10% of people make money in crypto, 90% lose. What is the key to success? It’s mastering trading psychology.

Crypto and trading, especially, are all about a bunch of if/then statements if you think about it. Did you know that only ~10% of traders are consistent winners, while the rest are either consistent losers or 50/50% players? Let’s figure out how to enter those 10%:

The key to success in trading is Trading Psychology

Your emotions and mindset can lead to both success and failure in trading. This is because you need to manage:

– Hope/Regret

– Fear/Greed

– Gains/Losses

First, let’s understand how to get rid of a negative mindset.

Negative Mindset

90% of losing traders mostly have a similar mindset, filled with self-criticism, regret, betrayal, etc. People fear making mistakes, especially if it costs money, and they fall into the trap of FUD, biases, and other. This is the main reason why cults exist.

Crypto Cults

Different communities, infls, people want to listen to others and rely on their decisions. In this way, they avoid responsibility. Understand that when you lose a trade, it’s easy to blame someone else, but the only person responsible is you.

The market owes you nothing; it is neutral

Only you are responsible— not the market, not an influencer, and not the economy. So, you need to develop your trading system:

• Taking Profits

• Blaming Rule

• Handling a Loss

• R/R

• Stop Losses

• Cut losses

Let’s dive in.

Taking Profits

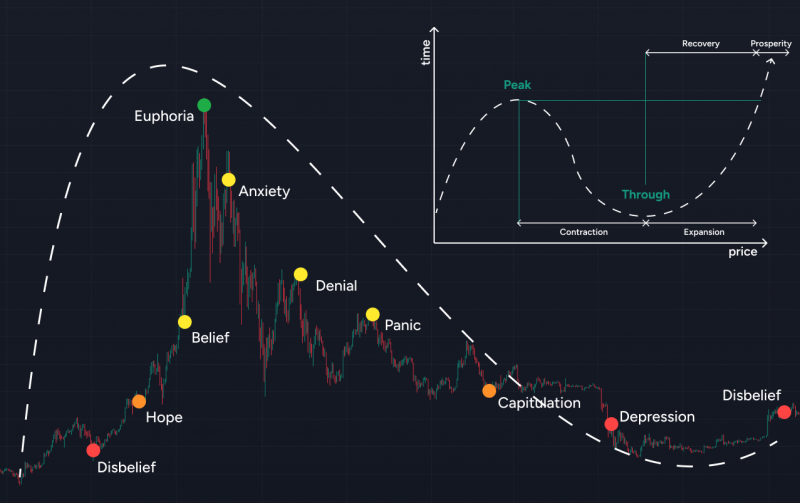

This is a fairly basic concept, but it also has complex nuances. The main rule is, “When you start feeling like a genius, it’s time to take profits. But it’s also important not to fall into an Over Winning Attitude.

Over Winning Attitude

You can win in the short term, accepting your results as if you are a pro. But sometimes we just get lucky; continue to think clearly and calmly. Many start increasing their stakes and risk, and it always ends with getting rekt.

Blaming Rule

I have seen many times how people lost everything they had, and some of them started blaming the market and so on. Usually, they invest their entire portfolio into a single project, without diversifying anything. So whose fault is it?

Handling a Loss

Even though losing money sucks, it’s important to handle it because it’s part of the journey. So, if you make a mistake—learn from it, and understand that losing money has given you knowledge. In this way, you are winning regardless.

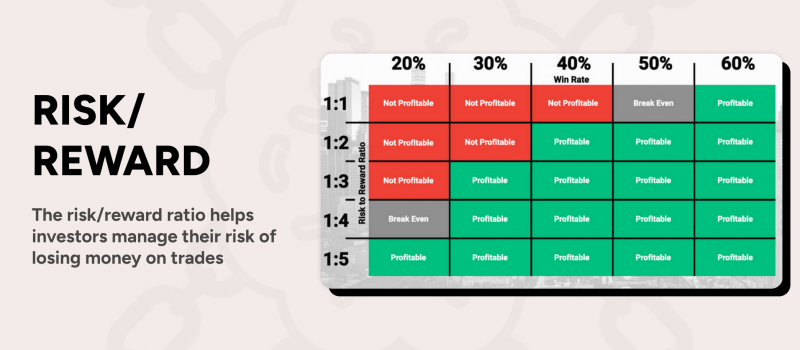

R/R

Risk management is a crucial part of success. The best traders pre-define their risks before the trade. So, figure out how much you’re willing to lose before even entering. Your main goal is to profit AND to protect your portfolio.

Stop Losses

As I already said, your goal is both to earn and to protect your portfolio. So, if you buy something, hoping it goes up, make stop losses anyway. You protect your downside by pre-defining your risks before you trade. This is much better than just shouting HODL.

Cut losses

The hardest thing is Cutting Losses. The price might bounce back and start rising again, but what if it goes down to $0? No one knows for sure, so always cut your losses quickly according to your plan. You can never predict either ATH or ATL.

Now you can create a foundation, but you still need to develop a complete system

Add your own rules to it as well. For example, you used leverage and lost everything.

Here’s a sample:

– Never use leverage

– Take Profit at 2x

– etc.

Long Run Mindset

If you’ve researched extensively and chosen a project, but end up losing a trade. It doesn’t mean all trades will be the same. Learn why it happened, do more research, and give it another shot. Consistency will make you a millionaire.

Some more Typical trading mistakes

– Impulse decisions

– Moving a stop close to your entry point

– Trading too large a position

– All portfolio in risk plays

– Refusing to take a loss, waiting for a rebound