Finding Your Own Alpha

If you keep relying on other people for alpha, you’ll become their exit liquidity.

Don’t be stuck at the bottom of the food chain.

I’m going to share a few techniques that you can apply using DeFiLlama.

Here’s your Edge 🗡️ :

Chain Traction

Imagine you’re buying real estate – you’d 1st check to see which cities are hot.

That’s how you should view each ecosystem.

BNB was hot at one point, and there was a Solunavax rotation.

It’s constantly changing & you want to be where the money is.

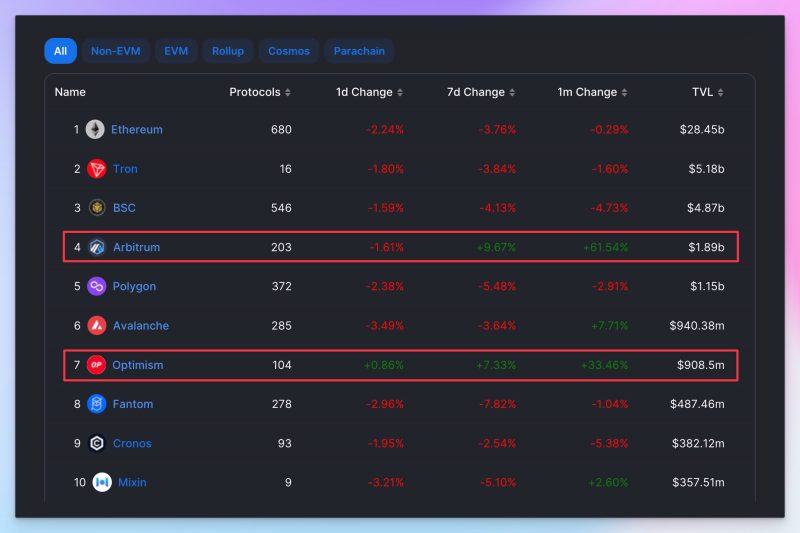

Chain TVL Growth

One simple indicator is TVL growth %.

1) Go to DeFi → Chains

2) Look at the 7D and 1M metrics – only Arbitrum and Optimism are growing.

This shouldn’t be surprising to anyone since we’re in ETH Layer 2 season.

Want More Potential Profit?

I prefer sticking to the top 10 chains, but you can scroll down if you want to be more degen.

Once again, look for outliers regarding TVL growth.

Judging by the 1M growth: Canto, Cardano, Metis, and NEO are also growing.

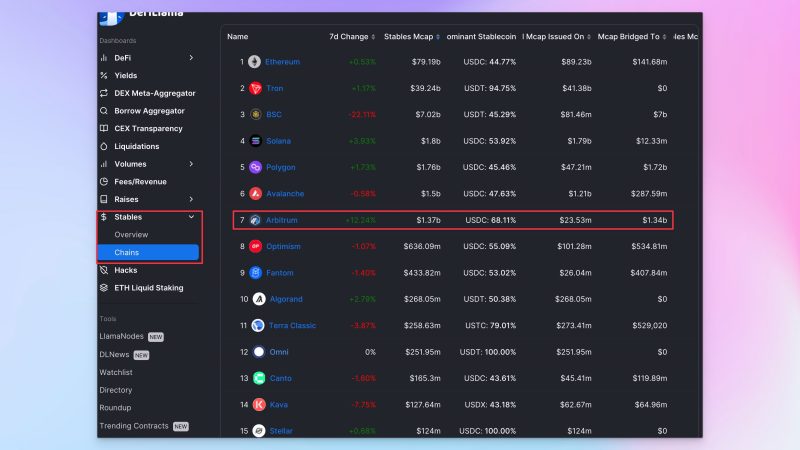

Stablecoin Inflows

I’ve identified a few chains with +TVL traction, but that doesn’t tell the whole story.

One underrated indicator is stablecoin inflow – it shows NEW money bridging into an ecosystem aka real growth.

• Go to Stables → Chains

Deciding on Chains

While Optimism has +TVL traction, their stablecoin flows are negative.

Arbitrum is +TVL and +Stablecoin inflows.

This makes Arbitrum more attractive to degen into than Optimism.

(Remember, this could change with the Base announcement)

Don’t be a Chain Maxi

I’m not a chain maxi, I’m a profit maxi.

You’re limiting your profits by confining yourself to a single chain.

My friend missed out on life-changing gains because he was an ETH maxi.

Get in, get out – go where the opportunities are.

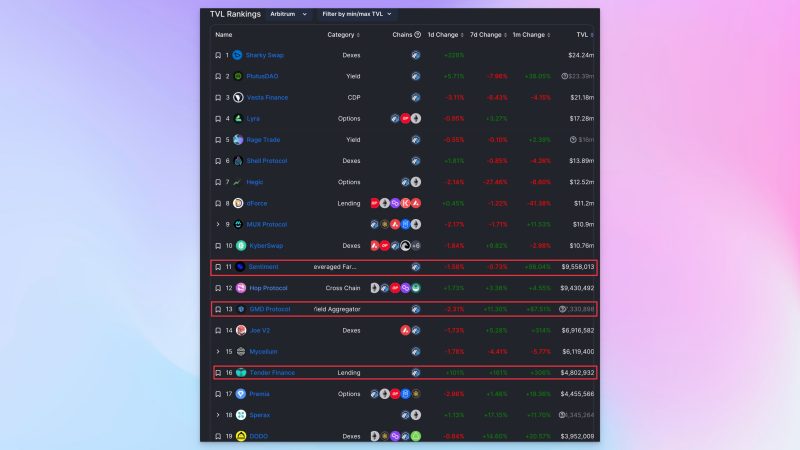

Finding Arbitrum Gems

Many of the top dApps are multichain.

If you want to find a gem, look for the Arbitrum exclusives.

There’s more profit potential in a new native dapp, than in an OG dapp expanding to its 7th chain.

Also, tokenomics tend to be better.

Look at All the Chains

I talked about identifying Arbitrum as the “hot” chain and finding great dApps on it.

You can also sort through ALL the chains and see opportunities outside of Arbitrum.

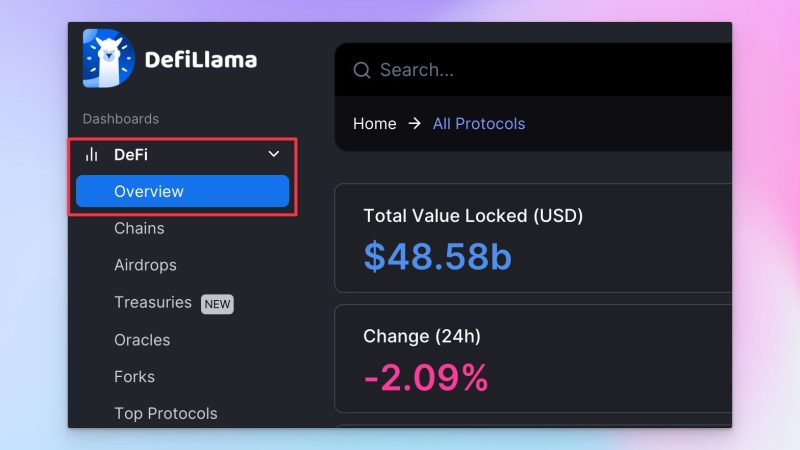

1) Go to DeFi → Overview

Set Filters

1) Set min/max filters for TVL. I set $3m

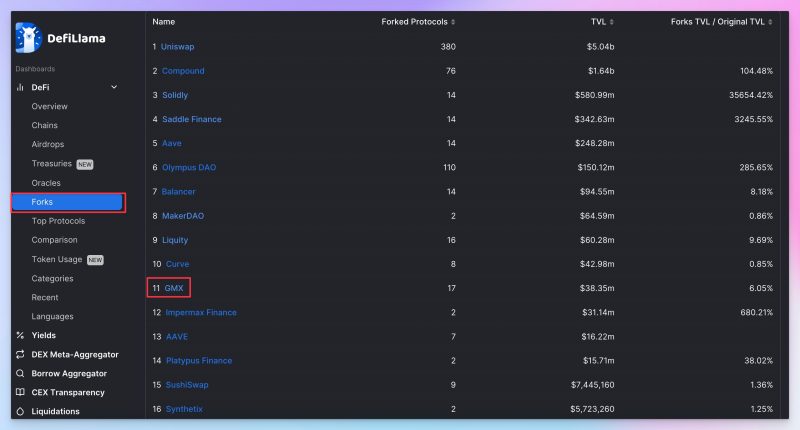

Fork Rotation

If a protocol is innovative and popular, there’s profit potential if another team forks and brings it to a new chain.

OHM forks were a massive narrative in late 2021, but I had to update my spreadsheet every day!

DeFiLlama makes it easy to find forks.

Which Forks?

GMX and Solidly forks are doing well now.

The thesis is:

“GMX is doing well now. Let’s see who is bringing it to other chains.”

1) DeFi → Forks

2) Click GMX

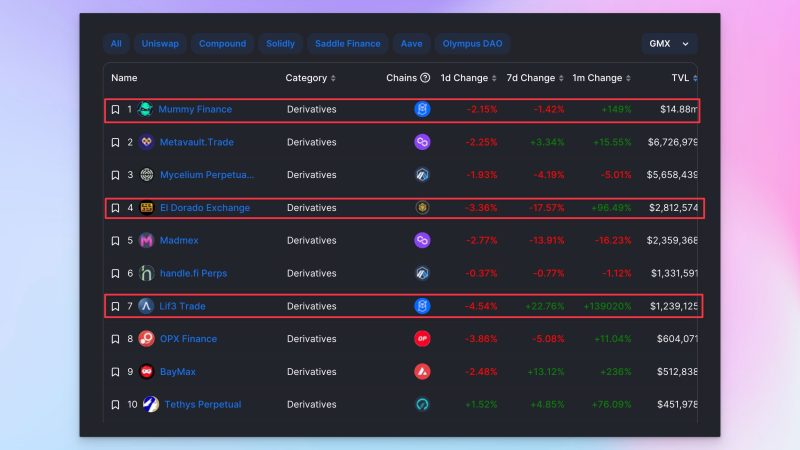

What Stands Out

1) El Dorado. It has momentum and it’s on BSC.

2) FTM Derivatives. Mummy has a solid TVL at $15m. Lif3 looks a little degen with such a low TVL – might add to the list to research.

Decentralized perps are hot, but not all are GMX forks

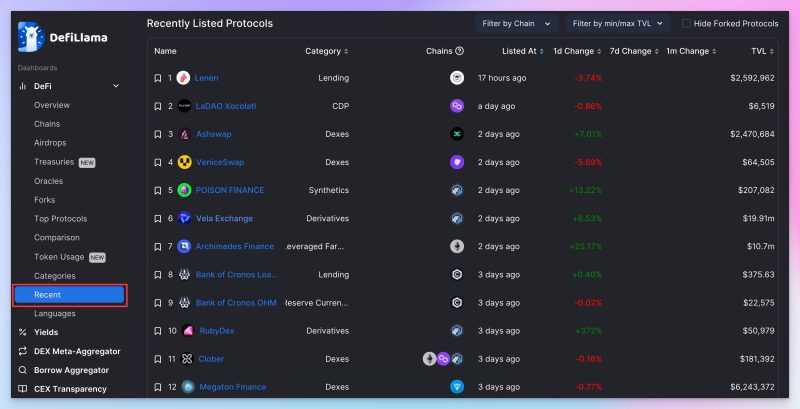

Find New Gems with the Recent Tab

DeFiLlama has a recently listed tab.

It’s good for finding new projects and seeing which chain projects are choosing to build on.

I usually search for the protocols that are TVL > $2m and see what the unique selling proposition is.

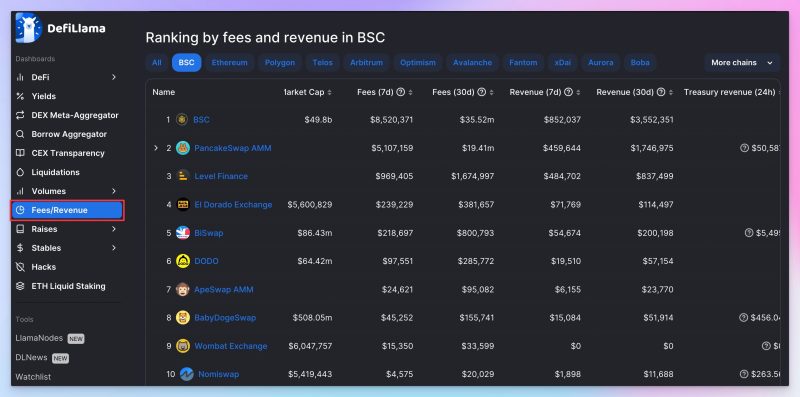

Revenue

In the fees dashboard, check the correlation between fees and revenue to see which protocols are making money.

I grab revenue + market cap information and create metrics like P/E ratios.

I’m looking to see if any protocols are punching above their weight.

Protocol Inflow

TVL alone can be misleading because it’s heavily reliant on token prices.

If the price of ETH doubles, then a protocol’s TVL can drastically increase.

An underrated metric is Protocol inflow.

You can see money is pouring into Radiant Capital.

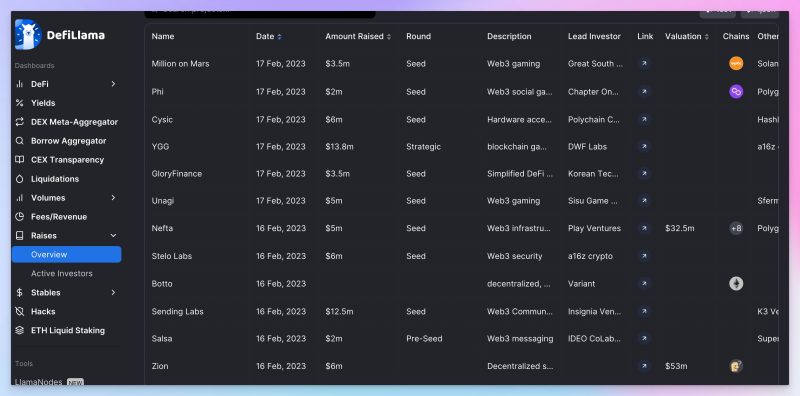

What the VCs are funding

This is straightforward – see what kind of projects venture capital is funding.

This is a way for me to see what potential narratives may form in the future.

Rather than individual projects, I’m more focused on patterns.

Risk Management

While new gems are higher returns potential, they also come with far more risks.

Make sure your portfolio’s built with ETH, stablecoins, low-risk projects, and medium-risk projects.

My high-risk bucket is ~20%, and each individual bet is ~2-5%.

Creating Your System

DeFiLlama is part of a LARGER system I use for finding gems.

1) DeFiLlama

2) Create Your Thesis

3) Smart Wallet Hunting

4) A few Twiter Accounts

6) Private masterminds / Telegram / Discords

5) Other Tools (Arkham / Nansen / Token Terminal)

Creating Your System

This thread is about finding gems. You have to do some research to see if it’s worth buying it or not.

1. Find potential gems

2. Put it through an evaluation framework

3. Decide if it’s a good bet based on your portfolio/strategies.

Decisions to Make

1) The chains you want to work with – bridging might be a pain.

2) The risk levels – the “earlier” you are the riskier it is.

3) Understanding the catalysts causing TVL increases.

My System in a Nutshell

1) I use DeFiLllama to try and find projects that have momentum behind them.

2) I research and try to understand what’s driving the momentum.

3) I ask myself, “How early am I, and does this protocol have the legs to keep running after I buy?”

Zero Endorsements

I’ve mentioned several protocols in this thread.

Keep in mind they’re all for education purposes and I don’t vouch for any of them.

I didn’t want to write a thread that’s too generic, so that’s why I shared examples.