Preface

Today’s world is rapidly evolving. New technologies are being integrated into our daily activities on a daily basis. Twenty years ago, the Internet seemed like something out of the question, but now it is an integral part of our lives. It allows us to open up new possibilities and master technologies such as blockchain, which is probably one of the key achievements of IT technology in the 21st century.

The distributed data registry (blockchain) makes our world more transparent. The payment systems VISA, MasterCard and SWIFT have announced developments and plans to use blockchain technology.

It can be used not only to create payment systems. For example, Sweden, Ukraine and the UAE are planning to maintain a land registry using blockchain technology. In June 2017, Accenture and Microsoft introduced a blockchain-based digital identity system.

As it happens in today’s world, the first technology on the blockchain was bitcoin , denoted by the ticker BTC.

A person or group of people under the pseudonym Satoshi Nakamoto published a white paper with the bitcoin source code in 2008. Nakamoto disappeared from the radar in 2010, and no one knows where he is or if he is alive. In spite of this, bitcoin cryptocurrency gained its right to life and gained its popularity due to its decentralization, which does not require the trust of third parties.

Bitcoin cannot be banned or stopped thanks to crypto. It has a limited issuance of 21 million coins. Bitcoin belongs to no one: neither companies nor individuals. It does not need banks, it can be easily transferred from person to person with a wallet on a smartphone or computer, and if bitcoins are sent to a non-existent address, they will be lost forever.

As of 2021, cryptocurrencies have been passed into law in many countries (U.S., Canada, Japan, Germany and many others). Leading U.S. banks and payment systems, such as PayPal, are integrating cryptocurrencies into their ecosystems.

Wall Street Exchanges are launching futures, and JPMorgan, America’s largest bank, is developing blockchain for cross-border payments. It is now safe to say that bitcoin and blockchain are not going away. Their imminent adoption around the world awaits them, as does the Internet.

Cryptocurrency? Tokens? Stablecoins? What are they?

Cryptocurrency is a type of digital currency whose internal units of account are accounted for by a decentralized payment system (no internal or external administrator or any of its analogues), operating in a fully automatic mode.

The cryptocurrency itself doesn’t have any special material or electronic form – it is just a number that indicates the number of units of payment data, which is recorded in the corresponding position of the information packet of data transfer protocol and often is not even encrypted, like all other information about transactions between the addresses of the system

In short, cryptocurrency is virtual money that has no physical form and which has its own system of interaction.

In general, cryptocurrencies are not reduced only to currencies and it is more correct to use the term “digital assets”, “open digital economy”, “open digital world”.

What is a token?

In simple terms, a token is a digital certificate that guarantees a company’s obligations to its owner, analogous to a stock on a stock exchange in the world of cryptocurrency.

Classification of tokens

Investment tokens – used for investing and receiving dividends in the future;

Credit – used for a short-term loan with subsequent repayment at a certain interest rate;

Unique (NFT) – belong to the category of non-exchangeable, used to record blockchain information about ownership of items, real estate and other property: photos, music, videos, etc;

Service – suitable for certain functions, adding value to the product / service;

DeFi – designed to trade and participate in the management, are part of the application ecosystem;

How and what can tokens be used for?

First of all, tokens are needed for identification. With this digital certificate, you can prove your involvement in the financing of a project, and as a result of its success, the token owner receives a good profit. Again, the token in this case can be compared to the key to the safe where the money is kept.

If all goes well and the project fails, then this key will be needed to get the benefits it is entitled to. If the project fails, the key can be thrown away.

Tokens can be used in many different cases:

To buy services and services;

To pay within games, for example to buy inventory in your favorite game;

Tokens can be used to get rewarded for doing some work or helping the project at the initial stages;

A token can give the right to participate in the profits of a future company (analogous to a stock).

What is the difference between tokens and cryptocurrency?

As we know, cryptocurrency is managed in a decentralized manner. Simply put, a certain algorithm is responsible for the functioning of coins, which cannot be regulated.

Tokens, in contrast to cryptocurrency, can be a decentralized currency or a centralized one. In the latter case, a single company is responsible for managing the coin, which is its creator. The same organization conducts all transactions, carries out transactions and processes all information related to the accounting of coins.

Stablecoins

The term “stabelcoins” appeared in 2014 with the appearance of the first such cryptocurrency, Tether. The essence of the digital asset is that its rate fluctuates in a minimum range and is tied to the value of fiat money or other instruments.

Stablecoins come in 3 types and differ in terms of their collateral with the following assets:

Fiat money.

Cryptocurrencies.

Algorithmic (operating on an algorithm to maintain rate stability).

USDT and USDC belong to the category of stabelcoins, secured by fiat money. The algorithmic type includes USDD.

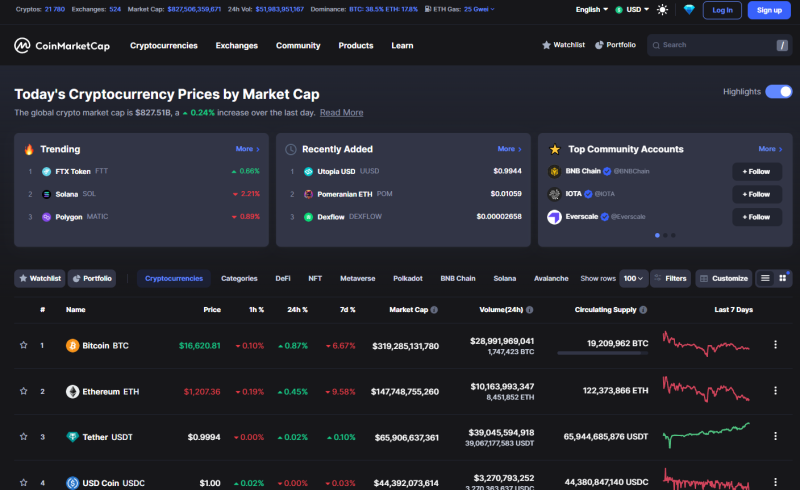

The most popular stablcoin is USDT, which is in the third place on the capitalization. Slightly behind is USD Coin, which is only one rank lower and is in fourth place.

The popularity of stable coins is due to the low volatility, the fixed price, the high speed of transactions and the possibility of insuring risks. Among the disadvantages are the risk of inflation, centralized management and periodic checks.

Crypto Dictionary

Now we need to learn the crypto-vocabulary – to better understand the crypto-world:)

Slang

DYOR – do your own research. Do your own analysis of what you’re investing in.

FOMO – fear of missing out. Fear of missing out on some profitable investment/feeling when you have already missed out.

To the moon – used to express positive expectations about a project.

Paperhands – people who sell cryptocurrency after the slightest growth.

Diamond hands – people who hold cryptocurrency in expectation of large profits.

Fud (fud) – fear, uncertainty and doubt, usually used in reference to negative feelings about a project that people are spreading somewhere.

Hodl – to hold an asset “until it’s blue in the face.

Whale – large investors who own a large number of tokens for a project.

NGMI – not gonna make it. It means that someone is not going to make it due to some circumstances.

WAGMI – we’re all gonna make it.

LFG – let’s fucking go. Used to express a positive sentiment about a project.

Shill – disrespectful practice to the audience to promote some project/token in which the investor has been influencer.

GMI – gonna make it.

Rekt – a slang version of the English word “wreck”, which means “to fail”.

Basic terms

Address – a string of characters that represents the number of wallet, where you can receive and send cryptocurrencies from.

Airdrop – marketing campaign to distribute some cryptocurrency for simple actions.

Blockchain – A sequence of blocks or units of information stored sequentially in a public database.

DAO – decentralized autonomous organization, an organization that is based on the blockchain, where each DAO participant can participate in decision-making on the conduct of the project.

Defi (DeFi) – decentralized finance. Infrastructure, which helps to get rid of the control of banks and other institutions over people’s finances.

Gas – commission for transactions in the blockchain.

NFT – Non-exchangeable token. A unique digital object that gives ownership of a virtual commodity (e.g., digital art).

Floor – The minimum price of an NFT in a collection.

Smart contract – Software code that can run on a blockchain.

Token – an asset that can be stored, sold, bought, steamed and so on.

Mint – The creation of an NFT in a blockchain.

P2e (p2e) – play to earn (play-to-earn). A model of blockchain games in which users can earn tokens through various game mechanisms.

Wallet – a place to store cryptocurrencies.

ICO – initial token offering, i.e., the sale of tokens before the project developers enter the exchange.

FCFS – first come, first served.

Staking – entering tokens for validation on the blockchain and receiving a certain reward for doing so.

Blockchain validator is a network node that takes an active part in building the blockchain: it checks incoming transactions and attaches blocks in the network.

Market Maker (MM) – an organization that controls the rate of a particular cryptocurrency.

OTC – trading stands for Over-the-Counter and literally translates to “over the counter”. This term means over-the-counter trading, when a seller and a buyer make a deal directly with each other.

How to buy and store tokens?

Before to buy token we need to understand what tokens exist, the help comes to us coinmarketcap.com

On this site you can see what tokens exist – where they are traded (on which exchanges) and you can read more details about the project (in fact you should always get acquainted before you go to buy token).

You can also see the capitalization of the token and more. In general, I recommend to fully explore this site.

You can buy and sell in several ways:

At a currency exchange;

At an electronic currency exchange;

By personal agreement between the buyer and the seller.

Tokens are bought and sold according to the same principles as all cryptocurrencies. Wallets are used to store tokens, including multi-currency wallets, presented in the form of applications for smartphones, computer programs or even browser extensions.

At the exchange, there is nothing difficult, just register to confirm your identity and then you can recharge your card and buy the coins you need.

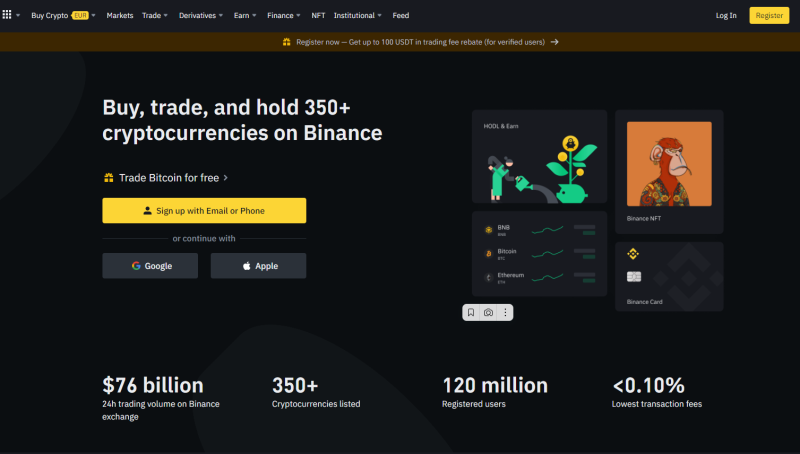

The most popular exchangers at the moment:

Binance

Bybit

Okx

Huobi

Where to store tokens?

Tokens can be stored both on exchanges and on wallets. But… It’s very dangerous to keep big amount in exchanges, because everything can happen. Recently FTX Crytoburrency Exchange (which had about $10M turnover per day) just collapsed in few hours and a lot of people of course were not able to withdraw their money.

So, either keep a small amount on wallets – or split the amount and keep it on 2-3 exchanges. But again – not financial advice:) think primarily with your head.

And the best idea is to keep your money in the wallets, but wallets are different:

Hot Wallet is a hot cryptocurrency wallet that has a constant connection to the Internet. They can be mobile, desktop, or can work directly from a browser. They allow you to instantly buy or sell coins and tokens without the need for additional configuration.

Cold Storage is a cold wallet that has no permanent connection to the Internet. It is connected to the network only for a few seconds at the time of the immediate transaction. Implies offline storage of currency under the protection of a secure personal key.

3.2 The best hot cryptocurrency wallets:

Trust Wallet

Metamask

Coinbase wallet

3.3 The best cold wallets for cryptocurrency:

Ledger

Trezor

Safepal

Ways to make money on the crypto market

Investing

Buying “tokens” at the start of the project

Mining

Trading

Steaking

Airdrop

NFT

Abmassador

Nodes and Testnet

Investing

Investing involves buying a coin and selling it only after a certain (long) period of time. We expect to make a profit in the long term.

Suppose we decide to invest in bitcoin for 5 years. We can choose one of the strategies. For example, buy bitcoins for a certain amount today, and sell in 5 years. In that case, we will earn on the difference, if the chosen strategy was correct, and bitcoin will grow during that time.

Or we can buy bitcoin for some amount every month regardless of its price. With this strategy we will get the best average price over that 5 year period.

That is, when we talk about investments, we mean long-term goals (1 year, 2 years, 5 years, etc.).

Buying “tokens” at the start of the project

ICO – (“initial coin offering”) – a form of raising investments by selling a fixed number of new cryptocurrency units to investors.

In words, everything is simple: you look for companies that attract investment, most often it happens at some sites (sites), launchpads.

You buy their tokens at the minimum price, before placing these tokens on the exchange for trading.

The price of tokens at the ICO was $0.025, and as soon as it went on the exchange, it started trading at $1,

your profit was 4000% – you invested $100 and got $4000 if you fixed (sold your tokens) at $1.

❕But there is a big BUT❕

Not all of the projects that come out, are in demand and therefore their token can give you 100%, also not bad (kept your investment), but it may be that the project will be a scam and will sell all its tokens.

And another “but” – the unlocking of coins!

The fact is that companies prescribe special conditions for investors to unlock their investments.

❔How does it work?

You invested $1000, bought 10000 tokens at $0.1.

Token goes on the exchange, and trades at $0.3, “Oh cool” you think, but no, so you do not sell everything now, and run away with your investment (for startups, it is not profitable, I would say disastrous), the project prescribes conditions for you to unlock coins:

Price at $0.3 per token, i.e. you already have $3,000 (300% profit), but according to the terms you can take back only 20% of your investment in 1 day of trading, which is $600 at the moment. The next 10% of your investment you will be able to pick up in a month, then another month, and so on.

All of your investment you can pick up in 8 months and here’s the catch – the PRICE OF THE COUNTRY MAY ALL THE TIME BE DROWNING, NOT GROWING!

And after 8 months, you will take not $ 3000, and if well your $ 1000, which invested.

But it may be the other way around!

In any case, do your own research!

Mining

Mining – “mining,” the extraction of cryptocurrency through the power of computer equipment.

People who are engaged in mining are called miners.

Miners on special “farms”, where the mining capacities are installed, consisting of one to tens of thousands of processors and video cards, calculate special blocks, which give the right to get a certain amount of virtual coins.

In simple words: we connect our “computer” to a special site (install the software on your computer) and this site (platform) uses the resources of your computer to generate new blockchain blocks (for mining), for which you get rewards (cryptocoins).

Blockchain is a decentralized database that is simultaneously stored on many computers connected to each other on the Internet.

Trading

Trading is a more active way to make money than investing. A trader must be constantly immersed in the market. An investor can choose certain assets for himself and buy them for a certain (long) period of time and get out of the deal when his goal is reached. A trader must close transactions with maximum profit and insure himself against risks with stop orders and other tools. He earns here and now.

Staking

To understand what staking is, we can refer to the concept of a bank deposit. When we open a deposit in a bank, we begin to receive interest on our amount. From the point of view of getting profit, shaking has a similar model – we freeze some amount of our funds and get a certain percentage of profit in the same asset which we put into the shaking.

The amount of profit we receive can vary from 1% to 500% per year or even higher.

Airdrop

In the crypto market, the term “AirDrop” is used when a blockchain project or platform distributes cryptocurrency to its potential investors or users. It is believed that 80% of the time it is nothing more than a marketing move of another crypto platform to attract the attention of future customers.

Such projects transfer cryptocurrency directly to users’ wallets for free. Sometimes, in order to participate in the distribution program and receive tokens, a client or potential investor must meet certain conditions, for example:

- undergo verification (KYC);

- subscribe to the project’s newsletter;

- subscribe to the project pages in social networks.

What are AirDrop cryptocurrencies for?

First of all – it is a way to attract attention and, as a consequence, increase the number of users on the platform. In addition to marketing purposes, cryptocurrency projects that are just entering the market can use AirDrop for the following purposes:

- Handing out management tokens. In addition to their monetary value, management tokens give holders voting rights and allow them to influence important decisions regarding the project. This form of governance is similar to a publicly traded company – where the shareholders of a company make decisions at a meeting by voting, with the number of votes proportional to the number of shares each shareholder has.

- In some cases, cryptocurrency airdrop is necessary to launch the entire blockchain system of the project. Having cryptocurrency in a wallet encourages users to make transactions, which allows the platform to get up and running faster.

What do I need to participate?

To participate in Airdrop and get cryptocurrency for free, you need to meet a few prerequisites:

- Have a cryptocurrency wallet. This can be done through a cryptocurrency exchange, through special cloud services or purchase a “cold” wallet option (based on a USB flash card).

- Find an appropriate aggregator platform or community in social networks, through which the next AirDrop will be announced.

- Fulfill the conditions of the project, which will carry out the distribution of tokens.

Types of AirDrop

There are several types of AirDrop, depending on the way they are conducted:

- Standard AirDrop. This type involves giving away cryptocurrency without any conditions or in exchange for a newsletter.

- “Bounty Airdrop. Involves users performing simple tasks to receive tokens. Most often, these are retweets about the project, creating a post on Instagram, or joining the corresponding group (channel) in social networks.

- Exclusive Airdrops. Programs of this type are designed for people who have an established history of cooperation or interaction with a particular project (cryptocurrency exchange, website or community). For example, in September 2020, the Uniswap project gave 2,500 UNI tokens to its regular users. At the time, this reward was the equivalent of $1,200, and there were no prerequisites for receiving them.

- Hardforge giveaway. This is a slightly different version of airdrop, relating to the technological conditions of a particular platform. When a coin or cryptocurrency is branched or split from the original block chain (network scaling), a new coin is created, and those who had the original digital asset receive an equal number of new tokens into their wallets. The most famous example is the Bitcoin Cash (BCH) hardforge, which took place in 2017. At that time, users who were BTC holders automatically received an equal amount of BCH.

- Rewards for cryptocurrency holders or investors. These airdrops are similar to hardforces in that users who already have certain tokens receive new ones. For example, EOS and Ethereum offer users free tokens when they create new projects on one of their blockchains. These are not hardforces of the original coins in the usual sense, but entirely new projects created on top of the EOS or Ethereum protocol.

Regardless of the type of AirDrop, all such projects have one thing in common, and that is the distribution of new coins virtually for free. In other cases, it’s either not an airdrop or a scam.

NFT

An NFT is a digital certificate that represents some kind of unique object.

We can attach an NFT to any digital product, such as an image, video, audio, etc.

The token will contain all the information about the product. A token is an exclusive right to the product. By owning, buying, selling or exchanging a token, we perform all these operations with the commodity itself.

Because tokens are stored in an open and distributed blockchain, information about that commodity, its owner and the history of transactions with that commodity will always be available and reliable. We can always know who made what item and who currently owns it.

NFT technology potentially allows any commodity to be tokenized, that is, transferred to blockchain. Even physical goods. But there are still a lot of challenges. Digital goods, on the other hand, are ideal for tokenization simply by their very nature.

What can be tokenized:

- digital art

- Game items: cars, skins, characters.

- any objects in virtual universes, e.g. earth

- anything

How do I make money with NFT?

Whitelists

A whitelist is essentially a privileged list of users who get the earliest opportunity to get NFTs from the project or buy them at the lowest price.

Whitelists give an opportunity to avoid gas wars, during which huge amounts of money are spent to pay commissions in the blockchain. This mostly happens in Ethereum when interest in an NFT run collection goes off the charts, thereby increasing the cost of transactions in the ETH blockchain.

How do I get a place on the Whitelist?

To get WL you need to perform various tasks from the projects, showing activity in social networks, messengers, etc.

All NFT projects use Twitter and Discord as the key sources of traffic and user attraction, so Twitter accounts are obligatory!

If it is Twitter, you have to subscribe to the NFT collection (project) page, retweet the post, like it, write a comment, post a prepared post to your profile and so on.

In Discord you can get roles, talk to people, upgrading your profile, inviting friends, referrals, etc.

Getting WL depends on how you express yourself in social networks and communicate with the community, with moderators, developers. In general, you need to show initiative, to be active and helpful to the community, then you will be noticed, will be rewarded with WL and other benefits.

If you’re not experienced enough, feel free to ask participants who have already received VLs, find out how they did it, what activity they did, how much time it took. Also, talk to people who did not get WL, it will help you to understand what you missed or what you need to improve in your own strategies and much more!

Selling Whitelists. OTC market.

You can earn in NFT by selling Whitelists via OTC.

There are actually a huge number of people who want to buy whitelists.

To do this, you have to work hard and find the right communities where people post their WL for sale and are willing to buy them.

Beware of scam!

1. Use Guarantor.

2. Use only reputable OTC.

3 Do not show a nickname in Disk, where the whitelist is, to the seller. Often surrender admins to take away whitelist.

4.Be sure to check the nicknames guarantors profile descriptions, where the nicknames!

5. It is not uncommon for a fake OTC to impersonate another name.

6. Always change account details during purchases (username, authenticators, passwords, etc.).

NFT Free Mints. How to buy NFT for free.

In order to grow faster and attract an audience, NFT projects offer free minis. During the free mines, the user does not spend any money to get NFT tokens. An NFT flipper’s dream. However, keep in mind that you will have to pay a fee for the blockchain transaction.

The whole point is that the obtained NFTs on free mines can later be sold at a very good price, earning huge dough if the project turned out to be good, at least temporarily.

With the bear market right now and a significant decline in NFT volumes, free mines significantly lower the entry threshold into NFT to make a good profit in the short term, especially for new users.

Raffles

Another way to get VLs and free mines early on is Raffles!

Raffles are raffles from NFT projects and authors with some conditions, according to the results of which a certain list of wallets (users) get a chance to mint NFT at an early stage or get a place in the Allowlist. Sometimes for free, sometimes you need to hold some tokens in your wallet, but you always need to have an amount on your balance to pay the commission in blockchain!

Usually you need a Twitter subscription and a Discord connection. Sometimes you have to hold a certain amount of ETH to mint NFT to participate in the raffle. At the same time, you have to keep a small amount to pay the commission in the blockchain, even if the raffle mint is free (0.0 ETH).

NFT Flipping

Flipping is the art of finding the cheapest NFT collections, buying them and selling them in the moment for dearly-good.

Ambassador

A brand ambassador is a person who promotes a brand and its products among a loyal audience in order to increase the company’s recognition and stimulate sales.

The main areas of focus are:

- Social media modeling assistance.

- Creating memes, pictures, art.

- Translation and creation of articles and videos.

- Offline meetings with people.

- Programming, help in creating websites, etc.

Before you become an Ambassador you have to understand the basic principle:

You do not work for the money, but for the idea and development of the project! What would make it easier for you, imagine that you are the creator of the project and you need to advertise it as much as possible.

Come up with the most interesting and original ideas, one example of this is a man who gave a lecture at the university and told about the project in which he is an Ambassador.

Do not go the way of other people, a lot of translate the articles and creates memes, the competition is great and you can not stand out. Be creative, create something that others have not done. One of the options is a flash mob, a cool theme that will very quickly fizzle out on the expanses of Twitter.

What skills do you need to become an Ambassador?

- Knowing how to talk to people is an important skill that will allow you to do your job more effectively.

- Money will not be superfluous, you can get your own team to do everything for you, to translate articles, to draw art.

- Your own channel or blog, if you have your own channel with subscribers it will increase your chances of becoming an ambassador.

- Knowledge of languages, will make your life easier, but you can do with a translator.

- Be a professional at something. For example, if you are a born programmer or PR and you have an education, all the doors are open to you.

- Time, time, time. You’re going to need a lot of time indeed.

Ambassadors have several kinds of rewards:

- Evergreen Dollars, or more specifically Stablecoins, a cool reward.

- Allocations to tokensale, they usually come out in big X’s, so that’s cool too.

- Various accesses and privileges, bullshit, you might get access to a course on improving your productivity and time management.

- NFT, currently 50/50, the NFT market is dead, but in the bullpen it’s a great reward.

- Project tokens, also a cool topic, but not always.

Nodes and Testent

A node is a device connected to other devices as part of a computer network and which is connected to a specific blockchain network.

Nodes are decentralized. If, say, some country shuts down the Internet, the nodes in other countries will contain all the history in the blockchain chain.

At the start, the project needs to test its network. Renting servers around the world is inconvenient and unprofitable for a startup. So they can delegate this to ordinary people.

In return, they promise a reward.

In simple words: you give your computer power to the network test, you rent a server for that test, and the startup pays you or does not pay. Depends on what the project promises, what rewards, they may send you just merch.

Guide itself to installing noda will not write, very much text and photos are needed (you can search the internet).

Testnet – alternative transaction blockchain test, prototype project or its beta version, designed to test network without the need to spend real cryptocurrency. Coins used in the testnet do not participate in the general issue .

It is not always necessary to put a node, you can participate in the testnet without it.

This is a slightly different kind of testnet.

Some projects testnet functionality. You will need to transfer coins from one wallet to another, put coins in the pool, staking and for all this, you can also get a reward.

“The pitfalls.

▪The project may be weak, unclaimed. You will be poured tokens, but their price will be $0.0001. Server rental costs, electricity, and your time won’t pay off.

▪Startup may leave you with no rewards at all or reward you symbolically (merch, $2~$3).

▪ You may not get into the final stages of the test. The projects began to select only the most active participants who care about the project, help newcomers, communicate in the diss, etc.

What is Tokenomics?

Cryptocurrency tokenomics are certain components that help form the interaction between a token, a business, and its project.

It is very important for tokenomics to be deeply developed and to inspire confidence with its reliability and validity. This is a fundamental factor, because with a well-established system it is possible to successfully implement a project. Otherwise, the project may fail. It is important to understand that investing in a cryptocurrency whose tokenomics are not good from an economic point of view is a big risk.

The components of the tokenomics of the project

Purpose of financing

It is necessary to clearly define the purpose of the investment in order to understand what the project wants to achieve and what the investor can achieve with the project. Therefore, when interacting with a large technology company, a measure of demand among investors is very important.

Allocation of tokens

Every project should have a distribution schedule. It is acceptable for developers to hold part of the tokens, but no more than 60%. Exceeding this value is a stop sign for the investor. Make sure public investors have access to the majority of tokens.

Vesting Plan

Usually a project has 4 stages of investing:

initial;strategic;private;public.

The ideal would be continuous growth at each of the mentioned stages. Then the project will look more attractive to investors. Another essential rule: the duration of each next round should be less than the duration of the previous one. This is so because the participant who entered the project later than everyone else pays more for his coins, and he does not have the patience to wait too long for the release.

The purpose of the token

The investor needs the token to not just lie in the account, but also to generate profits for him. For this, it is necessary to define the project goal and calculate the possible profits and risks. A well-worked out start-up must have detailed goals and ways of achieving them, with described deadlines. In addition, if the project is set up for long-term work, as well as solving important life issues, it is a good reason to invest. Consequently, there is an opportunity for stable profits in the long run.

Team Leaders

One should pay attention to the leaders of this business, those who run it, who are the think tank. This is very important because it is these people who will move the company forward and therefore generate profits and super profits.

Native Token

A project with specific goals, functions and a reward system often needs its own token. Digital currency is very similar to a loyalty program: it systematizes and simplifies the entire production process. Having a native token increases a project’s potential profit. And if you don’t have one, that’s cause for reflection.

How can understanding tokenomics help you earn more?

A focus on the future in the long term, a staffed team of specialists, clear and realistic plans, elaborated goals and deadlines: all this shows the reliability and sustainable growth of the asset in the future, which unambiguously promises benefits for the investor.

How to protect yourself from scams?

- Always set a long password – for example: SAVKsx__123oArl_ALlADIN007 as well do not save the entire password on your pc! better save half of it and the rest somewhere on a flash drive, or write yourself into a notepad:)

- Always work on a device with an antivirus.

- Always add two factor authorization! we are always used to having email and a password, but this does not guarantee your security for your personal data. that’s why we invented two factor authorization.

- Do not use WiFi in airports, hotels, etc. because they are not very secure, no encryption or password, so you can be hacked by identity thieves.

- Always check the address of the link. Very many people are not typing the address in the browser directly, but do a search on google and habitually go to the first link. Scammers can completely copy the site, buy a similar domain and keep it in first place through google ads.