Success isn’t always about recharging — sometimes it’s like pulling the plug.

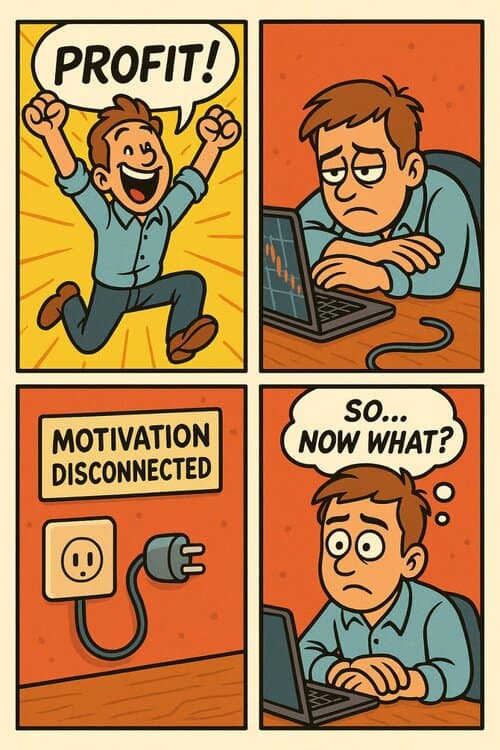

In trading, investing, and especially in crypto, there comes a moment when you’ve achieved a result — you got into a good trade, caught the rally, locked in your profits. And suddenly, it’s like something switches off — you lose interest, focus, and connection to the market.

Success isn’t the finish line. We often misuse the resources that come with that state.

After a strong trade, the result feels like: “That’s it, I can exhale now.” But with that exhale, we often lose our connection to the process.

Victory messes with your mental settings

After success, there are typically three reactions:

- Euphoria → You get hooked on the thrill and want to repeat it immediately, without waiting for the right signal.

- Emptiness → A loss of focus, apathy, “So what now?”

- Illusion of completion → As if it’s all done, and you can loosen the grip and relax.

All three are natural — but they knock you off the mental and emotional balance point from which good decisions are made.

You’re no longer in the same state that led you to profit

That’s key. You’re already someone else. Mentally. Emotionally. You’re operating from different internal resources.

Even if you’re still “in the market,” you’re not the same person who made that precise decision. You’ve gained a positive experience — and that becomes a new reference point. But in that moment, we often think we’re doing the same thing as before the winning trade.

Return to the place where you see the market clearly and calmly.

Where the picture makes sense — not blurred by emotion. Where there’s true understanding — not just the urge to hit another win.

A Post-Profit Ritual

To avoid falling into the trap of chasing another hit — or sliding into a “whatever, it’ll work” mode — here’s a simple ritual of questions:

- What worked?

- Why did it work at that moment?

- What part of this is repeatable?

- What’s important to keep in my system?

- What did I learn — about the market and about myself?

These questions bring you back into the process. That’s part of why people keep a trading journal — to remember how they got the result.

Emotions Aren’t the Enemy

After a good profit, emotions aren’t a bug — they’re a side effect of success. And not necessarily a bad one. Joy, satisfaction, even euphoria — they come with the win, and that’s normal.

What matters is realizing this: there’s no such thing as a purely rational or purely emotional state. It’s not a switch. You can be emotional — and still act with precision. You can act purely “rationally” — and still make mistakes.

The problem isn’t emotions themselves. It’s misjudging your state.

- Do you want to enter the trade because you truly see the setup — or because you just want to “win again”?

- Are you truly clear about what to do — or are you just riding the high where “everything’s working”?

Post-profit emotions can blind you just as much as fear after a loss. But they do it more subtly — and that makes them more dangerous.

What matters is understanding: are you still acting from the same mental space that brought the profit — or not? Are you acting from clarity — or from the lingering aftertaste of the win?

You Have the Right — and the Choice

You have the right to:

- Enjoy the moment

- Relax

- Take a break

But you also have the right not to lose yourself in it.

A Winning Mindset

Success isn’t an accident. It’s the result of your actions, your system, your inner focus. It didn’t just happen.

But profit often brings the illusion that now you’ll always be on top — without much effort, without tuning in internally.

And that’s the trap.

You can repeat success — but only if you remember where it came from, what effort it took, and the state you were in.

The market constantly changes. It doesn’t owe you anything. It doesn’t have to be convenient or profitable every day. You’ll have streaks of wins — and streaks of losses. That’s part of the process.

Success is a new reference point. A new platform

Your deposit has grown, your capabilities increased — but what matters most is keeping your focus and mental structure intact.

Everything described above helps you avoid the cycle of:

Money came fast — and left just as fast.

No. You earned it. Deservedly.

Now it’s time to shift yourself back into the mental, resourceful space — the one that brought the profit in the first place.