For most users, digital assets are associated with speculation, quick profits, or long-term holding of “reliable” coins like Bitcoin. However, today cryptocurrency is a developed and multi-layered industry that offers income opportunities for both seasoned investors and newcomers with minimal blockchain experience and limited starting capital.

In this guide, we will explore the most common ways to earn in the crypto industry for beginners, covering various difficulty levels, deposit requirements, and previous experience.

The Principle of DYOR and Its Importance for Beginners

Any activity in the crypto industry involves interacting with financial instruments and services. To reduce risks and better understand what you’re engaging with, it’s important to apply the DYOR (Do Your Own Research) principle. It helps you develop your own evaluation method for projects and opportunities instead of relying on someone else’s advice.

This is especially critical for beginners, who may be unaware of how widespread fraud, covert marketing, and theft are in the blockchain industry. Learning how to search for and analyze information, as well as critically assess public opinions, helps preserve capital and use it more effectively. That’s why diving into digital assets should start with mastering DYOR.

Given the wide variety of crypto activities, let’s categorize them to make them more accessible for newcomers, highlighting their pros and cons.

Activity on Centralized Exchanges

Participating in various exchange events. Earning rewards for simple tasks (quizzes, promos, campaigns, etc.).

Pros:

- Low or no financial cost

- Low risk

- Simple tasks

Cons:

- Some promotions are one-time only

- May require a small starting deposit

Centralized exchanges allow not only speculative trading but also give newcomers a chance to earn their first tokens. For example, bonuses in USDT, vouchers for trading, and fee discounts are often offered for registration or event participation.

Platforms like Binance Academy offer rewards for learning and passing quizzes, while exchanges like Bybit frequently run promotional campaigns with financial incentives.

Ambassador and Referral Programs

Promoting projects, attracting users via referral links, content creation, engaging with communities, etc.

Pros:

- No expenses

- No financial risk

- Opportunity to join a project team

Cons:

- Requires an audience or content creation skills

- Can be time-consuming

- Rewards are not always clear upfront

Ideal for influencers or content creators, ambassador programs involve promoting a project through content and social media engagement. Rewards are usually in stablecoins or tokens, and range depending on effort and reach.

Referral programs reward users for attracting others via links, commonly used by crypto exchanges to share trading fee commissions or deposit bonuses.

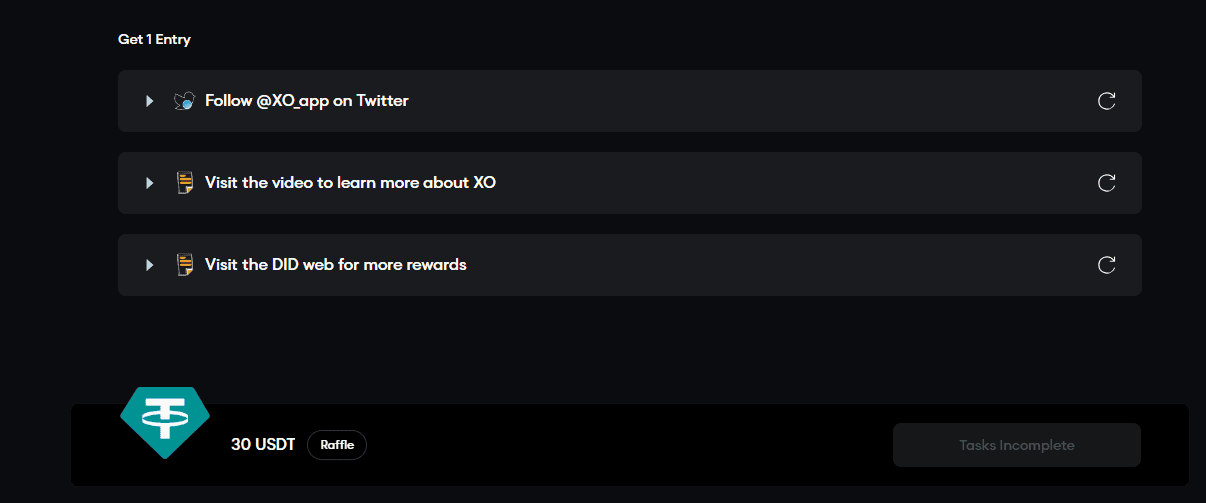

Quest Campaigns and Giveaways

Completing social media tasks, entering crypto prize draws.

Pros

- No expenses

- No risk

- Quick to participate

Cons:

- High competition

- Rewards not guaranteed

Projects use platforms like Galxe, Zealy, Intract, Gleam, and others to run quests and giveaways. These often lead to airdrops. While simple, these tasks attract many participants, so rewards are small and not guaranteed.

Airdrop Hunting

Interacting with projects, testing products, joining campaigns, providing liquidity, on-chain operations, etc.

Pros:

- Opportunities available for various deposit sizes

- Improves blockchain interaction skills

- Potential for significant returns

Cons:

- High competition

- No guaranteed rewards

- Might not meet airdrop criteria

- Activities can take months or years

Airdrop hunting involves active participation in projects with the goal of earning free tokens. There are multiple formats:

Using the service

Involves real blockchain interaction with minor fees or token purchases. Projects often reward this activity with points that later convert into tokens.

Testing

Involves testnets that don’t use real assets. Some testnets are rewarded directly with tokens, others may only improve your chances later.

Testnets are useful for both beginners (to gain experience safely) and advanced users (who can earn by reporting bugs).

Node Running

Nodes are essential parts of decentralized networks and are rewarded in some projects.

Pros:

- Potential rewards from operating nodes

Cons:

- Requires technical skills

- Hardware and hosting expenses

- No guaranteed income

Node operators must maintain uptime and security. While it can be profitable, the entry barrier is higher compared to other activities.

Play-to-Earn Projects

Mini-games on platforms like Telegram (e.g., Notcoin, Catizen) that reward players with tokens.

Pros:

- Low-risk, beginner-friendly

- No investment needed

Cons:

- Time-consuming

- Rewards may vary

Trading

Buying and selling crypto assets or derivatives.

Pros:

- Potential for high profits

- Multiple strategies available

Cons:

- Requires skills and knowledge

- Requires starting capital

- High risk

Trading includes:

- Spot trading (buy/sell assets directly)

- Margin trading (with leverage)

- Derivatives trading (futures, options)

- Meme tokens trading

Beginners should invest time in learning before risking real funds.

DeFi Tools

Earning through staking, liquidity provision, lending, etc.

Pros:

- High potential earnings

- Use of decentralized systems

Cons:

- Requires advanced knowledge

- Requires capital

- Security and user-experience risks

DeFi expands income options for crypto holders but demands a deeper understanding and tolerance for risk.

Public Token Sales

Buying tokens before they’re listed.

Pros:

- High profit potential

Cons:

- Requires research and capital

- Market risk

- Many scams

Token sales (ICO, IEO, IDO) require a deposit, and often reputation (such as Coinlist scoring). The market cooled in 2023–2024, making DYOR even more critical.

Premarket Trading

Selling or buying tokens (or points) before they’re publicly tradable.

Pros:

- High profit potential

Cons:

- Requires research

- Requires capital

- Risk of fund lock-up

Services like Whales Market allow these deals. Sellers guarantee income, buyers hope for cheaper tokens before market listing.

Launching Your Own Memecoin

Create a meme token via platforms like pump.fun or Raydium Launchpad.

Pros:

- Low entry cost

- Easy to launch

- High upside if successful

Cons:

- Requires time and promotion

- Risk of financial loss

- Needs understanding of crypto culture

If the token gains attention and demand, early creators can profit from their initial low-cost holdings.

Working in the Crypto Industry

A conservative method is to use your skills to get a job in Web3 (developers, managers, analysts, moderators, etc.). Services like Bondex and social platforms often list openings.

How to Start Earning as a Beginner?

Start by gaining knowledge and choosing a path with minimal risks. For example, educational campaigns or airdrops are great entry points.

Basic steps for a beginner:

- Learn about the crypto industry

- Choose a direction that fits your goals

- Find up-to-date news and step-by-step guides

- Do thorough research before committing

- Take action and build experience

The key is combining theory with real-world practice. Your results will depend on your knowledge and efforts.

Starting with $100

A small deposit allows access to most activities — from trading to airdrop participation. However, choose based not only on budget but also on skills and risk tolerance.

Trading can be profitable but is risky without experience. Airdrop hunting or testnets may be a better choice — they’re cheaper, safer, and educational.

Conclusion

The crypto space offers many earning opportunities for beginners and pros alike. But each method requires preparation and research skills.

By investing time into learning and gradually applying your knowledge, you’ll increase your chances of success — and build real value in this fast-growing ecosystem.