We analyzed the Pepe memcoin launch strategy and made their own assessment of the resulting profits. Fortunately, the Web3 space makes it easy to do such analytics.

Introduction

With a certain amount of persistence and luck, memcoins (sometimes) help their owners earn good money. But what about their creators? Do they manage to make serious money? Do they use certain launch strategies or rely on luck? Are there any secrets that dramatically change the situation in favor of the founders of such tokens?

How they started?

The uncomplicated WIX site and the choice of the Ethereum blockchain suggest that Pepe’s team initially aimed to maximize returns with a relatively minimal investment.

The fact that the average transaction size on the Ethereum network is five times larger than on the Binance network suggests that a wealthier group of crypto investors was chosen as the target audience.

The project also did not trifle with the issuance – a total of 420,690 trillion coins were issued.

Chronology

It’s worth noting right away that the first five days of the launch proved to be the most intense.

April 14: token launch

The team started by deploying a smart contract and adding liquidity on Uniswap. In doing so, 93% of the entire token issue was poured into the pool along with 2 ETH. All LP tokens were burned and the rest of the issue was saved for the future – for large centralized exchanges.

Immediately after the launch, easy shilling began, including through the popular TG bot. By the end of the day, Pepe had only 118 holders, with the majority of them being multi-account team members.

April 15: no sales before capitalizing at $350,000

The team began to systematically inflate the number of subscribers, adding about 10,000 followers on Telegram and Twitter. At the same time, the first retweets from major channels appeared.

In addition to the community, the volume and price of the token also began to be actively spun up. As early as the morning of the day, statistics showed a million-dollar turnover, and by the evening the figure had crossed the threshold of 6 million, which could not help but attract the attention of degen channels and chat rooms. Pepe confidently broke into the trends on DEXTools, and by the evening the token had collected 685 holdings.

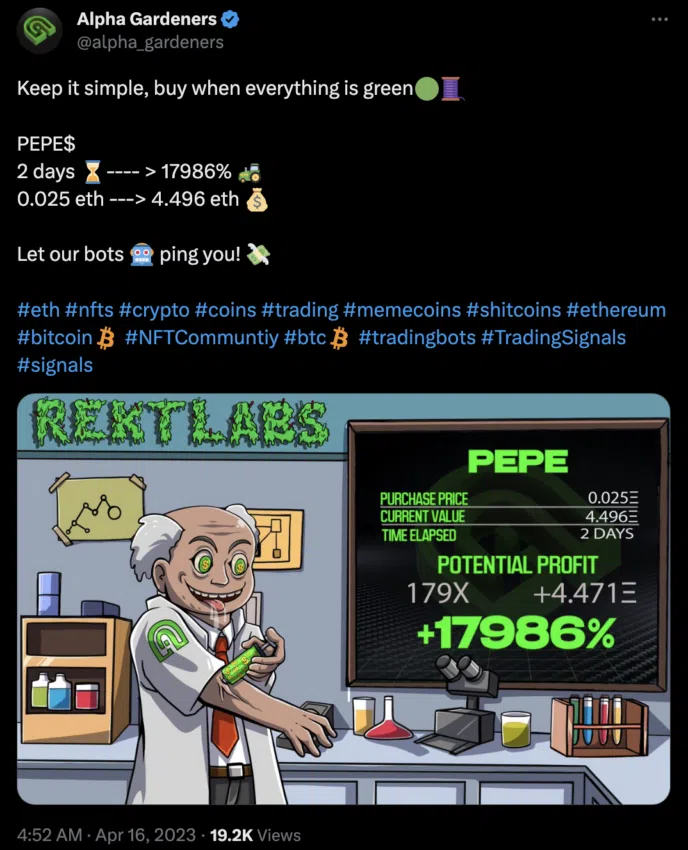

April 16: active shilling phase

The team took guerrilla marketing very seriously and avoided lazy copying of the same text. The whole campaign looked very organic.

By the end of the third day, Pepe had 2,763 holdings, $254,000, and a market capitalization of over 5 million.

April 17: listing on CMC and CoinGecko

The key objective of Day 4 was to show potential investors a chart with stunning results. Following this, the team aimed to demonstrate a rapid change in growth dynamics and create FOMO.

At the same time, the token achieves its first listing on the centralized Hotbit exchange, and information about it spreads through signal channels. Active shilling continues. Results at the end of the day – 9017 holders and 17-million capitalization.

April 18: Breakthrough

On the fifth day, the media picked up on Pepe’s agenda in a big way. In addition to a press release on Yahoo.finance, the token was covered in Coindesk, Bitcoinist, Cryptodaily and other media outlets. Shortly thereafter, the meme token went trending on Twitter, and a full-scale uncontrolled hype began.

The breakout yielded great results: 16,715 holdings and a 33 million dollar capitalization that almost doubled in a day.

April 19: turnover of more than $10 million per day

After news of Pepe’s launch spread throughout the crypto community, 10 more centralized exchanges poured the token on their platforms. YouTube vloggers were quick to pick up the hype. The sixth day ended with an impressive 26,608 holders.

May 6: one billion capitalization

By the beginning of May, traders had collectively earned 160 million dollars on the meme-coin, 150 million of which went to those who bought the token in the first week of its launch. It’s not hard to guess that the creators of Pepe were among them. According to our calculations, at this point the team managed to earn from 30 to 100 million. Investments in the first few days of the launch amounted to 300 to 500 thousand dollars, which covered the costs of marketmaking, commissions, and a little marketing.

Key findings of the launch strategy

When the entire process of launching Pepe is examined under a microscope, it becomes apparent that the project’s success was not just another fluke.

The “Make Pepe great again” narrative, originally intended for an American audience, played a critical role in its subsequent popularity. Pepe developed their own approach to the meme-coin economy by removing transaction fees, introducing LP token burning, and taking on the role of “people’s coin.” As a result, the project turned out to be interesting, straightforward and lively.

However, the startup process itself was not as simple and transparent as it may have seemed. Lack of liquidity, exaggerated turnover, along with the use of wallets with significant balances and manipulation of the buy/sell ratio were just a few of the activities that allowed the team to stay on trend and build real volumes.

The token has managed to attract a real audience through strategic use of platforms like Dextools and multiple large entry points. Pepe entered Twitter trends without significant effort, demonstrating the power of marketing. It is also worth noting the project’s commitment to maintaining high levels of liquidity and pampers without palpable harm to the market.

Moreover, Pepe was far from a first attempt at launching, but a culmination of the team’s previous efforts. The world of cryptocurrency continues to evolve, and the successful launch of Pepe is further proof of the community’s capabilities and creative approaches to marketing.