Meme coins have seen some of the highest trading volumes over the past year, reaching a capitalisation of $70 billion. As Layer 2 tokens shows dips at -80% of ATH, meme coins continue to rise. We keep our finger on the pulse of another hot market.

About the memes market

All markets go through their stages of development. So we have gone from DOGE on its own blockchain, to thousands of meme coins running daily on existing networks.

This is mainly happening through launchpads, which became popular six months ago. For example, Pumpfun.

Because:

- It’s convenient. You upload your avatar, social media links, set the number of tokens and press deploy. You don’t have to set up a development environment and write token contracts.

- It’s secure. Meme coins and fraud go head-to-head: One developer draining liquidity, the other blacklisting buyers or freezing their assets. Launching via launchpools eliminates token code manipulation.

The next branch of development was CTO.

What is CTO?

It stands for Community Takeover – the transition of a co-created project into the hands of a community that:

- Creates separate social networks: Telegram, Twitter.

- Buys ads on top of the scanner: DexScreener.

- Launches a social media shill.

- Hires alpha callers to signal their audience to buy token.

The most prominent example of a CTO is POPCAT.

POPCAT rate hike.

It’s just a meme of a cat opening and closing its mouth. After the launch, the developer saw the token grow to a market cap of $100k. Greed set in and he sold all his tokens.

The community saw this and apparently everyone liked the meme, but launching another token was not the right thing to do – there would be no OG status. The community held a CTO. The token was rocked to a $1 billion capitalisation.

The developer tried to regain control, even creating POPCAT 2.0 from the same wallet. But it didn’t work.

From nobility to speculation

In about six months, the purpose of using CTOs since the project’s revival has shifted to pump-and-dump strategies.

Ironically, it is not uncommon for CTOs to be handled by the developers themselves, who sell tokens and simply buy from another wallet.

CTO on the example of the $ratio token

$ratio was launched six months ago and was forgotten about for a few months. Then, for some reason, a strong pro-trade started, which sent the price of the token. Maybe it was CTO or some strange shilling. I would like to show where the fact of CTO is more clearly defined.

Let’s remember the developer who bought and sold the token in the beginning. Suspected CTO: FBoewbsRyUhZyDWsvkw8XjaQArcvmige57zgJgrBVjmQ

The chart is labelled B – where he bought; S – where he sold. Nothing suspicious?

All the growth spikes somehow started after he bought. And they can do tricks like this 5-10 times a day.

How to make money on CTO?

Find the wallets of the smartest people and follow them.

High risk. When a CTO notices that a lot of eyes are watching him, he will simply start entering and exiting tokens. All the liquidity of the copy traders will go to him.

How to look for such wallets? The main clue is abnormal token behaviour.

For example, high volumes, a price spike and a small number of traders. This can be monitored using DexScreener.

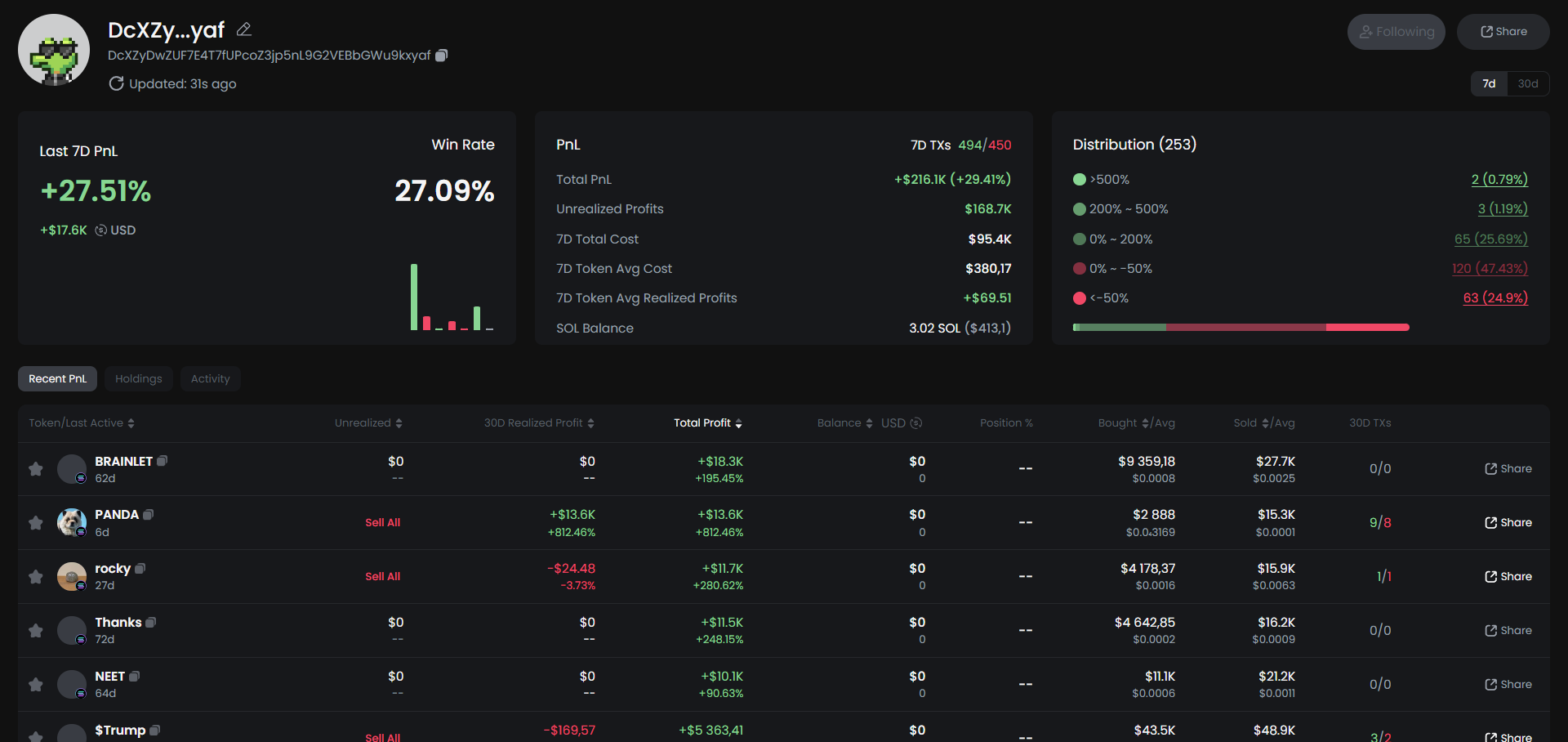

It is convenient to check suspicious wallets through the GmGN service. You enter the address and see all the transactions.

You can subscribe to the wallets you like and even add notifications about transactions in Telegram.

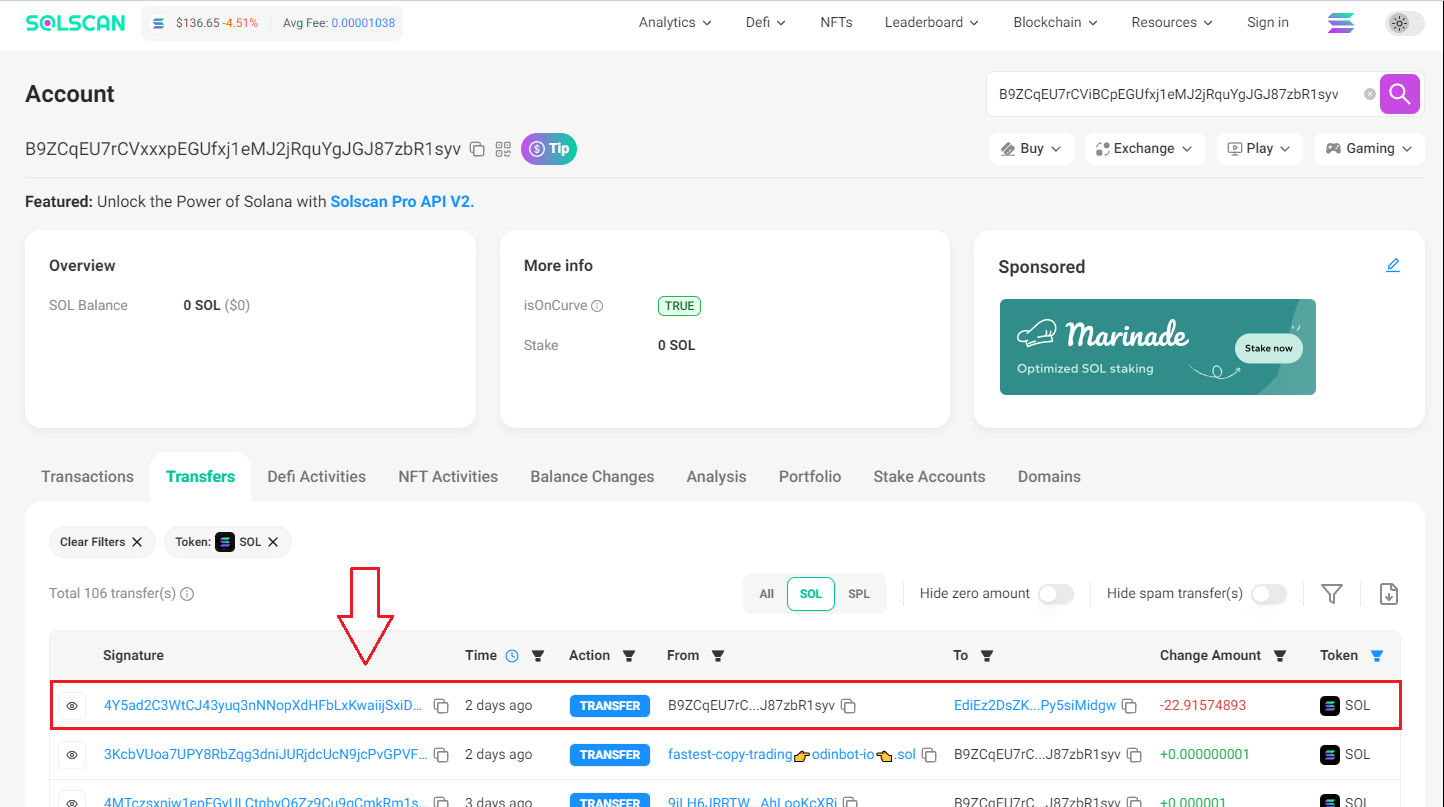

When a CTO sees that he is being watched, he will often transfer money to another wallet. This can be tracked by Solscan.

It’s the very basic, advanced search patterns that you’ll have to come up with yourself.

In the end

Most open copy trading tools are very slow, so it is better to rely on constant monitoring and manual opening of trades. For example, using the same GmGn. This way you will be in full control of the situation.

If you are thinking of doing this, start with small amounts. The most important thing is experience.