Most of us don’t even understand exactly what they are doing here. They make random moves without a strategy with purpose – money, which is why they don’t achieve success. You need to have your own vision and style of crypto investing.

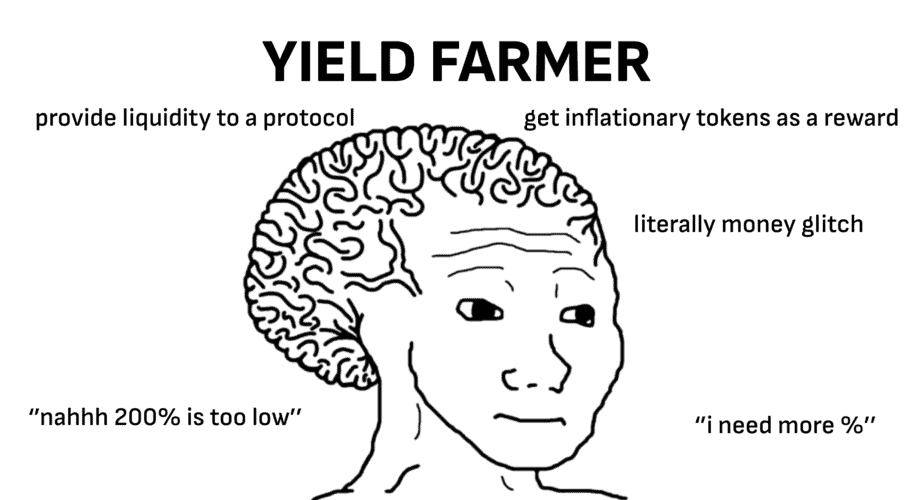

Few people talk about this, but the type of assets you trade should also depend on your size. Trading high caps doesn’t make sense if you have a small size. Similarly, trading low caps doesn’t make sense if your size is too large. Let’s move to 12 styles of crypto investing:

TA trader

These are people who understand Technical Analysis. They analyze charts, looking for different patterns, and trade based on them. Some people think it doesn’t work, but for some, it does.

Passive trader

Primarily, there are long-term investors who don’t have much time to understand and study crypto. They usually invest in $BTC/$ETH and simply hold, accumulating more and more daily/monthly/etc.

New listing Trader

Usually, after a new listing, a token tends to pump a little or a lot, depending on the exchange. So, you basically buy the rumor and sell the news.

All in Players

These are the ones who go all-in on one project, like those who hold only $BTC, for example. Something similar to a passive investor but without any diversification of their portfolio.

Whale Wallets Trading

By using various tools, you can find the wallets of whales or insiders to copy their trades. Finding 5-10 such wallets, one of them will definitely have insider info or they are just good at analysis. Then, you simply copy their trades.

Memecoin Trader

Hunters for 100x trades. This is a riskier type of investment, but with the right strategy, everything will work out. The main thing is to use the right tools and signals to try and find these gems.

Airdrop Hunter

Different projects give airdrops to their community for certain actions. So, hunters need to find a project with a potentially good airdrop and what behaviors are needed to receive it.

Narrative Trader

I think many have heard that being early in a narrative will print you millions. And that’s true, but the task is to find the right narrative and get in at the right moment. Some of the 2024 cycle trends are RWA, AI, MEME, GameFi, etc.

Yield Farmer

Provide liquidity to a protocol = get inflationary tokens as a reward. The task is to find the highest possible percentages and good projects with 300%+ return USD after a year.

Seed Round Investors

These are people who have access to investing in a project at the early stages. They are either insiders or VC members, etc. They buy before any public sales, overflows, etc.

Arbitrage Trader

These are the ones who find price differences for a token on different platforms. They take advantage of this difference by buying at a lower price and selling at a higher price. The task is to find a massive price discrepancy.

Day Trader

There are so many types of day trading styles out there. It can be swing traders, scalpers, etc. The main task is daily analysis and short-term trades that you hold for no more than a week.

How to understand what you will enjoy the most?

The answer is simple—try it out. For example, if you tried arbitrage, it didn’t work out or you didn’t like it, move on. Keep doing this until you find what suits you best.

Remember that you can mix different investment styles. For example, you can be a passive investor + yield farmer and also engage in arbitrage.

Diversification will bring you more benefits, but the key is not to over-diversify.

Also, consider your time availability. If you want to spend little time on crypto, then a passive investor or all-in player might suit you better. You can’t engage in day trading if you simply don’t have the time to trade daily.