Introduction

First, we should figure out what these flips and holds are and how to identify them.

What is a Flip?

FLIP is a relatively fast trade for instant profit. You can flip anything: NFTs, tokens, bots, or even whitelists! The flip usually happens at some news.

Example: you mined a NFT on a public sale for 0.1 ETH and immediately sold it for 0.2Ξ ETH on an opensea – flip!

Example #2: you bought launchpad tokens before a cool sale at $0.5/per token, and immediately after the sale you sold it for $0.65/per token – flip!

What is Hold?

HOLD is a long-term investment in NFTs or tokens. You can hold for a couple of months or a couple of years. Hold is more about believing the project than waiting for any news.

Example: you saw that the NFL project has a very cool team of builders, you believe in them, buy a couple of tokens and throw them away on a cold wallet until better times – hold.

Example #2: you buy a Bitcoin on a bear, leave it until the bull run – hold.

Pros and cons of Flip and Hold

Obviously, both strategies have their pros and cons, so let’s break them down.

Pros and cons of Flip

Let’s start with the pros:

- Fast money, no need to wait for months or years.

- There is no risk of death of the project (almost), for profit is enough temporary HYIP.

- Easier psychologically, it is not necessary to fight the desire to sell.

- Suitable for any deposits.

Now the disadvantages:

- Profit is usually less than with a successful hold.

- Takes more time and effort, for example, to monitor the exit point.

Pros and cons of Hold

Pros:

- Possible super profits (doesn’t mean there will be any).

- By and hold does not require attention.

Cons:

- Risk of total project death.

- Requires a lot of patience and waiting.

- Basically only for large deposits.

Watch examples in the NFT

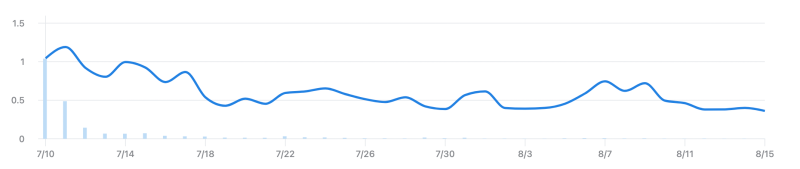

Saudis

The collection took out only on its high, thanks to a lot of cash poured into marketing and a +- new idea for derivatives.

I think it is clear which strategy with such a foundation pulled out, but nevertheless, here are the statistics about the prices immediately after the launch and now:

24h AVG = 1.05 ETH | 7D AVG = 1.06 ETH | NOW (~1 month) = 0.38 ETH | MAX = 1.19 ETH

It’s pretty obvious that a project that has nothing underneath it will not keep floor of quality, much less cost.

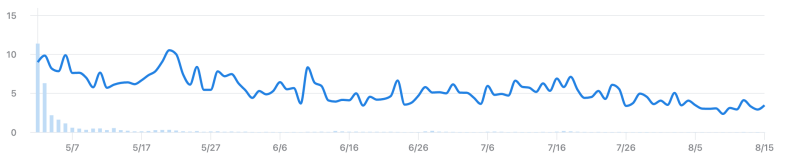

Otherdeed for Otherside

Okay, the Saudis may not be the best example, for lack of foundation, so let’s take apart one of the most fundamentally strong collections on the airwaves: Otherdeed for Otherside.

The project seems to have a huge live audience, cool backers, it’s ground on one of the most anticipated metaverse, but the stats are

24h AVG = 9.00 ETH | 7D AVG = 8.57 ETH | NOW (~2 months) = 3.58 ETH | MAX = 10.53 ETH

Although the statistics are not fun, it is still worth acknowledging that there was a huge hype around these lands in the entire crypto space, and as we see from the previous example, the hype only gives a temporary huge boom, the foundation of Otherside is not going anywhere, and they will probably still show themselves.

Okay, all these projects were launched in not the best market, so can we see what was launched on the bullrun?

MekaVerse

The collection was launched in mid-October 2021, when BTC was at $55,600-60,000, again this was a very hype collection, the first 3D collection with such art of such quality. Hype – already understand what happened to it? Let’s see, the stats are.

24h AVG = 5.07 ETH | 7D AVG = 7.10 ETH | NOW (~10 months) = 0.29 ETH | MAX = 7.87 ETH

Again, to be fair, the project didn’t have any foundation at all, except for the super-quality art. In fact, here it stands as a good PFP.

As we can see the project’s hype at the start regularly gives a good EXIT point, but what if the project will not have such a hype at the start, but there will be a cool team ready to work for the idea?

Bored Ape Yacht Club

I’m pretty sure everyone reading knows about this collection, most know about why they are worth so much now and getting more expensive, but have you seen how much they were worth at first, and how many of you have heard of them before the price of a couple of ETH? The stats are.

24h AVG = 0.31 ETH | 7D AVG = 0.67 ETH | NOW (~11 months) = 84.2 ETH | MAX = 167.6 ETH

As we can see this collection is as different as possible from what we have seen before, but why so? There are several apparent reasons for this:

- Absolute euphoria in the market – when BAYC shot above 10 ETH Bitcoin was going vertically up.

- Just a great publicity campaign with MoonPay that made a bunch of big artists BAYC holders.

- The first time in history that an NFT collection officially registered and started paying taxes.

- Several airdrops of minor collections for holders.

- Meetings and parties for exclusive holders.

There’s a long story to tell about the reasons for BAYC’s success, but if you sum it all up, you could say that the collection was just constantly being worked on and always staying on the radar. Just such a thing can be a motivator for a Holder.

How to find trends and analyse graphs?

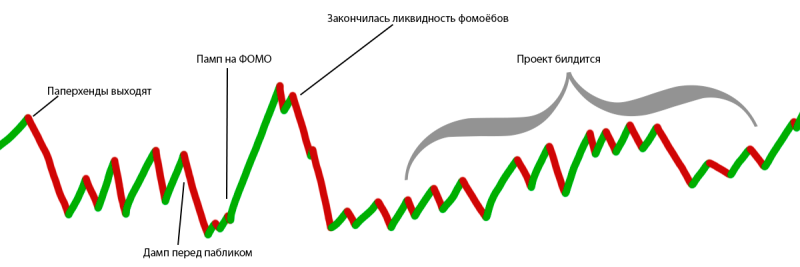

The successful collections almost always have the same chart:

- The whitelist begins to mint, the price decreases little by little-that’s when the papperhands come out.

- The bulk of the paperhands are out, and the price is either in the same range or rising slightly.

- Things are getting close to public, another drawdown happens in anticipation of a new mass of NFTs in the market.

- After the end of the public sale many people, as a rule, who did not have time to mint start to redeem NFT from the market under the influence of FOMO.

- At some point, the liquidity of FOMO holders ends and the price falls quite rapidly, often to pre-public price.

- This stage is the longest, here the team builds the project, little by little implementing roadmap, the price slowly but surely grows.

Analyzing crypto projects

Near

Near is a blockchain token that was launched in late 2020 on Coinlist, with work already underway for two years before launch. As many of you know, in 2020 bullrun was just in its infancy, there were not as many people then as there are now, nor was there a huge amount of liquidity. I think someone has already noticed a pattern:

- The team has been building the project long and hard, even without rewards.

- There is no huge hype around the project, as well as no huge expectations.

And now let’s look at the price:

At the time the first option was unlocked (40 days after launch) the token was worth $0.66, while it was selling for $0.40 and hadn’t fallen back down to the seale price in the past 2 years. This would have played out well on the hold and you could tell from the two factors described above.

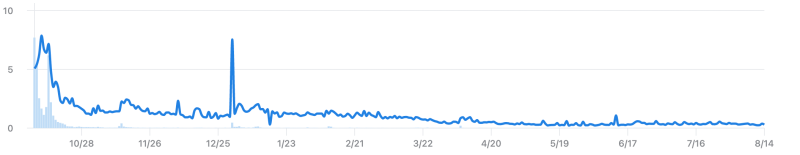

Ape Coin

The situation here is somewhat similar to Near, but it is not the same. Here the token came out of nowhere on a huge hype and even though there is a strong team behind it, but the price chart looks like this

However, they even had a one-time utility in the form of payment for Otherdeed for Otherside lands (you can see it on the chart), but now the token lies in the form of a phantom. The story is very similar to the Otherside lands themselves, and it’s likely that the token will still show itself after the metaverse is released.

About the same as in the case of NFTs, tokens grow with a good team willing to work for the idea and a slow even development of the product. There are many examples of such Near: Solana, BNB, XRP, and even ETH at the beginning of its path in 2015 cost $0.7.

Final notes

And so we broke down some real examples of coins and NFTs, but I only wrote out a few of them in the article, in fact I reviewed about a hundred graphs of NFTs and tokens and this is what I learned from it –

- A high-profile project launch doesn’t make it better in the long run, but it gives a good exit point for a flip.

- The more euphoria in the market – the more the flippers dominate the holders.

- Those projects, which long and persistently develop more often win in the long term.

- Virtually every project, even the most fundamental, at high-profile launch, there is room for exit and subsequent re-entry at better prices.

Bottom line, we have that flippers win almost always because they retain the ability to re-enter, and often at better prices. But that doesn’t mean that holding is a bad strategy, it’s just more suitable for those who have too much dept to flip, or those who don’t want to bother with it too much.

Bonus

As a bonus, I want to share some good tools for project analysis, both for flippers and holders.

Nansen is a great tool for money flow analysis, although not the easiest to understand, definitely worth its 116$.

Dune – a service where users can create their own charts and tables with statistics from various projects.

Messari Fundraising Data – formerly dove metrics, it was bought and now ask $25 a month, but it is not a bad tool, I personally from there took a lot of early stage projects.