Altcoins have had a wild ride this year, leaving many investors on edge. However, with U.S. elections & rate cuts ahead, a major shift could be brewing. Here’s everything you need to know to stay ahead and avoid getting wrecked.

No Altseason

Many are frustrated that this cycle hasn’t seen an altseason. Altcoins have been underperforming since Nov. 2022, as TOTAL3/BTC shows. The ratio of the top 125 cryptos (excluding BTC/ETH) to BTC has dropped from 1.05 to 0.49.

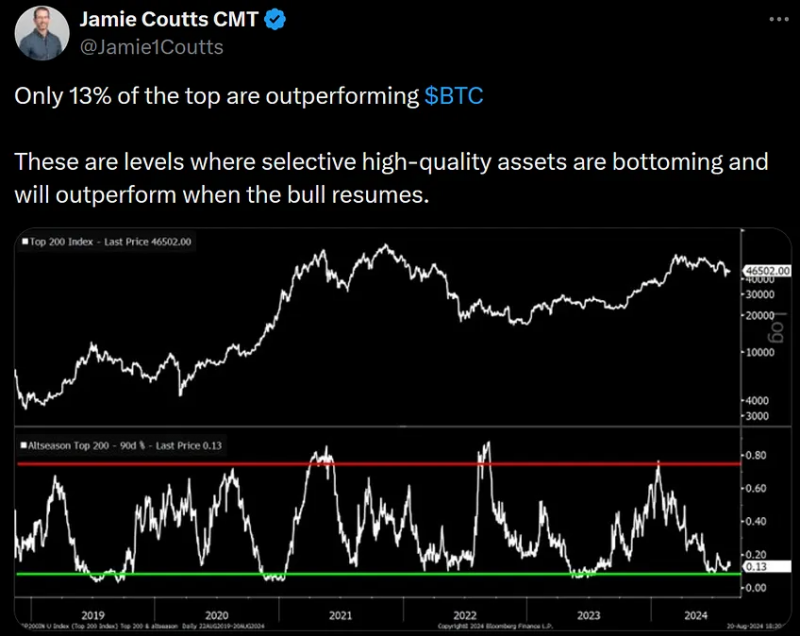

Alarming Market Breadth

The market is also extremely top-heavy, dominated by a few large caps. Only 13% of top assets are outperforming BTC. Picking winning altcoins is like trying to find a needle in a haystack.

Key Events Shaping The Market

Four key developments have influenced ALT vs. BTC performance this year:

– Spot BTC ETF Debut

– BTC Halving

– Spot ETH ETF Debut

– Ripple Partial Victory vs. SEC

The Death Of “Path To Altseason

The launch of US spot $BTC ETFs was the most vital event. While positive for $BTC, they broke the typical “path to altseason”. A brief altcoin rally was followed by a sharp decline. The $BTC “trickle-down” effect was vastly overestimated.

Macro Uncertainty

Recent macro shifts have significantly increased market uncertainty. Rising unemployment, high interest rates, and the yen carry trade are all factors. Altcoins, reflecting consumer confidence, have struggled in this risk-off environment.

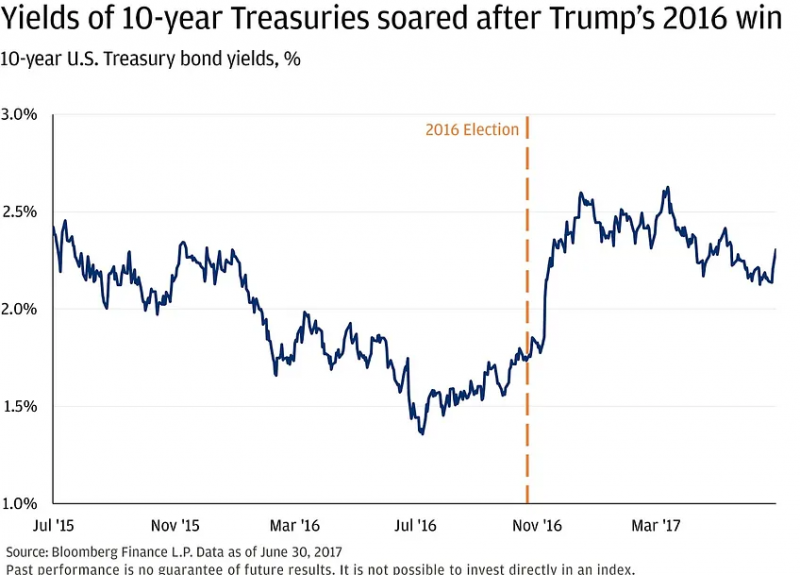

The Trump Trade

Another big variable at play is the Trump Trade. It reflects market expectations of a 2nd Trump presidency, focusing on pro-growth policies. After Trump’s 2016 win, small-cap stocks surged, outperforming large caps by nearly 8%.

Trump Trade In 2024

With so many events this year, pinpointing the Trump Trade’s market impact is difficult. However, we can gauge it by comparing Polymarket prediction odds vs. market indices. The TOTAL3/BTC index, for example, shows little correlation with Trump’s odds.

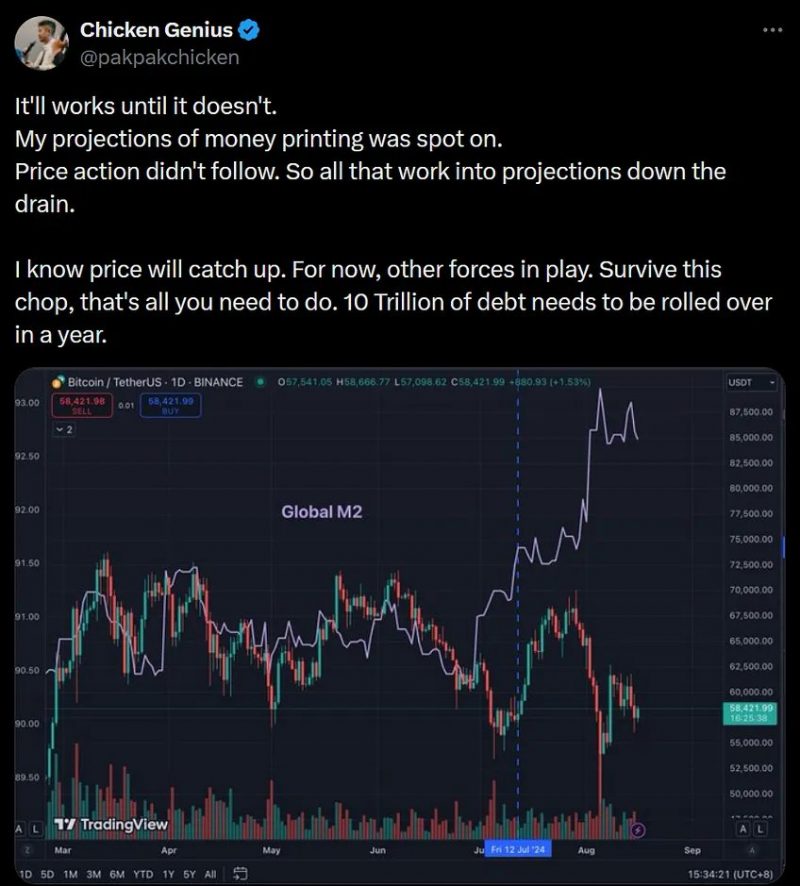

When Money Printing?

A key indicator that suggests prices could eventually rise is the global M2 Money Supply. An increase in M2 usually boosts market liquidity and asset prices, including crypto.

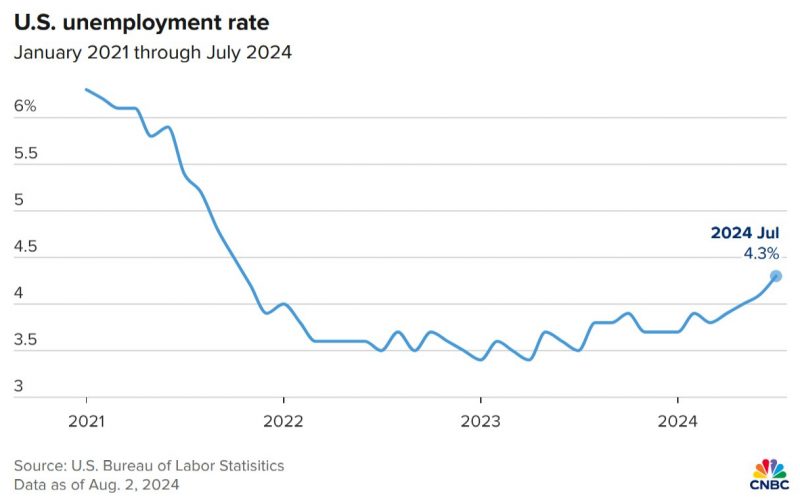

Unemployment & Recession Fears

With US unemployment rising to 4.3% in July, the Sahm Rule indicates a recession. This environment can hurt altcoins as investors move to safer assets. Note: trading on macro data is very tough due to the market’s forward-looking nature.

Where To Next?

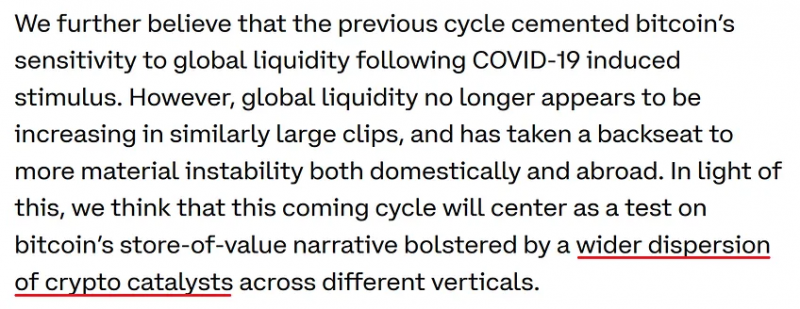

By EOY, $BTC dom. may decrease if rate cuts stabilize the economy. However, if recession fears grow, $BTC dom. could remain high. In either case, expect increased dispersion among altcoins (be ruthlessly selective). Not financial advice.

Time To Play Defense?

We’ll explore strategies to profit from weak altcoins facing pressure from upcoming supply unlocks. With a fearful macro backdrop, extreme seasonal weakness, and an uncertain political landscape, this approach is especially timely.

Key Concerns Include:

The Sahm Rule signaling a potential recession

Risks associated with the USD/JPY unwind

Abnormally high US political uncertainty

September is historically the worst month for BTC

These factors suggest the March 2024 highs for BTC could be a local peak, with potential declines ahead.

If this is the case, it’s likely we won’t revisit these highs until late Q4 2024 or early 2025 at the earliest.

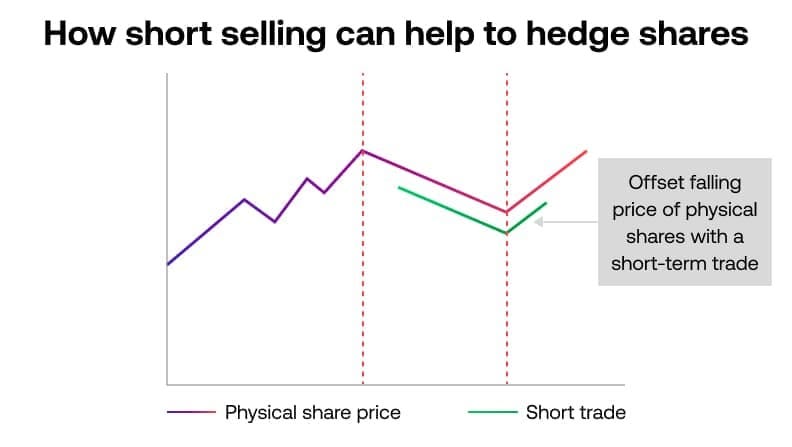

Defensive Shorting: Turning Gloom Into Opportunity

Despite the gloomy outlook, with solid risk management, shorting can serve as a defensive strategy to:

Profit from downside momentum

Hedge long positions during market uncertainty

Exploit relative strength differences between coins

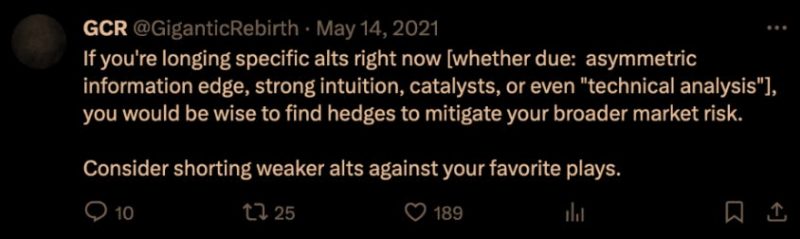

The Key To Strategic Hedging

In a risk-off phase within a macro uptrend, hedging long-term positions can be more effective than flipping net short. This strategy allows you to stay bullish long-term while profiting from short to medium-term bearish momentum. For example, if you’re bullish on BTC long-term but bearish on SOL short-term, you could long BTC and short SOL, effectively shorting SOL/BTC.

This approach leverages the relative strength differences between the coins rather than their absolute performance.

GCR, a top crypto trader, is known for this approach, having successfully shorted LUNA and other overvalued altcoins in the 2021 cycle.

Being fully net short in a volatile and uncertain crypto market is risky, making hedging a more strategic choice.

Consider a scenario where you’re bullish long term (e.g., 2025 onwards due to an improving economy) but remain bearish in the medium term.

Analytics firm CryptoQuant supports this view, suggesting that the March peak was likely just an “initial top,” not the final one.

Low long-term holder activity and decreased selling pressure indicates the market isn’t fully matured and the peak is still far off.