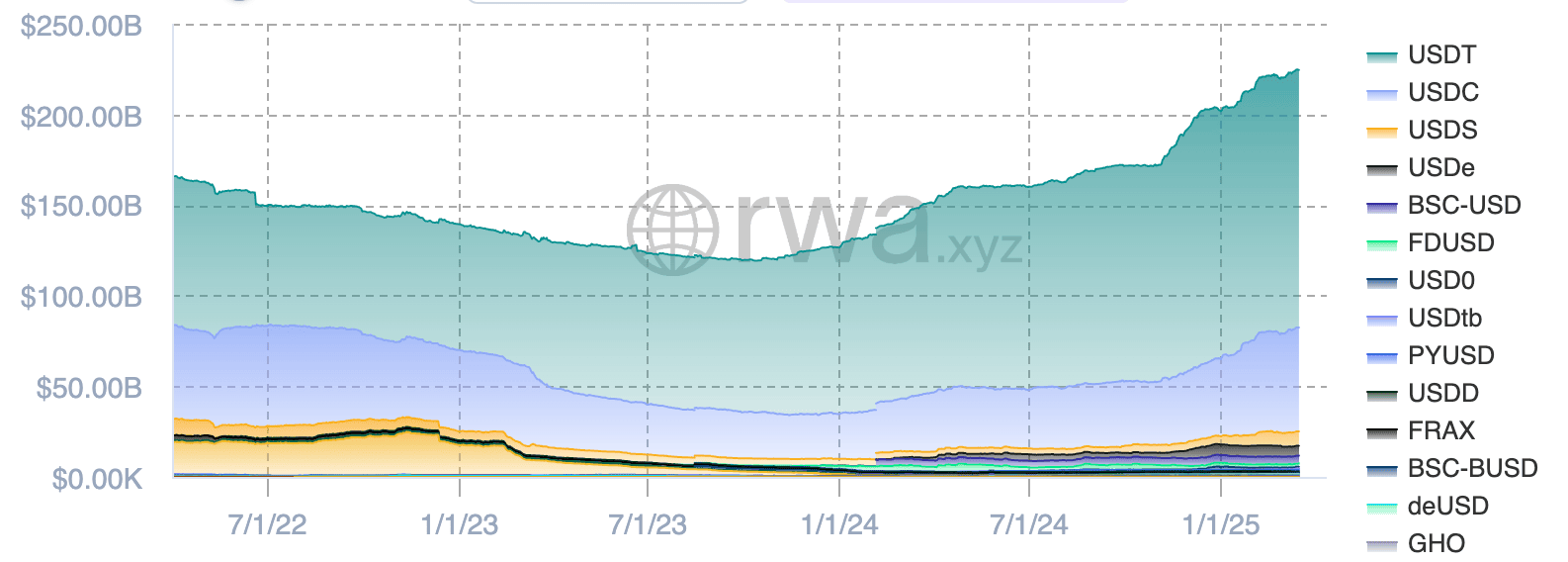

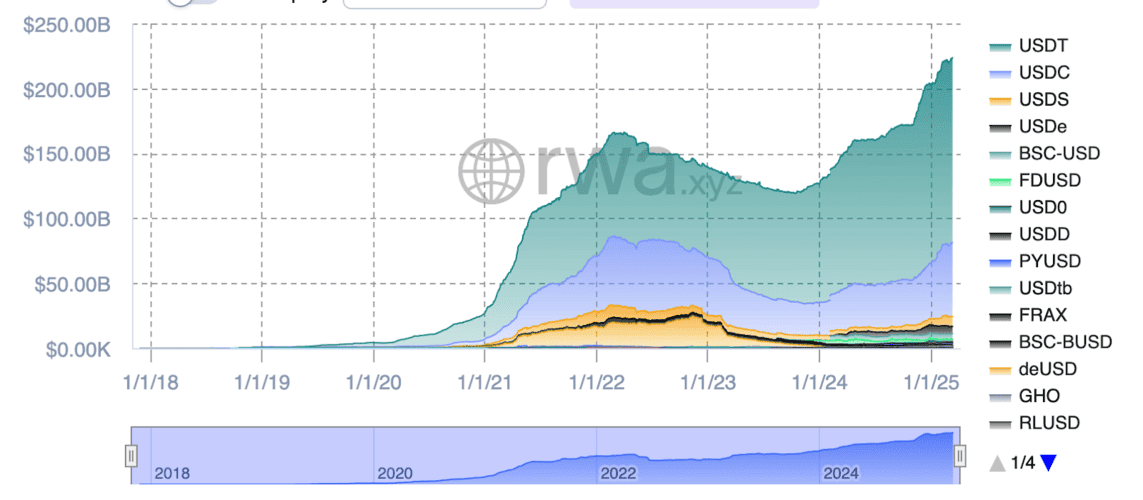

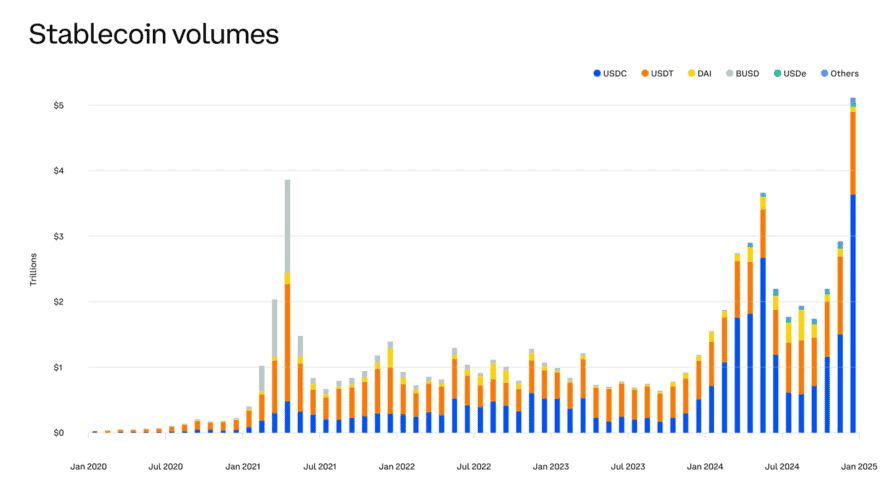

By August 2024, the supply of stablecoins had rebounded to levels seen before the Terra crash two years earlier.

Since then, despite adverse market conditions, the total volume of these assets has continued to grow, and as of this writing is valued at roughly $224 billion, an all-time high. For comparison, that’s about 1% of the M2 money supply in the US.

As the storm rages around

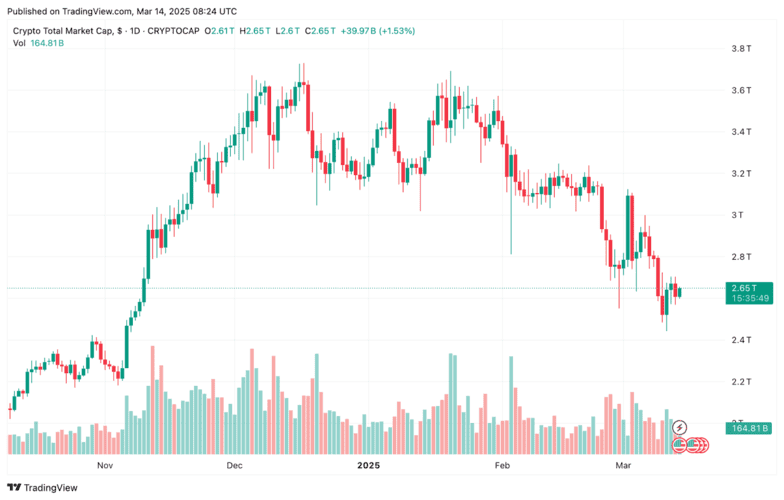

The cryptocurrency industry opened 2025 with record highs. On January 20, market cap reached $3.64 billion, just shy of the all-time high, and five days later, bitcoin updated ATH at around $109,000.

The main catalyst for this rally was the inauguration of Donald Trump and the expected U.S. turnaround on digital assets.

However, the euphoria was quickly replaced by a correction. By the end of January, sentiment had soured, first because of the DeepSeek hype, then because of trade tariffs and expectations of a US recession. These factors triggered a stock market sell-off and reduced investors’ tolerance for risky assets, including cryptocurrencies.

As a result, the crypto market experienced a significant downward trend in February and March:

- Bitcoin has fallen 28% from its all-time high, dropping to $76,000 at one point;

- Ethereum has shown even worse dynamics – at the time of writing, the asset is trading below the $2,000 mark, down about 50% from its December peak;

- cryptocurrency ETFs are showing record outflows, reaching hundreds of millions of dollars per day;

- total market capitalization has fallen by $770 billion in the past two months, back to October 2024 levels.

According to VanEck data, the Smart Contract Platform Index (MVSCLE) is down 34% since the end of January, with Memecoins down 41% on average, Oracles down 36% and GameFi down 35%. Only a few major altcoins have held up better – Tron (TRX) is down 9%, BNB is down 13%.

Against this backdrop, the stablecoin segment is showing positive momentum. For example, the total supply of “stable tokens” in March 2025 is approaching $224 billion, maintaining stable growth both during the “Trump rally” at the end of 2024 and the subsequent period of instability.

Total stablecoins supply:

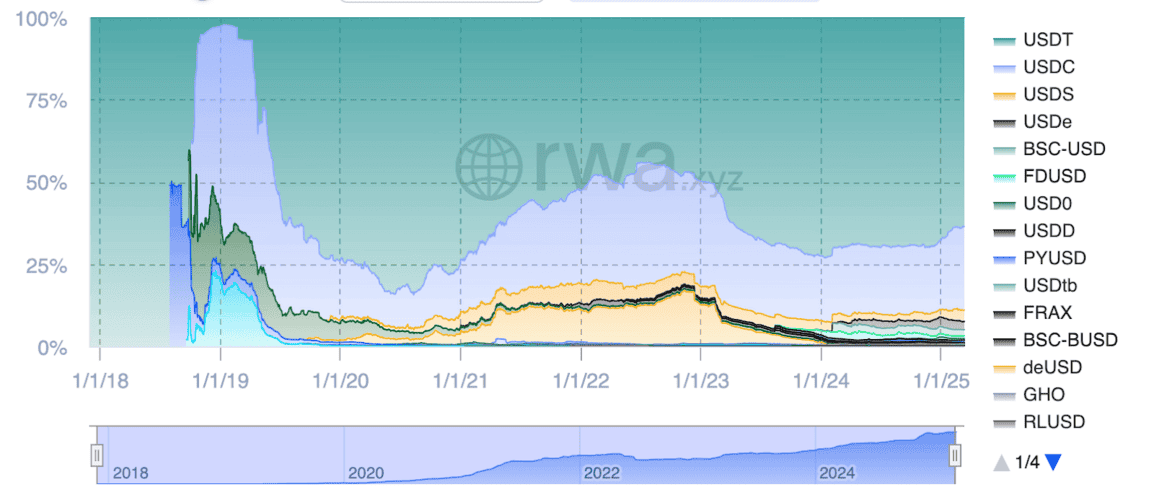

Market share of major stablecoin issuers:

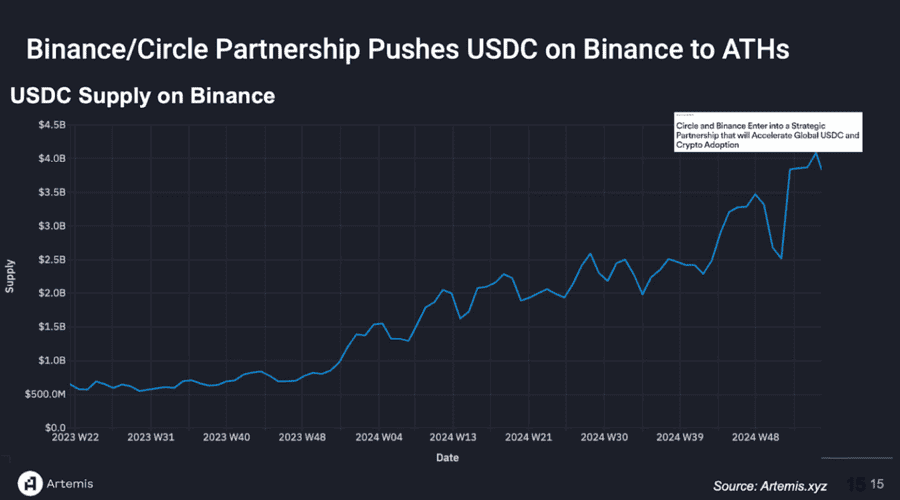

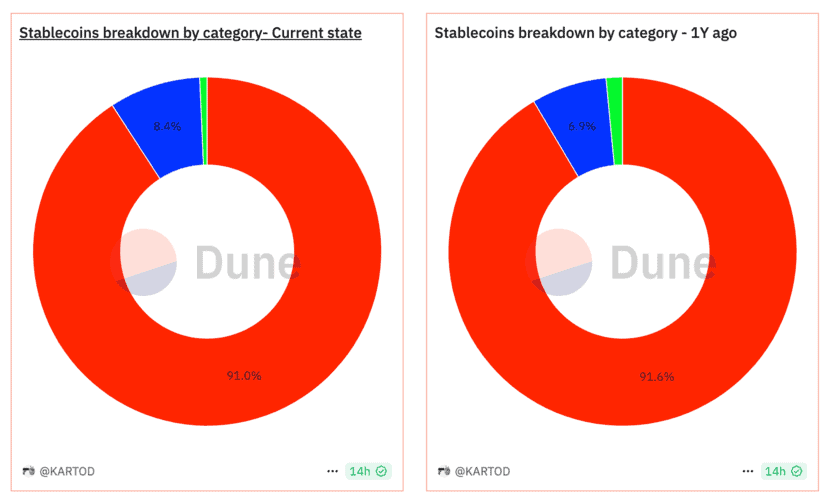

Tether remains the segment leader with its Dollar Token (USDT) accounting for approximately 64% of the total stablecoin supply. Its closest competitor, Circle’s USDC, accounts for approximately 25% of the market. Notably, the USDT’s dominance has grown from 50% to 70% over the past two years, even though demand for the USDC has increased significantly thanks to its partnership with Binance.

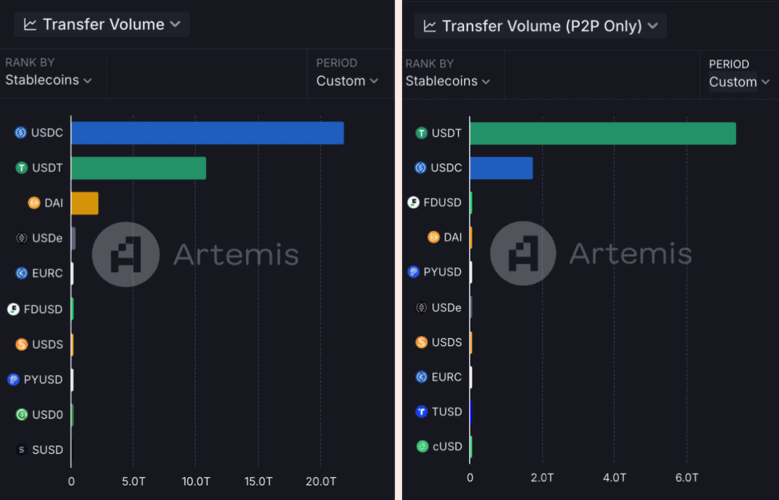

Dune also noted that these tokens are focused on different categories of users. For example, USDC is the top token in terms of transaction volume, while USDT remains the top token in terms of P2P transfers, indicating high retail demand for the latter and increased interest from whales and institutional investors in the Circle product.

Total transaction volume and P2P transfers using stablecoins:

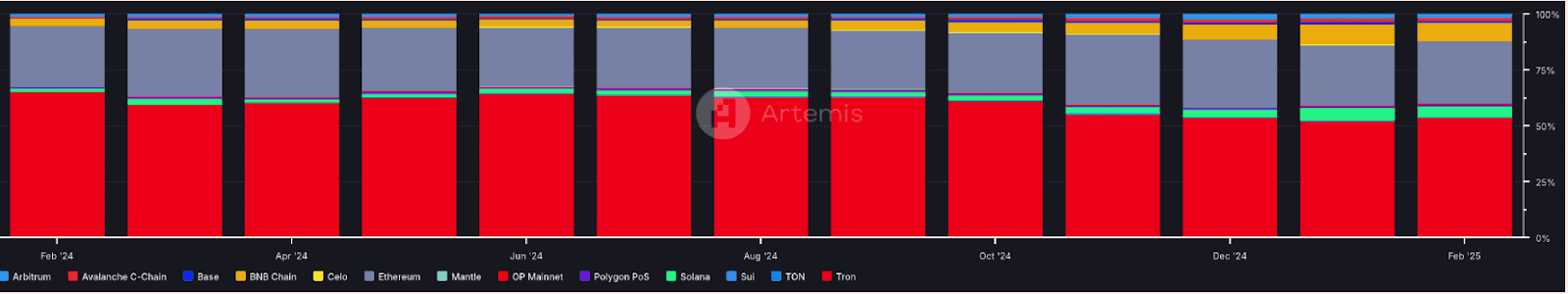

However, the dominant network for retail users is Tron, likely due to the low transaction costs and high supply of stablecoins on that blockchain-about $62 billion at the time of writing.

Using different networks for P2P transactions with stablecoins:

Glassnode believes that the main drivers of growth in this sector are institutional interest, the proliferation of payments using stablecoins, and demand from DeFi.

The analysts noted that the volume of transactions using these instruments will reach $30 trillion in 2024. By comparison, Visa’s transaction volume in the same period was $15.7 trillion and Mastercard’s was $9.8 trillion.

In addition, the number of stablecoin holders has reached 150 million at the time of this writing, up from an estimated 100 million as recently as April 2024.

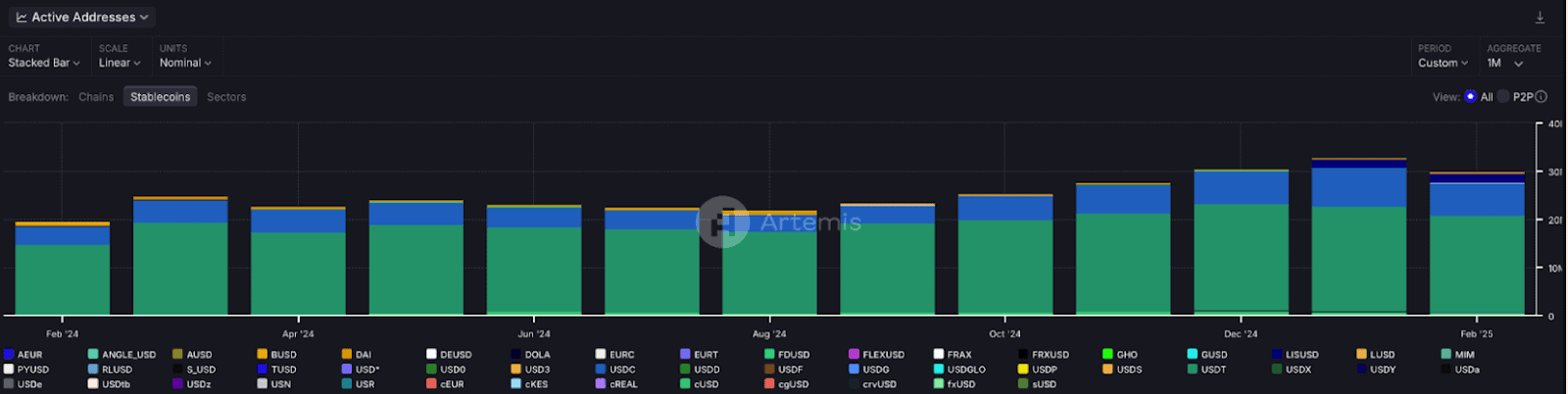

The number of active addresses also shows positive dynamics – in 2024 the indicator grew by 53%. Against the backdrop of the growing supply of stablecoins, these metrics confirm the interest of users in these instruments.

Stablecoins are positioned as a bridge between digital and traditional finance, as well as a “safe haven” for the cryptocurrency market. This is largely due to the fact that the value of these instruments is tied to fiat currencies – primarily the US dollar.

For investors, stablecoins have become a convenient way to exit risky positions. Instead of converting to traditional currency, which requires interaction with banks and takes a long time, traders transfer funds into these tokens, keeping the value denominated in fiat. This allows you to stay in the crypto market but protect your capital from volatility.

Essentially, stablecoins eliminate the complexities and delays associated with traditional banking – you can lock in profits in the digital equivalent of a dollar and then transfer them into a new asset at any time.

In addition, many platforms charge higher fees for trading with fiat currencies and offer more trading pairs with stablecoins. Coupled with DeFi’s ubiquitous support for digital assets, traders have many more opportunities to exchange and make money by holding stablecoins instead of traditional money.

Switching to fiat currency also means withdrawing capital from the crypto market, so the growing popularity of stablecoins may indicate that users are not looking to end their involvement in the industry, but are simply seeking a safe haven while uncertainty reigns in the market.

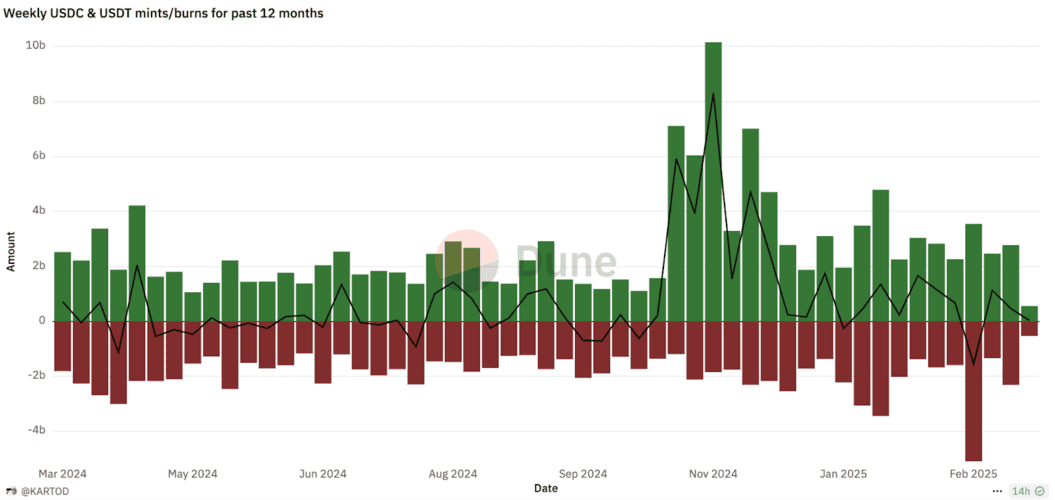

Thus, January-March 2025 saw an increase in the number of holders and the supply of stablecoins. At the same time, relatively small amounts of token redemptions were recorded last year, which were repeatedly compensated by the issuance of new tokens.

Another incentive for capital owners is taxation – in some countries, the conversion of cryptocurrencies into other digital assets, including stablecoins, is not formally a taxable event. This allows investors to postpone the declaration of income and payment of relevant fees until the moment of withdrawal of capital into fiat.

However, it should be noted that the Internal Revenue Service (IRS) equates the sale of cryptocurrencies for stablecoins with the exchange for dollars. This means that such a transaction entails the obligation to report profit or loss, so for investors from the United States, stablecoins are no longer a “gray area”.

Another advantage of stablecoins compared to fiat savings is the yield. Thus, the maximum yield of American bank clients is about 4.5% per annum and this is in the presence of a special account and special service conditions.

At the same time, even relatively low-risk lending platforms such as Compound or JustLend can offer stablecoin holders up to 8% per annum at the time of writing. In addition, the user has the flexibility to manage profits and risks by using other methods of earning, such as providing liquidity.

In general, the growth of stablecoin supply is seen as a sign of investors’ optimistic long-term expectations, indicating their desire to retain the ability to invest capital quickly in the event of changing market conditions.

Stability is profitable

For stablecoin issuers, creating tokens tied to traditional currencies is a profitable business, especially in light of rising interest rates in the United States.

The business model of most of these companies is based on receiving fiat currency from users, issuing tokens, and then reinvesting the accumulated funds. Typically in US Treasury bonds and other liquid assets.

Share of stablecoins with different types of collateral:

With the U.S. Federal Reserve rate at 4% per year, these reserves generate enormous interest income – each additional $1 billion in circulation generates ~$40 million in annual revenue.

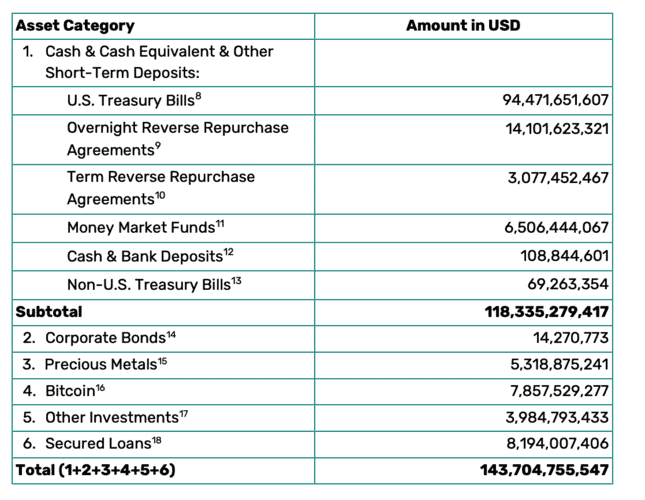

The market leader, Tether, has essentially become one of the most profitable organizations in the crypto industry (and beyond), generating $13 billion in net income in 2024. By comparison, BlackRock, which manages $11.6 trillion in assets, will only earn about $6.4 billion over the same period.

At the same time, Tether held $95 billion in U.S. Treasuries as of Dec. 31, 2024, which is comparable to Germany’s investment in the instrument, which ranks among the top 20 foreign holders of U.S. government debt.

In addition to bonds, the company invests some of its funds in gold and bitcoin, which will give it an additional $5 billion in profits from the growth of these assets in 2024.

Assets on Tether’s balance sheet:

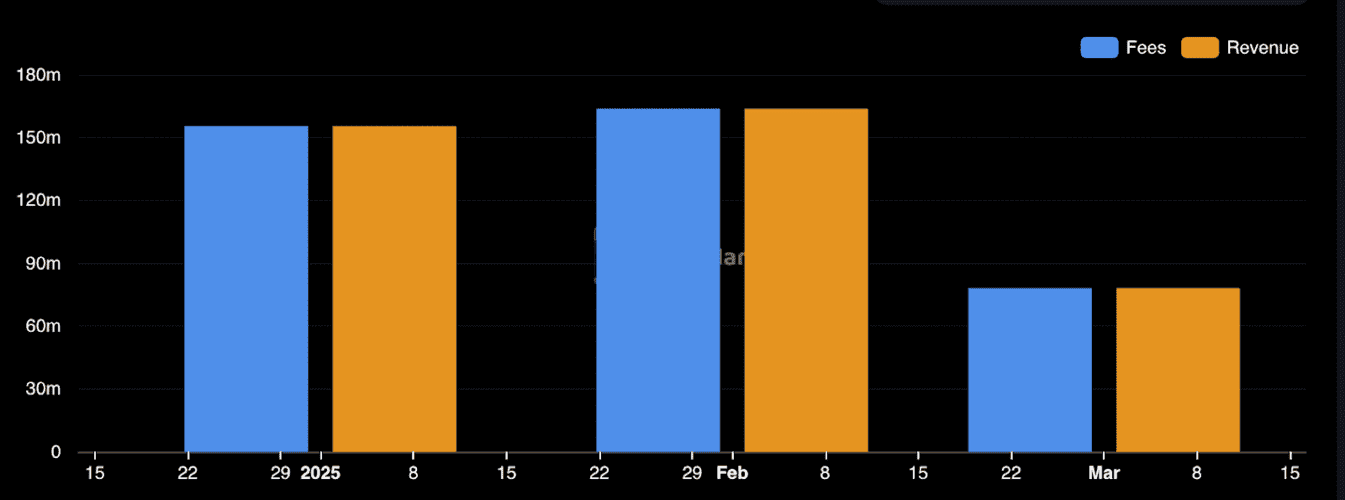

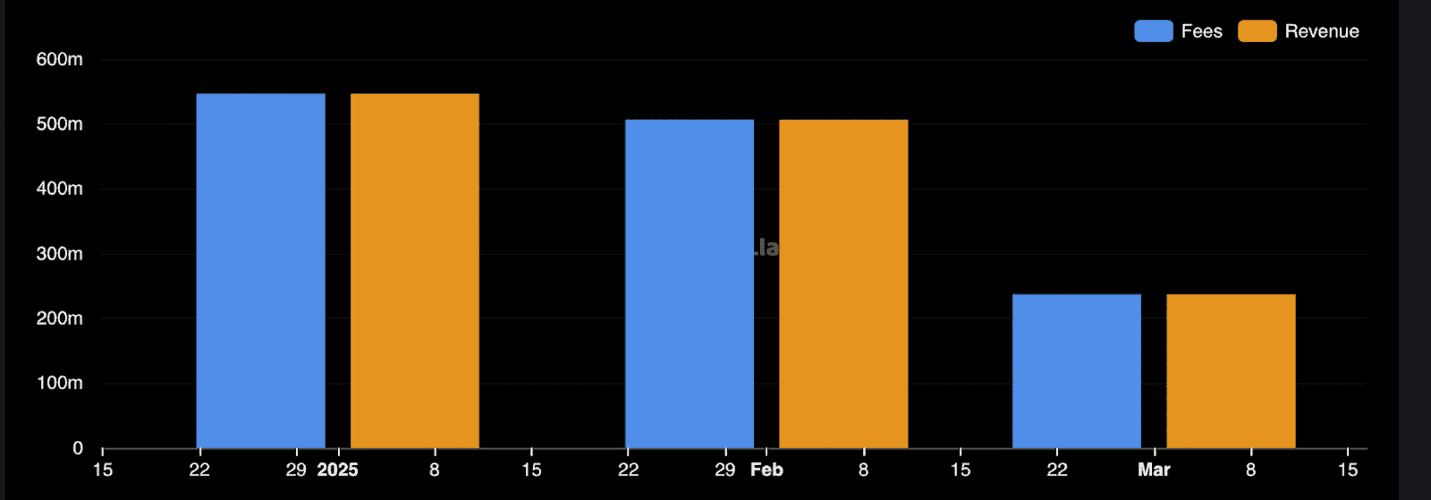

According to DeFiLlama, Tether’s main competitor, Circle, has earned about $400 million in interest payments on investments since the beginning of 2025 alone. Together, the two companies have generated more than $1.7 billion in revenue.

Circle’s monthly income in 2025:

Tether’s monthly income in 2025:

In essence, the monetization model of steblecoins is similar to the banking model: the issuer attracts “deposits” in exchange for tokens and places them at an interest rate that generates profit. But unlike banks, these companies do not need to make payments on deposits, which significantly reduces operating costs and increases margins.

The issuer’s primary obligation – to redeem the token at face value – also requires the company to maintain sufficient liquid capital to do so, and imposes certain restrictions on the reinvestment of funds raised. Banks are also subject to similar collateral requirements for their deposits.

On the other hand, stablecoin issuers pay a portion of their revenues to banks in the form of commissions, since the collection and subsequent reinvestment of fiat funds is only possible through a bank transaction.

It is noteworthy that the need for constant cooperation between credit organizations and stablecoin issuers creates for the latter risks associated with problems in the financial system. For example, during the bankruptcy of Silicon Valley Bank, where Circle held part of its reserves, USDC faced depeg due to suspicion of insolvency of the issuer.

In any case, such substantial revenues are attracting new players to this segment who have the infrastructure or user base to launch their own stablecoins.

For example, in August 2023, PayPal launched the PayPal USD (PYUSD) stablecoin in partnership with Paxos. PayPal became the first major fintech company from the US to create a dollar stablecoin for mass use.

It is worth noting that previous attempts by bigtech to create its own payment instrument were met with active resistance from the authorities. Facebook’s Libra (Meta) project, announced in 2019, was effectively stopped by the regulators due to the threat to financial stability, while PayPal, which has a more neutral reputation, managed to harmonize its steiblcoin with the New York State Department of Financial Services (NYDFS).

The change in attitude of the authorities is probably due to the relatively small volume of PYUSD – about $720 million at the time of writing, which is significantly below the performance of the market leaders. However, the launch of PayPal USD has attracted the attention of the US Securities and Exchange Commission.

Another notable entrant is Ripple Labs. In December 2024, Ripple received permission from the NYDFS to issue a dollar stablecoin, RLUSD. However, this token is primarily aimed at institutional clients who need full regulatory certainty.

In addition to PayPal and Ripple, several other notable stablecoin-focused projects have been launched in the past two years. For example, in the midst of BUSD’s troubles, the First Digital USD (FDUSD) token, launched by Hong Kong-licensed trust company First Digital with over $1.8 billion in offerings at the time of writing, has emerged as an alternative.

At DeF, Ethena USD (USDe), an algorithmic stablecoin backed by derivatives on digital assets such as bitcoin, Ethereum and tokenized Treasuries, rose to prominence. USDe supply grew from $100 million to nearly $6 billion in 2024, although it has declined slightly to $5.4 billion at the time of writing.

Stablecoins also increased in 2023-2024, with pegs to other national currencies. For example, BiLira launched the TRYB token with a peg to the Turkish lira, and Colombia launched instruments pegged to the peso. Euro coins are in relatively high demand. However, none of these alternative currencies can yet shake the position of dollar tokens.

The emergence of new players is diversifying the market structure, although Tether’s leadership seems unassailable in the short term and can only be undermined by unfavorable regulatory changes.

In addition, competition and diversification of approaches to customer acquisition are leading to the emergence of new products, such as payment cards linked to stablecoins.

Beyond the crypto industry

The development of the stablecoin sector in recent years can be explained not only by the dynamics of the crypto market, but also by the expansion of the scope of these instruments. While initially tokens linked to fiat currencies were seen as a convenient tool for traders or a way to provide liquidity to the market without involving banks, today they are used in traditional finance and economics.

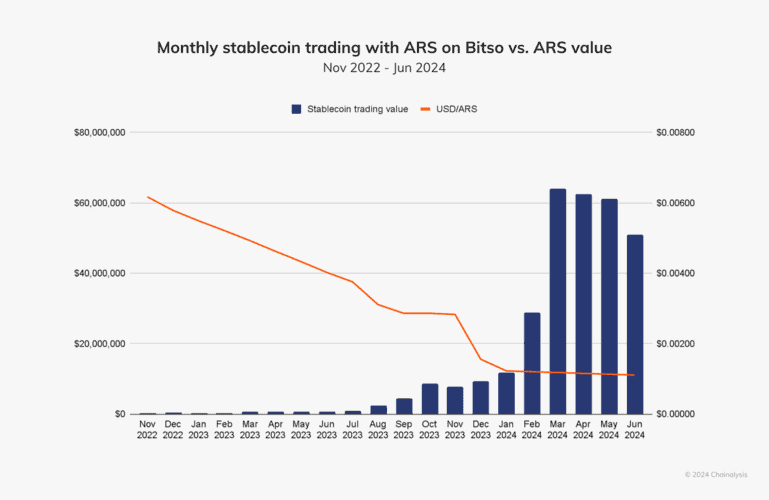

For example, in countries experiencing currency instability and hyperinflation, dollar-stable coins have become a tool for the population to protect their savings. Citizens of Argentina, Turkey, Venezuela and a number of African countries transfer their savings into such tokens to protect them from the depreciation of their national currencies.

According to Chainalysis, after the 50% devaluation of the peso as part of Javier Miley’s government’s “shock therapy,” the volume of stablecoin trading in Argentina hit a record high, peaking at more than $10 million per day. At the same time, Argentina accounts for nearly 62% of the volume of stablecoin transactions in Latin America.

Stablecoin transaction volume and argentine peso exchange rate:

The situation in Turkey is similar: with inflation of 38-60% observed in 2023, Turkish citizens tended to convert liras into US dollars. Even in the absence of formal restrictions on such transactions, the official exchange rate often differed significantly from the real one. Therefore, people had to use the services of crypto exchanges and P2P platforms, where they could get the digital equivalent of the currency at the market price.

In the situations described above, people are actually using stablecoins as a dollar surrogate to preserve purchasing power in an environment where local money is depreciating literally every day.

There is also a less attractive side to using stablecoins. Their main feature – the ability to move value outside the banking system – has attracted the attention of under-sanctioned countries and companies looking for workarounds to international payments.

For example, in April 2024, U.S. senators sent a letter to the Treasury Department alleging that USDT had become a preferred tool for circumventing sanctions. In particular, the token allegedly allowed Russian companies to buy components for drones and other equipment. Another example is Venezuela, whose oil producers began exporting commodities in exchange for USDT amid U.S. sanctions.

The practice of using cryptocurrencies for international settlements amid economic sanctions is widespread in Russia, Venezuela and a number of other countries. Analysts also note that digital assets, and stablecoins in particular, are also being used by ordinary citizens for capital withdrawals, cross-border transfers and payments for goods.

However, such cases attract the attention of U.S. regulators: the Treasury Department and the Department of Justice have begun tracking stablecoin transactions to identify wallets associated with individuals caught up in sanctions programs. From time to time, Tether blocks certain addresses on the OFAC sanctions list.

In addition to extreme scenarios, stablecoins are beginning to enter the mainstream economies of developing countries. For example, in many African countries, retailers are using USDT and USDC as a means of payment or store of value – stablecoins account for about 43% of all crypto transactions in the region. Analysts have also noted that USDT-pegged tokens are being used by local businesses as a substitute for fiat currency due to the difficulty in obtaining it.

In addition, many issuers and some crypto exchanges, such as Coinbase, offer ready-made solutions to quickly integrate stablecoins into businesses’ operations.

Another important area is cross-border remittances for migrant workers – instead of using Western Union or SWIFT, they can send stablecoins to their families via cryptocurrency, which will be faster and cheaper. Visa and Mastercard are integrating support for stablecoins and related services and products through pilot programs to ensure that these financial flows are not lost.

Cases like these illustrate the changing perception of stablecoins – from being a tool to allow the crypto market to seamlessly use fiat currencies, it is now a blockchain infrastructure that even TradFi representatives are using.

The popularization of stablecoins among both retail and institutional users, as well as the expansion of their scope, is leading to a global transformation of the industry.