Work with the terminal of the Binance exchange

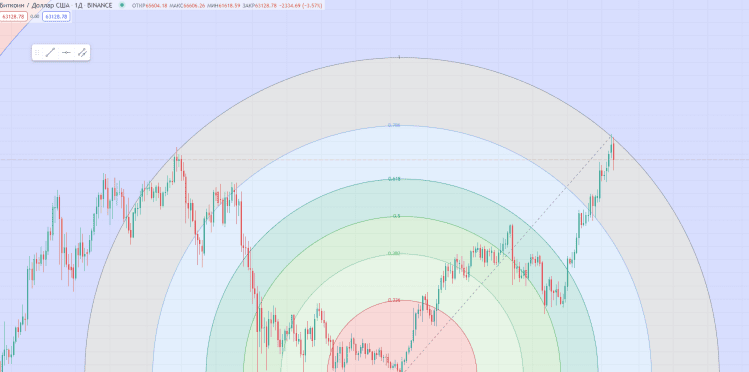

Here we will analyze work with Spot/Futures terminal by the example of Binance stock exchange.

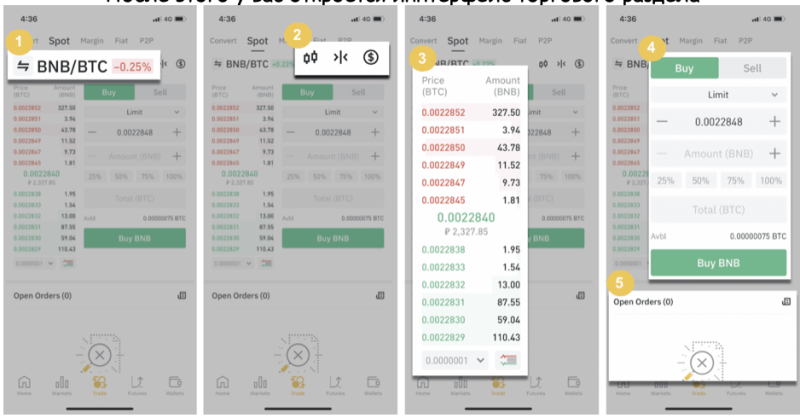

Trading on Spot. To enter the spot trading section, click on (Deals/Trade):

After that you will open the interface of the trading section

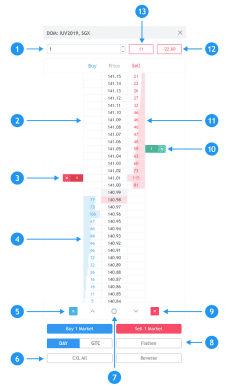

1. The market and trading pairs.

2. Candlestick market chart in real time, supported cryptocurrency trading pairs, “Buy Cryptocurrency” section.

3. Buy/sell order book.

4. Buy/sell cryptocurrency.

5. Open orders.

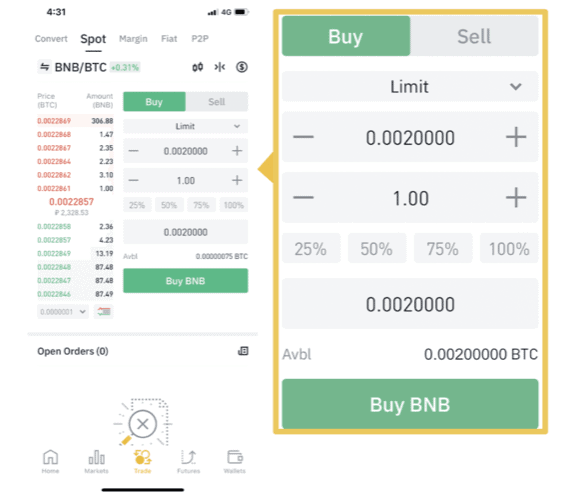

The default order type is Limit-Order, but if you want to place an order instantly or with restrictions you can change it to the desired type in advance (we will cover all order types later).

Selling takes place in the same way.

Trading Futures

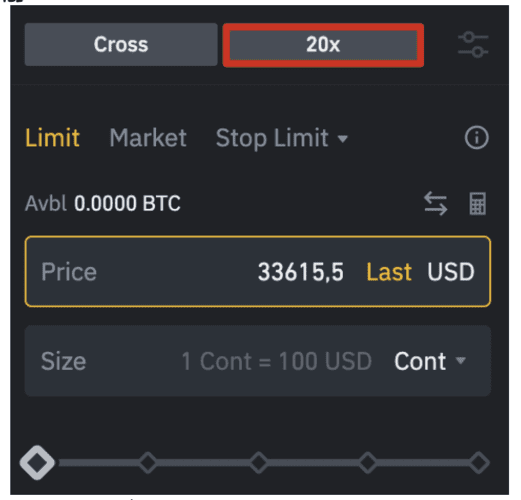

To begin with, you will need to choose the type of margin and leverage. There are 2 types of margin Cross and Isolated.

With Isolated, the margin is independent of all open pairs.

Each open trade has its own independent account accordingly liquidation does not affect other accounts.

With Cross-Margin, margin is distributed throughout the trader’s account.

Cross-margin assets are distributed among all positions. The liquidation of one position eliminates all others.

Next to the choice of margin, there is the choice of leverage, keep in mind that the higher the leverage, the greater the chance that your position will be liquidated on price fluctuations.

To open a position, select the amount and type of order, then click Buy/Long or Sell/Short.

Just below you can also pre-set your SL and TP (stop loss and take profit):

Basic concepts in trading

Who is your trading? The difference between a trader and an investor?

– Trading is the trading of currency, securities or commodities for profit.

– A trader is someone who buys and sells assets, places orders, closes positions, and thinks through short-term trading strategies. He may do this for himself or a client. In addition, traders trade frequently and the essence of their work is speculation.

– Investor is a person who can buy and sell assets on his own or ask a trader to do it. The important difference is in the purpose and terms of financial investments. An investor is focused on profits in the long term.

Animals in the market

– Bulls: In the stock and cryptocurrency market, this is what buyers are called. They believe in the good prospects of the market and actively buy various assets, expecting to earn a further increase in their value.

– Bears: Traders who sell assets hoping for a further drop in the price of a commodity. Bears at any time can be former bulls, who believe that an asset has reached its optimal price or the overall market has changed and it is time to lock in profits.

– Chickens: Cowardly traders. These investors are overly cautious and very timid. They ponder for a long time before they enter the market. They wait for their “stars to align”, but more often than not, they panic for fear of suffering losses, close their positions early and make other mistakes, which naturally affects their financial results.

– Wild Boars: Fearless or perhaps reckless traders. In contrast to chickens, they have no fear at all.

– Hares: These are scalpers. That is, traders who make a large number of deals in one session, trying to make money on small fluctuations in the price of an asset.

– Wolves: These are experienced traders. These are “mature” investors, true market gurus. A cold head, a strict calculation and a perfect understanding of the market let them close the most of their deals with profit, while possible losses are limited in advance.

– Giraffes: Extraordinary Optimists. These investors, in the pursuit of super profits, set pending buy/sell orders too far away from the actual market opportunities. However, this strategy can be justified – sometimes the deal is still realized.

– Hamsters: These players are constantly making the same mistakes over and over again and are unwilling to learn and draw conclusions.

– Whales: Large investors. These, most often, are hedge funds or national investment funds, the real whales of the financial world, which can significantly move the value of an asset and generally change the balance of power in the whole market. They go their own earlier planned course and do not pay attention to the vanity of the market plankton.

– Sharks: Super-successful investors. These traders are not concerned with financial philosophy, their goal is profit, and if there is an opportunity to get it here and now, they will not theorize long, but prefer to grab the loot. These are experienced investors who, in addition to fundamental and technical knowledge, have a keen sense that allows them to see a profitable deal where others fail to notice it.

Types of Orders

– Market order: An order to buy or sell immediately at the best price available.

– Limit order: An order with a specified Buy or Sell price.

– Stop Loss: a request placed in the trading terminal by a trader or investor to limit their losses when the price reaches a predetermined level.

– Take Profit: A closing order to close a position when the price reaches a certain level (if the price moves in a favorable direction for you).

Key terms

– Bid: the asking price or the maximum price at which a buyer agrees to buy an item.

– Ask: The price at which the seller agrees to sell.

– Target price: the average amount you are willing to pay for each conversion.

– Volatility: intense price fluctuations.

– Bull market: rising.

– Bear market: falling.

– Currency pair: value of one currency expressed in another currency.

– Leverage: Borrowed funds provided by the broker to the trader.

– Margin: The personal funds of a market participant used for financial security of a deal.

– Trend: A direction of price movement during a certain time interval (stable trend).

– Correction: A short-term price movement against a trend.

– Flat (sideways): A fluctuation in price within certain limits without a clear trend.

– Timeframe: the time frame in which a single bar (one candle) can be formed.

– Volatility: A fluctuation in price. High volatility means fast price movements in a wide range. Low volatility: A situation where prices are stagnant and there are no sudden price movements.

– Support: A level from which price “springs” and is repeatedly pushed back and moves upward.

– Resistance: a “glass ceiling” into which the upwardly moving price stumbles, unable to break through that level. Once the price reaches this level of support, it rushes down again.

– Long: A position held for the purpose of taking advantage of price movements upwards. It opens to buy.

– Short: A position held for the purpose of taking profits on the downward price movement. It opens for selling.

– Market Makers: major market players (national banks, financial-investment companies), which have a significant and, in some cases, determining influence on prices.

– Technical analysis: a method of forecasting price fluctuations based on the idea of recurrent market cycles.

– Fundamental analysis: a method of forecasting price fluctuations based on the analysis of current political and economic events.

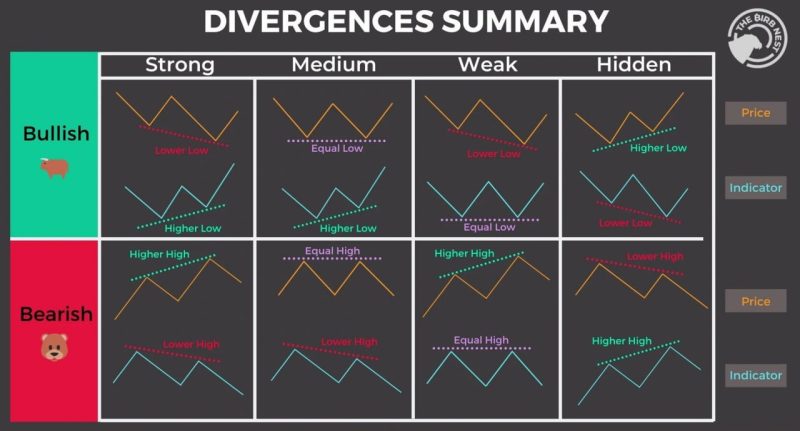

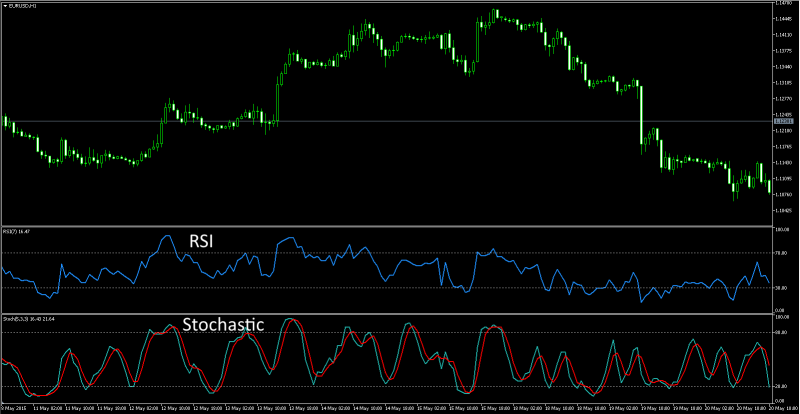

– Divergence: a signal in technical analysis that indicates the weakening of an uptrend. On a chart, it represents a divergence between the upward price movement and the downward oscillator.

– Convergence: a signal in technical analysis showing that a downtrend is weakening. On a chart, it represents a divergence between an upward price movement and an upward oscillator.

– Diversification: Allocation of funds among various assets (financial instruments) in order to reduce risks.

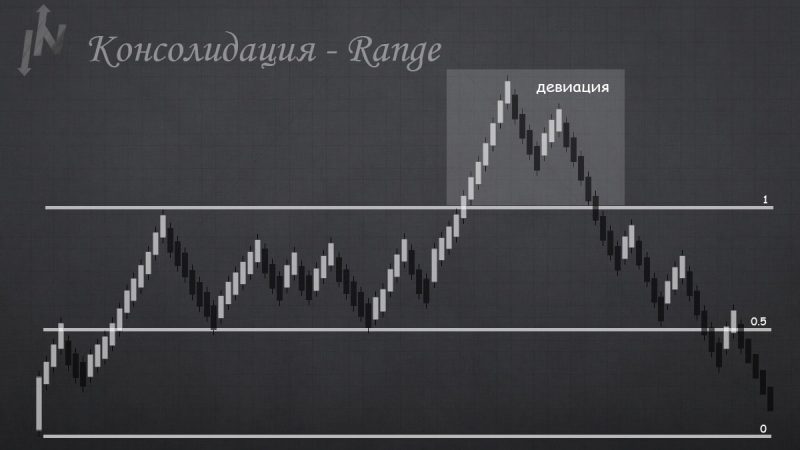

– Consolidation: a stabilization of the market expressed as a sideways movement of price within a certain range. It occurs either after a pronounced trend or in the absence of serious players on the market, or after the accumulation of their positions before a new impulse.

– Market liquidity: a market is liquid if investors are always present and ready to trade.

Abbreviations

– SL: Stop Loss

– TP : Take Profit

– B/E : Breakeven

– COVER : Closing a portion of the profit to cover expenses

– IMB : Imbalance

– LQ : Liquidity

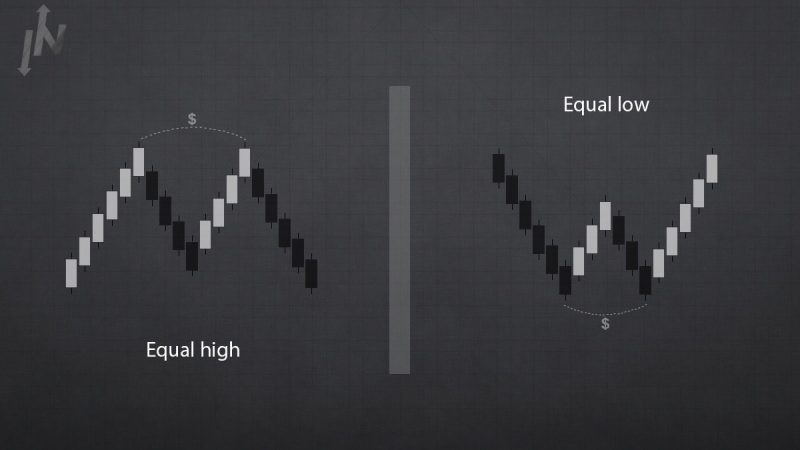

– EQL : Equal Lows

– EQH : Equal Highs

– PA : Price Action

– RR : Risk – Reward

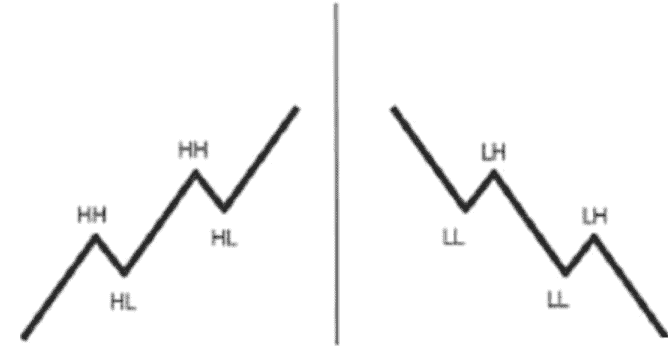

– LL : Lower low

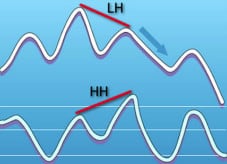

– LH : Lower High

– HH : Higher high

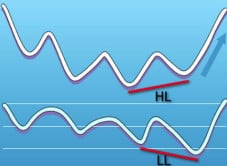

– HL : Higher Low

– AOI : Area of Interest

– POI : Point of Interest

– SMC (Smart Money Concept) Brain

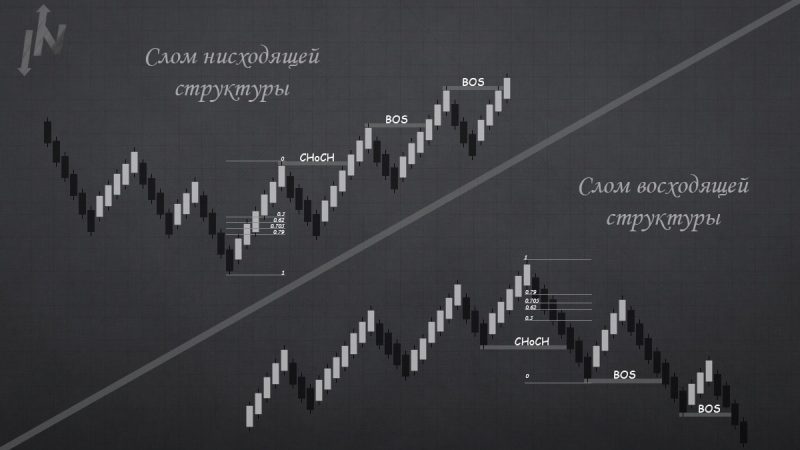

– BOS : Gap in structure

– dBOS : Double structure break

– mBOS : Slight break in structure

– SB : Structural sub-break

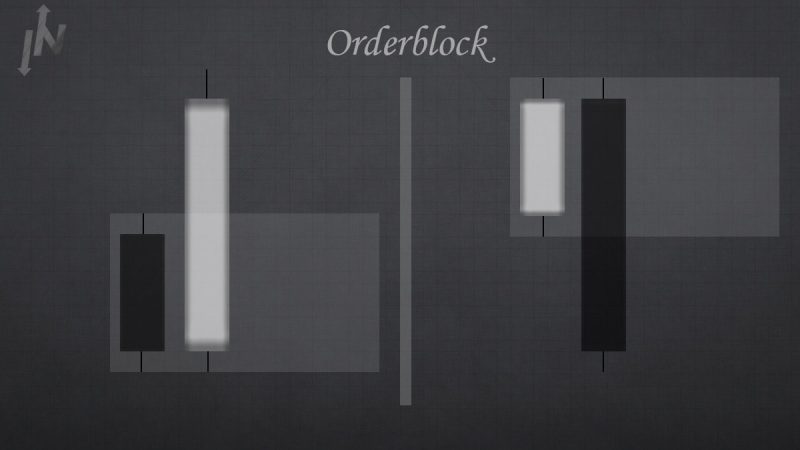

– OB : Order Block

– Choch : Change of character

Trading styles

At the very beginning of your journey, you will have to choose a certain style of trading based on your abilities, experience, free time, etc.

There is no easier or harder style, each one is unique and requires a lot of knowledge, experience and practice.

You should get into the essence of each and determine for yourself the path from which your strategies and deals will be built in the future. There are many types, we will break down the most basic and popular ones.

The first type of trading “Scalping

Scalpers are the fastest traders who react to price changes at lightning speed. Scalpers work on short timeframes from 10 seconds to 2 minutes. This is approximately the duration of their deals. The idea of scalping is to gain small or even scanty profit little by little and often, without counting on big profit.

+ and – of such trading

+ Quick experience through frequent trades.

+ High profit potential due to trading, both during the ups and downs.

+ No risk of losing money while you sleep.

+ Huge selection of tools allowing you to more accurately determine the best positions.

+ Due to small stops, you can start with a small bank.

– Fast market movements, the trader needs to be constantly attentive and focused, which is quite difficult for a long time.

– Constant observation of the market, it becomes the main job, which takes many hours a day.

– High emotional and psychological burden.

If you are able to make decisions in seconds under heavy pressure and can devote most of your time to crypto-trading, scalping is for you.

The second type of trading “Daily (medium term)

Unlike traditional stock markets, the cryptocurrency market has no opening or closing time. Cryptocurrency markets are active 24 hours a day.

Day trading in cryptocurrency takes place during the most active hours. It is a short-term trading strategy in which the trader opens and closes trading positions in intervals from 30 minutes to several hours (no overnight positions, that is, only in the period in which you are able to monitor the market). Unlike scalping, day trading allows you to have more time to close a position.

+ and – this kind of trading

+ It takes very little time per day, it’s enough to find good entry points.

+ This kind of trading can be combined with work.

+ Low psychological stress.

+ Strong movements.

– It is necessary to have a sufficiently large bank, due to wide stops.

– Due to more quiet trading, the profit can be less than when scalping.

– Due to a smaller number of trades, the experience will take longer to gain.

– The drawdown on the purse will be longer.

– The risk of holding a position while you sleep.

The third type of trading “Swing Trading”

Many traders start from the premise that cryptocurrency prices go up and down on a certain curve.

Swing trading is identifying such a pattern and using it to make a profit, that is, trading on fluctuations. With this type of trading, a position can be open for days to weeks.

For those who are new to cryptocurrency trading, it is recommended to start with swing trading because it gives much more time to determine trading positions, unlike day trading or, even more so, scalping, when you need to make decisions instantly.

The + and – of this kind of trading.

+ You’ll start to identify clearer boundaries and areas

+ Less time for market analysis

+ It’s easy to combine with work.

– You can get caught in two market trends at the same time

– You must analyze the market very well

– Success rate is lower than in medium and long term trading

– You will need patience

The fourth type of trade “Long term”

Long-term trading is the longest trading cycle, which can last from a year to several years.

Long-term trading is investing. By choosing this type of trading, the trader prioritizes not the profit from speculations but rather investment for the expected growth. As a rule, this type of trading is carried out on the spot market.

+ The advantages and disadvantages of this type of trading

+ After a clear analysis and opening a position, you will only need a couple of minutes a week or a month to check the chart.

+ You get the opportunity to diversify your portfolio (choose several assets that in your opinion will be potentially successful).

– You need a big bank for such trading, because trading is mostly done without any leverage.

– You need a good patience.

– This is not about flipping.

Approach the choice of trading wisely.

Types of Market Analysis

Any successful transaction at the exchange begins with studying a huge amount of various information. In order to take action: to enter or exit the market, or to make adjustments to your portfolio, it is necessary to understand the current market situation and predict future changes in the price of selected assets.

It does not matter whether trading is short-term or long-term, opening a position should be based on a deliberate decision. It can only be made as a result of serious analytical work. The difficulty is that determining the big picture requires a comprehensive approach – observe the dynamics of trading, study supply and demand, pay attention to consumer behavior, assess news from trusted sources, and much more.

There are several types of market analysis.

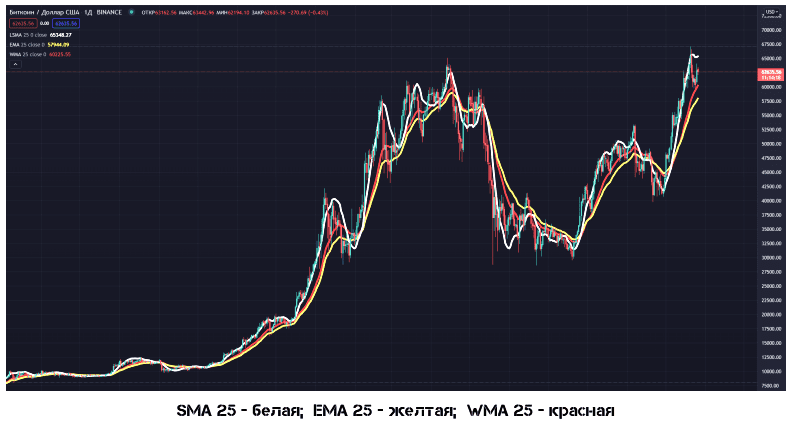

Technical Analysis

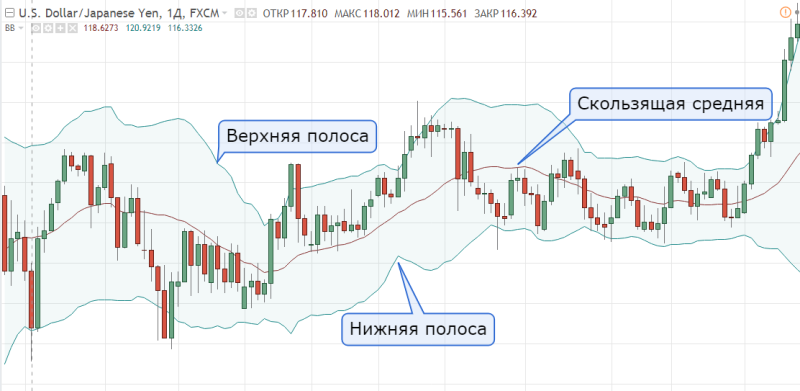

Technical analysis is based solely on data derived from charts, and fundamental factors affecting prices are not considered. Traders analyze past price behavior, which allows them to predict future movements.

Candlesticks Analysis

Candlestick analysis is one of the methods of predicting the price of a currency using its display in the form of Japanese candlesticks.

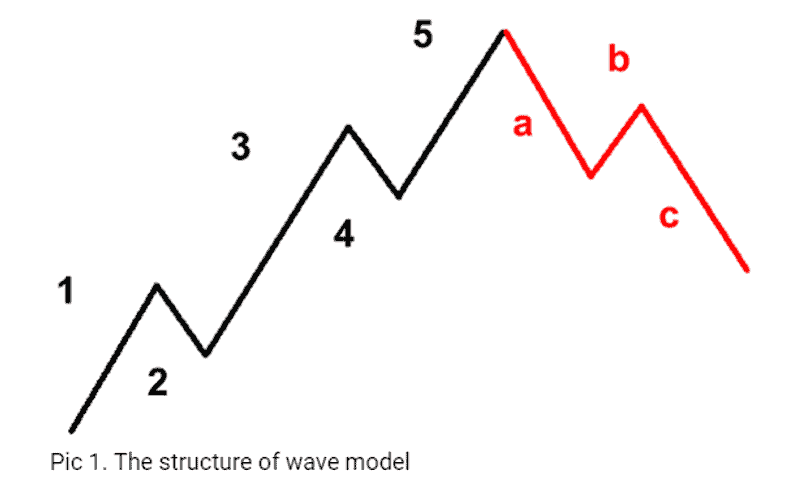

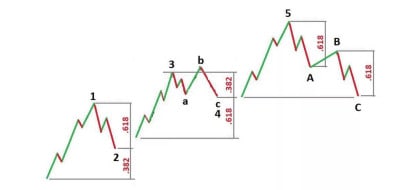

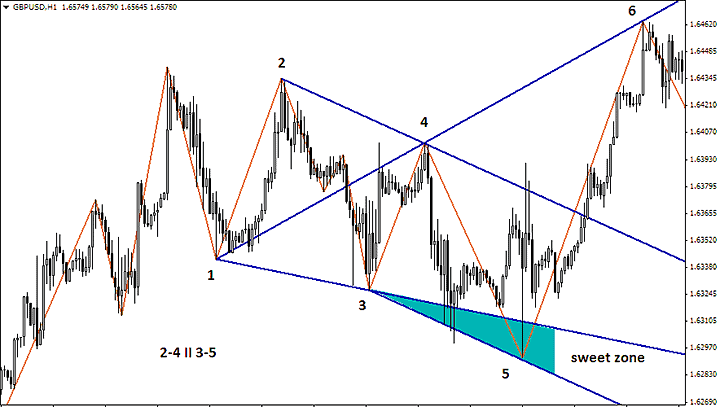

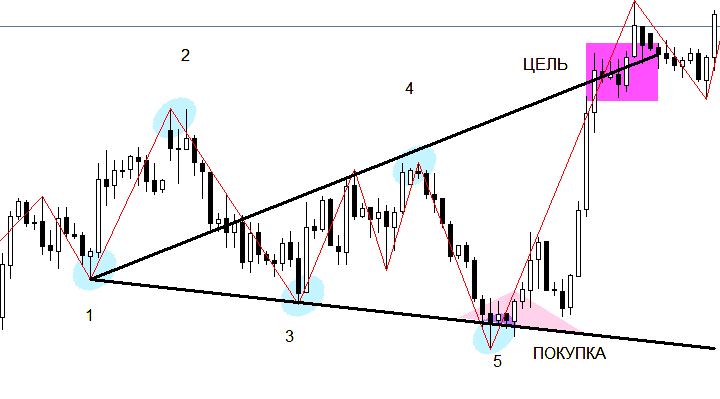

Wave Analysis

Wave analysis is based on the notion that markets follow certain patterns, called waves, which are the result of the natural rhythm of mass psychology that exists in all markets. There are several wave theories which we will come to a little later.

Fundamental Analysis

Crypto fundamental analysis involves taking a deep dive into the available information about a financial asset. For instance, you might look at its use cases, the number of people using it, or the team behind the project.

Your goal is to reach a conclusion on whether the asset is overvalued or undervalued. At that stage, you can use your insights to inform your trading positions.

Fractal analysis

A fractal is a set which has the property of self-similarity (an object which exactly or approximately coincides with a part of itself, i.e. the whole has the same shape as one or more parts).

In the market, you can observe the fractals in different timeframes, repeating or similar to the price movement that is on a larger / smaller TF

Applying fractals will allow you to memorize almost the entire history of pair quotations in a moment.

You will be able to analyze dozens of pairs, because now it will not be a problem. The theory of fractals is self-sufficient and does not require tools. By applying the properties of fractals, you can create your own trading system.

The more analysis methods you have and how to combine them, the better results you will get.

Trading Algorithm

An important part of trading is to prepare for it. Seasoned traders know, point by point, their trading day.

The algorithm gives you a clear understanding from opening a trade to closing, including your risks that are expected during the day.

You must realize that building your own algorithm will save you from unnecessary emotions and wrong trades during the day and make your trading more qualitative and productive. Each person’s algorithm is different depending on trading style, time, etc.

The main points that traders use to build an algorithm.

News studies

– As described above.

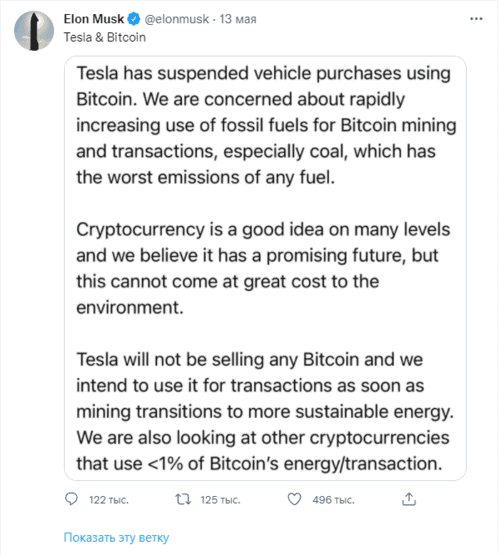

The stock and cryptocurrency market is directly dependent on certain news. This can be a change of the Fed rate, statements of large companies, updating of the blockchain protection system, etc.

Definition of Technical Analysis

– The technical analysis itself is very global and everyone is comfortable to trade based on their own proven tools. If the market at the moment is not clear to you and does not agree with your analysis, it is worth to think it over a few times before you make a decision to open a trade

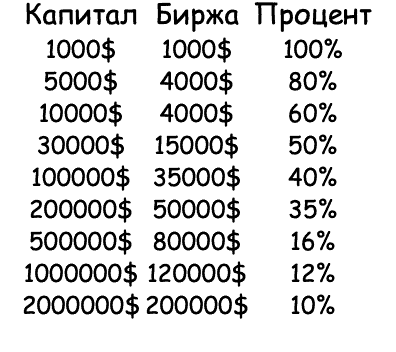

Conditions for opening a deal

– This is your risk management and money management. Depending on your decision to open a trade in the near future you need to give yourself an account of the risks. What part of the loss you are prepared and what kind of profit you expect to achieve. Accordingly, you will know your SL and TP. You also determine for yourself the size of the opening transaction. What % of your funds you are ready to give to the risk.

An important part of your constructed strategy, is discipline.

– You must strictly follow your plan and not to give in to unnecessary emotions, which will confuse you.

Accounting for your trades

– At the end of the day, you need to keep an account of your finances, your victories and defeats, to do this, traders use the “traders’ diary”, in which they record their transactions throughout the day. Later, we’ll analyze this diary separately and each of you can save it for yourselves.

Types of price charts

Price charts are plotted on the coordinate plane. The horizontal axis shows the date and time, the vertical axis shows the price of the asset corresponding to the given time period.

The time axis can have a different scale depending on the trader’s preferences. This scale is called the time period or time interval, as well as the timeframe.

Let’s consider the most common types of price chart displays.

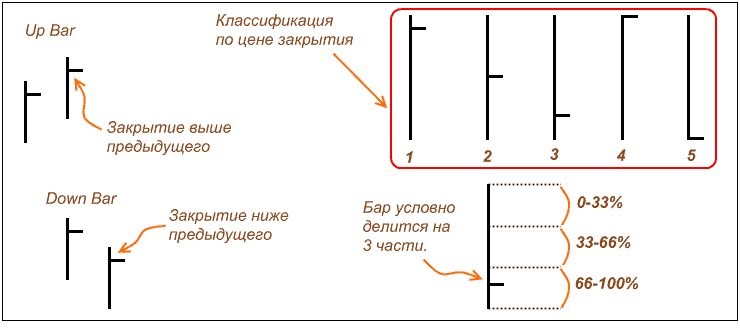

Japanese candlesticks

The Japanese candlestick chart is the most common due to its more convenient reading and visual perception. Each candlestick in the chart is equal to the time period chosen by the trader.

When constructing a candlestick, four basic price values are used: period open price (open), period close price (close), maximum period price (high), minimum period price (low).

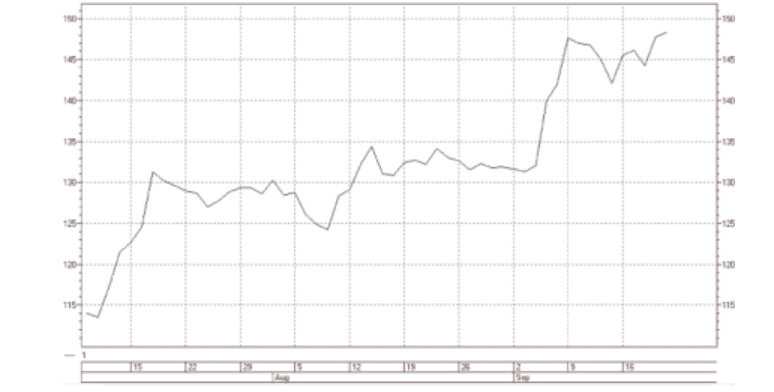

Linear Chart

Represents a broken curve, which is plotted using one of the price values discussed above (opening, closing, maximum price, or minimum price) and the estimated price values for the period.

A linear chart has a number of advantages and disadvantages.

– Advantages

– convenience when searching for patterns of technical analysis

– Absence of redundant information

– Disadvantages

– impossibility to estimate the price change within the trade period

– impossibility to see gaps (price gaps between the previous period closure and the next one opening)

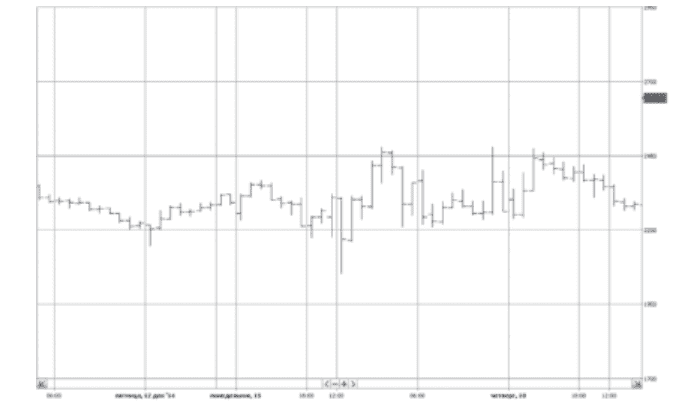

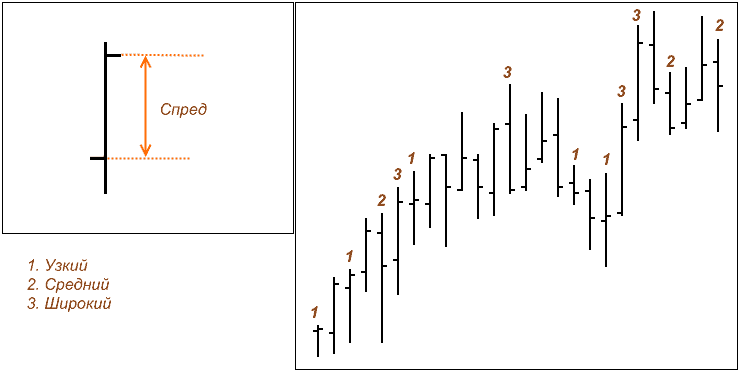

BARS

The price chart shown in the form of a bar reflects, just as in the Japanese candlestick, all the main price values: the opening price, the maximum price, the minimum price and the closing price (open, high, low, close).

The bar represents a vertical line with two risks. The upper border of the line indicates the maximum price value in the given time period. The lower border indicates the minimum price of the period. The left risk – the opening price of the period, the right one – the closing price.

If the left risk is higher than the right risk, the market in this period showed a decline. If the left risk is lower than the right one, then in this period the market was growing.

There are disadvantages and advantages when using this type of price chart.

– Advantages

– A visual identification of gaps and market trends for a period.

– Disadvantages.

– There is no clarity and it is difficult to determine the market trend for large time periods.

Price histogram

It is usually built on the closing price of the period, which is shown by the upper edge of the vertical lines. This type of chart is usually applied to various indicators or oscillators of technical analysis.

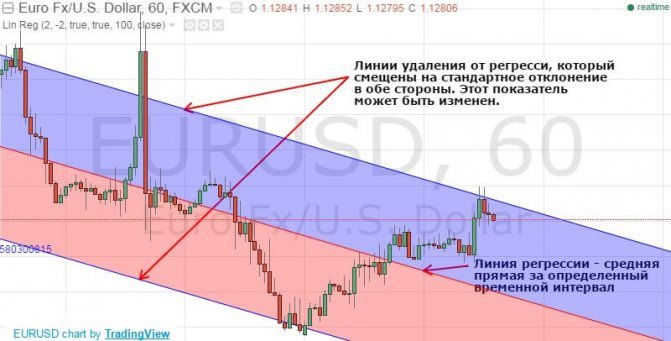

Trend types, trend lines

Trend – price movements in one direction; it may be upward or downward and flat (sideways, sideways, consolidation).

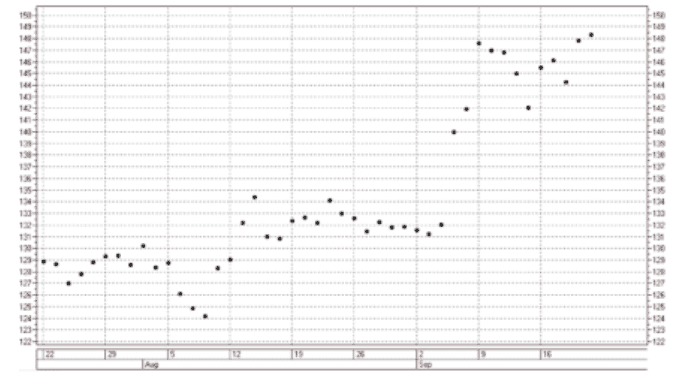

Uptrend – a sequence of higher maximums and higher minimums; it lasts as long as each new minimum and maximum of price is higher than the previous values.

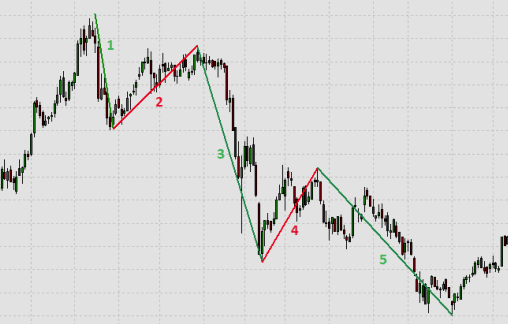

Downward trend is a sequence of lower highs and lower lows.

Flat – a single-level sequence of highs and lows.

As you understand, for a trader understanding where the price will go and where it is better to enter/exit a position is the most important moments. Note that in an uptrend both minimums and maximums move up.

It is common, but not necessary, for the support line to be drawn through the rising lows. Likewise, in a downtrend, both lows and highs move downward. This is a common, but not required, rule for a resistance line, which will be drawn through the descending highs.

Highs and Lows

HH (higher high) – highs (up trend)

HL (higher low) – upper minimums (upward trend)

LH (lower high) – lower maximums (falling trend)

LL (lower low) – lower minimums (falling trend)

A trend line is a straight line that connects two important minimum or maximum price points on a chart. Any number of secondary and minor trends can occur within the main trend. A trend line is a support or resistance level where price fluctuates within a corridor.

For an uptrend within the period in question, draw a line from the lowest low to the highest secondary low preceding the highest high so that the line does not cross prices between the two points of lows.

Extend the line upward beyond the point of the highest high. It is possible that the line will pass through prices past the point of the highest high. In fact, this is one indication of a possible trend change.

For a downtrend within the period in question, draw a line from the highest high to the lowest secondary high preceding the lowest low so that the line does not cross prices between those two highs. Extend the line down past the lowest high.

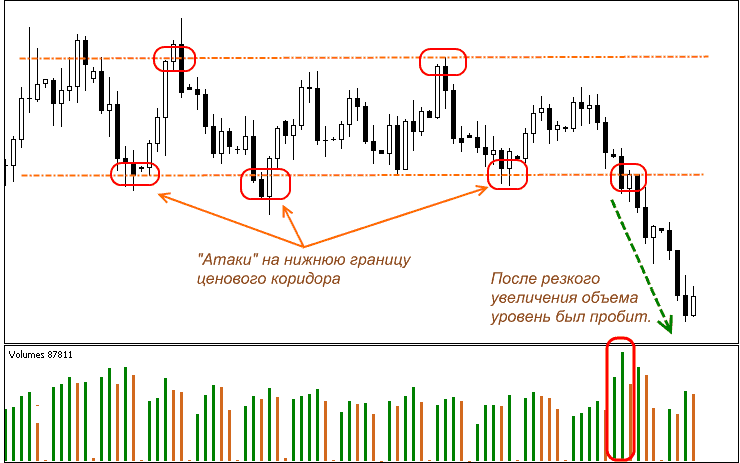

Flat in trading

Flat is a price movement in a horizontal price corridor (no trend)

The main reasons for the price to enter the flat:

– The period preceding the release of important economic news. At this time, the whole market is in anticipation. Players are getting ready to stand on one of the bulls or bears sides, depending on what the expected news will be.

– Time of day and day of the week. For example, on weekends and holidays the trade is quite sluggish and many financial instruments are in flat condition.

– Insufficient liquidity level. If there is no supply and demand for the traded financial instrument, there is nothing to change its price for. Such instruments are of little interest for traders.

The price corridor formed by the price movement in the flat may be wide or narrow. A wide price corridor is formed when the price is between two strong resistance and support levels. The entry of the price into a narrow flat tells traders that at this time there is no clearly defined prevailing force in the form of bulls or bears. In this case, in contrast to the trend movement, all extremums are approximately at the same level (local resistance or support). Each following maximum and minimum of the price approximately corresponds to their previous values.

Flat may represent itself:

– An intermediate in the process of changing the direction of an existing trend

– Correction of an existing trend movement

Trends by time

A short-term trend

This trend can fit into a single trading session and can be found on the charts with timeframes M5 – H1. Intraday (short-term) traders and scalpers work within this trend.

The medium-term trend

Its duration is measured in the interval from one week to several months. It can be found on the H1 to H4 charts. This trend is the main domain of medium-term traders.

Long-term trend

It may last from several months to several years. Long-term traders and investors work with this trend on timeframes from D1 and above. Any long-term trend consists of a set of medium-term trends, which, in turn, is the result of a set of short-term trends.

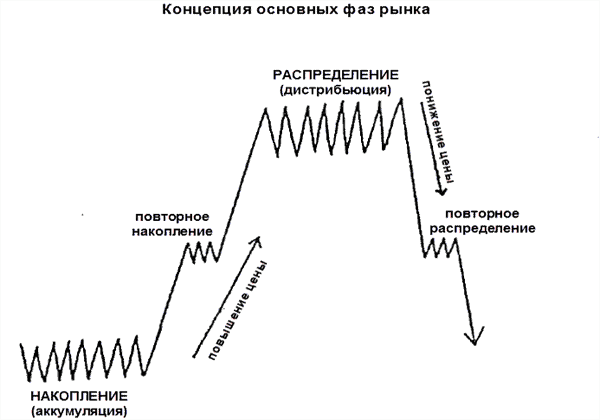

Trend phases

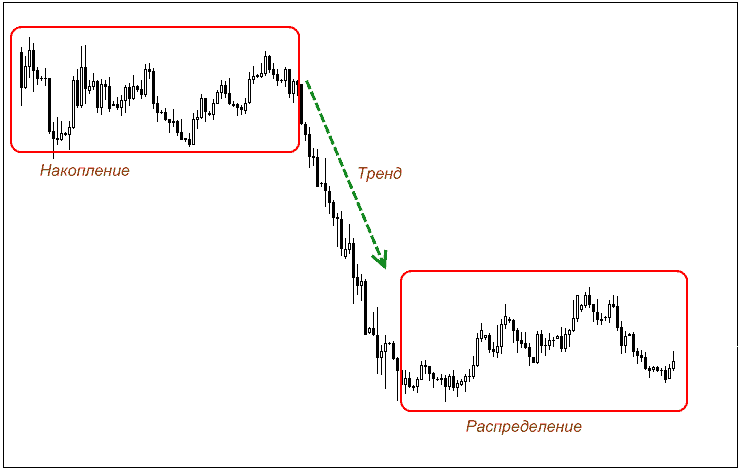

Accumulation – first phase

What is meant here is position accumulation when traders place orders, including pending ones, and decide whether they are going to buy or sell. That is, everyone sort of chooses a side in the confrontation between buyers and sellers. It causes the temporary parity of forces and the market is in the flat position; the main trend is not present yet. When, eventually, the forces of one of the parties are outweighed, the trend begins. Thus, the second phase begins.

Stabilization is the second phase.

Means that the market has decided on the direction and the trend has stabilized. The forces of one of the parties have won and all traders are actively following the formed trend. The best and safest way to trade is to enter the market at the beginning of the stabilization phase so you can move with the trend and not risk trying to guess the direction during the accumulation phase. At the same time, a late entry into stabilization is a bad idea, because at any time the market can move into the third phase, which is called distribution.

Allocation – the third phase

The time of fixation or distribution of profits and the end of the current trend. Competent traders have received their profit and decide to fix it – to close positions. It causes the transition of the trend into a flat, or serves as the beginning of an opposite trend. That’s why it’s a bad idea to enter the market at the end of the stabilization phase, let alone the distribution phase. So the distribution phase – a time to get out of the market for those who have worked well in a trend, whether upward or downward, but not the time to open new positions.

Conclusion:

1. The safest time to open a position is the beginning of the stabilization phase.

2. Unlucky – the distribution phase.

3. Risky, but potentially the most profitable time – early entrance on accumulation phase.

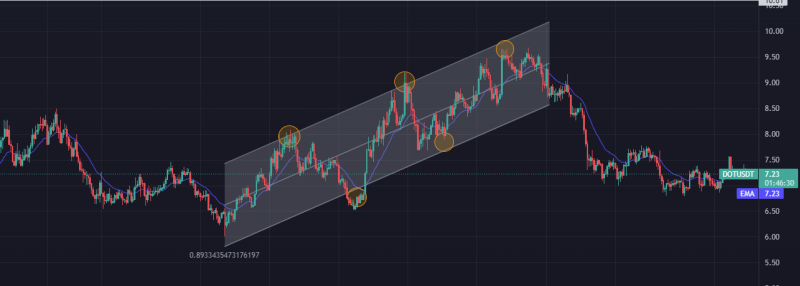

Trend channel

A trend channel is two lines uniting significant extrema in the trend direction (highs and lows). Important note: The main trend line is only a part of the channel. Some sources mistakenly call it a channel. In reality, a channel always includes two lines.

Types:

– Upward – pointing upward.

– Downward – directed downward.

– Horizontal – does not have a pronounced direction.

Rising trend in the market

Horizontal trend in the market

The downtrend in the market

How to build a channel correctly?

It is customary to build trend channels manually using lines. Special technical tools for this are available in every popular platform. It is worth highlighting a few key rules of construction:

1. The line (channel boundary) is drawn only along the extremes, i.e. tops or bottoms of the movement, as shown in the examples.

2. The price should not excessively go beyond the line, while a slight slippage of the quotations is acceptable (ideally, it should not exist).

It is necessary at least two extrema for drawing the channel, as well as for drawing any line, the third one is confirmatory.

4. The channel borders serve as support and resistance zones for the price.

5. A secondary indicator of support and resistance is a line that can be drawn in the middle of the channel between the borders (dashed line in the examples).

By following the above rules, a proper trend channel can be constructed.

However, each trader-analyst draws the lines differently, so channels are essentially a subjective method. It is performed visually and does not lend itself to strict formalization.

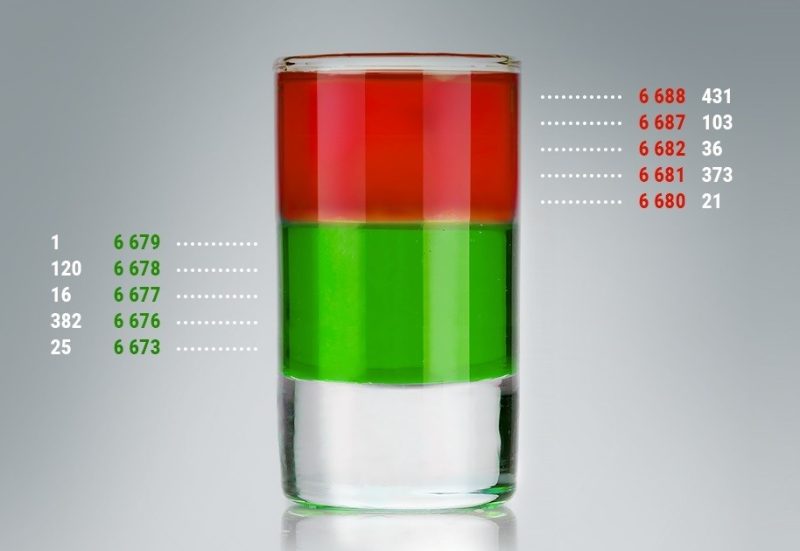

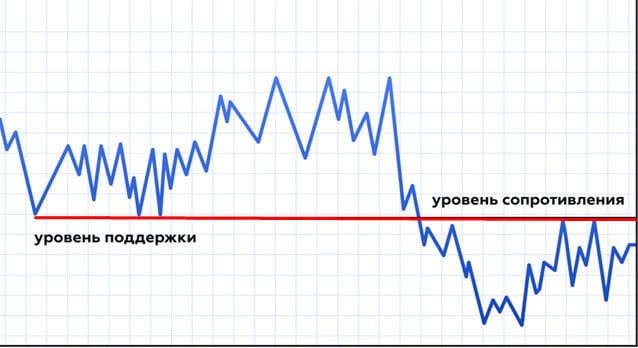

Support and resistance levels

When observing the chart, you can see certain patterns – for example, when the price reaches an invisible level, it bounces off of it. A level is a horizontal line of a specific price value, but more often it is an area. When the price reaches this price (area), the chart can change direction.

A support level is a price level from which the price reverses when approaching from above downward. This level can be called a floor for the price, i.e. does not allow it to go lower. Next, let’s look at support levels on a real chart.

A resistance level is a price level from which price reverses on the way up. This level can be called a ceiling for the price, not allowing it to go higher.

Before we go any further, let’s get a general understanding of why these levels work?

Why do support and resistance levels work?

As you may have guessed, there are buyers and sellers in the market. Buyers in turn buy an asset and sellers respectively sell it. But there are two ways to buy and sell an asset:

1. On the market.

This means that you buy assets from takers (who are they, below), in turn performing their orders. The more market-takers, the more profitable your purchase price will be (as close to the market price as possible).

2. Through a limit order

This is exactly the takers who put their limit orders to buy or sell, thereby forming an exchange glass of orders. These orders, in turn, are executed by market players.

Let me give you an example of the stock market glass and show who is who:

P.s – This is not a stock market glass, but a clear sketch of it.

As we see, at the top there are limit sell orders, and at the bottom there are limit buy orders. And who do you think executes them? – That’s right, the broker executes these orders. If he buys on the market, he executes limit sell orders, thereby pushing the price up.

If someone is selling at the market, he executes limit buy orders, thereby pushing the price down.

So, the levels are in fact a cluster of limit orders, whether to buy or to sell.

That is, the level of support on the stock looks like just a large number of limit buy orders. Usually, this level is a major player, which is not profitable to buy on the market.

And the support levels are just an accumulation of limit orders to sell. This level is usually a major player, who is not profitable to sell on the market. I hope I explained it clearly, let’s move on:

Mirror level

Mirror level is a support or resistance level (depending on the current price on the chart), confirmed by testing from below as well as from above, which increases the significance of the level.

This is also called a level retest. Let’s understand why a retest to a level occurs:

As you know, those who go long place their Stop Losses to sell. If they go long from the level, they place their limit sell orders behind the level. When the level is broken through downwards or upwards (depends on context), those who are entering long positions are in the red. That’s why they wait for the price to go back to the level of position opening, in this case, the support level:

When the price reaches a level (the opening price of a position), traders begin to close at breakeven, thereby selling the asset and pushing the price down.

It is important that you understand what is behind the levels, and not just trade on some figures or lines.

What is Dow’s theory?

Dow Theory is the basis for technical analysis based on the writings of Charles Dow regarding his theory of market behavior. Dow was the founder and editor of the Wall Street Journal and co-founder of Dow Jones & Company. As part of the company, he helped create the first stock index known as the Dow Jones Transport Index (DJT), followed by the Dow Jones Industrial Average (DJIA).

Dow never described his ideas as a specific theory, nor did he call them one. Nevertheless, many learned about it through his editorial in the Wall Street Journal. After Dow’s death, other editors such as William Hamilton refined these ideas and used his articles to piece together what is now known as Dow’s theory.

The following principles are not infallible and are open to different interpretations.

Basic principles of Dow theory

The market takes into account all events

This principle is closely connected with the so-called efficient market hypothesis (EMH). Dow thought that if there is a discount in the market, it means that all the available information is already reflected in the prices.

For example, in the expectation that a company will report a positive yield increase, the market will reflect the news before it happens. Demand for their stock will increase before the report is published, and then the price may not change much after the expected report is released.

Also, Dow was able to notice that in some cases, a company may even see their stock price decrease after the good news is published because the news was not as good as the community expected it to be.

This principle is still considered true for many traders and investors, and especially for those who regularly use technical analysis. However, those who prefer fundamental analysis disagree with this statement and believe that market values do not reflect the real, intrinsic value of stocks.

Market Trends

Some people say that Dow’s work gave rise to the concept of the market trend, which is now considered the most important element of the financial world. Dow’s theory states that there are three basic types of trends:

Primary or Primary Trend – Duration of action, ranging from a few months to decades, also this trend is the main movement of the market.

Secondary trend – Duration of action from a few weeks to a few months.

Minor or minor trend – The action of this trend may be limited to less than one week or ten days. In some cases, the duration reaches a few hours or one day.

By studying different trends, investors have the opportunity to find the most appropriate moment to enter. While the primary trend is key when considering an entry, secondary and minor trends contradict the primary trend.

For example, if you believe that an asset has a positive primary trend, but it periodically experiences a negative secondary trend, you are given the opportunity to buy it cheaper, and try to sell it as soon as the value increases.

In such a case, the only problem is to correctly identify the type of trend, and that is the essence of in-depth technical analysis. Today, investors and traders use a wide range of tools to identify and understand the current trend.

The three basic phases of each trend

Dow established that long-term primary trends include three phases. For example, in a bull market, the phases would be as follows:

Accumulation (accumulation) – After the preceding bearish trend, asset values are still low as the sentiment of the masses is predominantly negative. Experienced traders and market makers begin to accumulate assets during this period before a significant price increase occurs.

Public Involvement – The market, at this point in time, realizes the opportunity that experienced traders have already seen, and the community becomes more and more active buyers. At this point, prices are skyrocketing upward.

Distribution – While the bulk of the participants continue to speculate, the trend is coming to an end. Market makers are beginning to allocate their assets, i.e., sell to those who do not yet realize that the trend is about to reverse.

In a bear market, the phases will be arranged in reverse order. The trend will begin with the allocation of its assets from those participants who have recognized the signs of a downtrend, and will be followed by community participation thereafter. In the third phase, the community will continue to speculate desperately that the market will continue its decline, but investors who notice the coming shift will begin to accumulate assets again.

There is no guarantee that this principle works perfectly, but thousands of traders and investors consider these phases before making appropriate financial decisions. It should be noted that Wyckoff’s method also relies on the idea of accumulation and distribution, which can also be seen in the somewhat similar concept of market cycles (transition from one phase to another).

Cross-index correlation

According to Dow, the underlying trend seen on the chart of one of the indices should corroborate the trend of the other market index. At the time, this was mostly true of the Dow Jones Transportation and Industrial index.

The transportation market at the time (mostly railroads) was closely tied to industry. This implied itself: in order to produce more goods, it was first necessary to increase railroad activity in order to supply the necessary raw materials.

Thus there was a clear relationship between the manufacturing industry and the transport market. If one market was in a normal, healthy state, so was likely the other. However, the principle of cross-index correlation is not as good today because many commodities are digitized and do not need physical delivery.

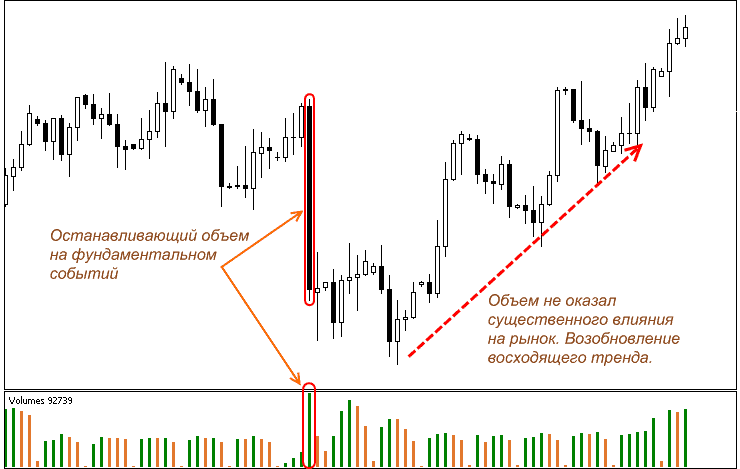

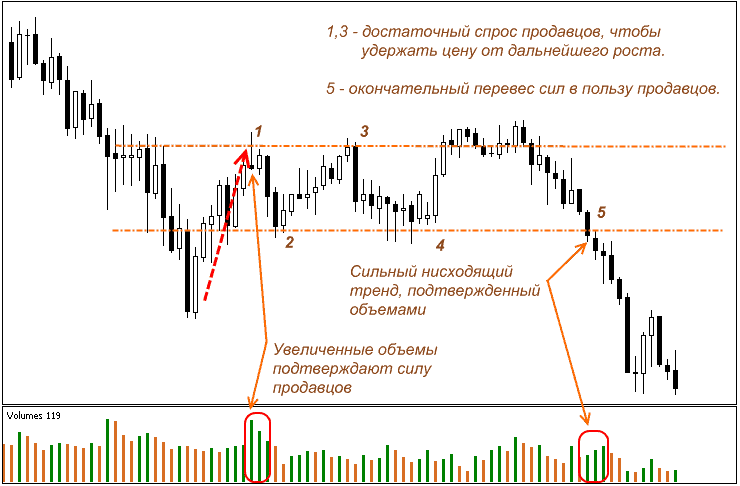

The value of volumes

Like many other investors, Dow believed that trading volume was the most important secondary indicator because a strong trend should always be accompanied by high trading volume. The higher the volume, the more likely it is that the price movement reflects the true market trend. Otherwise, on small volumes, the trend is poorly manifested, as well as the growth in the price of the asset, which in turn does not reflect the real, healthy action of the trend.

Trend action before confirming a reversal

From Dow’s perspective, if the market is in a trend, it will continue to move. For example, if a company’s stock price starts reacting positively after good news is released, they will continue to rise until a trend reversal is properly evidenced.

For this reason, Dow recommended treating all such changes with caution until a new primary trend is confirmed. Naturally, distinguishing a secondary trend from the beginning of a new primary trend is quite difficult, and traders often encounter misleading reversals that end up being a secondary trend.

Conclusion

Some critics argue that Dow theory is outdated, especially with respect to the principle of cross-index correlation (which states that an index or its average must support or relatively match another index). Nevertheless, most investors believe that Dow theory is still relevant, not only for determining the phases of the most favorable financial opportunities, but also because the concept of market trends is a product of his work.

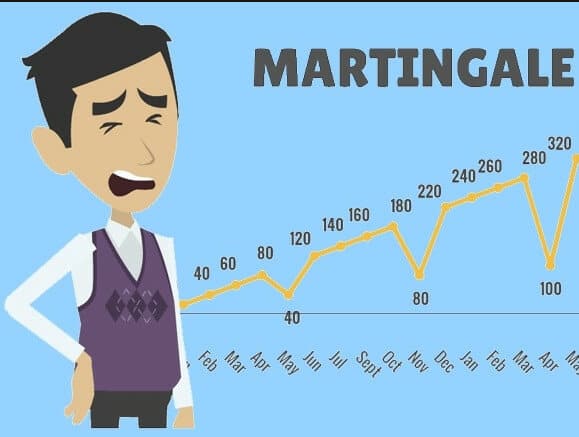

Martingale Strategy

One of the strategies in the world of trading is the Martingale method, the essence of which boils down to a series of deals calculated in accordance with the mathematical theory of probability. A little history This phenomenon came from gambling. It was first mentioned in the mid-18th century.

At that time the Martingale method was successfully applied during the roulette game. It forced the casino owners to change the rules and limit the maximum bet. According to some historical information Martingale was called a clamp, which specifically put on the horse, so that it is not too much tilted head, as a restriction, you catch the analogy?

The word is also found in the terminology of sailors, where it means one of the reinforcing pieces of rigging of a ship. What is Martingale in trading? The parallels with the market are obvious – at the heart of the phenomenon lies the principle of limiting and applying the increasing force after each negative result. Literally, the term means “playing absurdly.

Judging by the meaning, it is clear that this method belongs to high-risk and high-return trading strategies. That is why it is most loved by beginners who come to the exchange market with small deposits. Naturally, their first goal is to make the deposit faster. Experienced traders are wary of this method, resorting to it seldom, because the risk of a deep drawdown or complete loss of the deposit is too high. Nevertheless, there are reasons for using the Martingale method in trading. When the market turns against Bac, all you have to do is just wait.

Sooner or later it should go in your direction, because nobody cancelled the theory of probability based on mathematical analysis. But in order to wait for a favorable trend, you must have not only patience, but also a sufficient amount of money. The deeper the drawdown becomes, the more trades must be opened in the direction of the open position. Yes, exactly the open position – the position that is in a decent loss.

It seems to Co that the trader is trying to reverse the price movement, spends a lot of effort and money, which are almost used up. Then, when the market finally turns in its direction, the trader has a decent amount of open positions allowing him to compensate all of the losses in one go and gain a substantial profit. This is the Martingale method.

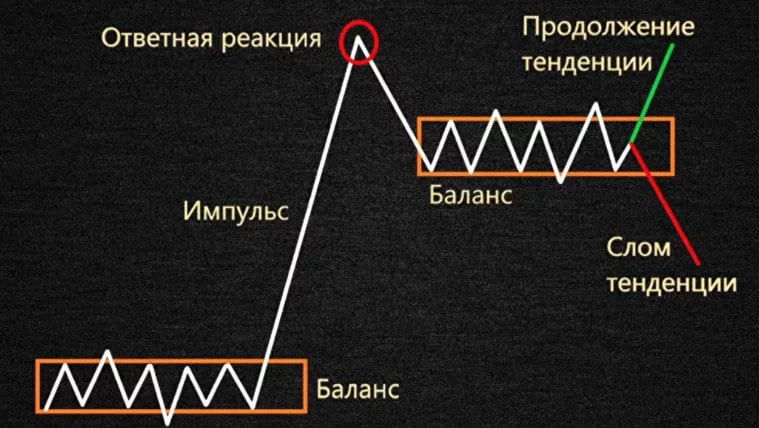

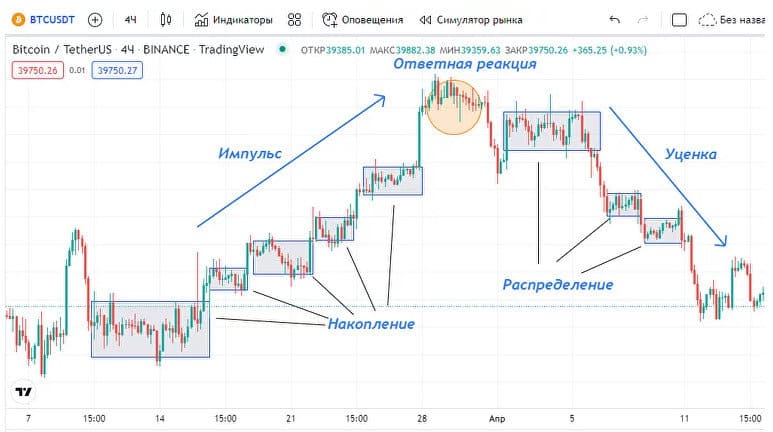

What is the Wyckoff Method?

Wyckoff’s method is designed to analyze the market based on supply and demand. The creator of the theory distinguished the stages preceding significant price changes: accumulation (after which there is a sharp rise in price) and distribution (after which there is a sharp decline).

According to Wyckoff’s model of market behavior includes four cycles:

1. Accumulation or accumulation.

2. momentum – upward trend movement. 3.

3. Distribution.

4. Appreciation – downward movement.

Wyckoff’s method has a direct impact on modern technical analysis and is applicable to stock and cryptocurrency exchanges to analyze stocks, cryptocurrencies, futures, and other instruments.

The Three Weikoff Laws

The Wyckoff method of trading involves three rules: the law of supply and demand, the law of cause and effect, and the law of effort and outcome. Let’s take a closer look at each rule.

The law of supply and demand. An increase in the value of assets is observed when demand exceeds supply. A shortage of assets causes prices to rise – buyers are willing to pay more. The value of assets decreases when demand decreases relative to supply. The market must raise funds to buy back the resulting surplus. When the demand equals the supply, the price is almost unchanged. Volatility in the market is reduced to a minimum. Comparing price movement to volume helps you understand the market better.

Causality. The differences between supply and demand are legitimate. The author of the theory defined a period of accumulation (cause), to which corresponds an upward trend (consequence). Conversely, distribution (cause) leads to a downward trend (consequence). On the basis of accumulation and distribution Wyckoff suggested a technique for determining trading targets. It has been observed that powerful impulse movements are characteristic when an asset has spent a lot of time in the accumulation or distribution zone.

The relationship of effort and results. Results will occur when effort is applied to achieve a goal. If the increased price corresponds to high volume, the trend will continue upward. But, if the increased price corresponds to low volume, the trend will change direction downward.

The “composite person” heuristic

According to Wyckoff’s method, the market should be analyzed from the point of view of large players: market makers, institutional investors, etc. The author suggested to combine such participants into a heuristic device “composite man”. All price fluctuations are considered as a result of actions of one person. The market behavior of the “composite person” is opposite to the actions of most retail investors or traders. However, this behavior is predictable and can be used in trading by retail market participants. Let’s discuss the four cycles of the Wyckoff market model in detail.

Accumulation

“The composite person accumulates assets. A trading range is established. Price moves sideways. The hunt for stop-losses of retail traders is traced: on low volumes support is broken, stops are triggered and small players leave the market. The accumulation occurs gradually until the moment of an impulse.

Impulse .

Over time, the “compounder” increases the number of assets and begins to move the price up out of the trading range. The number of investors increases. Demand increases. Volumes increase. The trend rises sharply to new highs and moves into the next cycle.

Distribution

“The Composite Man” allocates acquired assets by selling profitable positions to participants who entered the market in the last stage. The cycle is characterized by a sideways price movement with increasing volumes. There is an absorption of demand until it is completely exhausted. Then the “composite person” passes to sales. The price breaks through the distribution zone and goes down. Retail traders and investors close positions on stops, accelerating the downward trend.

Markdown

Supply exceeds demand. “Compound Man” pushes the price down until a certain point (distribution), of which there may be several. Once the downtrend is complete, the market moves back into an accumulation cycle. On the BTCUSDT crypto-asset chart, we see all of Wyckoff’s cycles: accumulation, momentum, distribution and markdown. There can be several accumulation and distribution phases.

The Wyckoff method helps traders make logical and informed decisions because it presents specific rules and strategies. The author describes the logic and psychology of the market by which purchases and sales occur. The method is combined with cluster analysis and many other types of analysis.

Japanese candles

Japanese candlesticks are the most informative part of the market chart, they show the price maximums and minimums within the selected timeframe, and also show the market mood

Each candlestick consists of a Body and a Shadow.

The body is the distance between the open and close prices. If the close price is higher than the open price at a certain time interval, the body is green, and if it is the opposite, it is red. There are also candlesticks of uncertainty (doji), about them we’ll see later.

The shadows are the highs and lows (lows and highs) of the prices for the corresponding period.

Candlestick analysis

Candlestick analysis is a basic method of technical analysis; studying this method is important because it allows us to evaluate the market’s emotional state and price movements on the chart.

Candlesticks allow traders to understand who currently rules the market bears or bulls.

Based on combinations of candlesticks, it is possible to determine whether the current trend will continue or reverse.

Based on the candlesticks, it is possible to accurately predict the direction of the price, to determine the SL and TP.

Candlesticks clearly show at what moment it is better to close the current position, leaving the market.

Candlestick patterns (Patterns)

Candlestick models are not necessary to memorize, they are quite simple to understand, the main thing is to understand their principles and analysis

There are three indicators

1. Length and position of the body

2. Shadow length

3. Ratio of body to shadow

The length of the body determines the difference between the opening and closing of a candlestick and shows who is stronger at that moment, the buyers or the sellers.

An extended body, resulting in a surge in the value of the asset, indicates a rapid increase in interest from buyers, and also indicates that the price will change. A further lengthening of the candle indicates an acceleration in the value of the asset by the trend. When the number of buyers and sellers is more or less equal, the candle will naturally shorten.

If you see a series of candles with approximately equal bodies, then the dominant trend is stable. Long bearish candles can quickly change to long bullish candles, and vice versa. This is called a trend reversal and the emergence of an opposite trend.

The shadows show the interval of price and its changes. A long shadow almost always indicates uncertainty in an asset’s value because it appears at a time of strong competition between buyers and sellers. A short shadow, on the contrary, indicates a stable situation. If the trend is stable, the candlestick body usually has a longer shadow.

Simple candlestick patterns

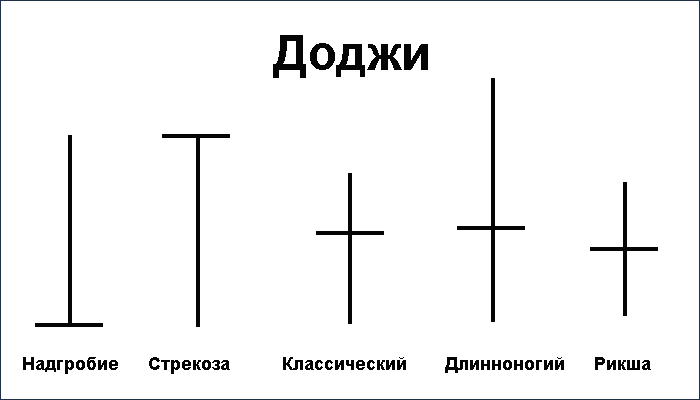

Doji

A doji is a candlestick with no body; i.e., the opening price is equal to the closing price. The longer the shadow, the stronger the pattern is considered. During a sideways trend, doji’s show neutrality in the market. But during an uptrend, doji can mean a market reversal.

Doji themselves carry little information, so it is worth taking into account the previous candlesticks in your analysis

Several complete bullish candlesticks with long bodies near the doji points out that the buyers are getting weaker and it is unlikely that further growth will continue. Exactly the same works in the opposite case.

Wolf

The wolf is characterized by a small body and long shadows on both sides, whereby the color of the body does not matter. The small body of the candlestick indicates that the price did not change much from the opening or closing, but it was strongly “walking” up and down.

This pattern indicates a halt in the movement and indicates indecisiveness on the part of buyers and sellers. But it has significance when there are two or more volleys on the chart. Then it is a strong signal to the end of the trend and its reversal

Tombstone

A tombstone is a candlestick that has no shadow (see picture above), that is, the minimum price for the period is equal to the opening and closing price.

This pattern “buries” the current trend – hence its name. The appearance of a tombstone at the top of an uptrend is a signal to sell (if confirmed by a bearish candle).

The Hanged Man and the Tombstone

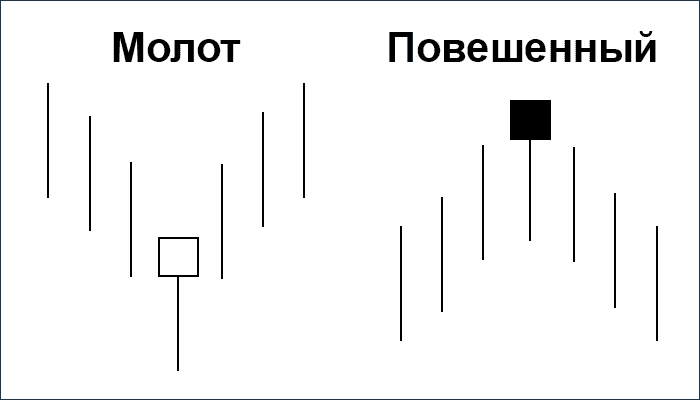

These candlestick patterns represent a candlestick without an upper shadow, with a small body and a lower shadow twice as big as the body. The color of the candlestick body does not matter.

The difference between the hammer and the hanged is that the hammer appears after prices fall and the hanged appears after prices rise. Both figures warn about the exhaustion of the current trend and its soon change.

When after the uptrend the “hung” pattern appears on the chart, it is a signal that the growth of the market may be close to its end. And this signal is the stronger, the shorter the upper shadow and the smaller the candlestick body. In addition, the signal for fall is stronger if after the “hanging” pattern appears tombstone.

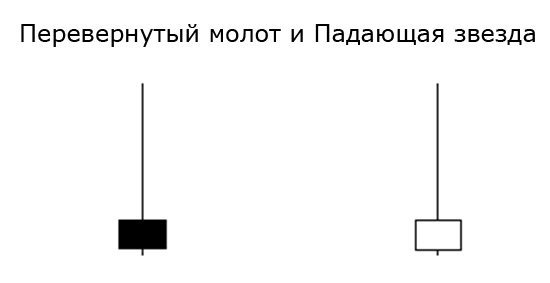

Shooting star and inverted hammer

Shooting star and inverted hammer represent a candle without a lower shadow, with a small body and an upper shadow twice as big as the body. The color of the candlestick can be any color. Both models warn of a possible trend reversal.

The difference between a shooting star and an inverted hammer is that the shooting star appears in an uptrend and the inverted hammer in a downtrend. As you can see, the shooting star represents an unsuccessful attempt of the bulls to accelerate the price after the opening and gives a bearish signal. An inverted hammer, on the other hand, reflects bearish weakness and sends a bullish signal.

Complex candlestick patterns

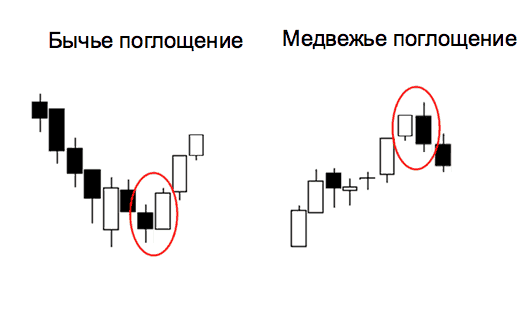

Absorption pattern

Signals a strong reversal and is formed with two candles. The second bullish candle completely engulfs the first bearish candle. It means that the sellers lost their initiative after the recent downtrend and the bulls are now in full control.

The inside bar

is the opposite of the absorption pattern and represents a small candle that is completely in the range of the previous one.

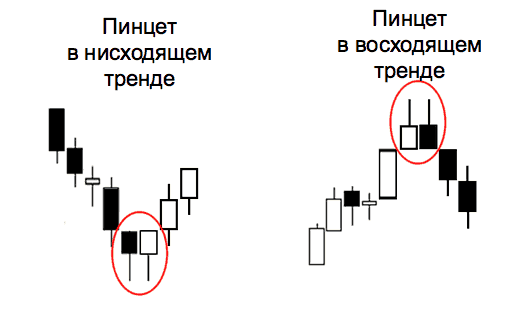

Tweezers

The pincer pattern usually occurs after a prolonged uptrend or downtrend and indicates an imminent reversal.

A veil of dark clouds and a gap in the clouds

A veil of dark clouds is a reversal pattern that occurs after an uptrend when the opening price of a bearish candle is higher than the maximum of the previous bullish candle.

The cloud gap pattern occurs at the end of a downtrend.

Three Soldiers and Three Crows

The three soldier pattern occurs when three bullish candles follow a downtrend, signaling a reversal. The three crows pattern is the opposite of the three soldiers. It is formed when three bearish candles follow an uptrend, indicating that the trend is likely to reverse.

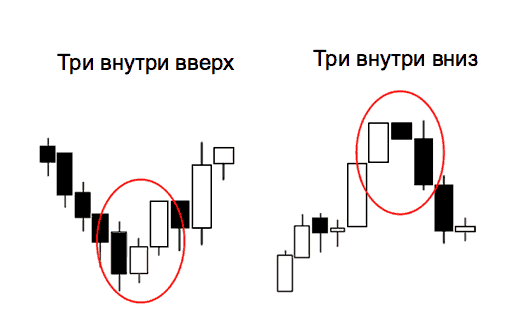

Three inside up and three inside down

Three inside up is a trend reversal candlestick pattern that shows that the downtrend may have ended and a new uptrend is beginning. Opposite for three inside down.

There are many other different candlestick patterns, but you should not memorize them all, they should just be understood.

Patterns of trend continuation

If one of the trend continuation figures appears on the chart in front of us, it means that there is a normal correction (pullback). After its completion there is an opportunity to profitably enter the market at the existing rate.

The complexities of simple analysis

At first glance, everything seems very simple. It seems to be enough for a trader to memorize what the patterns look like, then carefully follow the charts to buy or sell as soon as these patterns (also called technical analysis patterns) appear, and to steadily increase his capital.

Isn’t that too easy? If the analysis were limited to just knowing what a chart looks like, it is unlikely that 19 out of 20 traders would lose their deposits.

The question is: what position should a trader open, short or long if he sees the reversal pattern on M15, the continuation of the trend on H1 and the triangle on D1? And how long will it take the trader to find the right answer, then – the confirmation points, the points of opening and closing deals, setting a stop? The usual trader has to deal with such situations all the time.

It is necessary to synthesize figures of continuation and trend reversal with other instruments of technical analysis:

– Elliott waves (a trend reversal figure is the end of 5th wave, a trend continuation figure is one of correction waves, etc.).

– inclined channels

– resistance and support levels

– currency pairs movement

– Fibonacci levels etc.

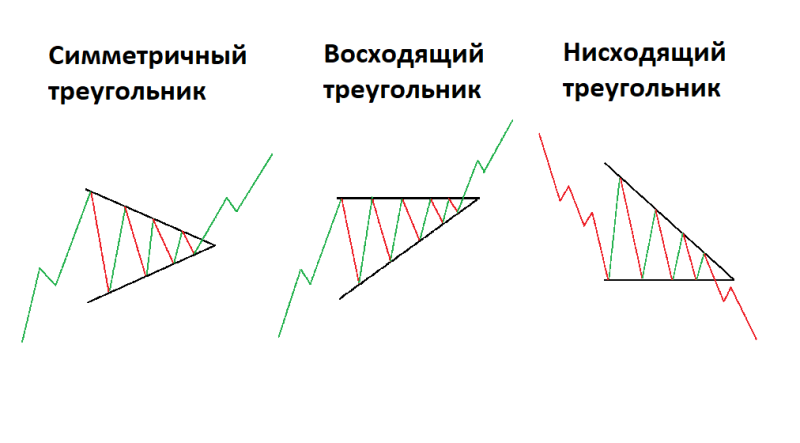

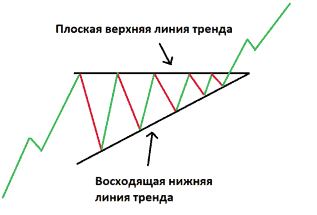

Triangles: 3 Triangular Patterns

Among triangle patterns, there are three main types that often show up in the market. It is important to clearly recognize each type of pattern:

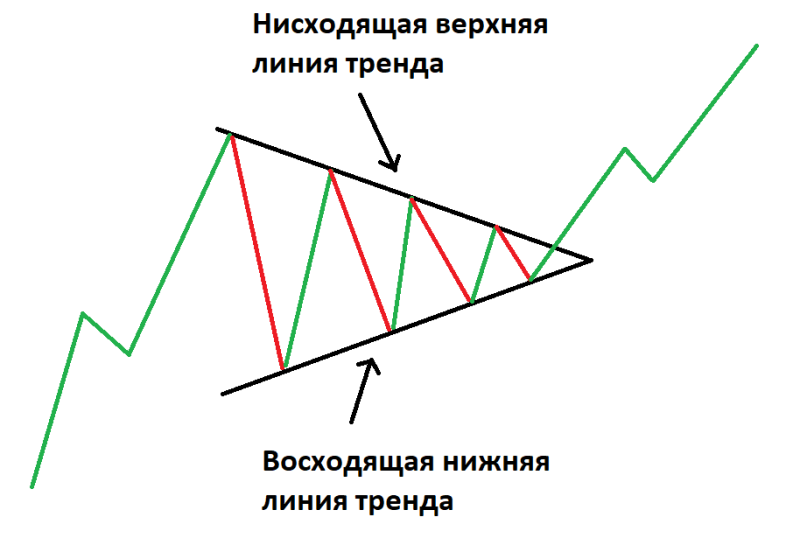

A triangle in trading is characterized by two converging trend lines, within which price fluctuates from one to the other. The minimum requirement for each triangle is the presence of four anchor points. To draw a trend line, as we remember, two points are always needed. Thus, to draw two converging trend lines, each must pass through at least two points.

Also, by definition, a triangle is a trend continuation pattern, i.e. if the triangle is formed on an uptrend, after it is worked out, the uptrend should usually continue, on a downtrend, after the triangle is broken down, the price continues to fall. In simple words, if the price was rising and a triangle is formed, it will shoot upward, and vice versa, if the price was falling and after we see the triangle, it shoots downward.

The triangle itself can be upward, downward or symmetrical (each of them will be discussed below). The type of triangle also affects the direction of the breakout.

And if we remember that we trade in the cryptocurrency market, the number of influencing factors increases many times – it is the news, events, whale psychology, all sorts of manipulations (which we have to try to uncover), it is also necessary to understand whether we are in the middle of a bubble, how the volumes behave, whether there are divergences, etc.

Symmetric triangle pattern

The most common type of triangle is a symmetric triangle (shown in the chart below). In this case, the price fluctuates between two converging trend lines: upward and downward. Such a triangle most often leads to a continuation of the trend.

The pattern can be considered complete after the breakdown of any of the boundaries, the direction of the breakdown indicates the direction of further price movement. At the same time, a symmetrical triangle is the most ambiguous one, as opposed to an ascending or descending one (discussed below), because a symmetrical triangle is the leader in terms of percentage of failed breakouts (about 30% of cases), i.e. when the price, after breaking through a border, does not reach its minimum and continues the trend, it goes back to the triangle body, a so-called false-break or crosses the level broken back.

How to Use a Symmetrical Triangle?

When working with triangles, it is easy to determine and measure entry, stop and take profit levels. In general, the methodology for calculations is not different when working with other types of triangular shapes. A symmetrical triangle is marked on the chart.

The vertical distance between the upper and lower lines should be measured and used to predict the target level when the asset will leave the symmetrical triangle figure. It is important to note that perfect symmetrical triangles are extremely rare, and you should not be in too much of a hurry and reject most triangle formations.

It should be understood that the analysis is not so much about finding an ideal figure as it is about understanding and interpreting the current dynamics due to the triangle.

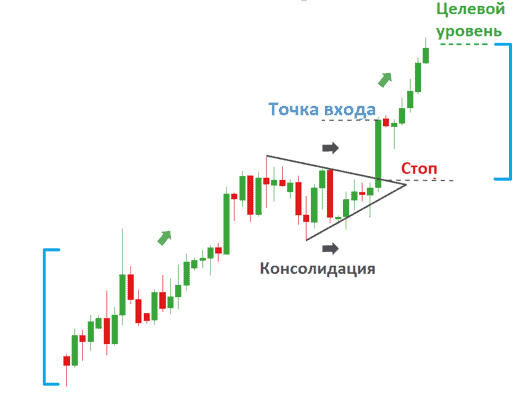

The ascending triangle pattern

The ascending triangle pattern is a consolidation pattern that forms in the middle of a trend and signals the continuation of a confirmed dominant trend. In contrast to a symmetrical triangle, which is rather neutral and almost always serves to continue a trend, an upward triangle is a bullish pattern and in the vast majority of cases there is an upward breakout. Such a triangle is formed more often in an uptrend and serves as a continuation of the trend.

The pattern finishes with a breakdown of the upper line, and it is necessary to register a significant exit beyond its boundary and a sharp increase in volumes – these points will be a buy signal. Further, the level broken through turns into support and prevents the price from going back inside the triangle.

Less often, but it also happens when this triangle is formed in a downtrend – this is a reason to think about a trend reversal, the first confirmation of which will be a breakdown of the upper (horizontal) line of the pattern.

How to use an ascending triangle

The preceding uptrend is followed by a period of consolidation during which an uptrend triangle pattern is formed. Traders usually measure the vertical distance at the beginning of the triangle formation and use it at the breakout to predict the take profit level.

In this example, you can set a fairly close stop at the level of the minimum of the last price swing to reduce the corresponding risks of a possible price drop.

Downward triangle

A consolidation pattern that forms in the middle of a trend and signals the continuation of a confirmed dominant trend. In contrast to the previous version, it is characterized by a descending upper trend line and a flat lower trend line, which appear during the temporary sideways trading of the asset.

This pattern indicates that sellers are more aggressive than buyers, so the price continues to make lower and lower highs. Traders perceive a breakout in the direction of the previous trend as a signal to enter the market.

How to use the descending triangle?

Gradually, a downtrend line is formed during the consolidation as sellers slowly push the price down. A solid breakout of the lower trend line is a signal to enter. In this example, the asset soon returns to its previous level, which emphasizes the importance of setting an appropriate stop. The take profit level is determined in the already known way – using the vertical distance measured at the beginning of the descending triangle formation.

Sell signal here is marked in red, it is better to sell after a significant exit beyond the triangle line with local volume growth, stop loss after opening positions are set on the opposite side of the broken line, which after the crossing becomes in this case a resistance (before the breakdown was support). The level of fixing the profit is at a distance from the breakout point, equal to the height of the triangle (price point). Also, an additional signal is a breakout level, where there was the last touch of the boundary, in which the breakout occurred.

Confirmation of breakout

Sometimes the price breaks through a triangle and sometimes comes right back to its edge, or gets a confirmation. This rebound is also a signal.

Volumes

Volumes in a regular triangle almost always fall in a smooth decline before the breakout (the closer to the convergence of the triangle boundaries the smaller the volumes) and after the breakout there is a sharp growth. If there is a pullback after the breakout, it is also necessary to watch the volumes; higher volumes during a rollback carry the risk of a change in direction; if the volumes during a rollback are low, it is possible to strengthen the position.

False breakout

If the breakout of a triangle border is not followed by the growth of volumes, we may consider it to be a false-break. Sometimes it is rather difficult to distinguish a false breakout, but it can always be prevented from considerable losses by means of a stop loss below the breakout level.

Conclusions:

1. be sure to determine the trend direction preceding the consolidation period.

2. Evaluate the degree of slope of the upper and lower trend lines to determine the type of triangle.

3. Always keep a risk management strategy in mind to reduce the risk of a false breakout and ensure that a positive risk-to-reward ratio is maintained.

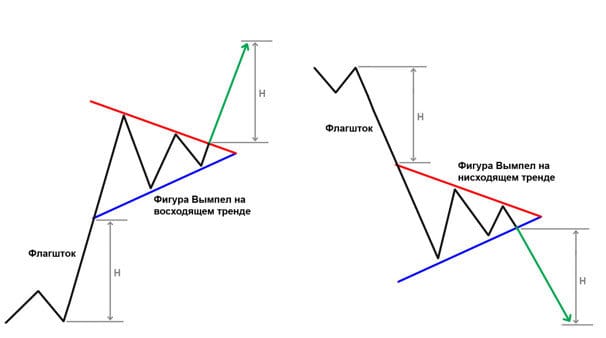

Pennant pattern

Pennant figure in the classical theory of technical analysis of the market is classified as a trend continuation model. It appears after an impulse movement of the price. As a rule, it is one or maximum of two candles or bars. After a strong impulse, the market takes a pause and remains in a state of pause for some time, or as traders say pro-trading.

To correctly identify the figure on the chart there should be a sharp impulse in the direction of the dominant trend. The formation of the Pennant pattern should be accompanied by an increase in volumes in both bearish and bullish markets. The pennant price pattern is very similar to the flag in many of its characteristics.

Although graphically it looks more like a small symmetric triangle. One of the main differences from the triangle is that the formation time is very limited. The pattern Pennant appears often after a vigorous movement has taken place.

Features:

Flagpole.

The formation of a pennant always begins with a flagpole, which is what distinguishes this pattern from patterns of a similar type (such as a symmetrical triangle). Flagstaff is an initial strong movement preceding the appearance of a symmetrical triangle on the chart.

Breakout levels.

There are actually two breakout points in the pattern: one at the end of the flagpole, and the other (we might say the main one) at the end of the consolidation period, after which the uptrend or downtrend continues.

The pennant itself.

A triangular pattern formed when the market consolidates between the flagpole and the main breakout. Two converging trend lines form a triangle – a pennant.

Bullish and Bearish pennant

A bullish pennant is a continuation candlestick pattern that appears in strong uptrends. The pennant is formed from an upward flagpole, a period of consolidation, a subsequent breakout and continuation of the uptrend. Traders wait for a bullish breakout above resistance to take advantage of the renewed bullish momentum and open a profitable trade.

A bearish pennant is the opposite of a bullish pennant. A bearish pennant is a continuation candlestick pattern that appears during strong downtrends. Its formation begins with a flagpole – a steep drop in price followed by a pause. During this pause, a pennant-shaped triangle is formed. Then a breakout occurs and the downtrend continues. Traders try to open a short on a break below the support level of the pennant.

The difference between the pennant pattern and the triangle pattern.

– The pennant pattern begins with a strong upward or downward spike that resembles a flagpole. If there is no flagpole, it is a triangle, not a pennant

– A pennant has a shallow correction (usually less than 38% of the flagpole). A deep correction indicates a triangle, not a pennant.

– In a pennant pattern, the upward or downward trend continues

– A pennant is a short-term pattern that usually takes one to three weeks to form. Creating a triangle usually takes much longer

Advantages of a pennant The big advantage is that despite the simplicity of the pattern, you can get a clear signal that allows you to make a quick decision.

It is easy and quick to observe both the fall and the increase in price associated with the further movement. The analysis of the pennant is quite uncomplicated, and the speed allows you to avoid mistakes. Of course, the frequent occurrence of false breakouts is not excluded. Technical analysis indicators will help to identify them.

Trading in bullish and bearish pennant patterns

Algorithm of trading by bullish and bearish pattern is similar, the only difference is the nature of open order – long or short respectively. The chart shows an example of trading in a bullish pattern.

Traders enter the market after confirming a breakout, which looks like a rapid change in price. The formation of the pennant itself after a sharp jump in price indicates the likelihood of a subsequent breakout and continuation of the trend in the direction of the initial movement.

The closing level of the candle above the pennant indicates the entry point. In this example, the breakout was quite significant, which increases the likelihood that the upward movement will continue.

Given that the breakout was very significant, a stop loss can be placed at the low of the breakout candle or at the breakout point. A more conservative option would be to place a stop below the pennant level (below the low of the breakout candle).

Always keep in mind a reasonable risk/reward ratio.The target level can be obtained by projecting the height of the flagpole from the breakout point.

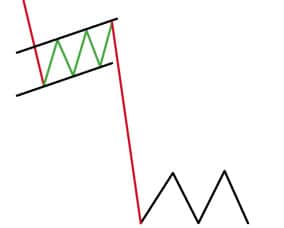

Flag pattern

– A technical analysis tool which predicts the continuation of the current market trend. It consists of two parts: the “flagpole” and the flag itself (the channel in which the price moves. If to consider the Flag pattern in terms of waves, the “flagpole” is an impulse, and the flag itself is a correction. And, of course, when correction ends – a new impulse is realized, resuming the previous trend. Types of graphical figure Flag:

– Bullish flag.

– Bearish flag

Bullish flag

In essence, a bull flag and a bull pennant appear in the same conditions (sharp and sudden price change), but it is in the conditions of flag formation that more attractive entry levels appear. A characteristic feature of the bull flag model is a downward sloping channel, which appears as two parallel lines against the preceding prevailing trend.

During this period of consolidation, volumes tend to decrease as the flag forms and rapidly increase on an upward breakout. As the name implies, this pattern resembles a flag hanging from a flagpole.

Bear Flag

Similar to the bullish flag pattern, the bearish variant is often associated with explosive price changes before and after the appearance of the pattern. A characteristic feature of the bearish flag pattern is an upward price channel, which appears as two parallel lines against the preceding prevailing trend.

The flag should not be confused with a rectangular pattern: the formation of the flag is completed in a much shorter period of time, and the consolidation has a clear bias.

How to identify the bull flag pattern

It can be quite difficult for beginners to identify a bullish flag pattern on a chart because this pattern includes several important components. Traders need to identify and correctly interpret these components in order to successfully trade on this pattern. Key points to consider when identifying the bull flag pattern:

– A preceding uptrend (flagpole)

– A period of downward consolidation (bull flag)

– If the correction exceeds 50%, the pattern forming may not be a bullish flag. Ideally, the correction should be completed before reaching a 38-percent level relative to the achieved peak of the preceding surge

– Entry into the market should be made upon a break above the high of the upper level of the consolidation channel

– Price could potentially break above the breakout point to the height of the flagpole

How to trade the bull flag pattern

The chart below is a successful example of a bull-flag pattern. The preceding uptrend (flagpole) is marked with a black bar. The price then consolidated in a downtrending price channel (marked in blue).

To use the bull flag pattern effectively, traders enter the market at the bottom of the emerging price channel or, more conservatively, wait for a breakout above the upper level of the price channel (marked with yellow circles). To get the expected target level, it is necessary to project the height of the flagpole preceding the formation of the flag to the breakout point (black dashed line).

The effectiveness of using a bull flag pattern depends on the correct identification of all its components.

Advantages of the pattern:

– The bull flag pattern works in all markets

– Easy to determine entry and exit points from the market

– Excellent risk/reward ratio

Disadvantages of the pattern:

– Identifying the pattern can be difficult for novice traders

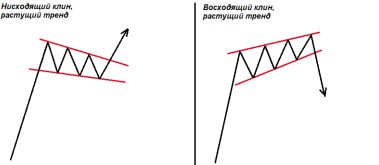

Wedge pattern

A wedge is an upward or downward pointing figure with a triangle shape. Unlike the pennant, the wedge lines have one direction – upward or downward. What distinguishes the wedge from the flag is the different slope of these lines.

Like most shapes, it is formed after the trend stops, when the price fluctuations begin to fade.

There are two variations of this pattern:

– rising wedge (bearish) – with growing minimums and maximums.

– downward wedge (bull) – with falling minimums and maximums.

It may represent both a trend continuation pattern and a reversal pattern. One key thing to keep in mind: the successful realization of a wedge is preceded by a price exit in the opposite direction to the wedge. The signal for opening a short position on a “bullish” wedge is a break-down of the support line. A buy position on a “bearish” wedge is made after the resistance line is broken upwards.

Conditions necessary for the formation of a wedge

– The first and one of the most important conditions is the presence of a trend. A bearish wedge must

A downtrend will precede a downtrend and an uptrend will precede a bullish trend. This pattern is not absolute, because sometimes you will see an upward wedge when the price is moving up and a downward wedge when it is moving down. However, the trend must be present for sure. It is very hard to make money on a sideways market.

– Price consolidates within two trend lines: upward for a bearish pattern and downward for a bullish pattern. The peculiarity: the lines are not parallel, and one of them (as a rule, through which a breakthrough will be made) has a bigger slope than the other one. Thus, they are directed to the same point, as in the formation of a triangle.

– To build a wedge on a chart, we need at least two peaks and two troughs. As you remember, a trend line can only be drawn through two points.

– The wedge pattern, as opposed to the flag and pennant patterns, is not fleeting. It is formed within a month or even longer. The last, but not the least important condition is the trading volume decreasing. The more the trading range and volatility is narrowed during the wedge development, the less the trading activity becomes.

It means that medium- and long-term traders do not hurry to close their profitable positions and wait for the continuation of the initial trend. At the moment of a breakdown, trading volumes increase significantly and maintain this trend as the trend develops.

How a wedge figure is formed

The standard way to open a position is to enter the market when the price breaks the resistance line towards the continuation of the main trend. As a rule, the resistance is the trend line, which has a greater slope. Stop Loss is placed either under the level, or just below the minimum of the breakdown candle (this is for the descending wedge).

A conservative way to open a position is to wait for the first pullback after the breakdown. This is a less risky option because you already know that the wedge pattern has formed finally and the stock has started trending again. But, sometimes the price moves so strongly that it does not give a pullback. In that case, you may be left out of the market. We place the stop loss either below the level or slightly below the low of the reversal candle (that’s for a downward wedge).

The wedge shape is not as popular as some other trend continuation models. But, it is not inferior to them in its reliability and stability. The more elements of technical analysis you possess, the more trading opportunities will be open to you.

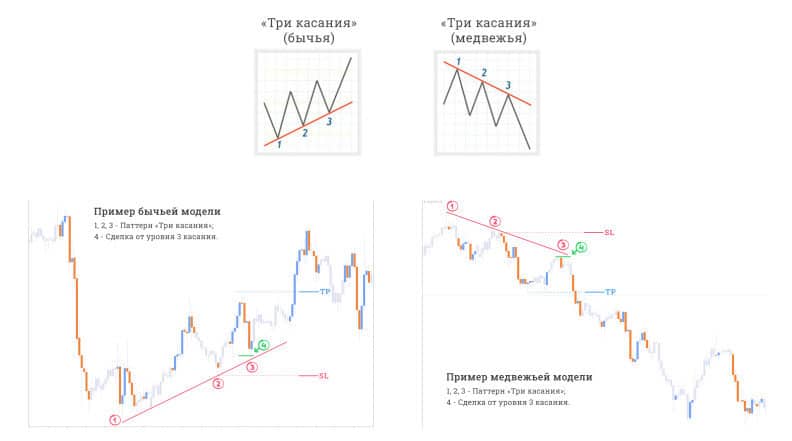

The Three Indians pattern

The “Three Indians” pattern is known to many traders as the “third point”. It is also called “pattern 1-2-3”, “three touches”. Its appearance on the chart is a signal of a trend movement, understandable even to beginners. As the name implies, the “Three touches” strategy involves finding three points. These points should be on one straight line, i.e., the trend line.

The classic strategy “3 Indians”

The essence of the classic strategy is that if you draw a trend line on two points, then the third touch of the price of this line, you can confidently make a deal on the trend. Please refer to the picture for details:

– Market entry – at the point 3 of price touching the trend line – point 4 on the chart above

– Take profit – when maximum of the figure is updated – level 5

– Stop Loss – is set at 6-th level of the second minimum

The beauty of this strategy is that we open trades only following the trend.

Quality criteria for the “Three touches” pattern

The figure of three touches on the interval M30 and less gives very weak signals. The reason is simple – not all market participants have time to notice it. Hence the conclusion: the longer the timeframe, the better. But even here it is not worth “going too far”. On a weekly interval (W1) they may even forget about the third touch.

2. The pattern of three touches implies entering the market only along the trend, so one should not make a mistake and look for a counter-trend entry.

3 It is best when each of the touches looks like a hairpin, as if the price carefully pierces the trend line and immediately comes back. The pattern itself should resemble a series of arches. This is all to say that the pattern should be as obvious as possible, then the probability of it working out will be higher.

4. One more important nuance: the trend line should be drawn from the outside, so that it would not intersect with the price. That is, if the trend line were an infinite straight line, it should not intersect with the price in the near past.

A few recommendations when trading

1. Don’t immediately recklessly open a trade believing that the price will rebound at the third touch point. This pattern can act as a confirmation signal or a favorable point to enter, but not as a signal to enter. Therefore, to avoid getting in such situations, it is necessary to have the main signal.

2. In contrast to the previous point, very often the price still reacts to the third touch, even if it is not going to work, that is, there is a small rebound. We mean the situation when the price rebounds from the trend line, but does not go far and breaks through it. Perhaps it is a kind of manipulative maneuver. In such cases it is important to correctly assess the situation and, if such a development is assumed, to move the stop loss to the breakeven level.

Be careful when placing a limit order on this strategy. Considering the fact that the trend line is oblique and we cannot know the exact time when the 3rd touch occurs, the limit order in this situation has to be moved constantly. Therefore, it is better to open a trade manually when the price makes the third touch, in order to control what happens.

Trend reversal patterns

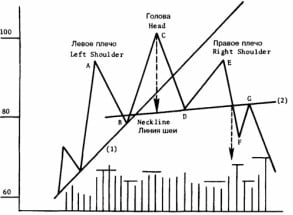

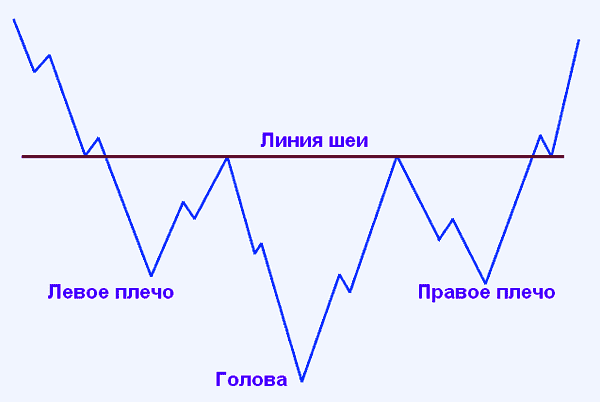

Head and shoulders

The most popular and used model for traders is exactly this reversal figure of technical analysis, signaling the imminent change of the current trend. It is quite light and represents 3 peaks, among which one is considered to be the central (head), and the other two are lateral (they also make up the shoulders of this figure).

The specific form-factor has similarities with the human figure, in which the central maximum point resembles the head and the others are the shoulders.