Everyone knows that you can hit x10, x50 or even x100 in crypto, but few people understand how to find an appropriate entry point to do so. Especially when it comes to shitcoins and meme tokens – the most risky, but also the most profitable assets. With such coins, success often depends not on luck, but on your preparation and ability to read the market.

It is important not only to buy “by feel”, but also to spot patterns and moments when the crowd has not yet arrived. If you want to be one step ahead and get into coins before they fly away, this guide is for you.

Let’s take a look at a few key patterns we can use when trading shitcoins.

Trend

When the most popular shitcoins that have fallen hard start to recover, I look for signs of a trend change: rising local lows and highs. If there is such a thing – it boldly points to a recovery and a price push higher.

It is important to note that I personally do not rely on a single indicator, but on a number of signals: news background (whether the shilling is still tweeting or whether a new narrative has already started), whether there is volume growth, and what kind of activity holders are doing in general.

If the project shows good signs on these takes, I fly in on pullbacks or local lows.

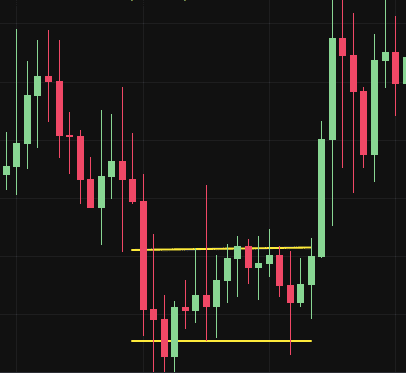

Accumulation zones

After large drops, the token often begins to “consolidate” – the price moves in a narrow range without falling further. It looks like an accumulation of forces before the upward movement. These are the moments when you can think about entering the market.

But be careful: the price may break through this area to the downside and set a new level for the swing. With such a pattern, you can wait for a break to one side or the other, and then look at the situation and decide. Keep the buy button nearby.

Breaking the highs

When a price breaks above an all-time high (ATH), it is often a signal for further growth. However, such breakouts should be taken with a grain of salt: if there is no consolidation, the market may turn back to the support level.

If the ATH is held for at least 5-10 minutes, then the real movement begins and the price becomes very bullish in anticipation of new and higher highs.

Support and resistance levels

The most important levels are the old ATH, accumulation zones, and places where the price has failed to break resistance before.

If the price can’t break the resistance level for a long time – wait for a pullback. Such things are best seen on the one-minute chart if the meme is new, or on the five-minute chart if it has been around for a while.

Final tips

Don’t rely on a single chart or pattern

Use multiple factors + news background (mandatory) to understand the market situation. No influencers, who shills the token is death.

Learn to lock in profits

I’ve said it a hundred times, but I’ll say it a hundred more: greed kills, especially in a bull market.

Don’t fall in love with coins

You will often catch good X’s on fresh coins, but if you get stuck in a coin hoping to catch a dozen more X’s, you will be left with no underpants at all.

Stay tuned and don’t get FOMO

Late to the story? No big deal. Missed x10? Better than losing money on a dying meme.

Experience and speed are the main indicators of winning in the shitcoins. The more time you spend on the charts, the faster you will notice patterns. Every memecoin is unique, but the basic principles always work.

The main thing is not to rely on luck, but to keep a cool head and make quick decisions about entering a pose, because in a minute your token can fly to the sky. Or to the ground.