Tokenomics analysis is one of the most critical steps in crypto research. Many projects get disqualified at this stage alone due to inflated valuations, poor vesting schedules, or insider-heavy allocations. If the tokenomics look bad, there’s no point digging deeper.

To filter out weak projects and find the ones with real potential, here are the key elements to analyze.

FDV & IMC: How to Evaluate the Project

- FDV (Fully Diluted Valuation) = token price × total supply

- IMC (Initial Market Cap) = token price × circulating supply at TGE

TGE (Token Generation Event) — the moment when the token is launched and enters circulation.

Both metrics matter, but their importance depends on market conditions:

- Bull market → IMC is more important. With low circulating supply, it’s easier to push prices higher.

- Bear market → FDV takes priority. High future emissions scare off investors due to potential sell pressure.

Example: A project with a $1B FDV and $5M IMC may look cheap at launch, but if unlocks are aggressive, price pressure is inevitable.

Vesting: Who Gets Tokens, When, and Why It Matters

Vesting is the token release schedule for investors, team, advisors, and the community. Good vesting protects the market from sudden dumps and aligns incentives for long-term success.

What to look for:

- TGE Unlock: % of tokens distributed at launch

- Cliff: delay before vesting starts (e.g., 6–12 months)

- Vesting Duration: how long the tokens are unlocked (ideally 2–4 years)

Good Vesting:

- Public Round – 30–50% – Balanced market entry

- Private Round – 10–20% – Low sell pressure

- Team – 0% + 6–12 mo cliff – Long-term motivation

- Community/Airdrop – over 2–5 years – Incentivizes active supporters

Bad Vesting:

- 30–40% TGE unlock in private rounds

- All tokens released in under 6 months

- Very small community allocation (

- Team tokens unlocked earlier than public

TGE Circulating Supply: How Much Hits the Market

The percentage of tokens unlocked at TGE can signal early market behavior. Too little = artificial price pump. Too much = potential dump.

Ideal range: 10–30% of total supply circulating at TGE, depending on hype and vesting schedule.

Example: If 25% of tokens are circulating at launch, and investors/team have strict vesting, it could be a fair launch setup.

Token Utility: What’s It Actually Used For?

Utility refers to how the token is used within the ecosystem.

Common use cases:

- Fee payment (e.g., BNB on Binance)

- Staking, governance participation

- Access to premium services or features

- DAO voting or liquidity incentives

Utility is essential for long-term projects. Memecoins may succeed without it, but infrastructure/DeFi projects need real use cases.

Examples:

- Trust Wallet (TWT): token pumped after Launchpool integration

- Solana: price surged during meme season due to demand for farming

Early Round Prices: What Did Investors Pay?

If early investors bought at a 10x discount compared to public sale — that’s a red flag. They’re likely to dump at the first opportunity.

- Healthy difference: no more than 3–5x between rounds

- Warning sign: seed investors paid 10x less + fast unlocks

Best case: Seed/private rounds with similar pricing to public or slightly cheaper, but with longer lockups.

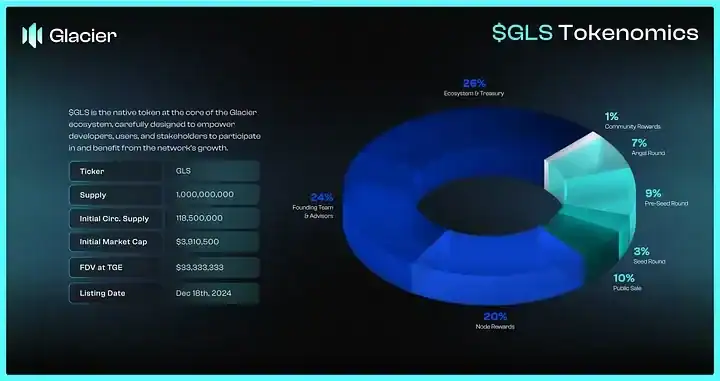

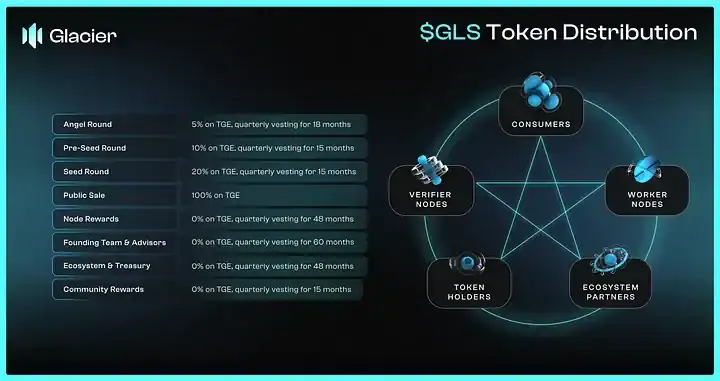

Case Study: Glacier

IMC — $2.6M → low initial valuation

FDV — fair and sustainable

Great tokenomics visuals

Team — 0% at TGE

Investors — slow release schedule

Community — tokens unlock over 5 years

A well-structured and community-aligned example.

Evaluate Tokenomics with a Balanced Scorecard

There’s no perfect tokenomics. Strengths can offset weaknesses.

A well-rounded assessment model:

- Competitors – 20% – Is the project unique or oversaturated?

- Utility – 20% – Is the token actually used for something?

- Marketing – 20% – Community engagement, hype, influencers

- Tokenomics – 20% – Distribution fairness and structure

- Unlocks – 20% – Sell pressure, long-term sustainability

Pro Tips for Tokenomics Research

- Study the whitepaper and tokenomics sheet

- Compare projects using FDV/TVL/Revenue ratios

- Check what’s live vs promised — is the utility functioning now?

- Use tools like Messari, DropsTab, TokenUnlocks, Cryptorank, or Artemis

Final Thoughts

Tokenomics is the backbone of any crypto project. It reveals team incentives, investor alignment, and market sustainability.

A great product can still fail with bad tokenomics. But a well-designed, transparent structure can be the foundation for long-term success.

Always remember: tokenomics alone won’t guarantee success — but bad tokenomics can guarantee failure.