Introduction

We need the FINVIZ screener, which you can use to find the companies we want. The screen has 64 stock selection criteria. We will also need to select the All section, which will allow us to display all the stock selection criteria for different categories at once.

Then you will need to set separate parameters for each algorithm.

You should also take into account that the selected shares will change over time with the help of these parameters. Annually according to the results of the annual report, quarterly according to the quarterly reports, daily based on the change of the current market price. So with the help of this algorithm it is possible to calculate companies all the time, even without changing the multipliers readings.

You will begin to change the values of these multipliers at your own discretion with time and experience, when you study them more thoroughly and understand how and what each of them affects.

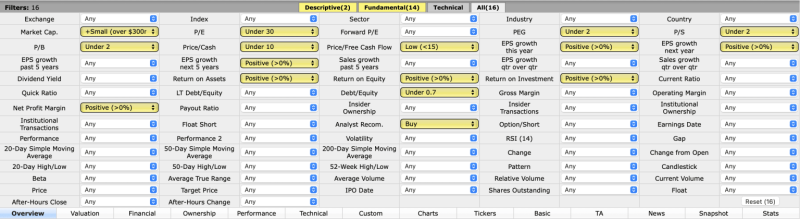

Algorithm for selecting growth companies among companies with large capitalization

Market capitalization – +Small (more than $300 million).

Net Profit Margin – Positive (>0%).

P/E – less than 30.

PEG – Less than 2.

P/S – Less than 2.

P/B – Less than 3.

Price/Cash – Less than 10.

Price/Free Cash Flow – Low (<15).

Debt/Equity – Less than 0.7.

Return on Assets – Positive (>0%).

Return on equity – Positive (>0%).

Return on investments – Positive (>0%).

Earnings per share growth next year – Positive (>0%).

EPS growth this year – Positive (>0%).

EPS growth over the next 5 years – Positive (>0%).

Analysts’ recommendation – buy.

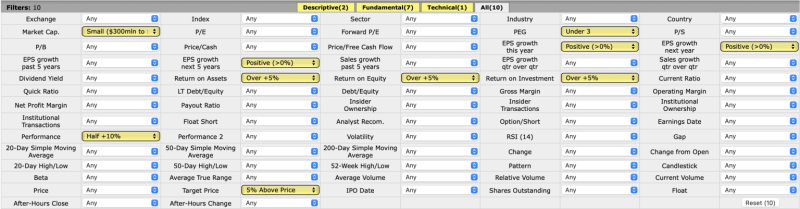

Algorithm for selecting growth companies among small capitalization companies

Market cap – Small ($300mln to $2bln)

PEG – Under 3.

Return on Assets – Over +5%.

Return on Equity – Over +5%.

Return on Investment – Over +5%.

EPS growth this year – Positive (>0%).

EPS growth next year – Positive (>0%).

EPS growth next 5 years – Positive (>0%).

Target Price – 5% Above Price.

Performance – Half +10%.

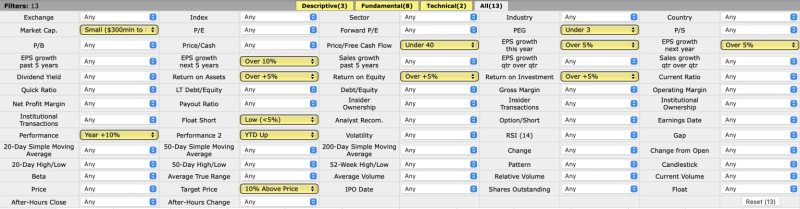

Algorithm for selecting growth companies among small capitalization companies #2

Market cap – Small ($300mln to $2bln)

PEG – Under 3.

Price/Free Cash Flow – Under 40.

Return on Assets – Over +5%.

Return on Equity – Over +5%.

Return on Investment – Over +5%.

EPS growth this year – Over 5.

EPS growth next year – Over 5%.

EPS growth next five years – Over 10%.

Target Price – Over 10% Above Price.

Float Short – Low (<5%).

Performance – Year +10%.

Performance 2 – YTD Up.

Table FINVIZ

In next lessons you’ll get information about data in FINVIZ table.

Index

A stock index in which a stock is included. There are stocks that are not included in any index.

Market Cap

Market capitalization is the valuation of a company by stock market participants. It is calculated by multiplying the current share price by the total number of shares outstanding. Usually, when they talk about the value of a business, they mean its capitalization.

The market price tells us how big the company is. The higher the market capitalization, the bigger the company. In general, large companies are known throughout the world, they have a stable business built up over decades, a large number of markets, a huge number of employees, a rich history, and expensive assets.

A large company is considered a company with a capitalization of $2,000,000,000 or more. Large companies have less chance of going bankrupt, a higher chance of paying uninterrupted dividends year after year, and a large amount of cache, which is necessary in crisis situations. So the higher the capitalization, the better and safer it is for investors.

But small capitalization doesn’t mean a bad company. You have to look at the company and evaluate the fundamentals in the aggregate to give a competent assessment of the company.

Market capitalization is the total dollar value of all issued shares of a company. It is a measure of the size of the company.

The market capitalization of companies changes daily. Why, you ask? Because stock prices change daily, and market capitalization depends directly on the price per share. Example: Today the price of a stock is $12, and the number of shares outstanding (in total available for purchase) is 1,000,000,000. We multiply 12 by 1,000,000,000 and get 12,000,000,000 ($12 billion), this is the capitalization of the company. If the stock price is $12.48 tomorrow, using simple calculations we get a capitalization of $12,480,000,000.

What is a good Market Cap value?

Any value is good, it all depends on you and your preferences. If the company has a small capitalization, and the product or services are unique and change the world, the capitalization can grow a lot and cause your stock price to go up. A large capitalization doesn’t always have room to grow, but it is more likely to withstand a recession or crisis, where a small-cap company might not.

Income

The company’s net profit for the previous year.

Profit goes to the development of the company and the formation of reserve funds. Dividends are also paid out of profits.

Profit is the difference between the company’s revenue and expenses (cost of goods produced, taxes, depreciation, rent, salaries, interest on loans, current debt obligations, and more).

Sales

Last year’s sales. A company’s revenue is a measure of demand for goods or services.

Book/sh

Book value per share is the book value of a company divided by the number of shares.

The book value of a company is the company’s capital, that is, the result of the valuation of all of its assets minus its liabilities. Capital may include: financials, equipment, long-lived assets, and share capital.

Investors often compare a company’s book value to its market value to assess a company’s prospects and to identify whether it is overvalued or undervalued.

The book value cannot change every minute, it depends directly on reinvestments into business, as well as current and fixed assets of the company. It is often called – the real value of the company. Thanks to it, you can determine the liquidation value of the company in case of bankruptcy.

This figure may differ depending on the chosen sector. In a real sector such as an oil refining company, this figure is quite high, because the company’s assets include plants, real estate and other expensive assets. And for example, in the information technology industry, the book value may be very low because it may only include a couple of dozen computers.

Cash/sh

Cash assets per share are all cash and cash equivalents. Such assets may include:

- Demand type bank deposits

- other accounts that have similar characteristics to such deposits

- highly liquid short-term investments that can be converted into cash at pre-known quotes and do not depend much on the interest rates change due to their close maturity

Dividend

Dividends are payments to shareholders, most often on a quarterly basis. It is part of a company’s profits, which are distributed to the owners of its shares.

Dividends guarantee the investor a steady income. That is why many investors buy dividend stocks with a good payout history and live off the dividends, or reinvest them.

A company has to pay for high dividends with growth potential. Every dollar a company pays in dividends to its shareholders is a dollar it does not reinvest in itself.

Some companies that are actively growing don’t pay dividends, but instead reinvest all of their profits in business development.

Dividend %

Dividend yield is the ratio of the annual dividend per share to the share price. This value is expressed as a percentage.

It can be calculated by dividing the dollar value of dividends paid in a given year per share by the dollar value per share.

Employees

Employees – full-time employees who have a permanent contract and work full-time.

The more employees, the bigger the company. A bigger company means more sales and more profits. But sometimes things don’t go that smoothly. Sometimes, companies have more employees than they can afford, which incurs unnecessary labor costs, especially if the employees are inefficient.

Optionable

The “Yes” marking means that the stock has options. That is, this marking indicates that it is possible to sell or buy the stock at a predetermined price at a specific, predetermined time. In the case of marking “No”, on the contrary.

Shortable

Shortable tells us whether the stock has a sell without buy feature (Yes/No). If the stock has this feature, it is more liquid on the stock market and more interesting to investors and traders.

Recom

This is an analyst recommendation based on the company’s fundamental and technical data as well as last quarter’s earnings reports.

1 – buy soon, do not miss your chance. Most likely the company is doing well, not high debts, positive profits, there are growth drivers, dividends, profits are growing every year, all the fundamentals are close to normal. Just for some reason, this stock is still undervalued by investors.

5 – Don’t get into this deal by buying, sell. It could be anything: a bad revaluation of the company, large debts, negative profits that are falling every year, poor forecasts for the next quarter, unstable dividends or lack of them recently, lack of cash in the accounts, etc.

The closer to one, the better the company is doing. The closer to 5, the worse. The analysts have already done all the work for you, just didn’t show their analysis, leaving just the number. It’s up to you to decide.

- A bad value is 3-5 (red).

- An average value is 2-3 (black).

- A good value is 1-2 (green).

P/E

The ratio of a company’s capitalization to its annual earnings.

To calculate the P/E, we need to take the current market value as a basis and divide it by the net profit for the last year. Also, this indicator tells us how long it takes for the company to fully recoup its market value. Thanks to this indicator, we can understand whether the company is overvalued or undervalued.

If the P/E ratio is above 20, it means that the company is overvalued. Although, these days, many companies have overvalued this indicator, especially companies from the field of information technology.

There are companies that use all profits to reinvest in the business, strengthening their position in the future. They develop very rapidly. Despite the fact that now they do not earn much in relation to the market price, investors continue to buy these shares, supporting their growth.

The range of P/E ratios varies, with the lowest being in slow-growing companies and the highest in fast-growing ones. The average value belongs to cyclical companies.

According to this indicator, we can understand how many years a company needs to earn the profit it earned last year, so that the amount is equal to the current capitalization. Roughly speaking, it will take 10 years for the company to break even. For example, the company’s capitalization is $100,000,000 and last year’s profit is $10,000,000. Divide 100 million by 10 million, we get 10, P/E = 10, the company needs 10 years to earn such a profit to break even.

It is also useful to look at the industry average to see if a company is overvalued or undervalued.

A bad value – above 50 (red) – indicates that the company is highly valued relative to its current earnings.

An average value of 15-50 (black) is generally the norm.

A good value – below 15 (green).

Forward P/E

This is the projected P/E for the next fiscal year. If analysts forecast an increase in earnings, the company’s Forward P/E will be lower than the current P/E.

PEG

Capitalization to Earnings Growth is a ratio used to determine the value of a stock based on earnings growth. Growth is the company’s projected earnings growth over the next 5 years (EPS next 5 Years). When analyzing a company to determine the PEG multiple, the P/E multiple is divided by the expected EPS growth rate.

It is calculated by dividing the current P/E ratio by EPS growth next 5 years. Let’s imagine that the company’s P/E ratio is 15, while EPS growth next 5 years = 14.79%. Dividing 15 by 14.79, we get 1.01 – that is the PEG.

Many people prefer PEG over P/E because PEG is designed to correct for P/E deficiencies. Unlike P/E, which reflects a company’s past, PEG also takes into account its growth trends.

A lower PEG ratio indicates the stock is undervalued. A high PEG ratio indicates that the stock is overvalued.

It was originally developed by Mario Farina, who wrote about it in his 1969 book “A Beginner’s Guide to Successful Stock Market Investing.”

It was later popularized by the famous investor and head of the Fidelity Magellan Fund, Peter Lynch. Peter Lynch believes that a fair P/E ratio for a growing company is the same as the growth rate (EPS next 5 years), that is, PEG = 1 or lower. The projected interest yield should be equal to or higher than the P/E ratio. In that case, the stock is promising and can be bought for the long term.

- A bad value – 2 and above (red) – such companies are not very promising.

- Average value – from 1 to 2 (black) – average value.

- Good value – below 1 (green).

P/S

Shows the ratio of a company’s market capitalization to its annual revenues.

Imagine that a company’s market capitalization is currently $6,000,000,000 (6 billion) and its revenue (Sales) for last year was $4,000,000,000. The company’s revenue is the money received from all products and services sold, it is not net profit.

Looking for the P/S, to do this we need to take $6,000,000,000 and divide by $4,000,000,000, we end up with 1.5. This is the Price to Sales (P/S) ratio.

It is believed that the bigger the company’s revenue and the closer it is to capitalization, the easier it is for the company to breathe, because the total sales also determine the profit (unless, of course, everyone is taking out loans).

Small values of the coefficient signal that the company in question is undervalued, while large values signal that it is overvalued. A significant advantage of the ratio is that it does not take negative values like the P/E ratio, as well as being more resistant to subjective factors and abuses of company management.

The P/S ratio is good for evaluating large capitalization companies and worse for service companies, e.g. banks, insurance companies, because they do not have sales volume in the literal sense of the word.

The lower the P/S, the better, and the less an investor pays for each dollar the company gets from sales.

- A bad value is 10 or higher (red) – most likely overvalued companies.

- An average value is 1 to 10 (black).

- A good value is 0 to 1 (green).

P/B

Capitalization to book value is a financial indicator equal to the ratio of the current market capitalization of a company to its book value.

What is the book value of a company? It is the amount for which all of the company’s assets (cars, factories, steamships, manufactured products in the warehouse, the desk in the boss’s office, etc.) can be sold. From this amount we subtract all the liabilities (debts, loans, interest, salaries, unpaid bills, etc.). The total amount is the book value.

This figure does not provide any information about the company’s ability to make a profit for shareholders, but it does give the investor an idea of whether he is overpaying for what will be left of the company in the event of immediate bankruptcy.

It is widely believed that if the book value is higher than the market value, the market value will sooner or later catch up with the book value, bringing good earnings to the shareholder. Such companies are considered undervalued and attractive to invest if other indicators are normal, as well as the company’s revenue, profits and growth prospects.

P / B less than one means that the company is valued by the market below the assets on its balance sheet. A fair P/B is equal to one: the capitalization is fully consistent with the assets. If the P/B is well above one, the stock is probably overvalued. However, there can be exceptions here, everything depends on the specifics of the business. For example, electric power companies usually have a lot of infrastructure and tangible assets: land, buildings, power lines, transformers, special equipment. As a result, the P/B of such companies is low.

On the other hand, the activities of many technology and service companies do not involve large-scale infrastructure, and their main assets are intangible: intellectual property, patents, trademarks. In such cases, the P/B parameter may be high and should not be given importance.

- A bad value – from 5 and above (red), which would indicate that the company is overvalued in relation to its book value.

- The average value of 1 to 5 (black) – depends on the industry (an average of 1-3 is normal), but the lower it is, the better and higher the outlook (assuming that the other multiples say the company will grow and gain momentum).

- A good value is below 1 (green).

P/C

Capitalization to cash assets is a ratio equal to the ratio of a company’s current market capitalization to its liquid cash. A company’s liquid assets are the health of the company and an indicator of sound management.

For example, capitalization equals $1,000,000, money in the account is $95,000, we divide $1,000,000 by $95,000, we get 10.52. 10.52 – this is Price to cash (P/C). The number 10 tells us that the company has at least a 10th of its current capitalization in its account.

If that number is lower than number 3, that’s very good. This means that the company has enough cash assets for all contingencies and the company’s cache is at least a third of its market capitalization. If the figure is 1 or lower, it means that the company has an amount of liquid assets equal to or even greater than its market capitalization.

Why do companies need cache? Cache is used to reinvest in a company, to pay debts, to pay dividends, to buy back stock, and much more. In fact, it’s used to make the company feel more confident in any economic situation.

The lower the P/C, the more free money a company has in its account. When a company has free money – it is very good. Such a company can easily cover its running costs, invest in various projects and not worry about its financial situation during recessions and unforeseen circumstances.

By the way, the banking industry has a very low index, which indicates a large cash reserves.

- A bad value – above 50 (red) – indicates that the company has no money and any problem such a company can not take out.

- The average value: from 3 to 50 (black) – is considered acceptable.

- A good value (green) – below 3 is considered good.

P/FCF

Capitalization to free cash flow – the ratio shows how much money remains available to the company and can be used to pay dividends.

Free cash flow is a company’s cash flow minus capital expenditures.

Capital expenditure (also CAPEX from CAPital EXpenditure) – capital used by companies to acquire or upgrade assets (residential and industrial real estate, equipment, technology).

For example, capitalization of a company = $100,000,000, P/FCF = 7.46. We calculate the amount of free cash flow. 100 000 000 / 7,46 = $13 404 825. The calculation shows that the company’s free cash flow for the previous year is $13,404,825. The higher the P/FCF ratio, the lower the company’s free cash flow.

If the P/FCF ratio is less than 15 (the green zone) – this is very good. Such a value indicates that the company’s business is healthy and it has sufficient free cash flow to pay dividends, make a buyback, or reduce its debt burden. A low P/FCF usually means that the company’s stock is undervalued. Thus, the lower the ratio, the cheaper the stock.

- If P/FCF ratio = 15 to 50 (black area) – the average value.

- If P/FCF ratio = 50 and above (red zone) – it is bad, the company has free cash flow problems, free cash flow is on the edge.

- If P/FCF is negative, it means that the company has negative free cash flow. It means the company will have to borrow cash, which in turn will affect its debt burden.

Quick Ratio

The quick ratio measures a company’s ability to meet its short-term obligations with its most liquid assets. The higher the quick ratio, the better the position of the company.

This ratio takes into account only the most liquid current assets (cash, short-term marketable securities and receivables), deducting inventories.

Calculated as follows:

(Current assets – inventories) / on current liabilities.

A score of less than 0.5 (red) means that the company is not doing well and may have trouble meeting its short term obligations.

Between 1 and 3 (black) – average indicator, can be considered normal.

More than 3 (green) – things are good, the company has enough resources to meet its short-term obligations.

Current Ratio

The current ratio is a liquidity ratio that measures whether a company has enough resources to meet its short-term obligations. It compares the firm’s current assets to its current liabilities. The higher the ratio, the better the company is able to meet its obligations.

It’s basically the same as Quick Ratio, except this ratio doesn’t subtract inventory.

It is calculated like this:

Current Assets / per Current Liabilities.

- Less than one (red) – it’s not good, the company may have trouble meeting its short-term obligations.

- Between one and three (black) – average, can be considered the norm.

- More than 3 (green) – things are good, the company has enough resources to meet its short-term obligations.

Debt/Eq

Debt-to-equity ratio is a financial indicator that shows the ratio of equity to debt used to finance the company’s current assets.

This indicator tells us how much debt the company has in relation to its equity.

The lower the company’s debt, the easier it is for the company to breathe. But not everything is as simple as it seems, very often a company is borrowing in order to grow and increase its profits and its influence in a region, an industry or even the whole world.

The calculation goes like this:

Current Liabilities / Carrying Value.

For example, a logistics company used its own money to buy 5 trucks worth $500,000 and borrowed another 2 for $200,000. If we add those two amounts together we get $700,000. Debt in our example is the 2 $200,000 worth of loaned trucks, and Equity is the 5 trucks that were bought with their own money. To get the Debt/Equity ratio, we need to divide $200,000 by $500,000. Dividing these two amounts, we get a ratio of 0.4. Debt/Equity = 0.4, in other words, for each dollar of its own money the company has 0.40 cents of borrowed money.

The ratio is less than 0.1 (green) – the company has low credit liabilities, it works and develops practically with its own money. In case of unforeseen circumstances or any adverse events, the company should have no problems with meeting its short-term obligations.

- Between 0.1 and 0.5 (black) is an average indicator and can be considered the norm.

- More than 0.5 (red) – the company has quite a lot of borrowed funds, in case of something unfavorable, it may have problems with fulfillment of its obligations.

- Each industry has its own norms of borrowed funds. The higher the cash flow, the easier it is for the company to meet its obligations. So if a company is growing aggressively and has this ratio in the red, most likely there is nothing wrong here.

LT Debt/Eq

The ratio of long-term debt to equity is a ratio that compares the total amount of long-term debt to a company’s equity.

A high ratio usually indicates a higher degree of risk, since the company must pay principal and interest on its obligations.

Potential lenders are reluctant to provide financing to a company with a high debt position. However, the amount of debt depends on the type of business. For example, a bank may have a high debt ratio because its assets tend to be liquid. A utility company can afford a higher ratio than a manufacturer because its profits are more stable.

Calculated as follows:

Long-term debt / equity.

A figure less than 0.1 (green) means the company has very low leverage. In the event of unforeseen circumstances or any adverse events, the company should have no problem meeting its short-term obligations. The company may take up more credit.

Between 0.1 and 0.5 (black) – the average figure, can be considered the norm.

Above 0.5 (red) – the company has quite a lot of borrowed funds, in case of something unfavorable, it may have problems with fulfillment of its obligations.

Each industry has its own norms of borrowed funds. The higher the cash flow, the easier it is for the company to meet its obligations. So if a company is growing aggressively and has this ratio in the red, there’s probably nothing wrong here.

The difference between LT Debt/Eq and Debt/Eq is only that LT Debt/Eq is a long-term debt, which does not require repayment tomorrow, it is spread over years, the company slowly pays it or does not pay it. And Debt/Eq is total aggregate debt, that is, long-term debt + short-term debt + other liabilities.

The value of the ratio – Debt/Eq will always be greater than or equal to LT Debt/Eq.

SMA20

SMA20 is a simple moving average of the last 20 days.

The moving average is the result of averaging the price of a security over a selected period. Once calculated, the final value is displayed on the chart as a curved line so that traders can view smoothed data rather than focusing on daily price fluctuations. It is also possible to construct multiple moving averages by adjusting the number of time periods used in the calculation.

Some of the basic functions of a moving average are to identify the direction of the trend, identifying potential areas where an asset will find support or resistance. In addition, moving averages can be useful when setting stop-loss orders.

EPS (ttm)

The higher the earnings per share, the more attractive the stock becomes to the investor. Earnings per share should be compared to the share price, good when EPS is more than 15% of the share price.

How is it calculated?

EPS = Net Income / Number of shares

EPS (ttm) (Diluted EPS) is a measure of diluted earnings per share that takes into account possible changes in the number of shares and earnings due to conversions of other securities into common stock (e.g., due to the exercise of options, conversion of bonds, payment of preferred dividends in new shares).

EPS next Y

EPS calculated approximately for the next year. Tells how much the company will earn approximately per share next year.

- A bad value is below 0 (red).

- Average value – between 0 and 25 (black).

- Good value – 25 and up (green).

EPS pecht Q

EPS calculated approximately for the next quarter. Talks about how much the company will earn approximately per share in the next quarter.

EPS this Y

EPS growth this year relative to last year.

- Bad value: from 0 and everything with minus – color red, we don’t need such companies with negative profit growth.

- Average value: from 0 and up to 25 is a good value, projected profits will grow from 0 to 25% next year, average value, color black.

- Good value: 25 and above is an excellent indicator, lit in green.

EPS next Y

The approximate growth of EPS in the next year relative to this year.

- The bad value is below 0 (red).

- Average value – from 0 and up to 25 (black).

- Good value – from 25 and above (green).

EPS next 5Y

This figure refers to the projected earnings growth in the next 5 years, and Positive means positive – greater than 0%.

The higher this figure is, the higher profit growth is expected in the company’s future. Don’t forget to compare this figure to your competitors – there are times when one company has 5% for the next 5 years and a competitor has 12% or even 22%, all other things being equal, the company with the higher projected profit is more attractive. Again – this ratio is different for each industry.

A bad value is 0 and below (red).

Average value – zero and up to 25 (black) – average value, moderate growth.

A good value – from 25 and above (green) – is a good indicator, which tells us that the company has a good outlook for the coming years.

EPS past 5Y

Annual growth in earnings per share over the past 5 years.

Sales past 5Y

Revenue for the past 5 years, annual revenue growth for the past 5 years.

Sales Q/Q

Shows quarterly revenue growth.

EPS Q/Q

Shows the quarterly growth of EPS.

Earnings

The date of the next reporting. Sometimes you can see a date that has already passed – this is the date of the last statement, it will soon change to the date of the next statement.

There are two acronyms: BMO (Before Market Open) and AMC (After Market Close), which tell us when the report comes out before market open or after market close on the reporting date.

SMA50

SMA50 is a simple moving average for the last 50 days.

Insider Ownership

Insider Ownership. An insider is basically a person from the management of a company. The numbers in this column are expressed as a percentage and tell us what percentage of the stock is currently owned by company management.

Insider Trans

Here we can see how a company’s stock is bought or sold by its own management. The value represents the percentage change in total insider ownership over the past 6 months.

Inst Own

The value tells us what % of shares are currently owned by institutional investors.

Institutional investors are legal entities that act as holders of funds and invest them in securities. They are mainly investment companies, banking structures, open-end and closed-end investment funds, insurers, pension funds, hedge funds.

Inst Trans

Here we can see how a company’s stock is bought or sold by financial institutions. The value represents the percentage change in total institutional ownership.

ROA

Shows how efficiently a company uses its assets. ROA shows how much net profit a company makes from its own assets. Gives an idea of how efficiently management is using its assets to make a profit.

Assets are anything you use in your business to make a profit – money, fixtures, machinery, equipment, vehicles, inventory, etc.

ROA is best used when comparing similar companies or comparing a company to its previous performance.

Return on assets, calculated by dividing a company’s annual profit by its assets, is shown as a percentage.

ROA = profit / assets

- A bad value is 0 and below (red).

- Average value – between 0 and 15 (black).

- A good value is above 15 (green).

ROE

A measure of the profitability of a business relative to its shareholders’ equity. Shows how much profit a company makes with the money invested by shareholders.

Equity = company assets – liabilities.

ROE measures how many dollars of profit are generated for every dollar of equity. ROE is a measure of how well a company uses its capital to generate profits.

ROE is calculated by dividing a company’s annual profits by its shareholders’ equity and is shown as a percentage.

ROE = profit / equity capital

- A bad value is 0 and below (red).

- An average value is between 0 and 30 (black).

- A good value is above 30 (green).

ROI

Illustrates the level of profitability or loss of a business, taking into account invested capital.

Invested capital = company assets + liabilities.

To calculate return on investment, return on invested capital:

ROI = Profit / invested capital

- A bad value is 0 and below (red).

- An average value is between 0 and 25 (black).

- A good value is above 25 (green).

Gross Margin

Gross Margin is a company’s revenue minus the cost of goods sold. In other words, it is the percentage of sales revenue that a company retains after incurring direct costs associated with producing the goods it sells or the services it provides.

The higher the average gross profit margin, the more finance the company retains for each dollar of sales, which it can then allocate to service other expenses or liabilities.

Gross profit is counted to see how much money the company made from selling a product without indirect expenses.

Expenses come in direct and indirect. Direct costs are specific to a product, line of business, or project (employee salaries, materials, purchases, etc.). Indirect costs are independent of sales and production (office rent, advertising, electricity, etc.).

In some industries, such as apparel, for example, the expected gross profit should be about 40% because goods must be purchased from suppliers at a certain rate before they can be resold. In other industries, such as software product development, gross margins can exceed 80% in many cases.

Gross Margin = ((Revenue – Cost of Sales) / Revenue) x 100.

Gross Margin above 50% is an excellent metric, although much depends on the sector.

Operating Margin

Operating margin is a measure of how much of the company’s revenue remains after paying production costs, such as wages, raw materials, but before taxes.

An increase in the indicator indicates that the company is growing more efficiently, while a decrease in the indicator may signal impending financial problems.

In order for a company to pay its fixed costs, such as interest on debt, a stable operating profit is required. It is worth comparing the operating margin indicator only for companies in the same industry because of the peculiarities of the industries and business models of the companies.

If a company has a negative operating margin, it is already loss-making at the core business stage, so the company needs to either increase revenue while maintaining the same level of operating expenses, or optimize and reduce the items included in operating expenses.

Operating margin = ((Revenue – Cost of sales – Operating expenses) / Revenue) x 100

Operating margin above 25% is an excellent indicator. You have to look at each sector separately and compare performance in the same sector, or better yet, even the industry.

Profit Margin

Net Margin is the percentage of revenue that a company has in net profit after deducting all expense items.

By looking at this figure alone, you can immediately understand what percentage of profit a company has on each dollar earned.

The higher the net profit margin, the more efficient the company is. If a company has a negative net margin, it is unprofitable.

Net Profitability = Net Income / Revenue x 100

For example, a company has sold $100,000 worth of goods and services, from this amount we subtract the cost of goods and services, as well as wages, bills, short-term loans, we get net profit, for example $15,000 – this will be Income. To calculate the Profit Margin, we need to divide 15,000 by 100,000 and multiply by 100 (to get %). We get the following example (15 000 / 100 000) x 100 = 15%. This is the Profit Margin.

Profit Margin affects the stability of the company in the market (to pay dividends, expand the business, pay its debts and loans, etc.). Profit is what companies work for in the first place, so a positive profit margin is a great indicator.

- A bad value is 0% and anything below that (red) – the company is operating at a disadvantage.

- An average value is 0% and up to 20% (black) – an average value.

- A good value – anything above 25% (green) – the company is generating net profits well.

Payout

The dividend payout ratio tells us how much of the company’s net income is spent to pay dividends to shareholders.

The normal value of this indicator is from 20% to 60%. That is, 20-60% of net income goes to pay dividends. If the figure is higher than 60%, it may mean that in hard times, the company may not be able to carry such a load and as a result will most likely cancel dividends or suffer losses, which will adversely affect the development of the company.

Only a very serious company with a well-developed business can afford such a pleasure, i.e. to let the major part of the profit go to dividends: Coca-Cola – 84% or McDonald’s – 75%.

Some companies do not pay dividends at all. These are mostly young developing companies, or those that are experiencing some temporary difficulties, but it happens that developed companies with large capitalization do not pay dividends either, as they consider themselves still growing.

Such companies attract investors with a higher growth potential of the stock value, because by saving on dividends, they spend free money for their more aggressive development.

Dividend payout ratio = Dividends / Earnings

SMA200

SMA200 is a simple moving average for the last 200 days.

Shs Outstand

Outstanding shares refer to the company’s shares currently held by all of its shareholders, including stakes held by institutional investors and restricted shares held by company officers and insiders.

The number of shares outstanding is used to calculate key measures such as the company’s market capitalization, as well as its earnings per share (EPS) and cash flow per share (CFPS).

The number of outstanding shares of a company is not static and can fluctuate significantly over time.

Shs float

The proportion of shares in free float. That is, it is the portion of the stock available to ordinary private investors who are in no way connected with the issuer issuing the stock itself and who do not participate in the strategic control of the company.

This figure is obtained by subtracting the company’s outstanding stock and subtracting any restricted stock, that is, stock that is subject to some kind of selling restriction.

The reason for the restrictions may be a lock-up period after the initial public offering (IPO) or stock options that are issued to the company’s top management to motivate them (such shares cannot be sold for some time).

The number of free float is an important number for investors because it shows how many shares are actually available for purchase and sale.

Short Ratio

Short Ratio shows the ratio of the number of shares sold to the average daily turnover from a given stock (Volume), or in other words, how many days it would take to buy back from the market all those shares that were borrowed and sold short.

The higher this figure, the more pressure there can be on the price of the stock when short positions start to close.

If you want to short a stock, you should look at the Short Float and Short Ratio of that stock. The lower they are, the less risky the trade can be, and the easier the stock price can fall. If both ratios are high, it makes sense to look for a place to buy, because a massive closing of short positions can lead to a powerful and rapid rally, which is called a short squeeze.

Target Price

This is the target price the stock price will aim for. This target price is predicted by analysts at leading investment banks. The price may or may not reach this target price, it is just an analysts’ forecast.

52W Range

We can look at the lowest stock price and highest stock price in the last 52 weeks.

52W High

The percentage difference between the stock’s 52-week high and the current price.

This indicator tells us how much the current price is below the peak. Thanks to this value, we can understand how much lower than the peak the stock is trading in real time.

If the highest price is now, this criterion will be green and show a positive trend. If the highest price was in the past, this criterion will glow red and indicate how much lower the price is than its peak.

52W Low

The percentage difference between the stock’s 52-week low price and its current price. This criterion shows us how much the share price has risen in 52 weeks from the lowest price.

RSI (14)

The Relative Strength Index (RSI) is a technical analysis indicator that determines the strength of a trend and the probability of its change.

It indicates oversold (buy signal) and overbought (sell signal) levels for a given stock.

The RSI indicator line ranges from 0 to 100. If the indicator rises to 70 or higher – the stock is overbought and it is unwise to buy now. If the indicator ranges below 30, the stock is over-sold. This is a good opportunity to consider buying.

Rel Volume

The ratio between the current volume and the 3-month average volume, adjusted within a day.

Relative volume = current volume / 3 months average volume

Volume in this case refers to stock turnover. For example, a day’s turnover of shares was 100 million. This means that 100 million shares were traded during the day.

Avg Volume

The average number of shares traded per day over the past 3 months.

Volume

The total number of shares traded for a given stock today or during the last trading session.

Volume affects the liquidity of shares, the higher the daily volume, the easier it is to sell or buy a certain number of shares, in addition, for traders it is a lower spread.

Perf Week

Performance is the stock’s return over a certain period of time.

Perf Week Performance = last 5 trading days.

Perf Month

1 month results = 21 last trading days.

Perf Quarter

3 months results = Last 63 trading days.

Perf Half Y

Six Months Results = Last 126 Trading Days.

Perf Year

The result for 1 year = the last 252 trading days.

Perf YTD

The result from the beginning of the year = from January 2 to the last trading day.

Beta

The beta coefficient is a measure of market risk, reflecting the variability of a security’s return relative to the return of another portfolio, which is often the average market portfolio.

A beta coefficient greater than 1 indicates that the dynamics of a stock correlate with the dynamics of the stock index, but the stock is more sensitive to any movement of the index.

A beta ratio of 1 means that the stock movement completely repeats the stock index movement and thus the correlation between the stock movement and the index movement is 100%.

A beta ratio greater than 0 but less than 1 indicates that the stock movement correlates with the stock index movement. But the stock is less sensitive to the movement of the market as a whole.

The beta coefficient is equal to zero. This value means that the stock movement has nothing to do with the stock index movement, i.e. there is no correlation.

The beta coefficient is negative from 0 to -1. In this case the stock has an inverse correlation with the stock index. The sensitivity of the share reaction is lower than that of the stock index.

The beta coefficient is negative and less than -1. Such stocks have an inverse correlation with the stock index, that is, they generally move in the opposite direction, and such stocks are more volatile and move with greater amplitude than the index itself.

ATR

ATR – Average True Range (14) – the average true range for 14 days. This indicator allows the trader to most accurately predict future price changes in order for the trader to independently calculate the places where you need to set stop-losses and take-profits.

Volatility

Volatility is an indicator of the security or currency market, showing the level of its volatility in a certain period. In this column we can also see (Week, Month) – it means that we can estimate the volatility of a given security for a week and for a month. In other words, volatility is the deviation of the price from the current price as a percentage.

Prev Close

This indicator tells us at what price the paper closed during the previous trading session.

Price

The current market price of the stock.