Here are 31 pieces of wisdom I wish I could send back in time to myself:

1. Taking profits and putting them into riskier bets isn’t taking profits – that’s just gambling. Lock your profits into BTC, ETH, stablecoins, and fiat.

2. Projects with cults can be extremely profitable. Just get off the rocket ship before it inevitably crashes.

3. Locking tokens for additional yield isn’t worth it. Nothing worse than being tied down to a sinking sink.

4. Protect your attention at all costs. You already have limited time and energy, don’t waste it keeping up with the latest Crypto drama.

5. Be careful overoptimizing yields – there’s no such thing as a free lunch. You stake the coin, earn yield, and then auto-compound those yields. Every additional yield comes with more risks.

6. Be skeptical of every piece of advice you see on CT – everyone has an agenda. Are they shilling a project to pump their bags? Are they spreading misinformation to game the Twitter algorithm?

7. When there’s a new narrative, be biased towards the market leaders. They have the 1st mover advantage and mindshare. The best beta plays are the forks on hot, new chains.

8. Being obsessed with the latest tools is a form of procrastination. You don’t need to use 50+ tools to make it. The biggest guys are simply using Etherscan, Debank, DeFiLlama, etc.

“I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.” – Bruce Lee

9. There’s an information food chain. Builders > VC / Insiders > Whales > bots > manual traders who receive news early ( manual traders who receive news late (> 1 min). By the time everyone’s shilling it on Twitter, it’s too late.

10. Alpha boils down to 2 things: having access to inside information or being able to do the hard work that others are too lazy for. People underestimate how far you can go by simply keeping up with a protocol’s medium articles and their discord.

11. Everything repeats itself, just repackaged slightly differently. Improving at DeFi is all about pattern recognition. For example, if certain influencers start discussing projects, they’re trying to attract exit liquidity.

12. Position yourself early and let the gains come to you. Anytime you feel FOMO is a sign that you might be too late.

13. Viewing your gains and losses as portfolio % rather than $ will help keep you rational. It’s hard to remain clear-minded if you equate your trades with IRL purchases.

14. Cut your losers aggressively. Set a stop loss and know when to exit a trade before investing. Don’t let small losers turn into big ones because of the sunk cost fallacy or emotional bias.

15. Record everything. Write down what happened daily in Crypto, your trades, mistakes, and lessons. This is how you improve your mental algorithm.

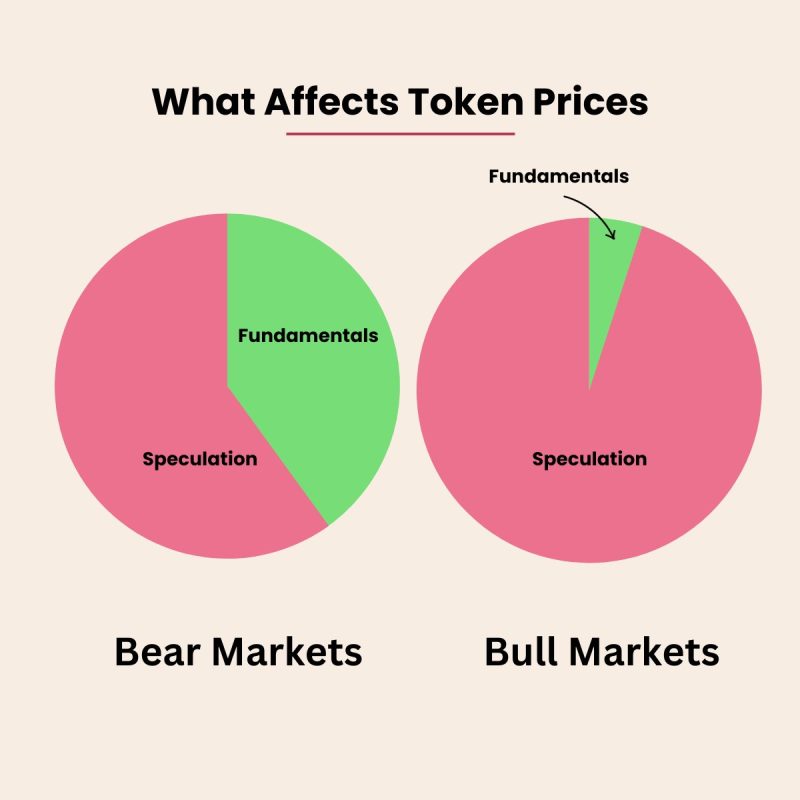

16. Don’t overrate fundamentals in a bull market. All logic disappears, and people buy based on hype, emotion, and speculation. See the industry as it is, not how you think it should be.

17. Incentives can drive prices. People buy when there are expectations of future profits. This can be affected through airdrop speculation, locking tokens for additional rewards, ecosystem incentives, etc.

18. Don’t put anyone on a pedestal. All the “smartest guys in the room” like Alameda and 3AC got rekt’ed. No one’s too big to fail.

Protect your funds when there are insolvency rumors. If you’re right, you saved a ton of money. If you’re wrong, you were inconvenienced for a few minutes.

19. It’s not about being right or wrong. No one bats 100%. It’s about maximizing the upside when you’re right and limiting your losses when you’re wrong.

20. Narrowing your focus is an underrated edge. No one can keep up with the entire space. Pick a few sectors and stay on top of them.

21. Keeping up with Macro is overrated. Just monitor capital flowing into the markets to see when we’re back. Your time is far better spent elsewhere.

“The track record of economists in predicting events is monstrously bad. It is beyond simplification; it is like medieval medicine.” – Nassim Nicholas Taleb

22. Don’t touch crypto if you’re on tilt, drunk, or sleep-deprived. A single mistake can erase years of hard work.

23. Stablecoins aren’t as stable as you think. UST collapsed, and USDC had the de-peg scare. Storing your dry powder as fiat in a TradFi bank is entirely viable.

24. Concentrate your portfolio if you want to grow it – Diversify if you want to keep it.

25. Develop systems – these rules and frameworks will prevent emotions from killing your games. These can include how you take profits and when to invest.

26. Thinking you can 100x your portfolio through trading is unrealistic. It’s not 2016 anymore. 99% of people are better off trying to find ways to increase their cash flow and putting more goals in the fire.

27. The crowd prefers new projects and narratives – not your 2021 bags. Don’t fight human nature.

28. Be skeptical of every piece of advice you see on CT – everyone has an agenda. Are they shilling a project to pump their bags? Are they spreading misinformation to game the Twitter algorithm?

Look out for yourself.

29. Stop limiting yourself to Crypto content. You’ll learn much more from studying game theory, behavioral economics, and psychology than reading the 9th article on EigenLayer.

30. The best projects have elements of both fundamentals and pumpmentals. Pumpmentals capture the attention, while fundamentals give people a reason to keep holding.

31. The unknowns, unknowns are deadly. The founder gambles with the treasury, or the anon founder has a shady past. You can’t predict them. This is where profit-taking, bet sizing, and portfolio management are your most critical defenses.

There are plenty more lessons to share, but we’re reaching everyone’s attention span limit.

Remember, there are exceptions to every rule. These are some of the principles I’ve learned, and some of them may change as I learn more.

The markets are choppy. It’s easy to feel down about DeFi, considering all the disasters in the past two years.

I still have the highest conviction in DeFi – I’ve staked the next decade of my life on it. Why? I see its potential. Efficiency. Transparency. It enables a new world where we have more control over our hard-earned money.

If you’ve learned something from this, then:

1. Repost and engage with this tweet if you think it’ll benefit your audience.

2. Make sure you bookmark this thread so you can re-visit it later during the bull run.