Welcome to our guide on Non-Fungible Tokens (NFTs)! Are you interested in learning about the exciting world of NFTs but don’t know where to start? Look no further! This guide is designed to introduce you to the basic principles of NFTs in a straightforward and easy-to-understand manner. By the end of this guide, you will have a solid understanding of what NFTs are and how to trade them.

Blockchain Explanation

A blockchain is a decentralized, digital ledger that records transactions on multiple computers, called “nodes,” in a network. Each block in the chain contains a record of multiple transactions, and once a block is added to the chain, the data it contains is considered to be unchangeable.

The decentralized nature of a blockchain means that it is not controlled by a single entity, such as a government or financial institution. Instead, it is maintained by a network of users, who collectively ensure the integrity and reliability of the data contained within the chain.

One of the key features of a blockchain is its ability to provide a secure and transparent record of transactions. Because the data in a blockchain is distributed across multiple nodes and can only be added to the chain through a complex, cryptographic process called “mining,” it is extremely difficult to alter or tamper with the data once it has been recorded.

This makes it an attractive technology for a wide range of applications, including financial transactions, supply chain management, and the issuance and tracking of non-fungible tokens (NFTs).

Changing Data in Blockchain

It is not strictly “impossible” to change the data in a blockchain, but it is extremely difficult and would require a significant amount of computing power and resources.

One of the key features of a blockchain is its ability to provide a secure and immutable record of transactions. This is achieved through the use of cryptographic hash functions, which take an input of any size and produce a fixed-size output, called a “hash.” Each block in a blockchain contains a hash of the previous block, creating a chain of hashes that can be used to verify the integrity of the data contained within the chain.

If someone were to try to alter the data in a block, the hash of that block would change, and the change would be propagated to all subsequent blocks in the chain. This would require the attacker to not only alter the data in the original block but also recalculate the hash of every block after it, which would be a computationally intensive task.

Additionally, most blockchains are decentralized, meaning that they are maintained by a network of nodes rather than a single entity. In order to successfully alter the data in a blockchain, an attacker would need to control a significant portion of the network and have the resources to outcompute the other nodes in the network. This makes it practically infeasible for an attacker to successfully alter the data in a blockchain. The following example may help you better understand this topic.

Let’s assume there are 100 miners working on block 30.

However, there is one miner who wants to change a transaction in block 18.

This one miner would have to make their changes and redo all the transactions for blocks 18-29 and of course, block 30. That’s 13 blocks of expensive computing.

What makes it even harder is that one miner has to finish making his changes before the other 99 people on the network finish just one block. If he fails, he will have to start again at block 18. Every time he fails, he will have to change an extra block. It’s really impossible.

What is a smart contract?

A smart contract is a self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code. The code and the agreements contained therein are stored and replicated on a blockchain network.

Smart contracts allow for the automation of certain processes and can be used to facilitate, verify, and enforce the negotiation or performance of a contract. They can be used to represent a wide range of assets, including financial instruments, real estate, and even personal relationships.

One of the key benefits of smart contracts is that they can help to reduce the need for intermediaries and increase the efficiency of certain processes. They can also help to reduce the risk of fraud or errors, as the terms of the contract are enforced automatically.

However, it is important to note that smart contracts are not foolproof and can still contain errors or vulnerabilities. It is important to carefully review and test smart contracts before using them in important or high-value transactions.

What is an NFT?

A non-fungible token (NFT) is a digital asset that represents ownership of a unique item or asset. NFTs are stored on a blockchain and are unique in that they cannot be exchanged for other tokens or assets on a one-to-one basis. This is in contrast to cryptocurrencies such as Bitcoin, which are interchangeable and can be freely traded on a one-to-one basis.

NFTs are often used to represent digital artwork, collectibles, and other unique items, such as virtual real estate or in-game items. They can also be used to represent physical assets, such as artwork or rare collectibles.

One of the key benefits of NFTs is that they can provide a way to easily verify the authenticity and ownership of a unique digital or physical asset. They can also provide a way for creators to sell and monetize their work in a more direct and transparent way. However, it is important to note that the value of an NFT can fluctuate and is not guaranteed.

NFT vs Blockchain vs Smart Contract

Blockchain technology and non-fungible tokens (NFTs) are closely related in that NFTs are often built on top of blockchain platforms. A blockchain is a decentralized, digital ledger that records transactions on multiple computers, called “nodes,” in a network. Each block in the chain contains a record of multiple transactions, and once a block is added to the chain, the data it contains is considered to be unchangeable.

NFTs are digital assets that represent ownership of a unique item or asset. They are stored on a blockchain in a similar way to how other digital assets, such as cryptocurrencies, are stored. When an NFT is created, it is assigned a unique digital identifier, which is stored on the blockchain along with other metadata about the NFT, such as its name, description, and creator.

The decentralized nature of a blockchain and the use of cryptographic hash functions make it an ideal platform for storing and tracking unique digital assets such as NFTs. The data in a blockchain is distributed across multiple nodes and is extremely difficult to alter or tamper with, which helps to ensure the integrity and reliability of the NFTs stored on the chain.

In addition to providing a secure and transparent way to store and track NFTs, blockchain technology can also enable other features and capabilities for NFTs, such as smart contracts, which are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. Smart contracts can be used to automate certain processes and facilitate the negotiation or performance of a contract. They can be used in conjunction with NFTs to provide additional functionality and flexibility.

Why would someone purchase an NFT?

There are many reasons why someone might choose to purchase a non-fungible token (NFT). Some common reasons include:

Rarity: Some people may be attracted to the rarity of an NFT and the fact that it represents a unique digital or physical asset. The perceived rarity of an NFT can be an important factor in determining its value.

Artistic or cultural value: Some people may be interested in buying NFTs because of the artistic or cultural value of the digital or physical assets they represent. For example, someone may be interested in purchasing an NFT of a digital artwork by a well-known artist or an NFT of a rare collectible.

Investment: Some people may see NFTs as an investment opportunity and may purchase NFTs with the intention of reselling them at a later date for a profit. The value of an NFT can fluctuate based on market demand, and some people may see the potential for appreciation as a reason to invest in NFTs.

Personal enjoyment: Some people may simply enjoy collecting NFTs and may find personal enjoyment in owning and displaying unique digital or physical assets.

It is important to note that the value of an NFT is not guaranteed and can fluctuate based on market demand. It is important for buyers to carefully consider their motivations for purchasing an NFT and to be aware of the risks involved in investing in NFTs.

History of NFT

The concept of Non-Fungible Tokens (NFTs) has a long history that dates back to the early days of the internet. However, it wasn’t until the development of blockchain technology that NFTs became a widely recognized and widely used digital asset class.

One of the earliest examples of an NFT is the “cyberpassport,” which was created in the 1990s by artist Joe Smith. The cyberpassport was a digital identity that was stored on a blockchain and could be used to prove the authenticity of online artwork.

In the early 2010s, the Ethereum blockchain was launched, which introduced the concept of smart contracts and enabled the creation of NFTs on a larger scale. This paved the way for the development of NFT projects and marketplaces, such as Cryptokitties and OpenSea, which helped to bring NFTs into the mainstream.

Since then, the use of NFTs has continued to grow and evolve. Today, NFTs are used to represent a wide variety of digital and physical assets, including artwork, collectibles, virtual real estate, and in-game items. They have also gained widespread recognition as a legitimate digital asset class and have attracted significant investment and media attention.

Future of NFT

It is difficult to predict the exact future of non-fungible tokens (NFTs), as it will depend on a variety of factors, including technological advancements, market conditions, and the evolution of consumer preferences.

However, it is clear that NFTs have the potential to disrupt and transform a number of industries, including the art world, the gaming industry, and the collectibles market.

One possible trend in the future of NFTs is the increasing use of NFTs to represent physical assets. For example, NFTs could be used to represent ownership of luxury goods, such as designer handbags or watches, or to represent ownership of real estate or other physical assets. This could provide a more efficient and transparent way to verify ownership and facilitate the buying and selling of these assets.

Another trend that may emerge is the increasing integration of NFTs with virtual and augmented reality technology. This could enable new and immersive ways for people to interact with and experience NFTs, such as being able to view and interact with digital artworks in a virtual gallery or being able to explore and experience virtual real estate in a more realistic and immersive way.

It is also possible that NFTs will continue to be used to represent digital assets, such as artwork and collectibles, and will continue to gain recognition and acceptance as a legitimate asset class. Overall, the future of NFTs is likely to be shaped by a combination of these and other trends, and it is an exciting time to be exploring and experimenting with this emerging technology.

Ownership of NFT

NFTs represent ownership of a unique item or asset. When someone owns an NFT, they are considered to be the owner of the digital asset that the NFT represents.

There are a few different ways that ownership of an NFT can be transferred:

Buying and selling: One of the most common ways to transfer ownership of an NFT is through buying and selling. NFTs can be bought and sold on online marketplaces, through auctions, or directly between individuals. When someone buys an NFT, they become the owner of the NFT and the digital asset it represents.

Giving as a gift: Someone who owns an NFT may choose to give it as a gift to someone else. This can be done through a variety of methods, including sending the NFT directly to the recipient’s digital wallet.

Transferring through a smart contract: Some NFTs may be associated with a smart contract, which is a self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code. A smart contract can be used to facilitate the transfer of an NFT from one person to another when certain predefined conditions are met.

It is important to note that the ownership of an NFT is not the same as the physical ownership of the item or asset that the NFT represents. For example, if an NFT represents a piece of digital artwork, the owner of the NFT does not have the right to physically possess the artwork. Instead, they have the right to display or use the artwork in certain ways, as specified by the terms of the NFT.

Monetization of NFT

Monetization can provide a way for creators to monetize their work in a more direct and transparent way. There are a few different ways that creators can monetize their NFTs:

Selling directly to collectors: Some creators may choose to sell their NFTs directly to collectors through their own website or through a marketplace. This can allow the creator to retain a larger percentage of the sale price and have more control over the pricing and distribution of their NFTs.

Auctions: Some marketplaces and platforms allow creators to sell their NFTs through auctions. In an auction, interested buyers can place bids on an NFT, and the highest bidder wins the auction and receives the NFT. This can be a good option for creators who have rare or highly sought-after NFTs.

Royalties: Some NFT projects may allow creators to earn royalties on the sale of their NFTs. For example, a creator may receive a percentage of the sale price every time their NFT is resold. This can provide an ongoing stream of revenue for the creator.

Sponsorships and partnerships: Some creators may be able to monetize their NFTs through sponsorships or partnerships with brands or organizations. For example, an artist may be able to create an NFT for a brand and receive payment in exchange.

It is important to note that the value of an NFT is not guaranteed and can fluctuate based on market demand. Creators should be aware of this risk and carefully consider their monetization strategy when selling their NFTs.

Rarity of NFT

The rarity of an NFT can be an important factor in determining its value. Some NFTs may be more scarce or limited in supply, which can make them more sought-after and valuable.

There are a few different ways that an NFT can be made rare or limited in supply:

Limited edition: An NFT can be made rare by limiting the number of copies that are produced. For example, an artist may choose to only create a limited number of copies of a digital artwork NFT, which can increase the perceived value and rarity of the NFT.

One-of-a-kind: An NFT can be made rare by being completely unique and one-of-a-kind. For example, an NFT may represent a physical artwork or collectible that is one-of-a-kind and cannot be replicated.

Rarity algorithm: Some NFT projects may use a rarity algorithm to determine the rarity of an NFT based on certain criteria, such as the performance of the NFT in the market or the reputation of the creator.

It is important to note that the rarity of an NFT does not necessarily guarantee its value. The value of an NFT is determined by market demand and can be influenced by a variety of factors, including the perceived rarity or uniqueness of the NFT, the reputation of the creator, and overall market conditions.

Applications

The NFT meaning is still relatively unknown to people. This can be explained because Non-Fungible Tokens are still relatively new and many people have not yet been introduced to digital ownership, the possibilities of NFTs are not yet fully unfolded. Real adoption started in 2021, with the focus mainly on trading illustrations, videos, and items in various games.

However, NFTs are suitable for all unique properties. Therefore, merchants selling paintings and watches, for instance, are also busy developing around NFTs. Several companies are also creating real estate NFTs. This allows you to sell your house easily, by transferring the NFT. The developer of the NFT has the advantage that royalties are involved in the sale, so you will receive royalties in subsequent transactions as well.

This also applies to musicians, who can release Non-Fungible Tokens. For instance, some artists release albums as NFT, but concert tickets can also be released this way. True fans and collectors also trade in these tokens, giving an artist additional income from royalties.

There are many other applications active in the real world. If you are interested in learning more about these, we recommend simply Googling and then clicking on “News”. This will give you a list of current results with the most recent applications of NFTs.

Security

NFTs are digital. They may not be able to be stolen physically, but digitally they can. For instance, there are several types of malware that make you lose all your assets simply by approving a transaction. Therefore, always beware. Do not respond to mysterious DMs you will see passing by on Twitter or Discord. Always do research before you actually take action. on this page, we will explain how to be optimally protected against digital theft.

Secure your Discord

You can secure your Discord in several ways. Let’s go through what you need to do.

Account protection

Use a strong password. Google provides a free “best password” option;

Enable Tweefactor Authentication (2FA). This is a good way to secure your Discord account and ensure that only you can log in;

Link your phone number as an extra layer of security.

DM protection

When you are in multiple Discord servers, you will undoubtedly receive DMs from bots. These bots send phishing content. They tell you that a certain mint is live, or that you have won something. This will also include a link.

You may end up getting hacked just by clicking on the link. Never interact with these kinds of DMs – they are all fake. Only follow the information in a Discord server if you are sure you are not going to be scammed.

When you join a new Discord server, you will want to adjust the following settings.

Right-click on the Discord server logo;

Click on “Privacy settings”;

Deactivate allowing private messages and any other settings you might want to adjust.

DYOR

Learn how to research an NFT project. We cover this on the “” page. Make a trade only if you are sure you won’t be scammed. When you start trading, you might start following other traders’ calls. This is no guarantee of success. There are some traders who are good at what they do, but ultimately you are the one who executes the trade. Therefore, always know what you are doing before you do anything.

Wallet

To buy an NFT, you need a wallet. Which wallet you choose depends on the blockchain you will be trading on. In this case, we will continue with the Solana blockchain. We have written a separate guide on . For optimal security, you need a , but to execute transactions you need a . Read through the guide, create a wallet, and then return to continue with this guide.

How do I put money in my wallet?

Om geld op je wallet te zetten heb je een exchange nodig. Als je nog geen account op een exchange hebt kun je deze guide lezen. We gaan er nu vanuit dat je een wallet en exchange hebt.

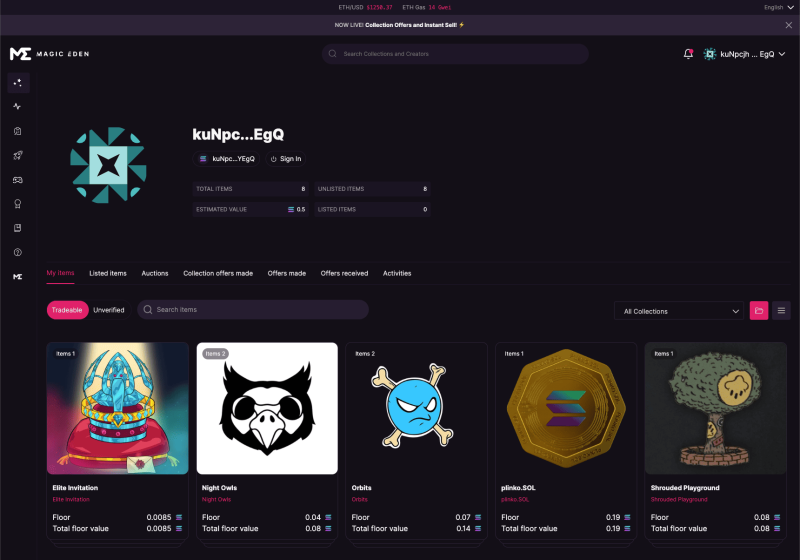

1. Copy your wallet address. In this case, it’s “kuNp…YEgQ”.

2. Go to the “Withdraw” section in your exchange and fill out the fields. Make sure that the information you put in is completely correct! You can’t change this information after submitting the transaction.

What does minting mean?

Mining means; registering an NFT on the blockchain. A creator develops an NFT. He then creates a smart contract to sell his NFT with. The NFT is not registered on the blockchain, as no transaction has taken place yet. When a buyer buys the NFT via the smart contract, it gets recorded on the blockchain. When an NFT is minted, it can be used or sold on marketplaces. In addition, you can send the NFT to other wallets. Selling an NFT or sending it to another wallet will also change its registered owner on the blockchain. However, you can see who the previous owner was.

When do mints take place?

A considerable number of mints take place every day. Creators and teams have developed an NFT project and then want the public to mint it. However, 9 out of 10 NFT projects that are released are good for nothing. Never be tempted and more importantly, never let FOMO (Fear Of Missing Out) rule your actions.

How can I mint an NFT?

Step 1 – Wallet installment

We explained how to set up and fund a wallet in .

Step 2 – Magic Eden

Head over to the website.

Step 3 – Connect wallet

Click on the “Connect Wallet” button top right.

Step 4 – Launchpad

To mint an NFT, head over to the and choose a collection.

Beware, most mints have different phases, for example, a Whitelist phase, and a public phase. A public phase can be very heavily botted if a collection has tons of hype and a huge following, this will cause your mint to fail in most cases.

Step 5 – Mint

After that, minting is just one click of a button away, the “mint” button. After clicking on it a popup will appear.

Step 6 – Approve

Click on “Approve”, this will take the mint costs out of your wallet and mint an NFT in your wallet. After the transaction has been confirmed, you can find your minted NFT in your wallet.

What is a marketplace?

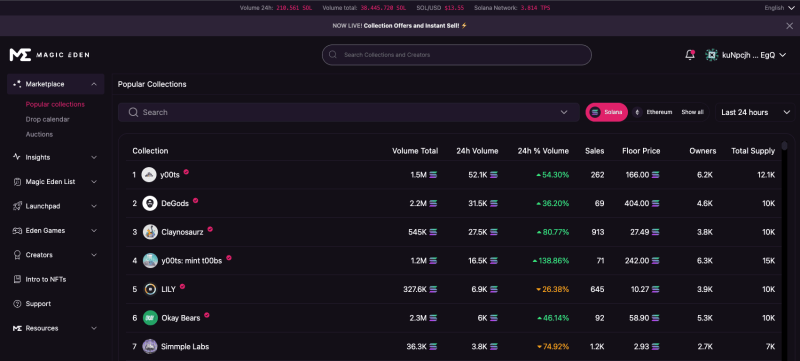

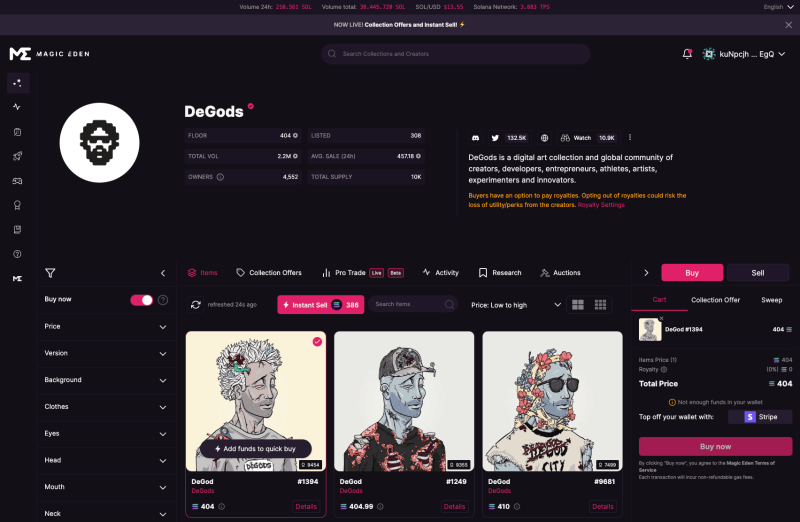

A marketplace is a website where you can buy and sell NFTs. On the Solana marketplace, the two best-known are MagicEden and Hyperspace. The difference between the two is that on MagicEden you can be cheaper because you don’t necessarily have to pay fees. Be careful with this!

Some projects will not give you access to the utility if you do not pay this fee, also known as the “Creators Fee”. We’ll give you a quick tour of MagicEden. The principles are the same on all marketplaces.

Buying an NFT

Buying an NFT on the secondary is not the same as minting an NFT. The word minting can only be used if the NFT is not registered on the blockchain yet. Buying an NFT means that you purchase an NFT which has already been minted, aka registered on the blockchain.

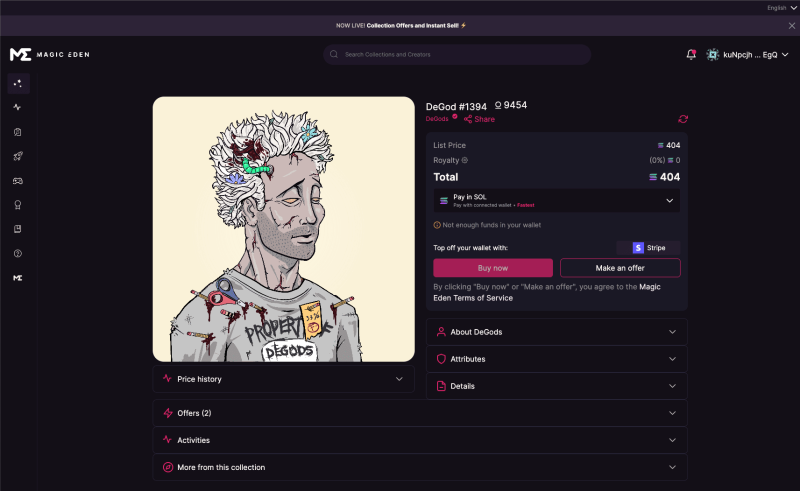

Step 1 – Find a collection

You can find the most popular collections on the Popular collections page. By clicking on a collection, you appear on the Collection page. Here you can see all listed NFTs of the corresponding collection.

Step 2 – Quick buy

Pick an NFT. Hovering over an NFT will show you a quick buy option, clicking this will buy the NFT at the listed price.

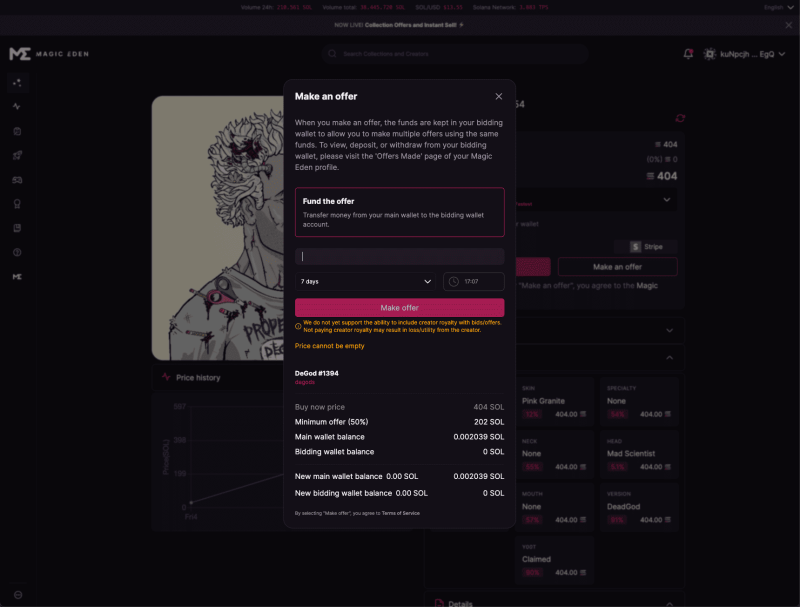

Step 3 – Make an offer

If you are not in a hurry to buy the NFTs, it is wise to place bids. Do this by clicking on “Details” when your mouse is on an NFT. Then click on “Make an offer”. This is a common method to optimize profits.

Step 3 – Details

Clicking on the “Details” button will lead you to the NFT’s own page; here you can check all the details regarding the NFT you clicked on.

Selling an NFT

Selling an NFT can be easy if you are selling a hyped collection. However, if the volume isn’t that high and there is a big delay between sales, it can be harder to realize a sale. The key is to be patient.

Step 1 – My items

Go to my items for the easiest overview of all your NFTs. You get here by clicking on the icon next to your wallet, at the top right.

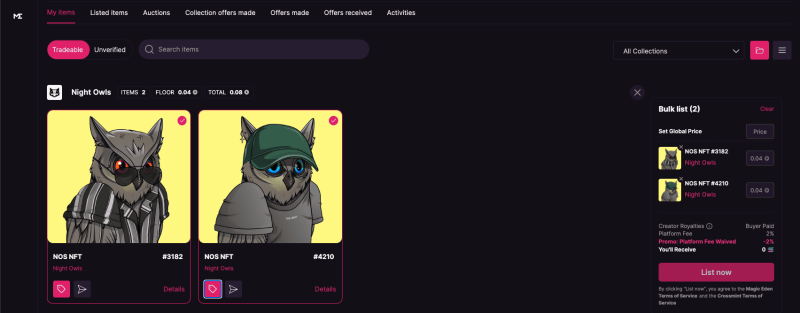

Step 2 – Select items

Click on the NFT to select it for bulk selling, here you’ll be able to fill in your listing price and list your NFT for sale.

Step 3 – Patience

Be patient since you will most likely not sell your recently listed NFT immediately. Patience is key.

NFT Project Standards

These benchmarks should be used when trading NFTs. They are the basic value that an NFT project must meet to be successful in both the long, and short term. Here, we will talk about the art, the team, the roadmap, the utility, and the community.

Art

Good art is important for both the short- and long-term. When the art is of high quality, people’s first impression will improve positively. This increases the chances of people actually buying the NFT, perhaps even purely for the art.

Team

Before buying an NFT as an investment or trade, you want to make sure the team is reliable and not idle. Research who the team members are, often you can find a LinkedIn account. Also look at what they have done with the project in the past, and what they plan to do in the future. The most valuable thing you can do is to request a call with the team, so you can ask questions directly.

Roadmap

It is important to know that innovative processes will take place in the future. These additions or sometimes even innovations can have a positive impact on the value of the NFT. If you think the team is going to deliver on its promises, and these promises will have a potentially positive impact on the value of the NFT, it could be a good choice to buy an NFT.

Utility

In addition to the roadmap, there should already be an existing utility. When a particular utility is already present, you know that the team has already delivered something. A utility is not a simple Discord server. Think of software, tools, or educational material, for example. When these utilities are of good quality, the team is promising, and the roadmap predicts a bright future, it becomes very interesting to purchase the NFT.

Community

An NFT project is carried by its holders no matter how you look at it. If the community is disappointed, the value of the NFT will most likely drop. Holders become sellers. You want to buy an NFT project when it is supported by a strong community. This is because it increases the likelihood that more people will buy the NFT. This is the only way they will have access to the community.

Investing in NFT

Investing relates to the long term. By investing, you sacrifice money or time to expect future profits. When you invest in an NFT, you invest in a project run by a team (like a normal company, but digital). When you invest, you assume that the team behind the project will give something back to you as a holder after a certain period of time. This could be money or some utility.

You don’t give money directly to the team behind the project. You buy an NFT. You can do this by minting an NFT or by buying an NFT on the secondary marketplace. This NFT keeps its value. Its price fluctuates with what the team delivers to its holders. Of course, this involves marketing, but there is a simple theory to remember: the more valuable utility a team delivers to its holders, the higher the price of the NFT will be.

You want to find teams that focus on quality and continue to deliver their work to their holders in a consistent manner. In addition, transparency is also important; you want to know what the team is working on. This way, you as a potential investor or holder can assess what the project will bring in the future. This in turn allows you to make a choice: buy or sell?

Don’t just invest in a team but do research first. Most teams that launch their projects every day are not here to cede responsibility to you as a holder. Once they get their money, they will never be heard from again. In addition, it may arise that a team was successful for a period, but this success came to a halt after a period. Due to demotivating circumstances, the team stopped working, and you as the holder are left with an NFT that is of no use to you. Always be careful about the teams you pick to base your investment on.

Don’t invest based on what others tell you. Invest based on reality. Research the project. Check out their website and whitepaper, join their Discord server, request conversations with the team, etcetera. Based on the information you gain here, you can make a very simple choice: does this project suit me, or not? When you invest, assume that your money will be tied up in the investment for a longer period of time. Invest only if the investment matches what you believe in, regardless of what others tell you, but remember to always check the facts.

Do Your Own Research (DYOR).

Trading

Like crypto, stocks, and forex, you can also trade NFTs. You can trade NFTs based on news about a particular project and on technical analysis. However, we recommend trading based on what you know about an NFT project.

Making your own calls

The standards you should walk past have been mentioned earlier. These standards can be applied to both the short and long term. Do you know that a project is going to make a bigger improvement to its utility tomorrow, or perhaps launch a completely new utility? Then the opportunity arises to open a short-term trade.

When news is mentioned by the team, this can create three situations. Let’s go through them.

The public captures the news negatively. This will have a negative effect on value.

The public catches the news neutrally. This will have no effect on the value.

The public captures the news positively. This will have a positive effect on value.

If you learn what kind of news can cause this kind of reaction, you can predict what the price might do in the future. As you gain more experience, you will recognize more features. The more experience, the better your trades.

Following calls from other traders

In our Discord server, you get access to a wide range of NFT callers. In the ・nft-recap channel, you can find a spreadsheet where our records can be found. By simply following traders, you need to do less work yourself. No success is guaranteed, so always do your own research.