Unlike traditional economics, which is often predictive, tokenomics is more focused on design. It allows projects to create systems of rules and incentives to achieve specific outcomes. This approach ensures a closer connection between the project’s product and its token.

Interestingly, not all successful blockchain projects start with a token. Examples like Uniswap and ENS proved their value before introducing a token. This approach can help establish product-market fit and build a strong community before adding the complexity of tokenomics.

Tokenomics is not just about token distribution. It encompasses the entire economic model of a crypto project, including:

- Supply dynamics

- Demand factors

- Token utility

Let’s take a closer look at each of these components.

Supply Dynamics

- Total Supply: The maximum number of tokens that will ever exist.

- Circulating Supply: Tokens currently available on the market.

- Inflation/Deflation: How the supply changes over time.

- Distribution: How tokens are allocated among stakeholders.

Demand Factors

- Return on investment (ROI) potential

- Use within the ecosystem

- Market sentiment and community engagement

- Incentive structures (staking, governance participation)

These factors influence why people buy and hold tokens.

Token Utility

- Governance rights: Participation in decision-making processes.

- Access to services: Use of platform features.

- Reward mechanisms: Earning benefits for participation.

- Value capture: Sharing in the project’s success.

Token utility is a key driver of long-term value.

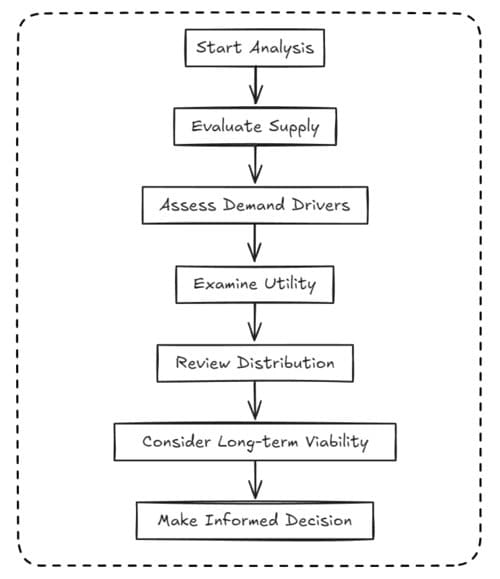

How analyze a project’s tokenomics?

- How is the token supply distributed?

- What utility does the token provide?

- How does holding/using the token benefit users in the long term?

- Is there a clear connection between the token and the project’s product/service?

A Visual Checklist for Tokenomics Analysis

The field of tokenomics is evolving. We’re seeing the rise of regenerative tokenomics, which aims to build sustainable, circular economies within blockchain ecosystems. This approach focuses on aligning incentives for the long-term health and growth of the network.

Here’s a tokenomics tracker by hitesh.eth and dyorcryptoapp – https://hmalviya9.notion.site/9d183b864f5a408e80d3241b842cbd6c?v=b8f1ae631a234ed4b648acddd33e112f. It’s especially useful in “Table” view if you’re just starting to understand what makes for good or bad tokenomics.

Pay special attention to the analyses at the bottom — they take a deeper look at newer projects. Reading 5–10 of these will give you a solid initial understanding.

Understanding tokenomics is essential for navigating the crypto space. It’s not just about short-term price movements, but about building sustainable economic models that provide long-term value and adoption.