It is already safe to say that 2024 has brought two major trends to the market: tap-to-earn and prediction markets. The mass interest in the former was fuelled by the success of ‘tap apps’, which added crypto elements to basic casual games, while the latter owes its popularity to the US presidential race. For all their differences, these two trends have something in common – the desire to simplify the user experience and the promise of easy money.

Kings of the game

The first reason to embrace the simplification trend was Binance co-founder and head of Binance Labs Yi He’s response to claims about the listing process.

We want to offer projects that are popular, in demand and relatively reliable. But that doesn’t mean that the value of all these projects will increase,’ the exchange co-founder said.

Some in the crypto community accused Binance of lowering standards after it listed the meme token Neiro, which had a capitalisation of around $15 million at the time. In less than two weeks, the figure rose 30-fold to $450 million.

The listing of such assets and subsequent vertical growth is commonplace in the crypto market, as are accusations of insider trading. However, it is worth noting Binance’s stance.

Yi He wrote a lengthy article in response to the criticism. In it, she said: ‘The exchange has to operate this way simply because customers demand it, and the era of selling tokens of serious projects at low prices is coming to an end as the market grows and matures.

The Binance product must serve the majority to have a chance of becoming the financial infrastructure of the future world,” Yi He noted.

So Binance is simply following the crowd, harvesting margin from social trends. And it’s a perfectly viable strategy, as we can see from the exchange’s place in the crypto world.

It’s for the same reasons that the market is falling for new cheap and fast ways to make money: the era of one-day play tokens and apps with no roadmap or plans for the future is coming.

The mechanics of attracting users are increasingly reminiscent of online casinos and casual mobile games, where the rules are extremely simple and require no special skills or time to learn. Come, click and get.

This sector is particularly evident in tap-to-earn apps such as Notcoin and Hamster Kombat, which capture users’ attention for a small reward and sell it on to advertisers.

Greed and the desire to quickly create value out of nothing add to the new trends with signs of mass ludomania. One of the unpleasant features of this disorder is usually a person’s supposed confidence in the idea that he or she can increase the odds of winning through hard analytical work. This may be partly true, but I would like to remind you that ‘the odds of finding a successful meme token for a profitable investment on the PumpFun platform were lower than making a winning bet in a casino’.

In the meme token market, tap apps only complicate the principles of traditional slot machines, to which an element of cryptotechnology has simply been added. But there is a more representative example of a cryptocurrency ‘casino’ – prediction markets.

Black or Red Predictor

Classic roulette has only two betting options: black and red (plus a zero that favours the house). It is clear to any casino visitor that this is a game of pure luck, but it also gives participants a choice.

Somewhat differently, market ‘predictions’ are binary events with a clear ‘yes or no’ bet. The trend has become massively popular in the run-up to the US elections: in 2024, Polymarket’s trading volume has already exceeded $1 billion.

The problem is that binary prediction markets are promoted as a manifestation of the unquestioned ‘wisdom of the crowd’, encouraging participants to act rationally. Unfortunately, this largely controversial concept is enthusiastically supported by crypto market leaders.

Ethereum founder Vitalik Buterin, for example, is certain that Polymarket is only described as gambling by those who do not understand the nature of the project. In his opinion, such platforms reflect reality more objectively than mass media and social networks.

No analytics

The problem is that the current binary betting based prediction format has nothing ‘under the hood’. To see this, just compare the prediction markets to a tool that calculates probabilities on the Chicago Mercantile Exchange (CME).

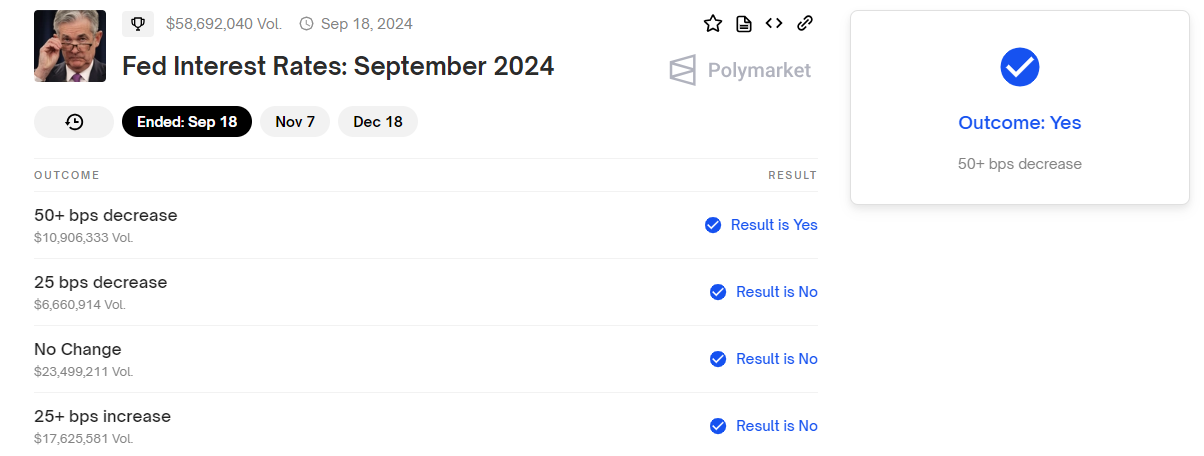

For example, a ‘bet’ on the Fed’s decision generated nearly $60 million in liquidity on Polymarket, where participants were simply asked to indicate how much the rate would be cut. The resulting data on this platform creates the illusion that it reflects the probability of something happening.

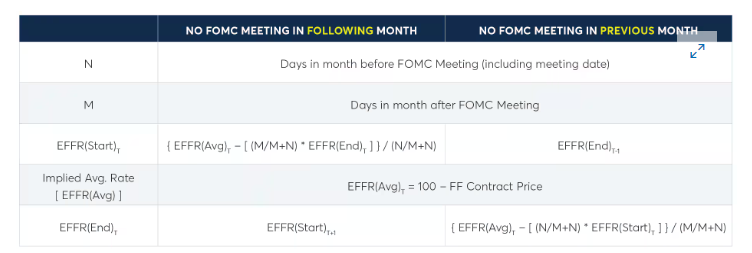

This is fundamentally flawed and distorts the entire methodology of the Chicago Mercantile Exchange, which is based on real futures rates and complex weighted calculations.

Polymarket simply votes for its favourite option, whereas the CME determines probabilities based on real rates in the interbank lending market.

The exchange uses data from the real market, where insurance companies, banks and financial institutions in the US hedge risk and trade. When the CME puts the probability of a Fed rate cut at 51.3%, it reflects the real situation in the banking sector, not the opinion of the crowd.

By the time the rate meeting starts, the financial institutions have already made all the necessary moves in the futures market. The only thing the ‘wise crowd’ can do is go to the CME website and see the probabilities at that moment – they have no other tools at their disposal.

Binary prediction markets thus offer a radically simplified view of the world, in which the most important decisions are made almost by chance, rather than by numerous transactions.

Conclusions

One of the major trends of 2024 is the desire to simplify probability markets and minimise the importance of real analysis in investing.

Unfortunately, users themselves are willingly ‘feeding’ meme coin and binary prediction markets, and large platforms are following the crowd of newly minted crypto investors to keep the business going.

Investing in and backing large high-tech projects has become less attractive to the small speculative investor who is not willing to wait months and years for a financial return. In addition, success in the current market is not the same as it was in the early days of bitcoin’s development. There simply aren’t as many opportunities as there were for early crypto investors.