First we need a disclaimer. This eduacation course is about the “free” mints on Solana. Why is the word “free” in quotes? Because you’ll still need to pay a commission for the mint, which ranges from ~0.012 to ~0.018 sol.

Now that you know that the mines are not entirely free, it is worth telling about the pitfalls and pros of mints on Solana.

To mint without the bot – hard, but it’s real if the excitement is little.

You can get drained if you try to mint when the candy machine is not open yet.

Finally, a huge bonus: let’s say you mined 0.018 nft and it fails/won’t fire, you can burn your nft and get ~0.01 back, which will compensate you 55% of your investment. (https://www.sol-incinerator.com/#/).

And so, please love and love, the site, using which (and my brain a little bit) I increase the balance in my purse

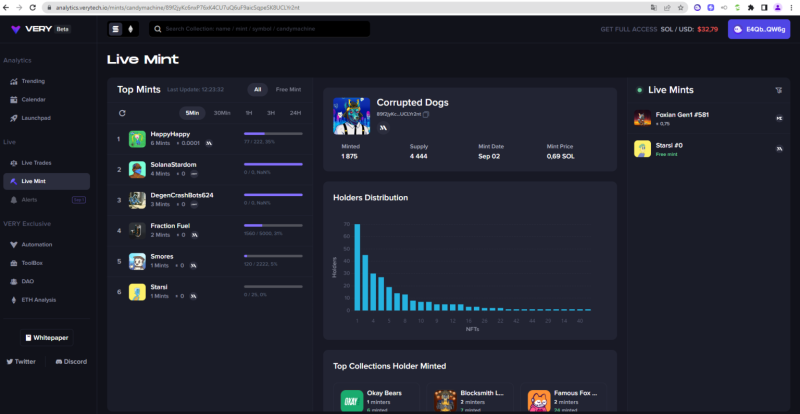

https://analytics.verytech.io/mints/

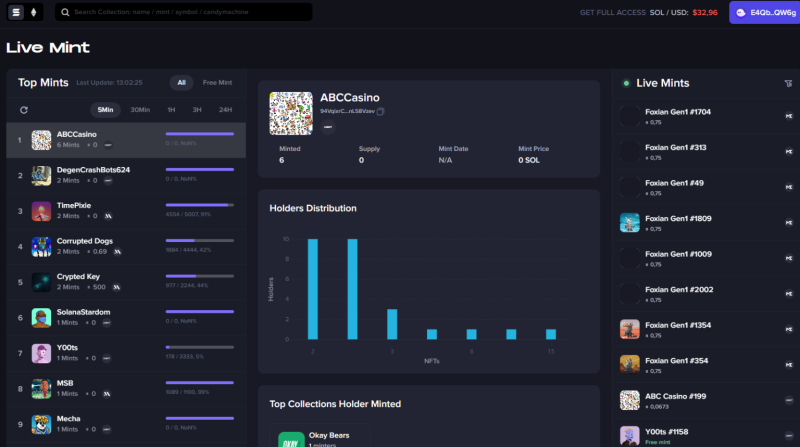

There are many functions in it, both for Solana and for Ethereum our education course is only about Solana and I am only interested in live-mint. Where to look:

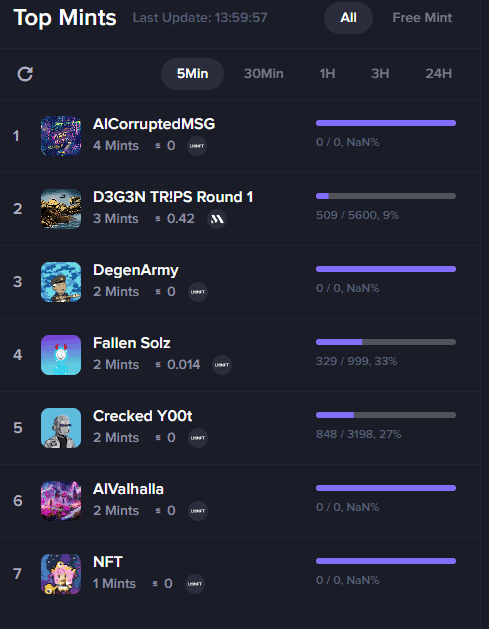

On the top left I select an asset in 5 minutes to have time to see a potential mint.

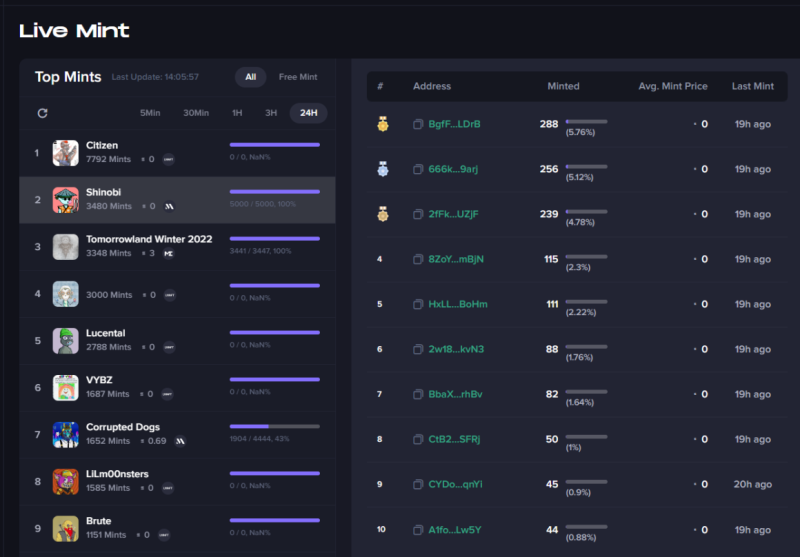

On the right in Live Mints I occasionally monitor the current mints to catch a gem (same as the 5 minute but faster updated and not structured)

We noticed the collection. What’s next?

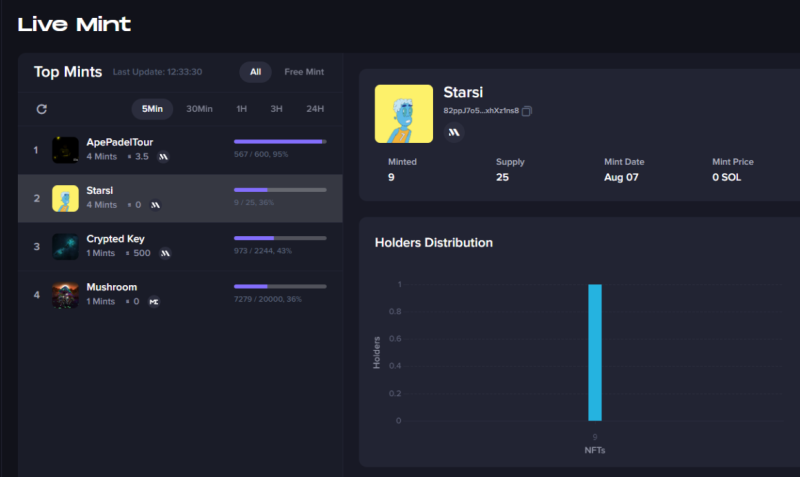

Poke at the collection, in the center we have a menu, and some information (some collections have more, some less, I do not know what’s wrong).

I’ll take apart the Starsi collection.

There are two variants: mint comes either from lmnft, or from any other place. In this case, any other place, because it indicates an icon Metaplex, not lmnft (on the screenshot you will see, the bottom two lmnft).

In general, you can mint directly through candy machine but then you need to understand minted WL or not.

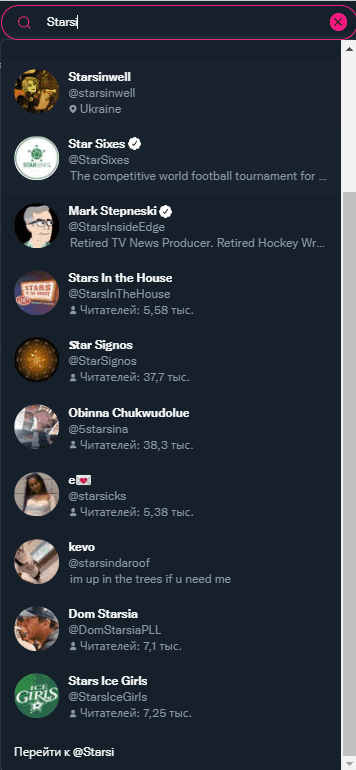

Let’s go try to find the collection through Twitter. In our case, the name is very fuzzy, not some cockney “Meagtrhonus Primus”, so I didn’t find anything there.

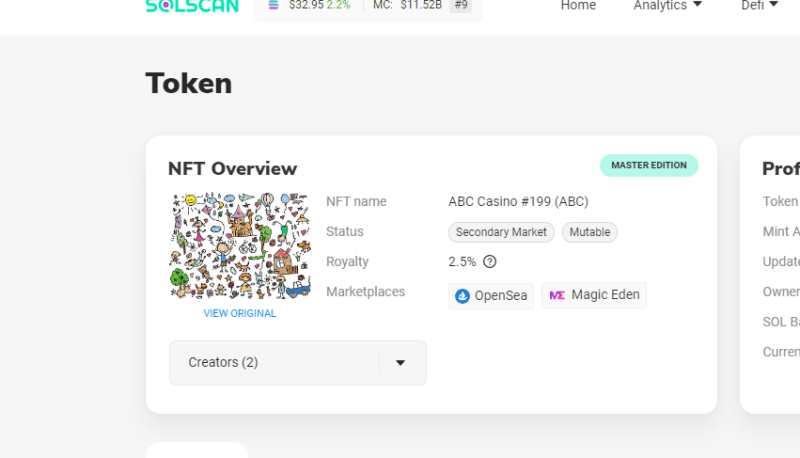

Next we try to find some information through solscan.io. To do this, scroll through the information about the collection of top minters.

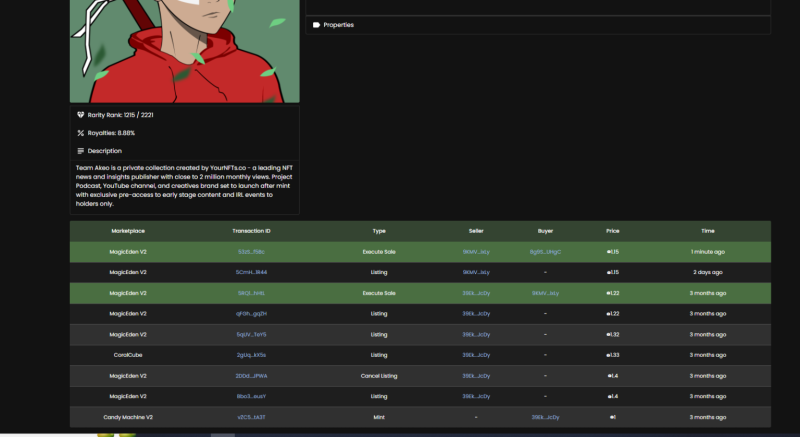

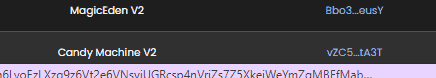

Copy the wallet of some guy who minted (here he is 1), then I go to coralcube.io/profile/here you need to enter the wallet of the man whose nft you want to see. While Later we find the nft in his inventory and poke at the transaction with a mint (the very first transaction) in the screenshot below it is at the bottom.

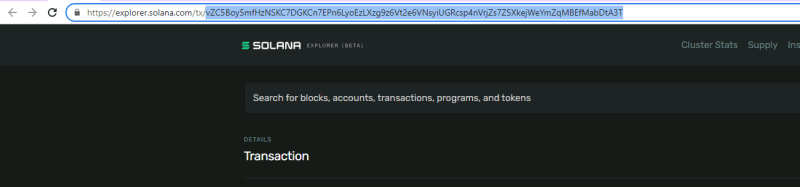

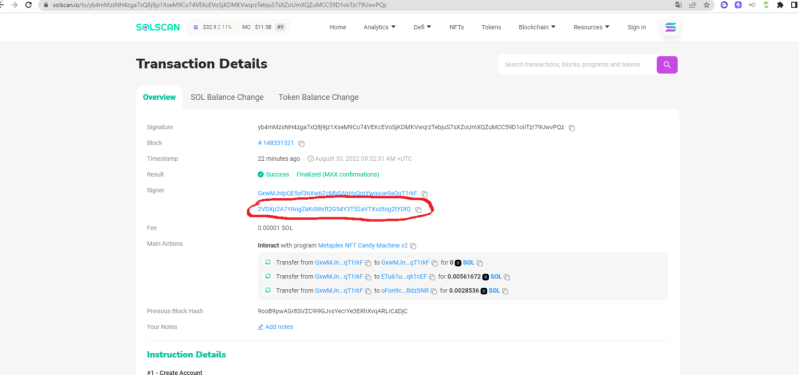

This vZC5… it takes you to explorer.solana.com. I copy the transaction from it and enter it at solscan.io.

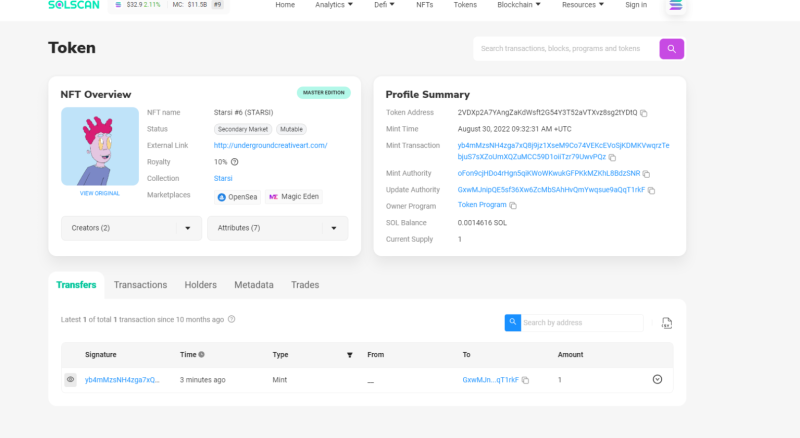

On the Solscan you will look like this, click on the line that I highlighted in the screenshot and it will take you to the softsheet itself. Here we have information about the collection and some links. Sometimes there is a link to twitter/discord/mint link.

In this case we have a link to mint, but it does not work, at this point we either find the collection or not, in any case, if anything, I continue to use the candy machine if I just want to try to mint.

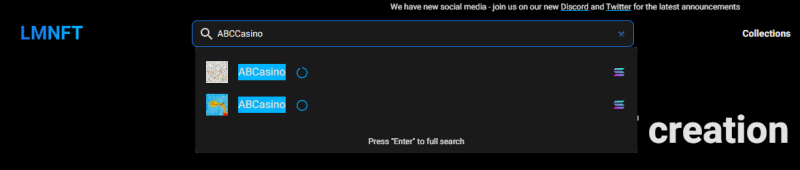

Now the first option: mint goes with lmnft, what’s next? Now some ABCCasino mint, let’s try to find their mint.

I hit the LMNFT button and hope I get jumped to the mint link.

I hit the LMNFT button and hope I get jumped to the mint link.

It worked, but be careful, there are often fakes here and you can’t know for sure which collection you found. I usually compare how the mint goes on veritek/lmnft and if +- everything matches, then mint too.

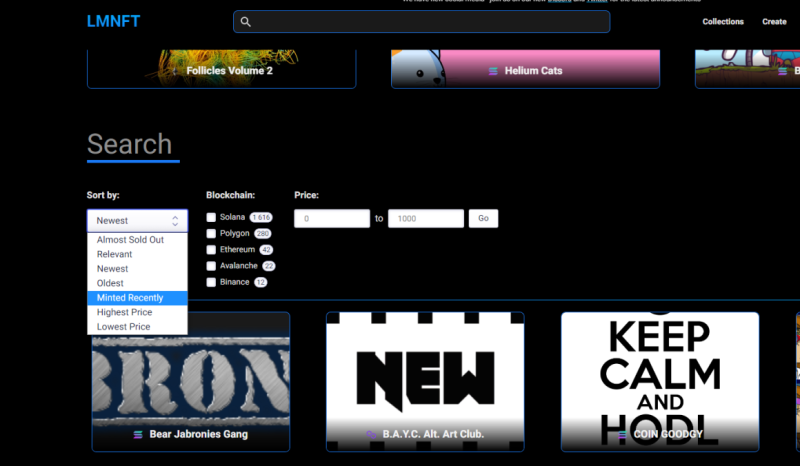

What to do if the collection is not found in the search? Go to collections -> New Collections –> Minted Recently and try to find it there, most likely you will succeed!

If it did not work, then try through Solscan as described above. There’s nothing interesting here either, or on Twitter.

Well, if it goes mines, it mint that someone mint it so there is a good chance that the link was thrown at someone in chats/dao/etc think of plz, so monitor everything and ask everywhere and I think you will find the link.

And now I think the most interesting and important part. How I select my mints ( I’m not a perfect machine, so my opinion shouldn’t be taken as absolute and think that you’ll hit 100/100 in every mint ).

The first thing to look at is the supply of the collection. If you do not take into account casinos/utilities (like bots/snipers) which have the less supply the better (too little is also bad (preferably at least 333-999 ( a lot is also bad for them ) ), the default supply for the collections I want to mint is 2222/3333/4444/555.

Saw a good supply then look at the picture. On Solana it is very important, again, if we do not take casino/utility (they should also have nice pictures, but less complaints about them). On Solana it is very important that NFT can be put on the avatar on twitter.

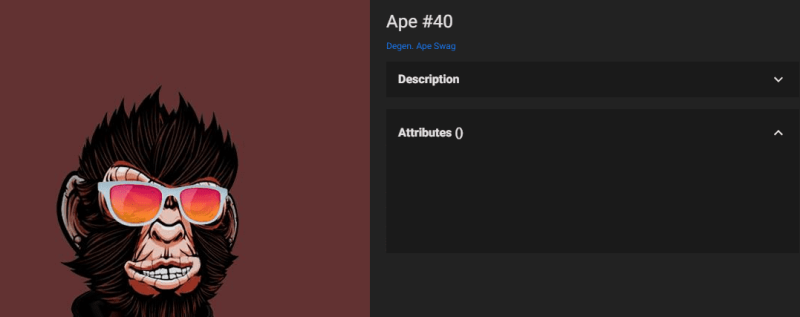

Next, it is important to understand if the picture is original or if it was stolen somewhere. The first factor that will tell us this is the attributes on the lmft. A collection where each nft is unique (1/1) can have no attributes, but these ultra rare, so if you see at least 2 NFT with the same attribute, it means that they were just loaded (Example: monkeys that have the same points, but 0 attributes).

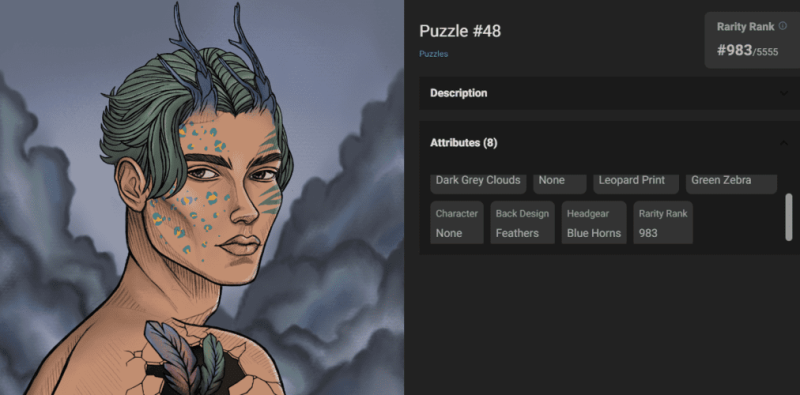

Also remember that people can randomly write some words and put them as “native” attributes, so look what is drawn on the picture and what attributes (here Back Design – Feathers and on the head of the Horns match, so it’s okay, so you need to check a few NFT to be sure).

With attributes all ok then load the picture in google lens (right-click on the picture and search through google lens) and see if there are any matches. Next, it is desirable to download the extension nftinspect https://chrome.google.com/webstore/detail/inspect/kamfleanhcmjelnhaeljonilnmjpkcjc which displays popular collections from ether and solana with icons under them (go to twitter of collection you want to mint and maybe there will be an ether icon – most likely a collection scam (unlikely the original creator came from ether to solana to release his collection for free here) ).

The method above does not work as often, but sometimes save, and the last way I determine the fake or not – I throw the picture to the dao / chats and ask their opinion.

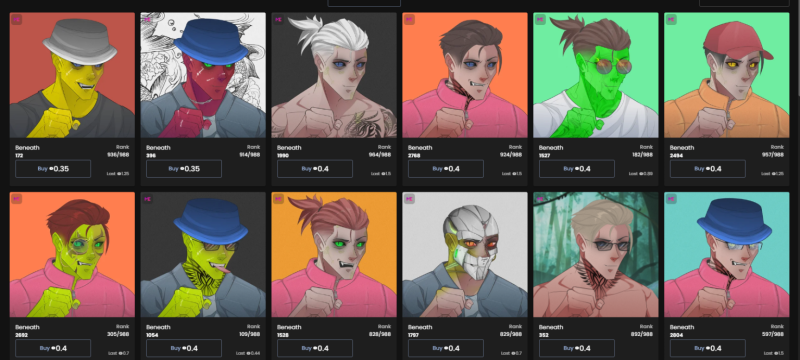

The picture is original and looks cool, the important thing is that the nft should not be similar to each other (for this you need a lot of attributes/many beautiful backgrounds (collection background). Example of benefits that look good one by one, but together they all look the same.

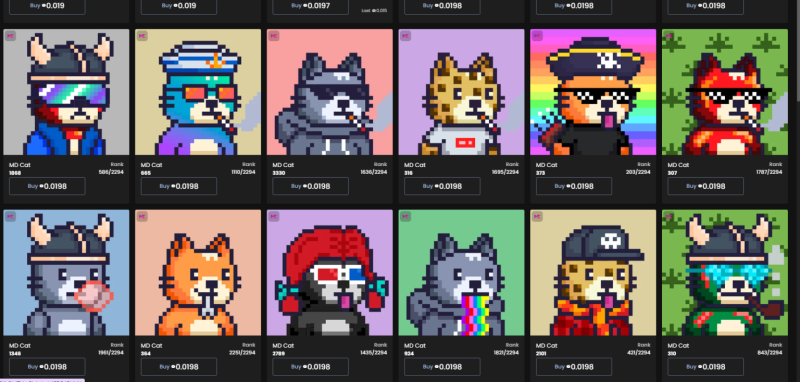

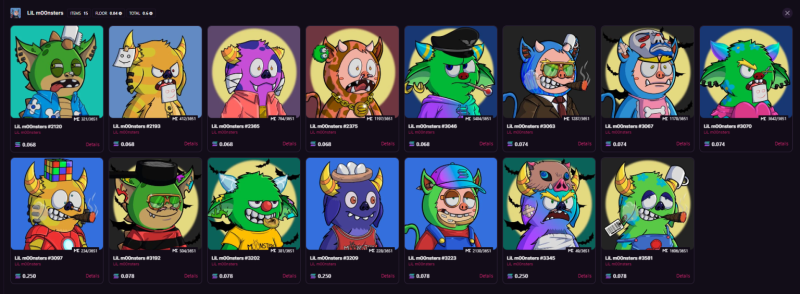

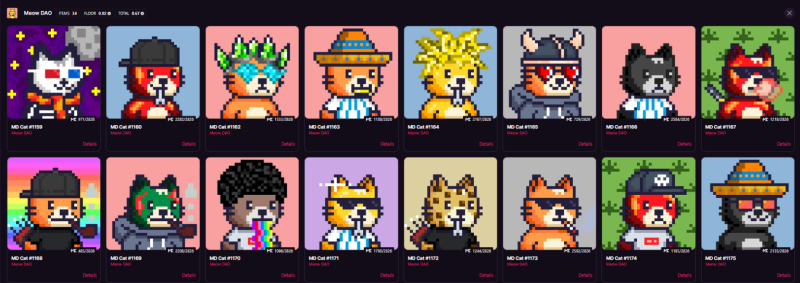

An example of beautiful pictures, were freesh and went up to 0.06 in the secondary – cats.

You see the collection in the LiveMint, you realize it looks fucking great and it’s not stolen from anywhere. What’s next? You have to understand that it makes no sense to be the first to go to the mint.

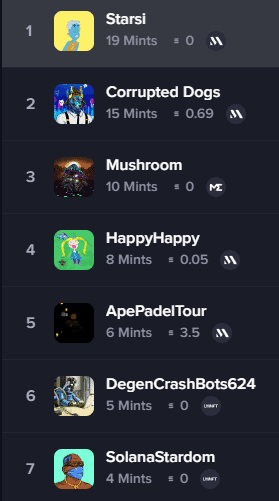

Looking under the name of the collection on the figure and realize that there’s only 4;3;2;2;2;2;1 mines for 5 minutes – in general, there’s no hype and there’s nothing to mince. When there are 50-100-500 mints for 5 minutes, it is more interesting and look at what this may be associated with.

And this can be related to a variety of things. Some “bullshit” announcement came out, or mint announced in some Dao, or people, like us, suddenly saw that someone mint and start to do the same, afraid that then they will not have time. Factors are different, sometimes there is something unreal, that I could not even think of, but nevertheless if you see an asset – something will potentially happen.

The main thing when you see any asset on the mint, you need to monitor – whether this asset creator himself spins a collection to attract the attention of people like us, who sits around the clock instead of plants looking at the screen waiting for a miracle.

To do this, we look at how many wallets mines this collection. Example yesterday shinobi – at 5k nft all mines are different (mints for 50-500 pieces is normal and such should not be afraid (unless suply 3k nft and soldier made 6 people for 500 nft or 30 people for 100 nft, then I would be afraid, yes ).

Also, the more a collection of minters popular collection, the greater its chances of success in the secondary (I myself never look at it and in general have come up with it only now since I saw this function on the site but it does not matter right ).

I want to remind you again that we’re talking about collections here that were only found through live-mint verytech, full-degens that may have zero social media, but can still be shot simply because the degens are bored. That’s how we live.

Factors are a fuck of a lot and they’re all different, and it’s hard to determine with zero gem. Especially to understand if the collection admin will work on the project, or released it to get the royalties and go off into the sunset.

Never look at it, but it’s important to remember before mincing that royalties should be around 5-10%, otherwise people won’t want to flip such a collection and it will dry up before it’s shot.

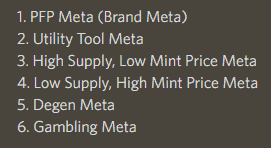

It’s important to remember about the meta and build on it (now we have no meta, so we can mint everything we have an asset and then deal with suckers, but with the meta it’s easier).

Since most of our degens are minted on lmnft, you need to know one important thing. The collection maker can change the price of a mint during a mint, don’t be afraid, this is not done in 1 click, and you are more likely to notice the “pause” and not dumb down, but sometimes you forget about it. In general, very important, do not forget.

Admins often make the first thousand free to catch up with the asset and then raise the price to snag easy money. In advance you may not know this, and often after such manipulations only to go burn nft, but nevertheless such is our life.

Unless you have 0.1 Solana on your wallet, don’t burn your NFT the first night after the rect, there’s always a chance some clown will pump the collection and flip flops will attack it.

I look at social networks superficially usually, as I have experience and I think this needs a separate article, so I will say only that it is important online in discord and reactions (not always) on posts/sneakpeaks. Signed/sitting in discord influencers would be a good factor. A great factor would be if the creator of the collection is not hiding his face and if his tweets have people from the NFT community signed them up, that’s cool. But this is rare.

You have to understand that there are bluechips on Ethereum and Solana and often release derivatives/plagiarism of these collections and they often do not shoot, inexperienced flipper can fall for this.

I love it when some mid-sized degens with a pretty sneakpeaks that has developed discord (at least 500 online) and Twitter, realizing that they won’t have soldiering on at the current price, greatly underestimate/make free mint. Most of the time mint to full and enjoy the profit.

Here’s another example, the pictures are similar to each other (at the same time they are beautiful, but you see, the main man does not change them).

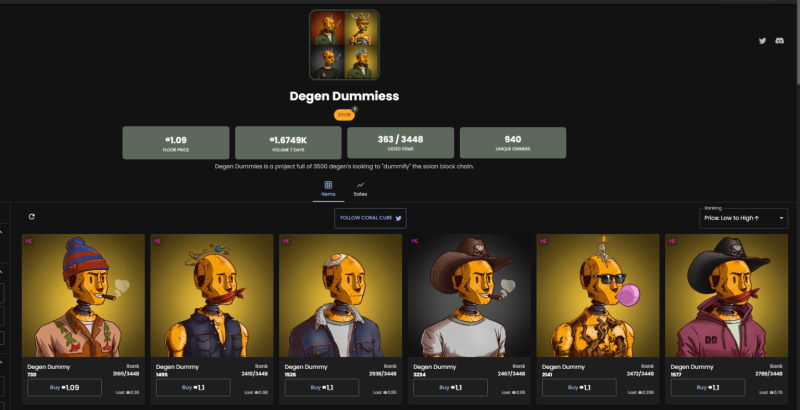

The original price they had to be 0.5, then the creators realized that they will not take out and did 0.1. Realizing that the 0.1 they take a little, they reduced to 0.01, and now you see the FP (Floor Price (minimum price)) 1.1 sol.

That’s the life of the Degen. Any project that doesn’t give up and has the potential to give profits/impact to its holders can reach these figures.

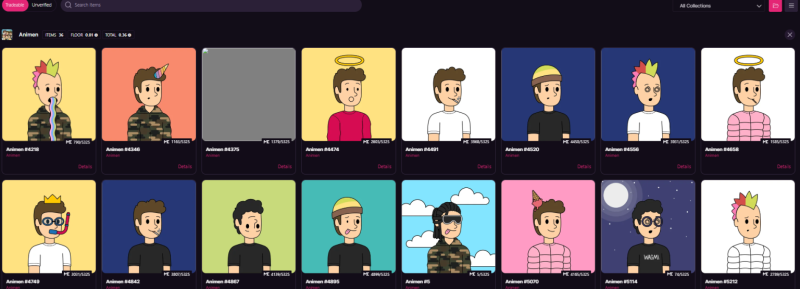

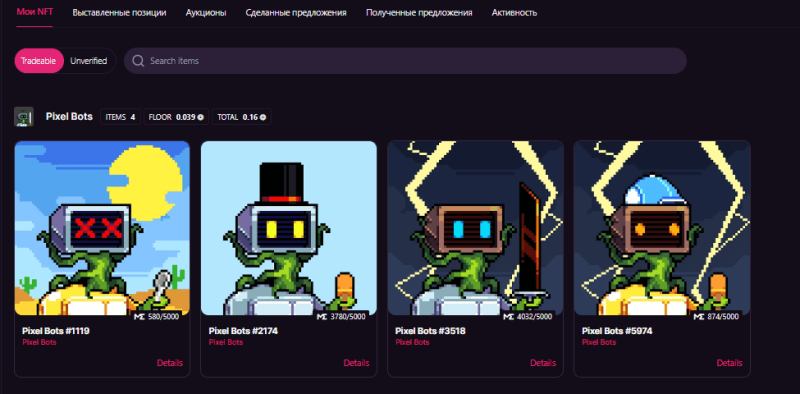

The following are examples of those NFT that I have left after my degen mint and how they showed themselves in the secondary. Immediately say that I do not remember why they minted and what they were online / active at the time, nevertheless they are with me.

The first go Animenes. Mint free, pictures are made in doodle style, supply of 5.5k and went up to 0.03 (very bad). I got out of them at 0 because of my mistake on the minte ( I was drained of 0.7 SOL), if it had not done, then went to +0.5-1. Minted 100 pieces I think, began to dump them when I realized that the asset falls, and all their plummet + chances to pay off small.

Next are the cats. This is their second collection (derug), the first time they went to 0.08 and then got bogged down. The guy decided to re-release them because the picture is fucking awesome ( it’s really fucking awesome, look at the first one in the fucking picture ) and at first the mint was supposed to be ~0.06 sol, but it went weak and after they made it free, there was a quick soldiering.

Due to the fact that the pump happened at night, when I was asleep, I was able to sell 10 of them at 0.05 sol, went up to 0.06. I have 50 of them left, if I burn – I will go out ~0 ( just stupid and put a little NFT before sleep).

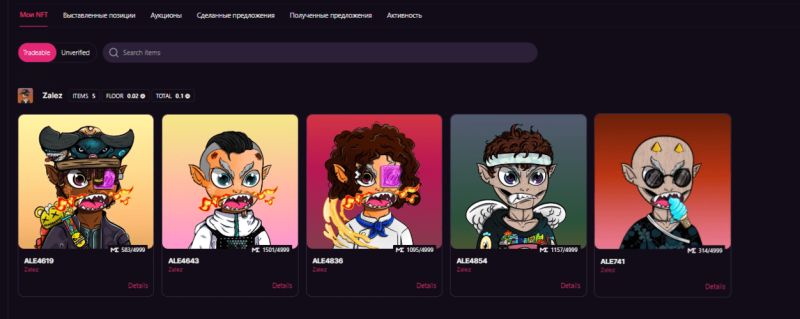

I minted them on the fun of an asset of 20 pieces, I leaked all ~0.1 sol, not even looked what their project, but it turned out cool.

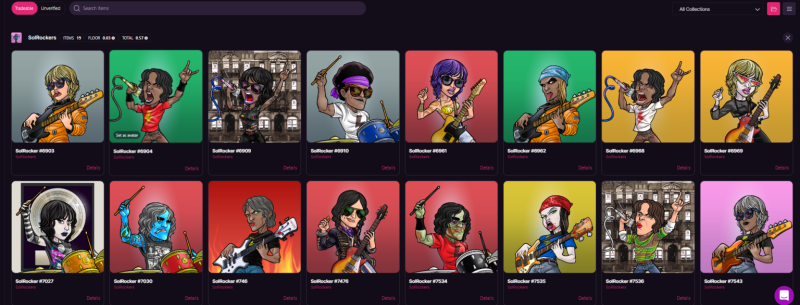

Rockers in general handsome, went up to 0.085, mint – the minimum 0.012. Minted them because when burning rect only at 0.002. Minted 80 pieces. The most expensive sale – the top 12 mifics for 0.5 sol.

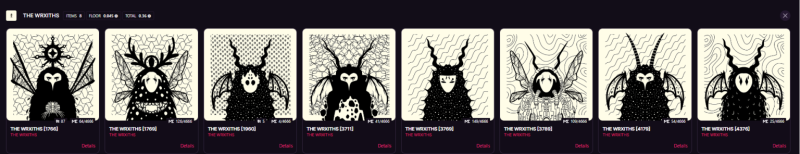

I won’t say I like the picture, but they look original compared to other collections. Minted 120+ NFT and they grew to 0.25 ( a lot of collie). Very glad I took them, I sold mine on average at 0.1 I think.

About these do not remember anything, I think in the plus sold at 0.05, I’m not sure, threw to see what kind of pictures in general are quoted on Solana.

Quickly dumped on the secondary market, as minted one Degen and bought back few people, sort of at a disadvantage of 0.5 + SOL.

Sometimes I min 10 NFT because I don’t believe it, but I see an asset and realize that I’d rather solo a 0.1 Solana than not loot “at least something” in the secondary so I don’t catch fomo. Sometimes I mint 100 because the collection is being staked somewhere and I can fix on the ones that didn’t have time to mint.

Sometimes I want to mint a million, but I don’t have time. If I get successful hold purchases are not as often, then on free degens drain very little SOL. And if I raise, then often get nice numbers.

When I mint, I’m not flying one of the first to sell at 0.03, at least try to wait for 0.05 in my heart imagining how much I’ll get if I sell them at 0.1 sol. I always look at the “walls” (when there are many nfts in one price zone ~0.039-0.0409 which is a wall of 0.04 if they’re 15-20+ sold) and try to reasonably estimate if there is a chance to break this “wall” with current asset. The asset needs to be watched every minute, for that you go to coral/mejic, open the asset there and count how many nft were bought “1 minute ago”.

A good asset, depending on the souplaia collection, is 25+. And if it’s a degens that just warmed up, preferably 50+. That said, if the asset drops and the chances are so-so for a cambake, I fly to build walls first and dump like a pig. But anyway I always leave some nft in reserve, in case something works out. I’d rather burn nft at 0.01 than go and dump 100 grand at 0.02.

You can look at a million factors: whether they buy the whales or suckers / what they write on Twitter / what they write in Dao / whether everything looks logical or it’s most likely a scam / announcements / activists and still can not figure out what will happen, it’s normal. The main thing to understand is that you can’t participate everywhere, you have to live life yet and not get caught fomo from not getting/going over.

I do not really like to buy a degens from the secondary, because there’s a good chance that just about you unload the men who mined and then the collection will roll away to 0. But the article is just about mining yourself.

It’s important to understand that the collection has already given a a lot of x’s from minting, and there are many people willing to fix those x’s and not wait for a miracle. Also sometimes it’s worth monitoring the wallets of people who mint in packs and watch them unload and not buy as long as the mint is fixed.

It’s very important to understand the state of the market, to look at the rise/decline of all NFT, at volume24h on the Magic, at the price of bitcoin. More often, when solana goes up in price, people fix it on “high” and wait for drawdown, so many do not have liquidity to fly like sick to flips in degenes.