When trading on Solana, it’s crucial to understand how to protect your assets. Here’s a simple breakdown to help you trade safely:

Common Risks in Solana Trading

Phishing Attacks: fake websites or links that steal your private keys or seed phrases, especially in Telegram, where people will easily call you or DM you. BONKbot mods and admins will NEVER dm you first – anyone who does is 100% a scammer!

Malicious Contracts: There are a few things in this case, such as Freeze Authority enabled, Mint Authority enabled, and the Liquidity Pool unlocked. We go through how to protect yourself from these dangers in the next pages under Mint Authority, Freeze Authority, and LP Burnt.

A quick and easy way to keep yourself safe is to use rugcheck.xyz before you buy any coin. You can paste the coin address (the unique ID of each coin), and rugcheck will tell you how safe it is.

How to Trade Safely on Solana

Verify Websites and Links:

Always double-check the URL of websites and links. Use official sources, and avoid clicking on suspicious links.

Research Projects:

Ideally you would do extensive research into the legitimacy of the project. With memecoins, this isn’t always possible, so we recommend using scanners like rugcheck.xyz to see how safe the coin is before buying!

Enable Two-Factor Authentication (2FA):

Wherever possible, enable 2FA on your Telegram account. This adds an extra layer of security.

You can also buy a private telegram number which will keep you safe.

Keep private keys secure.

Never share your private keys with anyone. No matter who asks you, anyone who wants your private key or access to your telegram account is a scammer!

Stay Updated:

Follow reliable news sources and community updates to stay informed about any potential risks or scams in the Solana ecosystem.

Mint Authority

Mint Authority should be disabled!

What is Mint Authority in Solana?

When trading tokens on the Solana blockchain, understanding mint authority is crucial. Here’s a simple breakdown:

Definition:

Mint Authority: This refers to the power held by the creator to mint (create) new tokens. Basically, if Mint Authority is on, the dev/the creator of the token is able to mint as many tokens as they want, increasing the supply.

Example of Mint Authority

Bad Actors: Some developers/creators might abuse mint authority by creating a large number of new tokens unexpectedly. This sudden increase in supply can devalue the tokens you hold, similar to how printing more money can lead to inflation, especially when the devs sell it all.

How to Protect Yourself from Misuse of Mint Authority:

To avoid getting affected by the misuse of mint authority, follow these steps:

Check for Mint Authority:

Before buying into any token, use tools thats available like rugcheck to see if the mint authority is still active.

![]()

If the mint authority is still in place, the creator can potentially mint more tokens.

Check in Birdeye, it should be in the info of the token.

Monitor Token Supply:

Keep an eye on the token’s total supply. Sudden increases in supply can indicate new tokens being minted, which could affect the token’s value.

By understanding and checking for mint authority, you can make more informed decisions and protect yourself.

Freeze Authority

“Token Account is Frozen”

What is Freeze Authority in Memecoins?

When trading memecoins, it’s essential to know about freeze authority. This can be a tricky concept, but here’s a simple breakdown:

Definition:

Freeze authority means the creator of a specific coin has the power to freeze any token at any time.

This can make it look like the coin is still active because others are buying and selling, but you might be unable to do so.

How Does Freeze Authority Work?

Freeze authority allows the coin’s creator to restrict you from moving or selling the token. This can effectively steal your money and create a ‘honey pot’ where your funds are trapped.

Example of Freeze Authority:

Bad Actors: Some developers might abuse this feature by freezing your token account. This means you can’t sell that specific token, even though you can still use other assets in your wallet.

How to Prevent Getting Trapped by Frozen Tokens

To avoid getting caught in a freeze authority trap, follow these steps:

Check for Freeze Authority:

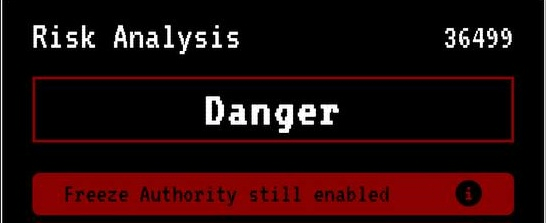

Before buying any coin, use a tool like RugCheck to see if freeze authority is enabled.

If it is enabled, it means the creator can stop you from selling the coin, effectively stealing your money.

Avoid Buying Coins with Freeze Authority:

If you see that freeze authority is enabled, it’s a sign that you should NOT buy the coin.

The creator might use this feature to freeze your tokens and prevent you from selling them.

LP Burnt

Another key thing to watch out for is liquidity pools, and importantly… whether the creator is able to access it!

What is a liquidity pool?

A liquidity pool is a crucial element in the world of decentralized finance. In simple terms, it’s a pool of money that lets you buy and sell any coin you’ve purchased through BONKbot!

Here’s how it works:

Creation of the Pool:

The developer creates a new token (e.g., $CatCoin).

They pair this token with an established cryptocurrency like Solana ($SOL) in the liquidity pool.

How It Works:

Users can trade $CatCoin and $SOL within this pool.

This system ensures there’s always liquidity (availability of funds) for trading, making it easy for anyone to buy or sell their tokens.

Benefits of Liquidity Pools

Liquidity pools are a fantastic invention for a few reasons:

Decentralized Trading: They allow trading without needing a central exchange.

Access to Any Coin: Anyone can trade any coin that’s part of a liquidity pool.

Potential Risks with Liquidity Pools

While liquidity pools are great, there are some risks to be aware of.

The Risk of Liquidity Pools

Imagine you have $SOL, a valuable token. Would you trade it for something that could drop to zero in value instantly? Probably not. Here’s why you need to be cautious:

Control of the Liquidity Pool:

When a liquidity pool is created, the developer gets a special token called an SPL (Solana Program Library token).

This SPL token indicates ownership of the liquidity pool.

Risk of ‘Rug Pulls’:

If the developer retains control of the SPL token, they can withdraw all the funds from the liquidity pool in one move.

This action, often called a ‘rug pull,’ can make your token worthless.

How to Protect Yourself

Before buying into any new token, it’s important to do your research:

Check if the Liquidity Pool is ‘Burnt’:

You can use platforms like BirdEye or rugcheck.xyz to see if the liquidity pool is burnt.

If the liquidity pool is burnt, it means the developer can’t withdraw the funds, making your investment safer.

Example of a Non-Burnt Liquidity Pool:

This is what it looks like if the liquidity pool is not burnt when you search the coin on rugcheck, meaning the developer still has control over the funds.