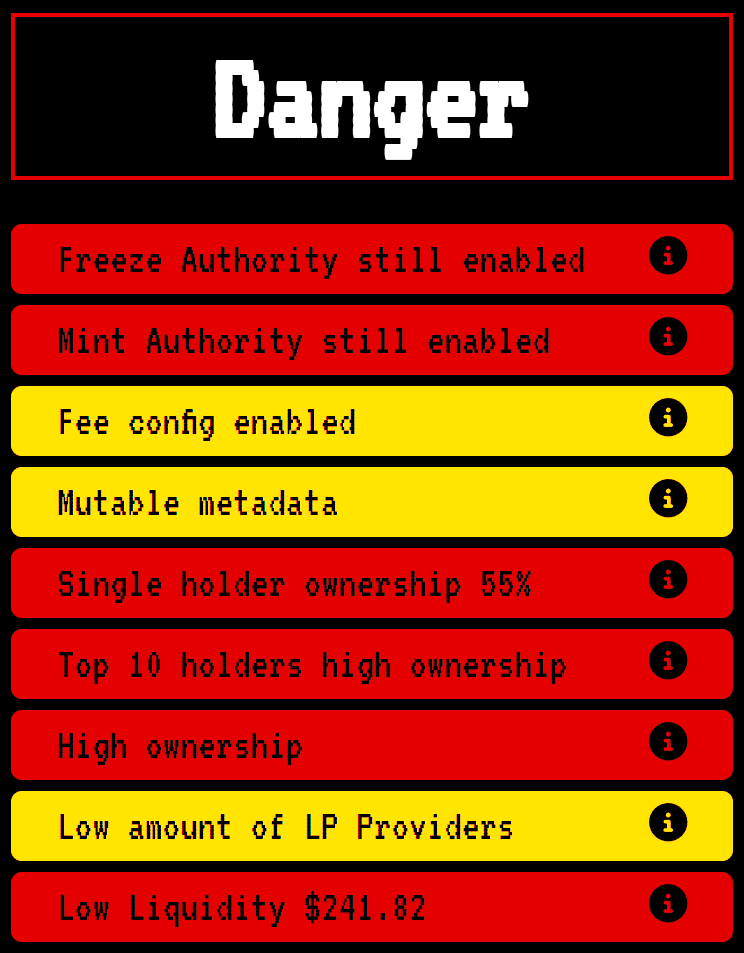

Rugcheck provides dynamic scoring on all tokens. The scoring provides an overview of the risk profile and moves with the market after trading begins. Aside from scoring, Rucheck provides warnings. Let’s have a look at what these mean.

🥶 Freeze Authority Still Enabled

This allows the token creator access to FREEZE trading at any time, for any reason. If you are trading meme-coins, this is something you want to avoid.

📉Mint Authority Still Enabled

The token creator or the mint authority can mint new tokens if this is enabled. This could potentially be used to dilute your holdings, post token launch.

⚙️ Fee Config Enabled

With this authority enabled the token creator can change the amount of fees that are charged. If the fees are increased, the cost to sell your tokens could be dramatically increased.

💱 Mutable Metadata

The ability to change Metadata could be used in various exploits, or to change the token information post-launch.

🧍 Single Holder Ownership

If one wallet holds a large portion of the token, it can either manipulate the market or cause extreme volatility in the price. High ownership combined with other warnings also can show the token creators’ true intentions.

🔟 Top 10 Ownership

This works the same way as single-holder ownership but points to the ability of someone to spread their holdings over several wallets for the same purposes mentioned above.

🔊 High Ownership

With this warning, it’s important to note that a small percentage of wallets hold a very large percentage of the total tokens.

🪫 Low Amount of Liquidity Providers

Consider this when looking at the overall markets. Are there multiple pools? What is the token standard? If there is only one pool and the token creator has authority over it, they can rug (remove the liquidity) making your tokens worthless.

🚨 Low Liquidity

The bottom line is if there is no liquidity for a token, you can’t trade on it, so having low liquidity means that you may not be able to sell when the time comes.

Always consider the Rugcheck SCORE, and the WARNINGS. There are legitimate use cases for each risk item, but those should be clearly identified in the tokenomics.If you are trading memecoins, with no documents, different then a project that has published tokenomics and a team that be contacted for questions. Stay safe out there!