80% of Portfolio in fundamental coins gives a better shot at 10x returns. But 20% of Portfolio in degen plays is more likely to deliver 100x.

This market forces us to be flexible. If you were expecting an altseason in the summer but now realize it might come in the fall/winter/next year, you HAVE to work with your positions.

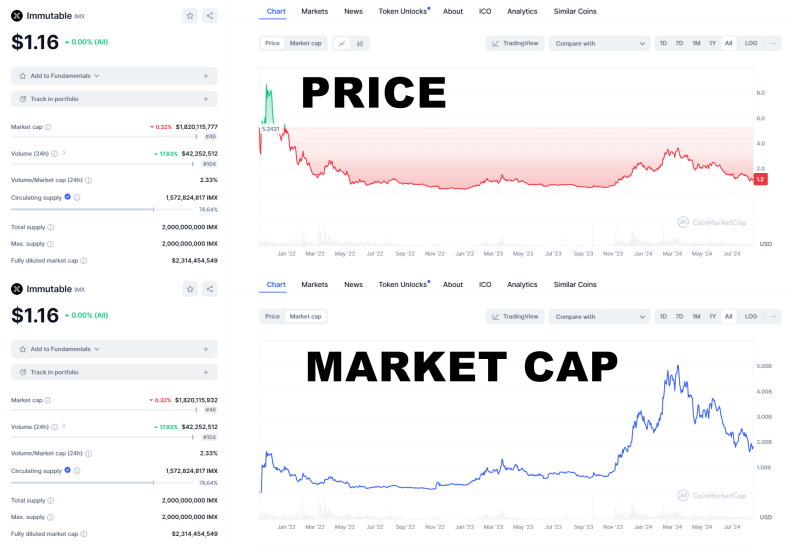

1. Market cap is rising while prices are falling

Few people notice this, but it shouldn’t be overlooked. The $IMX chart illustrates this perfectly.

The price is still far from its ATH, yet the market cap is already significantly higher than it was at the ATH price. As unlocks continue to happen, it’s important to consider this factor when choosing which coin to invest in for the altseason.

Market cap doesn’t necessarily have to grow. The coin should have potential for further growth, considering the market capitalization expansion.

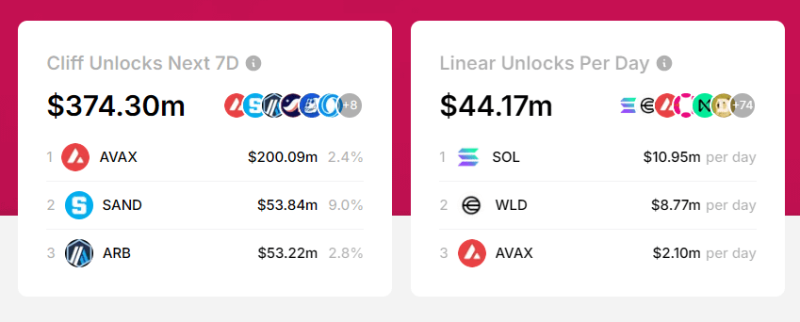

Either the next unlocks should either be long after the altseason begins. But I think at the start of the altseason, most will wonder why their coin isn’t pumping? You guys probably forgot to check the market cap.

Portfolio management: The 80/20 approach

The current market is very different from what we’ve seen before. The altseason is NOT PUMPING ALL coins at 100x.

– 80% of the portfolio in strong, fundamental coins

– 20% in degen play and venture ideas

Referring back to the initial thought:

➜ Allocating 80% to fundamental coins offers a higher probability of returns with significantly LOWER risk.

➜ Investing the remaining 20% in degen play: high-reward plays could either result in rekt or gain 10-100x returns.

If 80% of your investments are successful (they MUST be successful, you MUST reduce risk), then losing the initial 20% still leaves you with a substantial profit. Even if just one position out of the 20% is successful, you can earn as much as you would with your 80% in fundamental coins.

Here’s a simple example:

✓ With $8,000, you buy a fundamental asset and achieve a 10x return, resulting in $80,000.

✓ With $2,000, you invest in 10 memecoins at $200 each. If one of them gives you a 500x return and the others are worthless, your profit is ~$100,000.

At the peak of the alt season, your total portfolio will be $180,000.

Yes, it’s a rough calculation and being lucky helps, but you:

➜ Properly allocated capital

➜ Reduced risk

➜ Secured 1,000x chances

➜ Remained profitable regardless

When is altseason coming?

– Geopolitics is affecting crypto more than ever

– There are many experienced participants in the market

The mass adoption we’ve been dreaming of is ultimately what’s ruining us. As a result, the manipulator/big player needs more time to execute their plan to extract money from the market.

The market will start to rise out of total frustration; however, I am not seeing that yet. Here are the two options I am considering:

Option #1

Altseason: Fall 2024 – Winter 2025.

That is, it will roughly repeat the pattern of the last cycle.

Option #2

Altseason: Spring 2025 – Summer 2025.

Many people will likely dislike this option and provide numerous reasons why it won’t work. Ultimately, it’s up to you, guys. Better always adapt to the market and adjust your decisions based on the situation.

Why it is important to be flexible

Being flexible helps you stay psychologically calm during market turmoil and euphoria, reducing the likelihood of mistakes. Often, people strongly believe in one investment, put all their money into it, and refuse to consider other important factors.

Your coin is about to unlock another 50% of its total supply, but the altcoin season is nowhere in sight. It is worth thinking about, perhaps it is time to abandon this position if you are not sure about the future prospects.

The market is cyclical but evolving. Most investment books are outdated, and it’s important to recognize this. If your goal is to maximize capital annually rather than just making long-term $BTC purchases for a wealthy retirement, you need to be flexible.

I’m in this market to grow my capital, which is why I monitor and analyze market trends every week to make timely decisions. Don’t blindly follow others’ advice, and avoid becoming a stubborn maxi.