better. Based on this, you can judge about the activity and attractiveness of the audience.

4. The greater the number of retweets under the post, the better. Regardless of the topic of the post.

Look at the number of Inflows subscribed to the project

You can do this through – https://twitterscan.com/view/nft or simply by going to “Followers” => tab “Followers you know”.

1. Look at the number of signed accounts. The more the better.

2. Look at the quality of these accounts (in the list of infles, which I posted above, listed accounts by quality from top to bottom, look check it). Over time you will understand and determine for yourself the value of subscribing to a particular infle / project.

3. The value of another project’s subscription > the value of an infle subscription. My personal opinion + another project’s subscription could mean potential interest and collaboration with that project.

4. Most of the infles are “selling”, as the main purpose of a classic infle account is to sell advertising. So for yourself, you should try to categorize infles into these categories (sellable / not sellable)

5. If we’re talking about “selling” Infl, then they should be divided into “expensive” and “cheap”.

How do we know and check this? – The cost of expensive inflextime posts can be up to $ 1000. If the project could afford to buy these ads, it characterizes it as a well-financed project => a good indicator.

7. If a project has already shown sneak Picks, then pay attention to their quality and uniqueness. It happens that sneak pikes can be stolen from other collections on different blockchains.

8. Now let’s go to the subscriptions of the project itself in the tab “Following”.

1. Most often in the project subscriptions we can see the team members/founders. Thanks to this we can assess the level of this team, their past experience in possible project creation (for this we go to their profiles and study everything there).

2. also in the project subscriptions we can see subscriptions to other projects. What can it tell us ?

1. Possible cooperation with this project.

2. It’s possible that the collection we analyzed is Gen-2 or Gen-3 collection of an existing project (which is very good, since questions about the team and the prospects can be understood by looking at the Gen-1 project), or the project is the product of a joint collaboration (two or more) other projects (which is also a very good indicator, since questions about the project team, its funding and prospects can be determined by analyzing their accounts).

3. The project may be underwritten by any foundations, investor accounts or public figures. There is a chance that they are direct or indirect investors.

So, the main (basic) points have been walked through.

**Remember that search for Inflam projects is based on analysis of their subscriptions and in very rare cases analysis of their posts (I don’t recommend to look through their feeds, because often there are just advertising posts of other projects and chance to find a really good project is very small).

**Simplify your life by using this site – https://tweetdeck.twitter.com/. Thanks to it is much easier to keep track of new subscriptions to this or that Infla (I will not give instructions on how to use it, all intuitive).

DAO research

What we should know (let’s take https://twitter.com/CryptoAnglio as an example)

1. Unlike the same influencers, DAO’s do not sell ads on their page, which means that you can analyze their feed and find good projects there. Yes, it’s mostly FCFS there, but combined with the top DAOs, you can conclude => that it’s a gem project.

2. By analogy with Influx, we reserach their subscriptions in search of good projects.

Focus on reserch for infuencers, because this way you can find a lot more good projects, and additional subscriptions to the found project from other projects even more strengthen its value.