Have you ever bought at the top and sold at the bottom? Or forgotten to take profit and ended up with $0? It’s not because you’re dumb—it’s because you might not be aware of basic cognitive biases.

Anyone who has been in crypto for at least 6 months has likely experienced:

- Buying at the top and selling at the bottom.

- Not accepting a 10% loss and ending up with a 99% loss.

- Forgetting to take profit and ending up with $0.

It’s normal to make such mistakes the first time, but not the second. To achieve success, you need to learn from your mistakes. Understanding these essential cognitive biases will give you the awareness to avoid them. Here are the 20 cognitive biases I use daily to improve my trading:

1. Narrative Bias

Human psychology is predisposed to sensational stories. That’s how the real world works, and that’s how it works in crypto too. Some coins explode just because of their stories. Pay attention to the narratives driving a project—don’t ignore the power of a good story, but don’t let it blind you to the data.

2. Motivating Uncertainty Effect

The motivating uncertainty effect drives people toward uncertain rewards, leading them to invest in high-risk plays. Always remember your risk management and apply it to every transaction, from small to large. Don’t let the allure of uncertainty override your strategy.

3. Unit Bias

People, especially newcomers in crypto, prefer to buy a ‘whole unit’ of a token rather than a fraction of it. Don’t overestimate a token just because it’s cheaper. If you think this way, it’s better to understand how market cap (MC) works before making decisions.

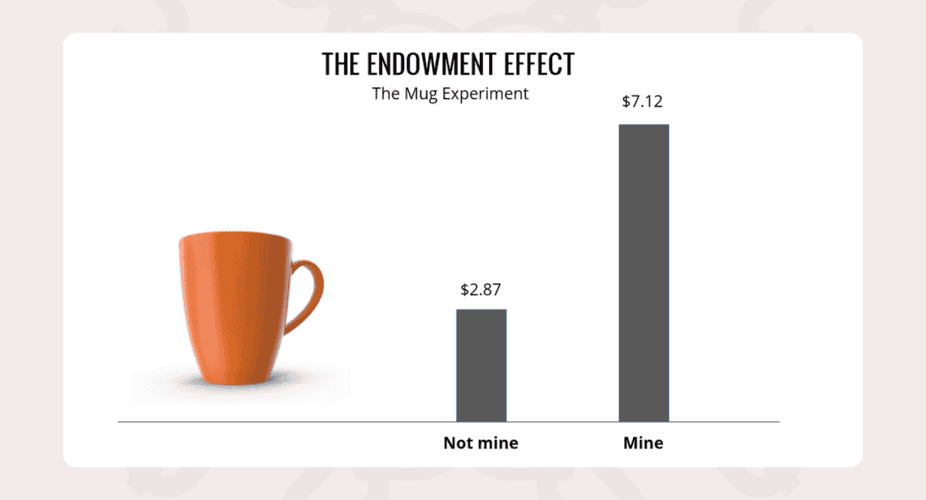

4. Endowment Bias

There’s an experiment where 90% of people refuse to sell a $1 cup for $5 simply because it’s theirs. Don’t get emotionally attached to a project; we’re here to make money. Ask yourself: If I didn’t own this token, would I invest in it now?

5. Self-Serving Bias

Self-serving bias means thinking that successes are your genius, while failures are someone else’s fault. Don’t blame anyone for your losses. All your moves are not random clicks, so take full responsibility and learn from your mistakes.

6. Anchoring Bias

Suppose you heard about $SOL at $8. You missed it, and now it’s $20, so you don’t buy it because it feels expensive. Now it’s $200. Don’t focus on the past—focus on the potential of the project today.

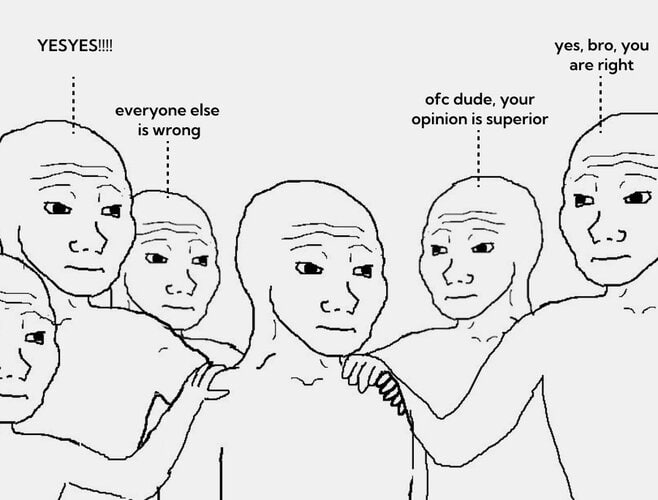

7. Confirmation Bias

People seek only the information they want to hear. When evaluating a project, always consider both the good and the bad aspects. This way, you conduct an objective analysis instead of cherry-picking data to fit your narrative.

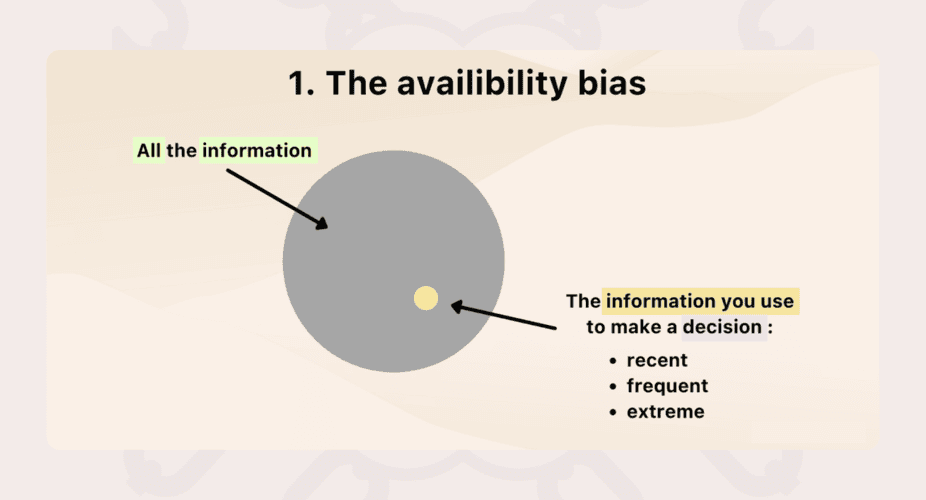

8. Availability Bias

Availability bias is the tendency to make decisions based on easily accessible info rather than a thorough, objective analysis. Always delve deep into a project, check everything about it, and only then will you achieve great profits.

9. Bandwagon Bias

Bought tokens on a hype? Get ready for their dump. Any token can behave like a Ponzi scheme. Once it reaches its peak, it will drop because early buyers want to take profits. So remember this principle: Buy fear, sell greed.

10. Hindsight Bias

Hindsight bias is the tendency to believe, after an event, that you would have predicted the outcome. You overestimate your ability to predict market movements and underestimate the role of chance. Keep a journal of your deals, and don’t be overconfident.

11. Herd Mentality Bias

Many investors prefer to follow and copy others. They are more likely to succumb to emotions and instincts rather than conduct their own analysis. If you’ve ever felt FOMO, it could be due to herd mentality.

12. Sunk Cost Bias

Let’s say you invested $5k in a project, and now it’s worth $1k. You might want to invest $4k more to “save” that $5k. But in the end, you’re throwing $4k of good money after bad. Don’t do that—cut your losses when necessary.

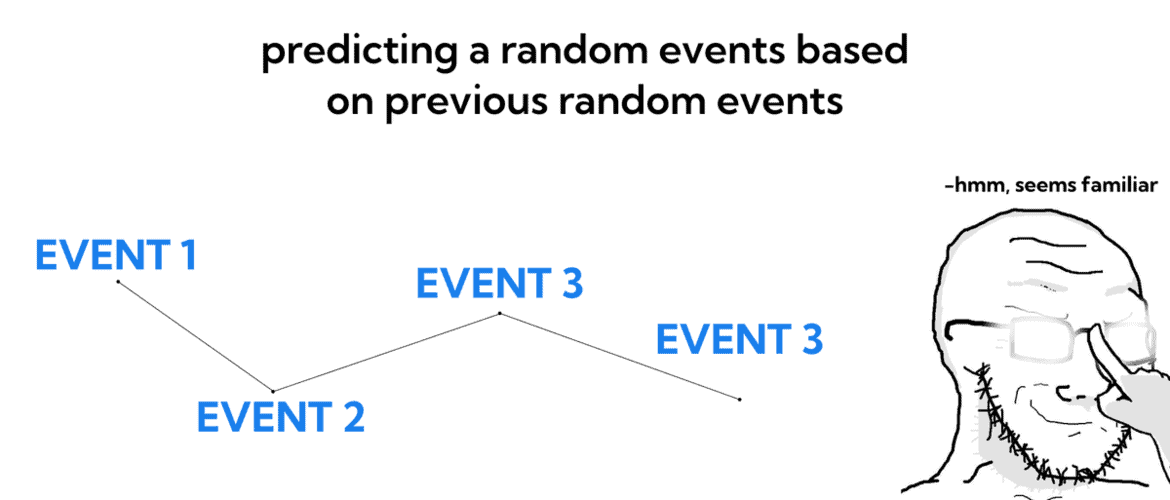

13. Gambler’s Fallacy Bias

The gambler’s fallacy is the belief that past events influence future ones. This can lead to making decisions based on non-existent patterns, causing misguided investment strategies. Recognize the unpredictable nature of crypto markets.

14. Overconfidence Bias

Overconfidence bias is the tendency to overestimate your abilities or the accuracy of your predictions, often due to a lack of self-awareness. That’s why it’s so important to have an investment strategy and stick to it to avoid making impulsive moves.

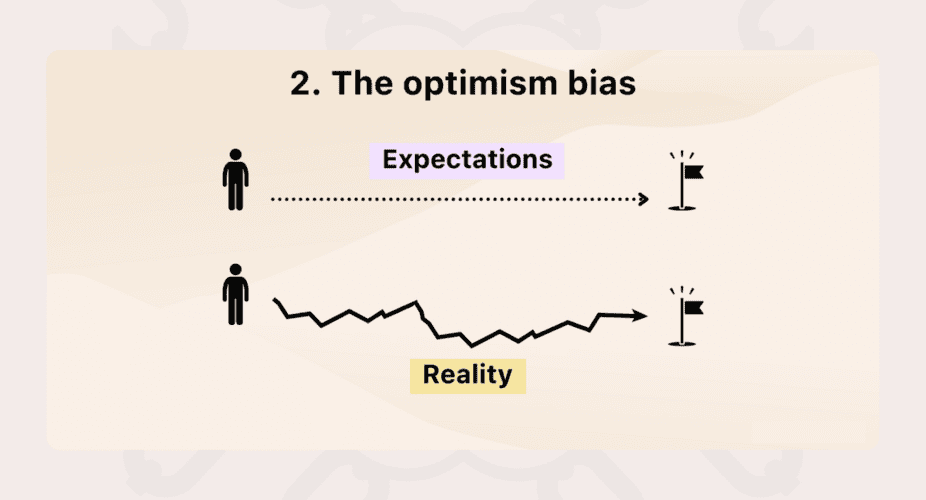

15. Overoptimism Bias

Overconfidence can lead to high losses. It’s better to delve deeper, check the project, and reconsider your risk/reward (R/R) strategy than lose your entire investment amount.

16. Loss Aversion Bias

Losing $1k feels worse than gaining $1k. That’s why most people prefer to wait it out when a deal goes bad. In fact, you just need to close the trade and cut your losses fast.

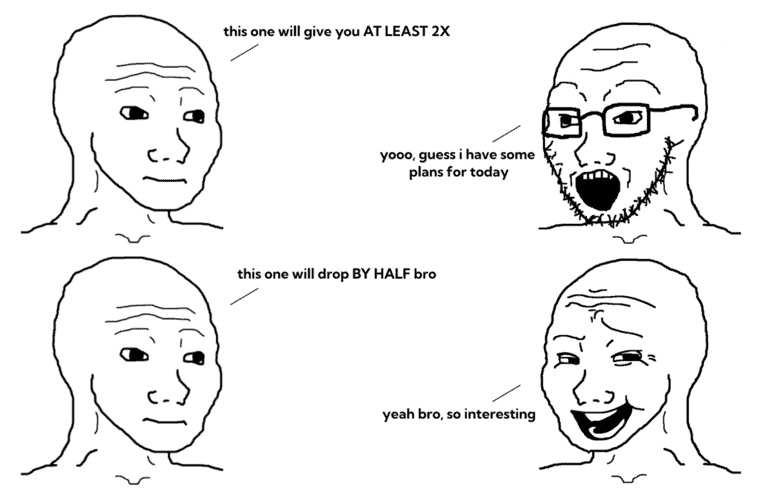

17. Framing Effect

Imagine hearing that some coin could double, while another might drop by half. Both mean high volatility, but the first sounds exciting while the second sounds scary. This is the framing effect in crypto. Ignore such hype or fear and base your decisions on your research.

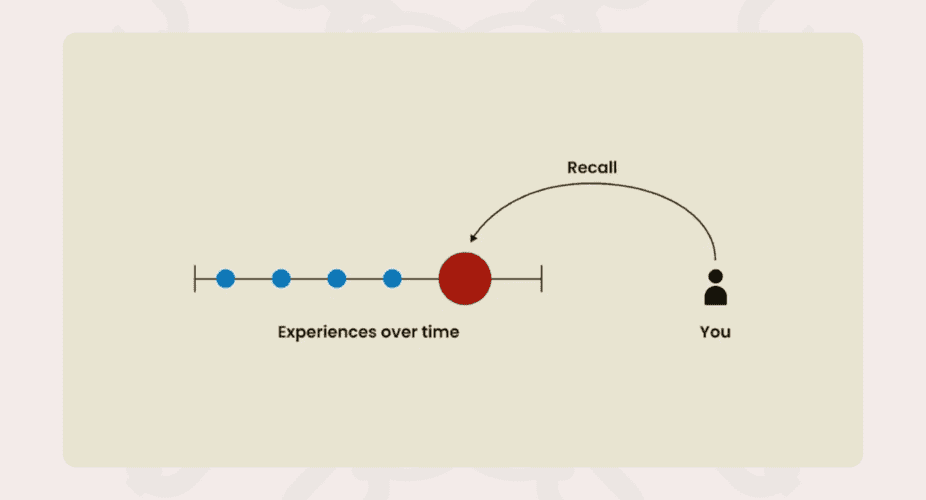

18. Recency Bias

Recency bias is the tendency to favor recent events or info when making decisions, often because they are easier to recall. Don’t make impulsive moves. Zoom out your charts and analyze the situation more broadly.

19. Survivorship Bias

You see a degen who turned $500 into $5M. You try to copy them and end up losing money because you don’t consider that the media only highlights success stories. Consider that there are thousands of degens who turned $500 into $5.

20. Outcome Bias

Invested in a random shitcoin, and it grew? That’s a bad decision but a good outcome. Invested in a potentially great project, and it dropped? That’s a good decision but a bad outcome. In the long run, good decisions win out, so make decisions with the best risk percentage.

Conclusion: Take Control of Your Trading Psychology

I hope you’ve found this guide to cognitive biases helpful! Understanding these biases can transform your approach to crypto trading, helping you avoid common pitfalls and make more rational decisions. Stay disciplined, keep learning, and always base your trades on thorough research.