Education guide which will help you find and evaluate good and profitable mints.

Before diving directly into the mints, let’s start with MRM 101 and then discuss how we can apply MRM methods to NFTs for success!

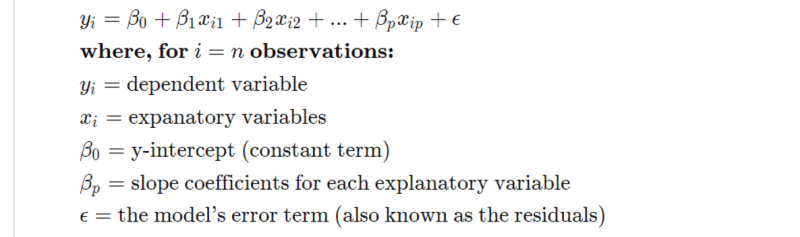

MRM’s are loved by medical scientists.

We use these models to estimate the effects of possible risk factors (smoking) on unwanted outcomes (cancer).

In this formula down below cancer (outcome) would be the dependent variable and smoking or alcohol would exanatory variables.

So based on the formula above if we have enough observations (data) we can estimate the risk of any given individual’s risk of developing cancer (compared to the general population) based on the expanatory variables such as smoking, alcohol consumption gender and etc.

The good thing is, that the same rules of statistics apply to almost every field including NFTs!

So how can we look at NFTs with the mentioned formula?

Easy let’s determine our variables!

Dependent variable == Floor price right after mint divided by mint price.

If our dependent variable >= 1.1 (not 1 because we need to account for royalties) we can say with some certainty that this mint will be flippable for profit.

Our Expanatory variables.

1) Supply

If supply is low higher chances of floor price / mint >= 1.1 (Increased chance for profitable flipping)

If supply is high, lower chances of floor price / mint >= 1.1 (Decreased chance for profitiable flipping)

2) Mint Price

Low mint price >> (Increased chance for profitable flipping)

High mint price >> (Decreased chance for profitiable flipping)

3) Number of reactions to discord announcements

High number of reactions >> (Increased chance for profitable flipping)

Low number of reactions >> (Decreased chance for profitable flipping)

(This can be botted be careful)

4) Chat movement speed in discord

Fast moving chat >> (Increased chance for profitable flipping)

Slow moving chat >> (Decreased chance for profitable flipping)

(This can be botted be careful)

5) Twitter engagement

Good engagement >> (Increased chance for profitable flipping)

Bad engagement >> (Decreased chance for profitable flipping)

6) Mint day discussions

The project is mentioned a lot in alpha chats >> (Increased chance for profitable flipping)

The project is not mentioned in alpha chats >> (Decreased chance for profitable flipping)

(Not Bottable, safe indicator.)

7) Mint speed

Being minted fast >> (Increased chance for profitable flipping)

Being minted slow >> (Decreased chance for profitable flipping)

8) Supply cut during mint phase

Supply cut (Yes) >> (Increased chance for profitable flipping)

Supply cut (No) >> (Decreased chance for profitable flipping)

9) Last day baseless FUD

Last day baseless FUD (Yes) >> (Increased chance for profitable flipping)

Last day baseless FUD (No) >> (Decreased chance for profitable flipping)

NFTs can be listed before mint ends (No) >> (Increased chance for profitable flipping)

NFTs can be listed before mint ends (Yes) >> (Decreased chance for profitable flipping)

So before minting any projects I go through mentioned explanatory variables list.

If the majority of them are in the favour of a good flip I mint if not I pass.

Important notes to know about the multiple regression models

1) Not all variables are weighted equally. Having high hype (3,4,5,6) could overweight high mint price (2) which results in a good flip despite the high mint price.

2) All of these variables just increase or decrease the chances of good flips. None of them alone or together will provide you information with 100% certainty.

But used right you can make well-educated guesses and win more than you lose.

3) None of these variables are constant their effectiveness changes over time based on the market conditions and meta.

4) Many other expanatory variables can be added to this list be added to my list and want to hear what you can add to it to make this model more comprehensive.

Sorry for the geeky thread next time will try to be more fun.

Cheers and out!