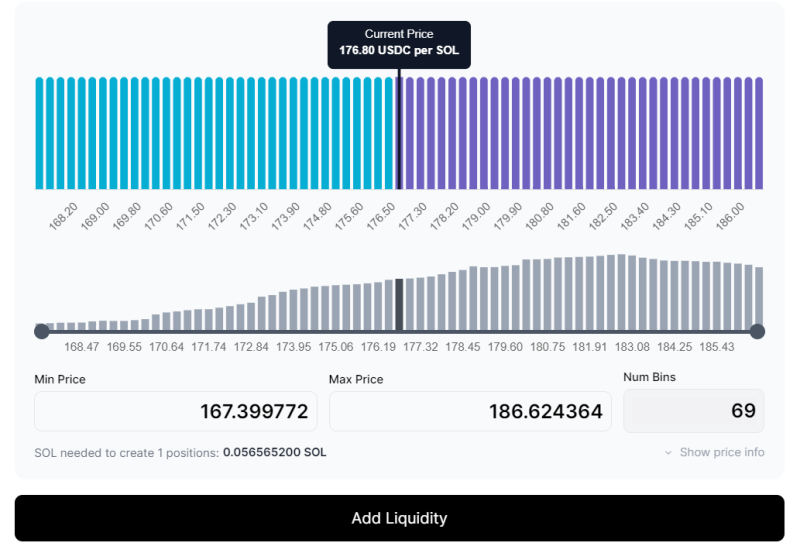

Pioneered by Meteora the Dynamic Liquidity Market Maker (DLMM) allows liquidity providers to organise liquidity into discrete price levels, known as ‘bins’. In this gudie we will explain how these ‘bins’ enhance capital efficiency, enabling liquidity providers to earn higher fees with less capital.

How does it work? Example?

Unlike previous liquidity pools (LPs), the DLMM pool is much more capital efficient.

But why is this?

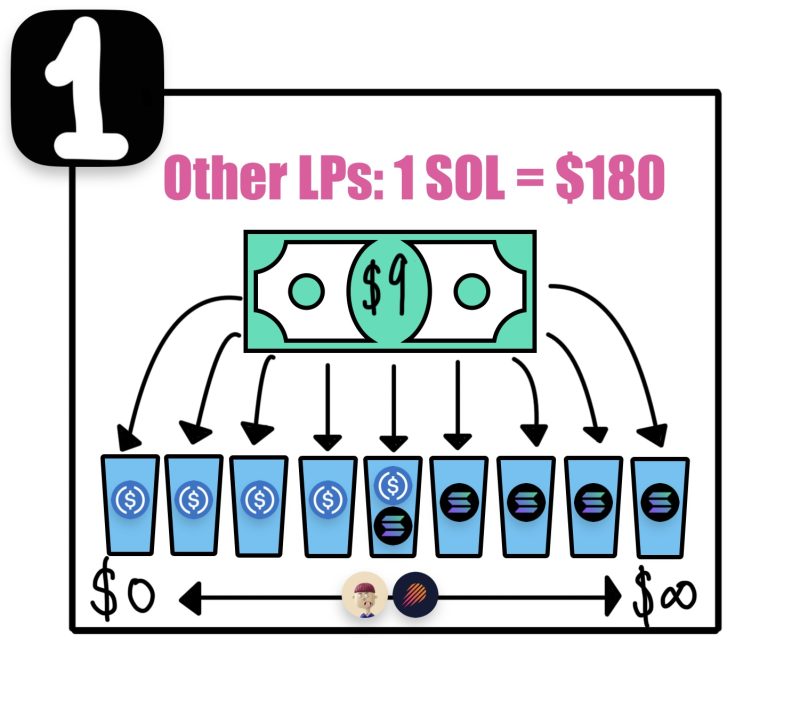

Let’s take a user with $9 of liquidity to deposit in this example.

If you look to the first diagram, depicting existing LPs, you can see that the liquidity is spread between every price level (represented by bins), from $0 to infinity.

As this range is well, infinite, it means that a users deposit is spread thin, and only a portion of the deposit will generate fees, rewarding the user poorly.

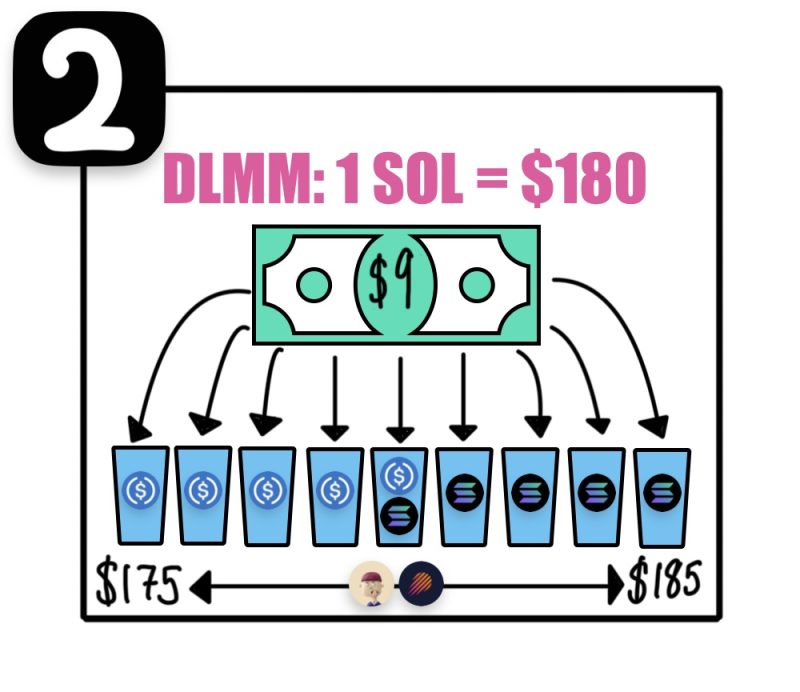

Taking a look instead at the DLMM pool, you can see that the spread between the lower and upper band is much smaller, and crucially, finite.

This means that liquidity deposited into the DLMM pool is used more frequently and thus generates greater fees for providers, whilst simultaneously improving capital efficiency.

Fundamental to understanding this concept is the idea of a liquidity ‘bin’.

In the DLMM pool, liquidity is organised into discrete ‘bins’, positioned at distinct price levels, and containing a set amount of liquidity for the asset pair. (SOL/USDC here) (e.g. each bin above contains $1 worth of liquidity as $9 is split between 9 bins).

The active bin, in which the market price trades, contains both assets in the pair.

In this case, both $SOL and $USDC, as shown.

If the market price for $SOL were to rise above $180 in this case, the $SOL liquidity in the bins to the right of the active bin would be exchanged for $USDC.

And in the case that $SOL exceeds $185, the LP upper limit, then all bins would hold $USDC only.

The opposite would happen if $SOL fell below $175, i.e. only $SOL in the bins.

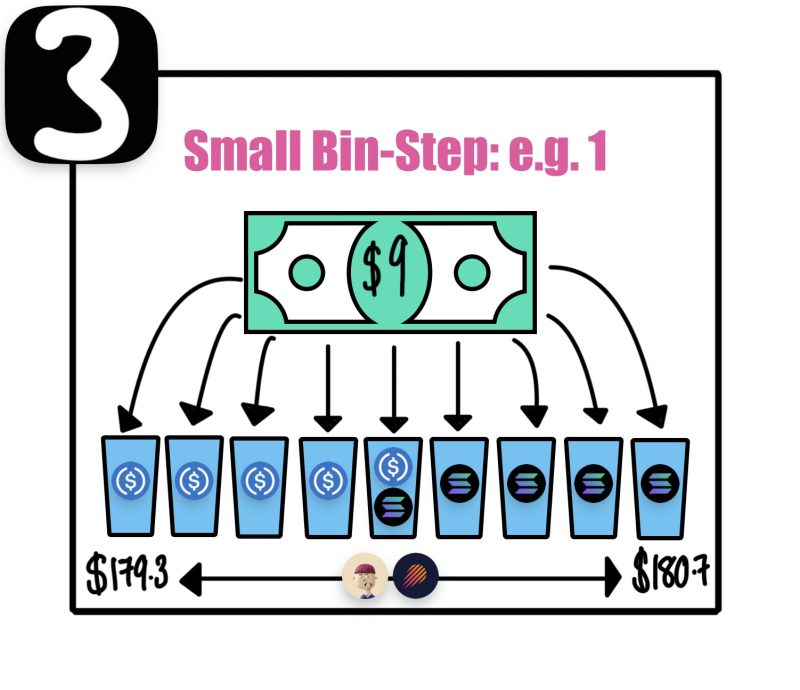

To add a layer of complexity, let us now turn to the idea of the bin-step.

A bin represents a single price point, and the bin-step is the % difference between two consecutive bins in basis points.

If we look to the third diagram, showcasing a small bin-step of 1, the range in which the deposit will generate fees is very tight indeed.

($179.3 – $180.7)

If price escapes this range, fees will no longer be generated, and there is a risk of impermanent loss.

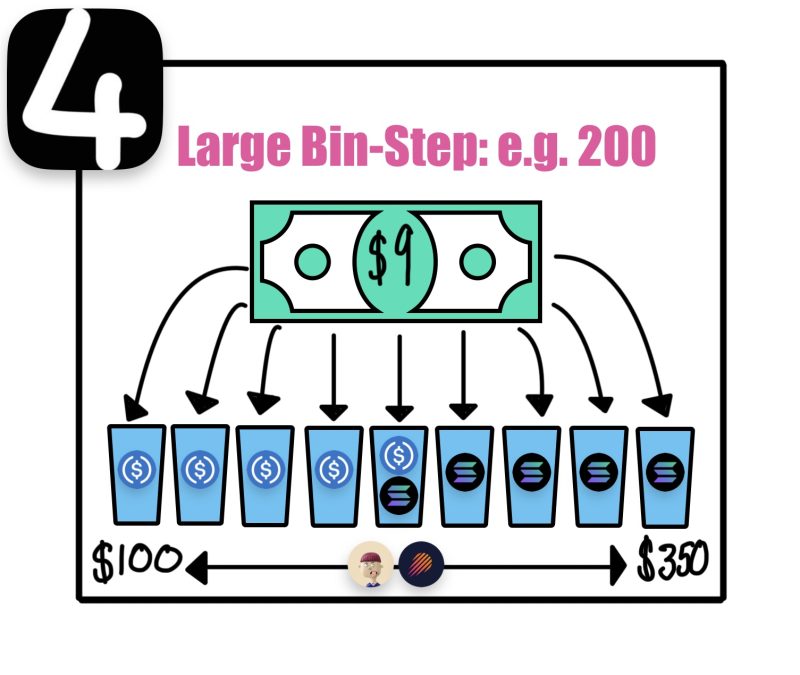

A significantly larger bin-step of 200, has a greater active liquidity range, as you may expect.

($100 – $350)

There are however, like most things in life, trade-offs.

A smaller bin-step, may prove more capital efficient, generating higher fees, yet the likelihood of the price moving outside of the range, and the risk of impermanent loss (IL) is much greater.

A smaller bin-step is much better for less volatile pairings, such as USDT/USDC.

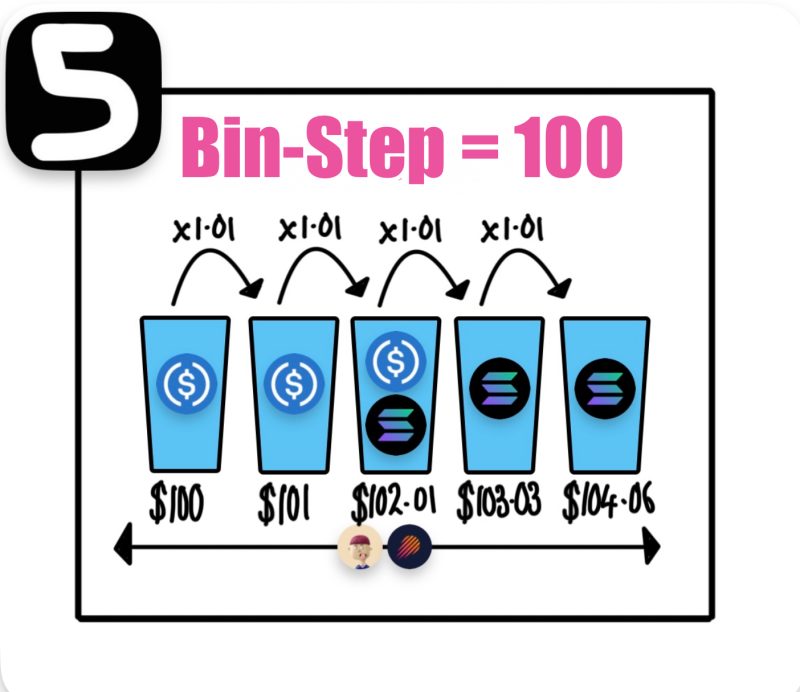

But what is bin-step?

The bin-step is the % change in basis points from one bin to the next, where a basis point is equivalent to 1/100th of 1%.

So, as in the example, a bin-step of 100 leads to each consecutive bin price being multiplied by x1.01

Dynamic

The ‘dynamic’ part of DLMM stems from the fact that the weighting of liquidity in each bin can be altered, depending on your strategy.

One such strategy that is currently available is ‘bid-ask’, shown in image six.

In this case, more liquidity is allocated per bin, the farther away from the initial active bin the price moves.

This is shown above by the size of the ‘bin’ – a larger bin = more liquidity.

In a similar light to an option, this strategy can be used to capture volatility in a market especially when prices vastly move out of the typical range.

Moreover, a single sided deposit could setup a DCA in or out strategy.

Why is this important? Pros vs Cons?

Whilst it may seem complicated at first, the benefits to those able to master the DLMM pool are twofold.

Firstly, greater capital efficiency leads to more fees for users.

And secondly, flexible liquidity weightings to suit market conditions.

Whilst the benefits of the DLMM pool are immense, they come at a cost, your time.

These positions require active management, to ensure that the price doesn’t deviate outside of its respective range, and that IL is minimised.

However, if you train yourself to join the LP army via the Meteora Discord, I’m confident in your ability to maximise returns whilst minimising the downsides.