On April 16, 2025, decentralized exchange Raydium unveiled a new memecoin platform LaunchLab. According to the developers, the project will allow rapid creation of new tokens with the possibility of deep customization.

Against the backdrop of the launch of LaunchLab, users began to talk about a new round of competition in this direction. The platform should “impose the struggle” on the segment leader – pump.fun.

Big Boss

PumpdotFun is the go-to memecoin launchpad on Solana. Since its inception on January 17, 2024, it has onboarded a tsunami of tokens, sending them straight to Raydium’s AMM once they hit a $69k market cap—like a graduation ceremony where memecoins get their first taste of decentralized trading.

By early 2024, the pump.fun platform has become a truly viral tool for launching memecoins. Its main advantage is that creating a token takes a minimum of time and requires almost no financial injection. Such a mechanism suited both speculators and novice enthusiasts.

The model turned out to be quite simple. When a token reached a certain capitalization, a pool was automatically opened on Raydium. Users drove the tokens toward that goal, forming a spontaneous community around new ideas, often without a white paper, team, or roadmap. In this sense, pump.fun became the first mass “hype builder” in the Solana network, and Raydium became the infrastructural backbone.

Raydium was the seasoned DeFi veteran, boasting deep liquidity pools and an unmatched reputation for seamless swaps. The two were a perfect match. PumpdotFun provided the projects, and Raydium provided the liquidity—a true DeFi power couple.

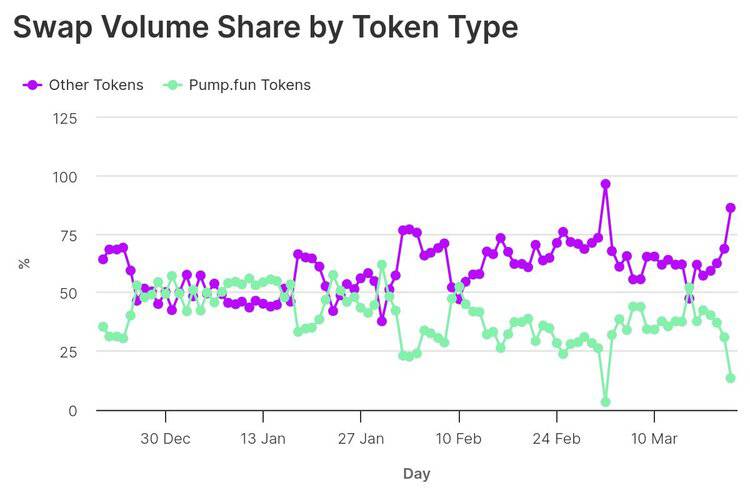

Behind the “facade”, however, significant trading volumes were hidden:

- according to Flipsyde analysis, in January 2025, over 62% of Raydium’s trading volume came from pump.fun tokens;

- Raydium receives a standard 0.25% swap fee for each asset, as well as a one-time pool activation fee;

- tens of thousands of new tokens are launched on pump.fun every day.

PumpdotFun brought the hype, the tokens, and the traders. Raydium provided the infrastructure, liquidity, and credibility.

At its peak, PumpdotFun contributed 30-40% of Raydium’s total trading volume—an eye-watering $300-400 billion out of Raydium’s $1 trillion lifetime volume as of March 26, 2025. That’s not just significant; that’s empire-building.

Trading volume on the Raydium exchange for two categories of tokens:

The situation changed dramatically in February 2025, when information about the amm.pump.fun test pool appeared online. This indicated that pump.fun was building a DEX infrastructure and preparing to launch its own exchange. For Raydium, such a turn of events threatened to lose not only traffic, but also commission income.

Rumors about a new project from the pump.fun team alone caused the Raydium token (RAY) to plummet by 65% in February of this year.

RAY token value collapse in February 2025:

A month later, the “memecoin giant” launched a decentralized platform called PumpSwap. It was created on the basis of the Solana network using the Constant Product AMM model. By the time the material was released, the trading volume on the platform exceeded $8.1 billion, according to Dune Analytics.

Under these conditions, Raydium had to look for a symmetrical answer – and LaunchLab became it.

A bold newcomer

LaunchLab, was launched on April 16, 2025. The platform offers users and developers an “alternative way” to issue memecoins, focusing on long-term models, transparency and customization. If pump.fun is a “token creation cannon,” LaunchLab is closer to a fine-tuning builder.

The main differences, according to Raydium’s documents:

- users can choose from linear, exponential and logarithmic curves of cost versus demand volume;

- in addition to Solana, users have access to stablecoins and Liquid Stacking Protocol (LST) tokens;

- developers can independently customize commissions from transactions, forming tokenomics for their needs;

- the project can freeze liquidity for a certain period of time, which reduces the risks of rug pull schemes and makes the launch more transparent.

As for the process of token creation, in addition to the standard mode with extensive LaunchLab settings, there is a JustSendIt option with instant issuance of Memecoin. In this case, after reaching a capitalization of 85 SOL, the liquidity of the asset is automatically transferred to AMM Raydium.

In addition, the developers announced flexible customization of token offerings, sales volume tracking, delegation and rights management.

LaunchLab Interface:

Creators receive 10% of the trading fees and also participate in revenue sharing from the AMM pool. For tokens launched through the LaunchLab interface, a fee of 100 basis points (1%) will be charged. Of this amount, 50% goes to the Community Pool for developers and traders, 25% goes to RAY token redemption, and 25% goes to infrastructure support.

In addition, a referral program with 0.1% of the exchange volume is available to participants. LaunchLab also provides additional tools for token distribution and interface integration. According to exchange officials, this allows new assets to be visible on all terminals and applications from day one.

Fight for users?

As early as February 2025, the Raydium team declared that the development of the pump.fun decentralized exchange would be a “strategic miscalculation”.

Thus, the actions of the two projects look less and less like a collaboration. The creation of pump.fun’s own AMM has deprived Raydium of the lion’s share of Memecoin traffic, and LaunchLab is openly competing for the same users.

Raydium is betting that experienced teams and users will start leaving the competitor’s site, experts say. In their opinion, this move should be prompted by the fact that LaunchLab offers not just a token launch, but an infrastructure for scaling and growth.

my thoughts on raydium vs pumpdotfun

— pump fun did $136m in 24h

— if launchlab captures 50%, $170k/day could flow to $ray buybacksthis is a protocol war for solana’s attention economy.

pumpfun productized the meme meta. launchlab is systematizing it.custom supply, vesting,… pic.twitter.com/JEovsk3tjS

— Arif (@arifkazi_) April 16, 2025

At the same time, pump.fun has a strong position at this stage due to:

- minimal entry threshold (cheap one-click token launch);

- a strong brand and a large community;

- an established and user-friendly way of issuing memecoins.

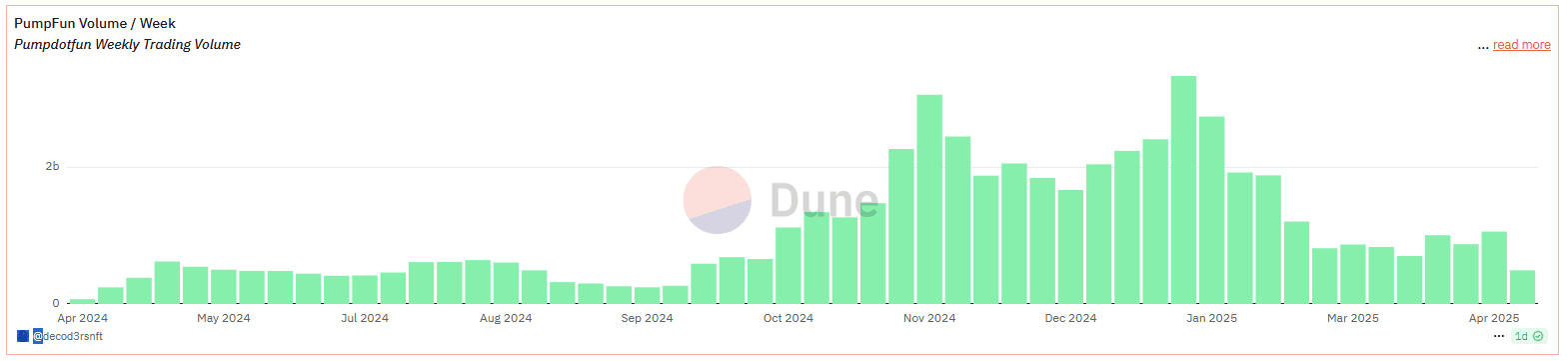

However, it’s not all smooth sailing. According to Dune Analytics, in February 2025, the monthly trading volume on the pump.fun platform dropped 63% to $43.9 billion. The daily average, in turn, is down 94% from its January peak. And performance continues to decline.

Weekly trading volume dynamics on the pump.fun platform:

This isn’t just a PumpdotFun vs. Raydium battle. This is a major shift in Solana’s DeFi ecosystem.

- For Memecoin Degens: You now have two competing launchpads and AMMs. More options, better rates, and potentially lower fees.

- For Raydium: The launch of LaunchLab was a defensive move, but will it be enough to retain its dominance?

- For PumpdotFun: It’s proving that agility can outmaneuver legacy. If it successfully pulls liquidity away from Raydium, it could redefine DeFi on Solana. But can it scale without Raydium’s liquidity depth?

Decentralization or fragmentation?

The situation with LaunchLab and pump.fun may not only be a competition, but a reflection of global processes in the Solana ecosystem. We are talking about the decentralization of the trading infrastructure and the transition to modular designs, where projects form their own chains for launching and trading tokens.

If the platforms continue to develop in their niches, pump.fun may remain a kind of experimental space, and LaunchLab may remain an infrastructure for more mature teams. In such a case, we will probably see a fragmentation of the token launch trend.

Pumpfun walked so Raydium could run?

Unlike PumpFun, @RaydiumProtocol brings fair liquidity distribution, shared ecosystem growth, and sustainable community ownership

Their first token has already launched, and it's clearly a competitor to PumpFun, but imo, it's better:

— Shiv (@shivst3r) April 16, 2025

At the same time, the Raydium team does not hide the fact that it has created a direct competitor to the main platform for launching memecoins. The developers intend to capture a significant share of this market and even spread statements of various experts about “possible change of the leader” in this sector, as in the case of the above publication. It was published by one of the key members of the Raydium team under the nickname 0xINFRA.

The fate of the market will depend on several factors:

- Who will offer more favorable terms to developers;

- how quickly real success stories will appear on LaunchLab;

- how well project developers will implement their marketing strategy;

- whether pump.fun will be able to actively develop AMM competitor Raydium.

The Final Question: Boom or Bust?

Short-Term: Boom for PumpdotFun, Bust for Raydium

- PumpSwap’s rapid adoption suggests PumpdotFun is winning the early battle.

- Raydium’s LaunchLab is playing catch-up.

Long-Term: Depends on Liquidity Wars

- If PumpSwap attracts enough liquidity, it could dethrone Raydium as Solana’s top AMM for memecoins.

- If Raydium stabilizes and retains institutional trust, it could weather the storm.

One thing’s certain: Solana DeFi just got a lot more interesting.

At first glance, the story of LaunchLab and pump.fun is just another round of competition in the memecoin space. But in reality, it may reflect a much deeper shift: a shift from “quick launches” to managed and sustainable assets.

If pump.fun created a trend to democratize token issuance, Raydium LaunchLab is attempting to “refresh” the trend and, in parallel, reformat the memecoin launch market.