The cryptocurrency market can be analyzed from various angles — from technical and fundamental indicators to assessing news flow and social media publications. Regardless of the chosen approach, most traders aim to understand market sentiment — the prevailing expectations and emotions that influence trader behavior and, consequently, price movements.

We’ve explored what market sentiment is, how it is measured, and how it can help inform trading decisions.

What Is Market Sentiment and Why Is It Important for Crypto?

Market sentiment refers to the collective attitude of participants toward the current state of the market, expressed as an expectation of rising or falling prices. A synonymous term is “market mood,” which reflects the dominant emotions among traders and investors — fear, greed, or expectations of stability.

Unlike technical and fundamental analysis, sentiment is not based on numbers or reports — it’s a reaction to news, rumors, and speculation that form a dominant subjective perception of the market at any given time.

Sentiment indicators are especially important in the crypto market, where asset values rarely depend solely on fundamentals. Due to high volatility, cryptocurrencies react actively to external events, and in such conditions, expectations, community engagement, and emotional tone often play a leading role.

A vivid example of sentiment influence was Donald Trump’s March 2025 announcement naming cryptocurrencies to be included in the U.S. national digital asset reserve. Investor optimism was sustained by speculation about the announcement, and after the reveal, several token prices rose.

However, a subsequent decision by authorities not to purchase new tokens, but instead to use previously confiscated bitcoins, led to a decline in market sentiment. Bitcoin’s price dropped, followed by Ethereum, Solana, and XRP.

How Does Sentiment Drive Price Movement in the Crypto Market?

Market sentiment directly influences investor behavior and cryptocurrency dynamics. Depending on prevailing emotions, the market tends toward either growth or decline — and this process is often amplified by how widespread these emotions become.

The most noticeable sentiment phases are periods of fear and greed, each producing distinct behavior patterns. During periods of greed:

- Investors expect continued price increases and aggressively buy assets out of fear of missing out (FOMO).

- Demand surges, even in the absence of solid fundamentals.

- Sentiment indicators (like the Crypto Fear & Greed Index) often reach “extreme greed” levels.

During panic-driven phases:

- Participants rush to exit positions, fearing further losses.

- Asset sell-offs create downward price pressure and accelerate declines.

- Sentiment indices register “extreme fear” zones.

Some traders use a contrarian strategy during such emotional peaks: buying amid panic when prices are low and selling during euphoric highs when assets are overvalued. This approach is based on the idea that market participants tend to overreact to both good and bad news.

Key Tools for Sentiment Analysis

There are several specialized tools and services for assessing market sentiment. These help identify prevailing trader emotions and suggest potential price movement directions.

Fear & Greed Index

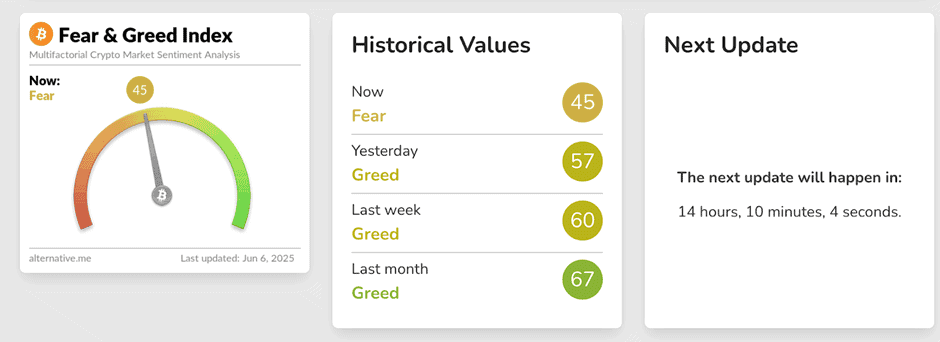

One of the most popular sentiment indicators. It’s calculated using parameters like volatility, trading volume, search engine activity, and social media behavior. The index ranges from 0 to 100:

- 0–25: extreme fear

- 75–100: extreme greed

It can be tracked on data aggregators like CoinMarketCap or specialized platforms like Alternative.me. It’s important to understand the index’s methodology when choosing a source.

Funding Rates

On futures markets, traders pay fees based on the dominant market position — long or short. Positive funding rates indicate optimism; negative rates suggest bearish sentiment.

For example, in early May 2025, negative funding rates on Binance reflected high demand for short positions and prevailing bearish sentiment.

Social Media Analysis

Social platforms are a vital source of sentiment insights. Influencer posts, Reddit discussions, and Telegram messages can significantly influence trading decisions. Specialized platforms can systematically assess:

- The emotional tone of publications;

- Frequency of token mentions;

- General discussion direction.

Examples of such tools include Kaito, Santiment, and LunarCrush, which analyze thousands of posts in real time to detect emotions before they impact prices.

On-Chain Analysis

Another way to assess sentiment is by analyzing blockchain data, which reflects actual trader behavior, such as:

- Large transfers from exchanges to cold wallets;

- Whale and long-term holder activity;

- Token concentration on specific wallets.

For instance, in late April 2025, analysts recorded the largest bitcoin outflows from exchanges in two years — a signal of accumulation, especially when involving major holders.

Google Trends and Search Queries

A simple way to gauge public interest in crypto is through search trends. A sharp rise in queries like “buy bitcoin” or “invest in crypto” often indicates growing retail interest and increasing market greed.

Google Trends allows users to monitor this dynamic and correlate it with price action — especially useful during hype or panic phases.

The complexity of each tool varies. While search query analysis is relatively simple and accessible, working with on-chain data requires experience and time to master.

How to Use Sentiment in Trading: Strategies and Tips

While sentiment analysis alone cannot provide precise price forecasts, combining it with other tools helps reduce risks and make more informed trading decisions. There are several ways to incorporate sentiment into your strategy:

Contrarian Trading

Sentiment is particularly useful when emotions reach extreme levels. Mass fear often signals local bottoms — a potential buy signal. Conversely, euphoria and belief in endless growth frequently precede corrections.

Combining with Technical Analysis

Sentiment becomes more effective when paired with technical tools like RSI, support/resistance levels, and others. For example, if the Fear Index shows panic and RSI indicates oversold conditions near a support level, it could suggest a trend reversal.

Monitoring News and Social Media

The crypto industry is highly reactive to news. Monitoring headlines, Telegram messages, and tweets helps detect tone shifts early. A sudden change in sentiment can foreshadow market moves.

Combining with On-Chain Metrics

Blockchain data offers insight into major players’ behavior and capital flows. Mass withdrawals, low transfer volumes, or token movements between wallets help validate or contradict sentiment signals. For example, if whales are accumulating during a fearful period, that’s a positive indicator.

Tracking Market Positioning

Analyzing open interest and funding rates can reveal imbalances. If most traders hold long positions and funding rates are high, it may signal an overheated market and increased correction risk.

Studying Historical Patterns

Reviewing past market cycles with similar sentiment can highlight recurring behaviors. If fear previously preceded a rebound, a similar scenario might repeat. While not guaranteed, this adds confidence to trading decisions.

Limitations of Sentiment Analysis and How to Overcome Them

While sentiment analysis helps understand trader psychology, it doesn’t provide a complete market picture. The crypto industry is fast-moving and prone to manipulation, so emotions don’t always reflect reality. Key limitations include:

Manipulation and Misinformation

Markets or assets may be targeted by information attacks. Big players might spread fake news, biased analysis, or provocative statements to influence investor behavior.

Lagging Indicators

Many sentiment metrics reflect past events, meaning signals may arrive after price action has already occurred.

Subjective Interpretation

Social media and news analysis is often influenced by personal bias. The same post can be interpreted in different ways by different analysts.

Disconnect Between Emotion and Fundamentals

Community reactions don’t always align with asset value, leading to irrational decisions during hype or panic.

To mitigate these limitations, apply sentiment analysis as part of a comprehensive strategy. Combine it with technical and fundamental analysis, as well as on-chain data to confirm hypotheses.

Use reliable sources, and maintain a trading journal to log your own observations and track the emotional tone during different market phases. Over time, this helps build a personal system for identifying true signals versus noise.