Many believe the market needs trillions to get the altseason. But $SOL, $ONDO, $WIF, $MKR or any of your low-cap gems don’t need new tons of millions to pump. Think a $10 coin at $10M market cap needs another $10M to hit $20? Wrong! Here’s the secret.

I often hear from major traders that the growth of certain altcoins is impossible due to their high market cap. They often say, “It takes $N billion for the price to grow N times” about large assets like Solana. These opinions are incorrect, and I’ll explain why.

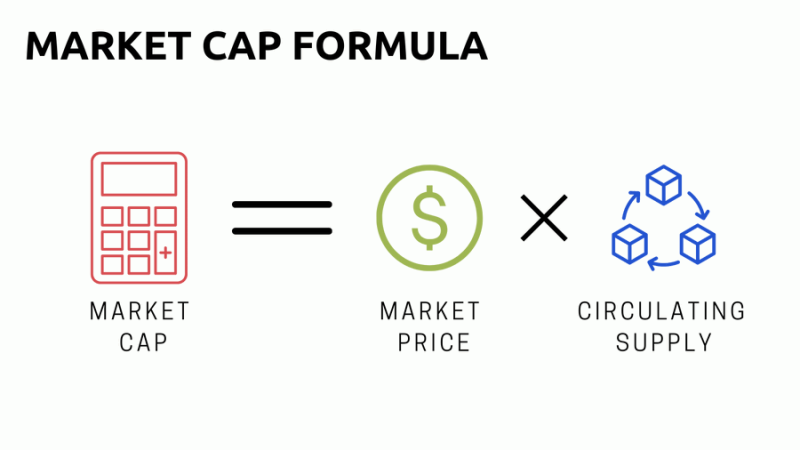

But first, let’s clarify some concepts. Market capitalization is a metric used to estimate the total market value of a cryptocurrency asset. It is determined by two components:

➜ Asset’s price

➜ Its supply

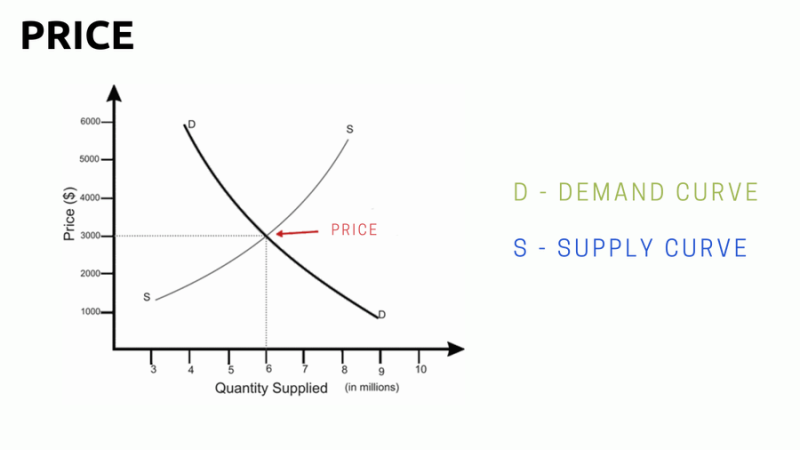

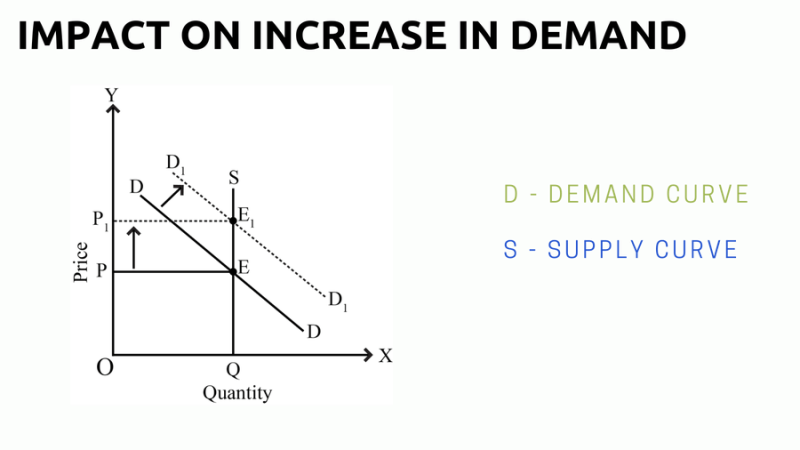

Price is the point where the demand and supply curves intersect. Therefore, it is determined by both demand and supply.

How most people think, even those with years of market experience:

$STRK at $1 with a 1B Supply = $1B Market Cap. “To double the price, you would need $1B in investments.” This seems like a simple logic puzzle, but reality introduces a crucial factor: liquidity.

Liquidity in cryptocurrencies refers to the ability to quickly exchange a cryptocurrency at its current market price without a significant loss in value.

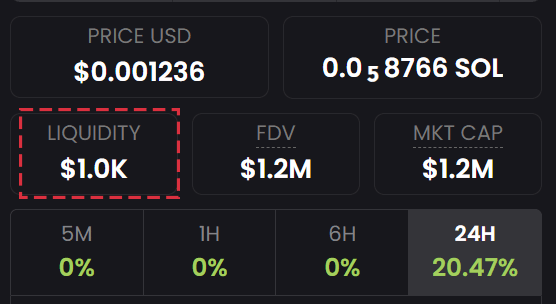

Those involved in memecoins often encounter this issue: a large market cap but zero liquidity.

For trading tokens on exchanges, sufficient liquidity is essential. You can’t sell more tokens than the available liquidity permits.

Imagine our $STRK for $1 is listed only on @1inch, with $100M available liquidity in the $STRK – $USDC pool.

We have:

– Price: $1

– Market Cap: $1B

– Liquidity in pair: $100M

Based on the price definition, buying $50M worth of $STRK will inevitably double the token price, without needing to inject $1B.

The market cap will be set at $2 billion, with only $50 million in infusions. Big players understand these mechanisms and use them in their manipulations.

Memcoin creators often use this strategy. Typically, most memcoins are listed on one or two decentralized exchanges with limited liquidity pools. This setup allows for significant price manipulation, creating a FOMO among investors.

You don’t always need multi-billion dollar investments to change the market cap or increase a token’s price. Limited liquidity combined with high demand can drive prices up due to basic economic principles. Keep this in mind during your research.