In April 2025, the Raydium team introduced LaunchLab — a dedicated launchpad for creating and initially listing new assets. We explored how LaunchLab works and what fundamentally new opportunities it offers users.

What is LaunchLab and how does it work?

On April 16, 2025, the Raydium team launched LaunchLab, a platform for creating tokens on the Solana network.

Introducing LaunchLab, Raydium's all-in-one token launchpad.

Built for Creators, Developers, and the Community 🫡https://t.co/yZVzShVZSJ

More info ⬇️ pic.twitter.com/r6s1DAegWf

— Raydium (@RaydiumProtocol) April 16, 2025

LaunchLab offers a basic set of tools for creating, launching, and promoting new assets. Users can launch their own tokens and receive a share of the trading fees without any technical knowledge, all through an intuitive interface.

As with most other “memepads,” token launches on LaunchLab use a bonding curve mechanism — a liquidity pool that stores the trading pair’s assets and through which users make purchases. As funds accumulate and demand grows, the system automatically adjusts the token’s price.

Bonding Curve Mechanics

Once a certain market cap threshold is reached — 85 SOL — the pool closes: the funds and remaining tokens are moved to the decentralized Raydium exchange. LP tokens are burned, and trading continues under standard AMM conditions.

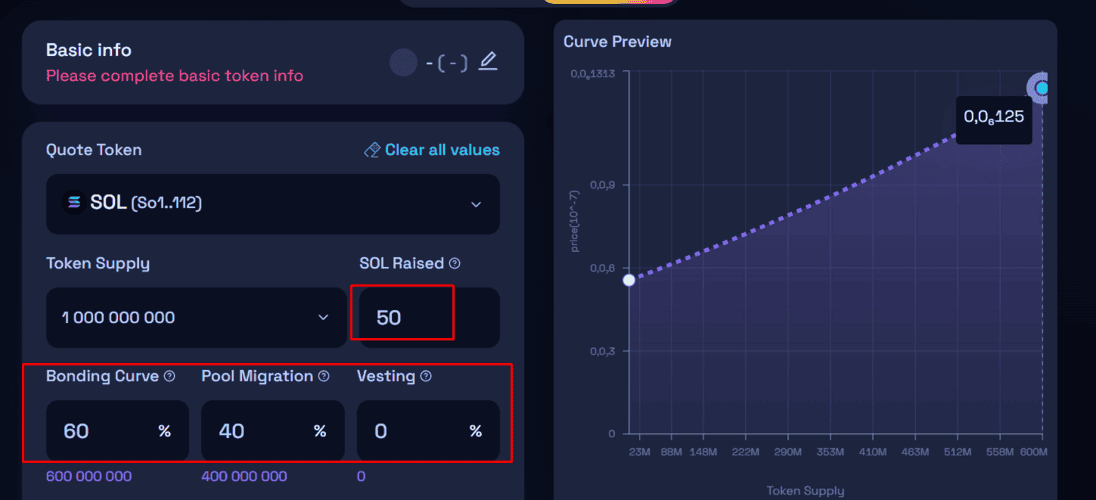

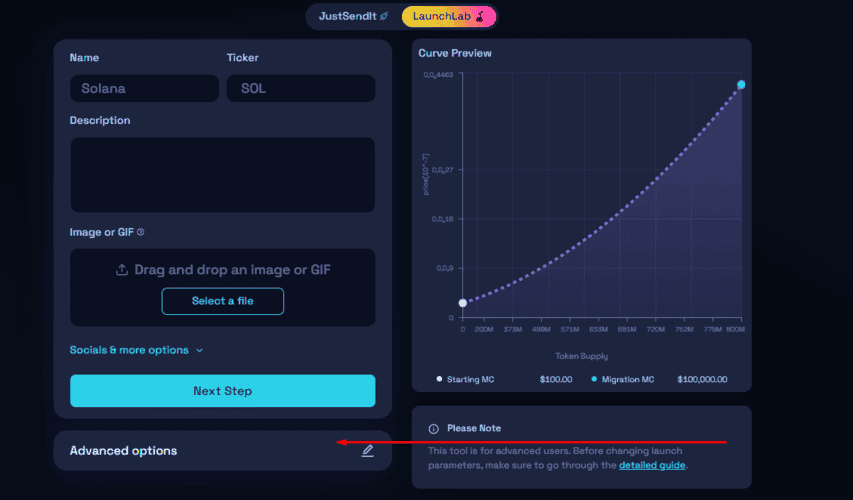

LaunchLab also supports an advanced mode, where token creators can customize pool parameters. These are visualized through a price curve: the X-axis represents total supply, and the Y-axis shows the asset price. This format allows flexible tokenomics and control over launch dynamics.

For example, with a total supply of 1 billion tokens, the curve may be set so that 80% (800 million tokens) are sold for 85 SOL. At this point, the token price reaches ~0.000000425 SOL, and the market cap is around 425 SOL. The remaining 200 million tokens and collected SOL are transferred to a liquidity pool on Raydium.

Each memecoin launched via LaunchLab has its own bonding curve progress scale. To migrate to the main pool, the token must pass through three stages:

- Heating up — market cap reaches ~$21,000

- On fire — ~$39,000 (around 65% progress)

- Graduate — ~$57,000 (450 SOL), triggering migration to Raydium.

A chart displays the token’s current status, remaining tokens for sale, target metrics, and real-time progress.

LaunchLab also includes a referral program — traders can generate a referral link via the Share button. If someone clicks the link and makes a purchase, the referrer earns 0.1% of the amount, paid in SOL or the paired token depending on the pool conditions.

LaunchLab Features and Interface

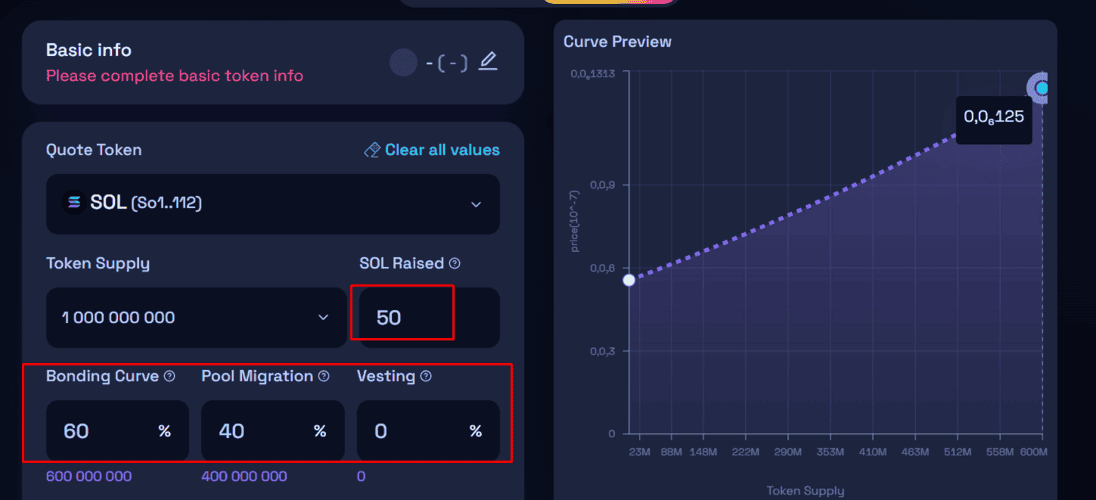

LaunchLab is available directly on the Raydium website, making access seamless. While the interface may initially seem overloaded, it becomes intuitive with brief use:

- The left panel displays recent purchases with amount, logo, ticker, and market cap — making it easy to track trader activity;

- When a memecoin reaches ~$39,000 in market cap (under default settings), it is automatically promoted to the top position and stays there until overtaken;

- The right panel shows newly created tokens. Clicking any notification navigates to the token’s page with chart, metrics, and trading tools.

The next block is the main dashboard, offering:

- Sorting by: latest trades, newly created tokens, and market cap (descending);

- Search by name, description, or contract address;

- Display settings: toggle animations, NSFW filter;

- Watchlist — a list of favorite tokens;

- Platforms filter — by token creation source (Raydium, cook.meme, Pump Fun Robinhood, etc.);

- Refresh button — updates the token list;

- Profile — tokens associated with the user’s wallet;

- Launch token — tool for launching new tokens (detailed below).

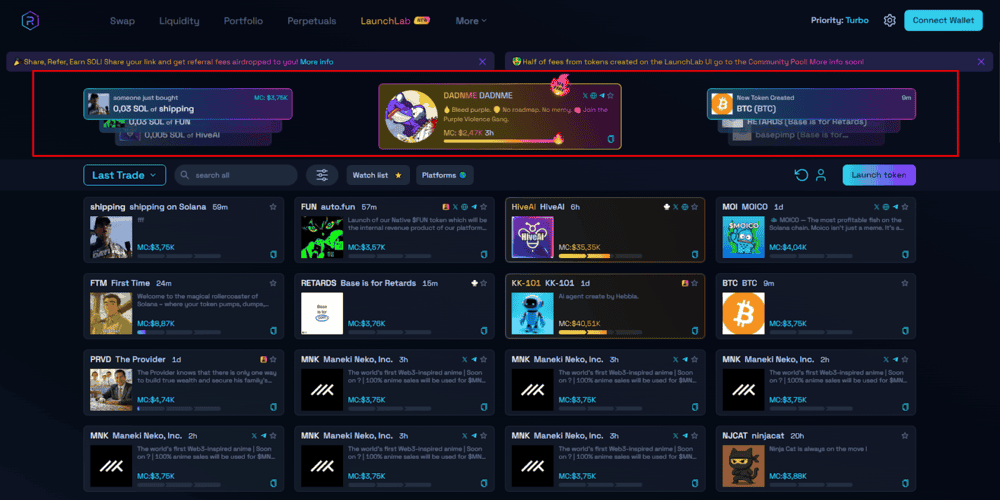

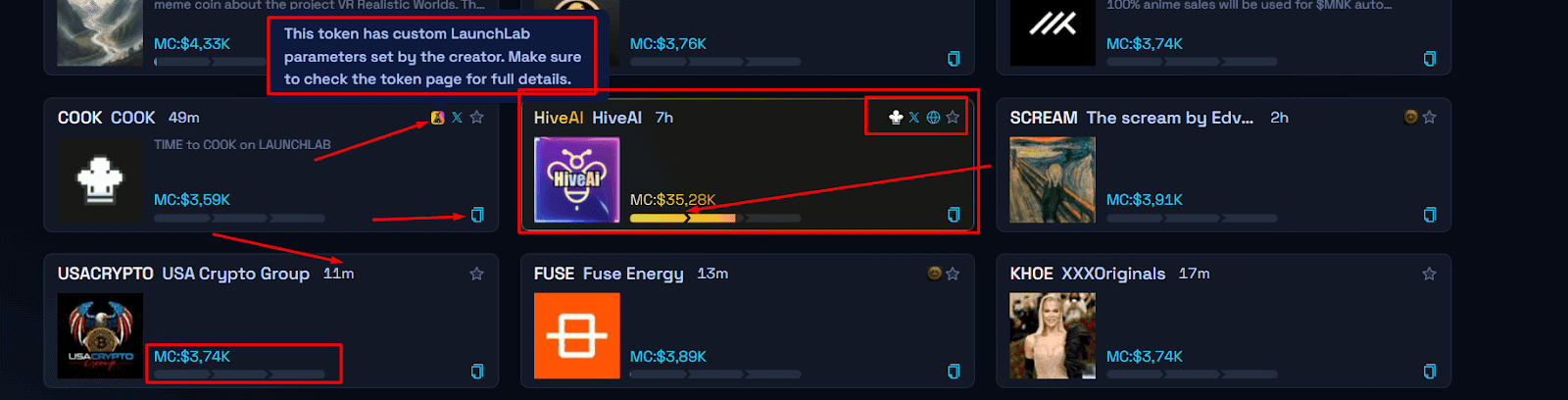

Memecoins are displayed as cards, showing:

- Time since creation;

- Logo, name, ticker, brief description;

- Buttons to the project’s website, X (Twitter), Telegram;

- Star icon to add token to Watchlist.

Also displayed is the platform used to create the token. If the developer modified default settings (e.g., added vesting, cliff, or custom migration conditions), a special icon marks this non-standard configuration.

At the bottom of each card is market cap info and bonding curve progress. Active stages are highlighted in yellow. The contract address can be quickly copied from the right corner.

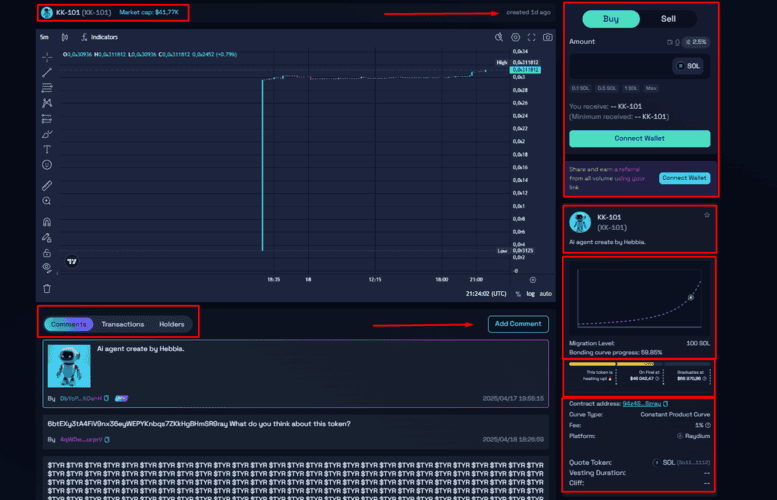

The token page resembles the pump.fun interface, with key differences. At the top: logo, ticker, name, market cap, and time since creation. Below: a chart and three tabs:

- Comments

- Transactions

- Holders

Next to these is a comment input field. On the right is the trading window, where users can buy/sell tokens, set amounts and slippage tolerance.

Below the trade panel is the token description. Further down: the bonding curve showing price dynamics versus demand, the target for migration to Raydium, and a visual progress bar.

At the bottom: technical details — contract address, curve type, trading fee, issuing platform, paired token, and vesting/cliff parameters if applicable.

How to Launch a Token on LaunchLab?

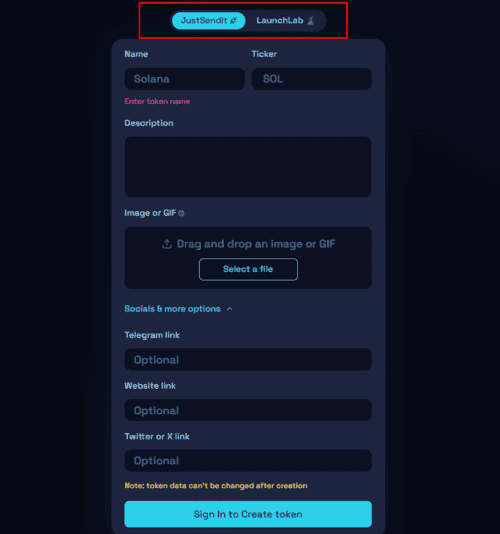

LaunchLab provides two creation modes:

- JustSendIt (simple)

- LaunchLab (advanced)

The simple mode allows quick token creation without technical details. You only need to enter:

- Name

- Ticker

- Description

- Logo (GIF or WebP — PNG not supported)

- Optional: website and social links

After filling the fields, you must either deposit SOL for the initial purchase or choose to launch without one.

The token gets a basic info page but remains hidden from others until you pay ~0.026 SOL to create the trading pair. Only then does it appear in the interface and become tradable.

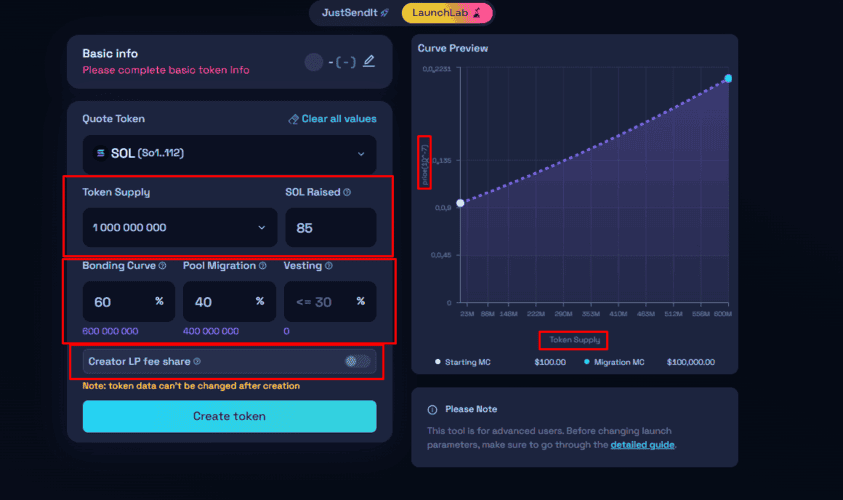

The LaunchLab mode offers advanced customization. In the Advanced options tab, you can configure:

- Token Supply — 100M, 1B, or 10B tokens (default: 1B);

- SOL Raised — amount to accumulate in bonding pool to trigger migration (default: 85 SOL);

- Pool allocation — % of tokens going to bonding pool (51–80%). The rest goes to Raydium post-sale; e.g., 60/40 split of 1B tokens → 600M to initial pool, 400M to Raydium;

- Vesting — optional token lock (up to 30%). Default: 0%; If set to 10% with a 60/40 split, only 30% go to Raydium, 10% are locked. You can set a vesting period and optional cliff (delay before unlock starts);

- Creator LP fee share — lets token creators earn AMM fees. If enabled, a CPMM pool is created post-migration: 90% of LP tokens are burned; 10% go to the Burn & Earn program;

The creator receives an NFT called Fee Key, granting 10% of the pool’s trading fees, which can be withdrawn anytime while the NFT is in the wallet.

This system gives creators flexible control over tokenomics and a direct financial incentive to promote and maintain the liquidity pool.

Conclusion

The launch of LaunchLab confirms Raydium’s ambition to maintain its leadership in the Solana ecosystem. The platform provides both a simple interface for memecoin creation and advanced features for fine-tuning, giving developers control over tokenomics, liquidity, and even access to trading fee revenue. With AMM integration and a bonding curve mechanism, LaunchLab is a full-fledged toolkit for early-stage asset launches.

The project aligns well with the ongoing memecoin resurgence, offering market participants easy and accessible tools to get involved. At the same time, it remains open to both beginners and advanced users who value configuration flexibility and transparent mechanics.