Introduction

When investing in cryptocurrencies you first need patience, not someone else’s opinion and burning eyes. Always do your own research and minimal analysis and have your own opinion. This material does not imply or give financial advice. Your money is your responsibility.

By picking up coins at the bottom of the market, we buy fear first, and sell them back in a period of greed, locking in profits. Just fear and greed. By the way, the market sentiment indicator – you can look here. Try tracking how much you would make if you bought and sold just by following this index.

It always amuses me how hard it is to buy when it shows Extreme Fear. After all, it seems like the market will keep crashing, and cryptocurrency, as people off-line like to say, “won’t be worth anything at all.

Risks in the crypto market are directly proportional to profit. Making twenty dollars out of a notional thousand dollars is, in fact, no surprise to anyone.

The opposite is also true. When they sell on panic and fix losses or lose everything in a few trades on futures with leverage.

A person is often too weak, greedy and undisciplined to stick to the intended plan and not descend into trivial speculation.

So the solution is quite simple – stay out of short speculation. Allocate a budget, quietly figure out where to invest and in what proportion. Form your portfolio (one or more), think about the time frame (1, 3 or 6 months) and keep doing what you do, not jerk these coins every day in the hope to sell on the haircuts and buy back the bottom.

You also don’t need to go to the other extreme – investing in a 3-5 year horizon. It’s not relevant for crypto.

What and how to buy and where to look, with this we will deal in detail further. Our main strategy is to invest in promising tokens with low capitalization in the early stages. In order to invest a conventional thousand dollars into ether or bitcoin and get two out of them, the price should grow twice and it may take years.

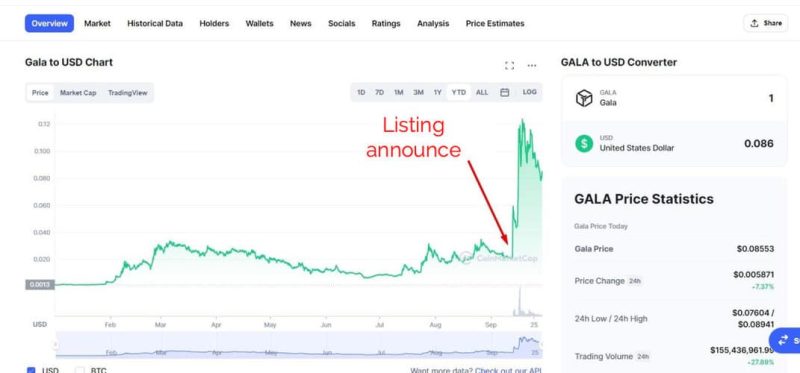

For altcoin to make x2, it is enough to have a working product and to list on one of the crypto-exchanges. It’s comparable to how offline companies go public with an IPO. Take any token that was poured on binance and see how its price rose on the news and the exit on the exchange.

Terms vocabulary

Let’s run through the most basic, so that we don’t have to go back and describe the text in detail later.

Scam/shchitcoin is a project/coin without a working product. Most often at the early stages, when money is raised “for an idea”.

Bull market – going up.

Bear market – the fall of quotations.

HODL (hodl) – strategy to hold the coins in all circumstances.

FOMO – regrets for lost profits.

FUD (fad -fear, uncertainty and doubt) – fear, great doubt.

Hot wallet – a software wallet.

Cold wallet – a hardware/physical wallet.

DeFi – decentralized finance.

DEX – decentralized token exchanges.

Smart contract – a digital agreement. Most often, it implies a token contract address in one of the networks (Therium, BSC, Polygon, etc.).

KYC (know your customer) – identity verification. Most often used in financial transactions of token purchase and exchange.

Stacking – freezing coins for a fee.

Farming – freezing coins for reward in pairing with another coin (liquidity support).

APR/APY – percentage of annual return.

The moon (to the moon) – the price will fly into space. Often used as a meme.

Fiat – real (paper) money.

Stablecoin – a coin with a fixed 1:1 exchange rate to the dollar.

Launchpad – a platform for raising investment for new coin launches.

Tools and wallets

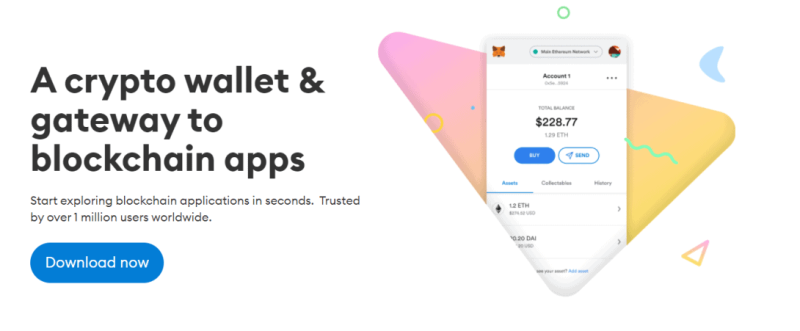

The main wallet for working with coins and decentralized applications is Metamask (download).

Once you start using Metamask, you will have access to buy and sell any coins with a smart contract in one of the networks. Coin lists and statistics are available on CoinMarketCap or CoinGecko. Metamask is a specifically for investing, not for speculation with ties to a particular exchange.

Using any other wallets (Phantom, SafePal) and networks after Metamask will not be difficult – the principle will be the same.

Let’s add metamask to Chrome right now as an extension and install the app on the phone. All this is on the download tab on the metamask site itself. Next, we just synchronize the wallet in the browser and on the phone.

We register, click “Start” and “Create a new wallet”. Come up with a password and generate a secret phrase. Ideally, the phrase should be printed out and saved somewhere. Let’s save it now in a file so we can send it to our phone to synchronize our accounts.

It will also be possible to restore the wallet and the funds in it on any device. Remember that funds are stored online, and the wallet acts as a browser.

Confirm the backup phrase, reproduce the word order and get to the wallet itself, which will look something like this (you will have “Ethereum Mainnet” by default:

Here everything is very simple, at the top of the current network, a little to the right access to the settings menu, the name (you can change) and the address of the purse in the current network.

Tokens are transferred to this address. If you made a transfer and did not see the desired coin in the list, then you just need to add it to the list by smart contract. Nothing gets lost, if you’ve specified the correct wallet address and network for the transfer.

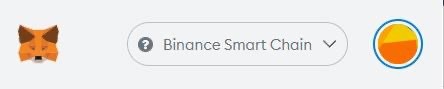

Maybe it’s a little difficult now, but everything will become clear in practice. Right now let’s add Binance Smart Chain (BSC) and Polygon (Matic) networks to our Metamask.

Let’s add a new network – Binance Smart Chain. The official instruction is here, and the recommended addresses are here. Or just copy and paste here the standard settings:

Network Name: Binance Smart Chain

New RPC URL: https://bsc-dataseed1.ninicoin.io

ChainID: 56

Symbol: BNB

Block Explorer URL: https://bscscan.com

If everything worked, the top will display the balance of BNB. To the wallet will need to throw $ 10-20 in BNB for transactions. Back to the phone.

The first time you start the application from your phone, select “Import using a secret phrase” and insert the secret phrase (I sent a letter to the phone and copied, do not forget to delete the letter with the phrase later, if you do the same) and the password. Exactly as we did in the browser add network Binance in the phone.

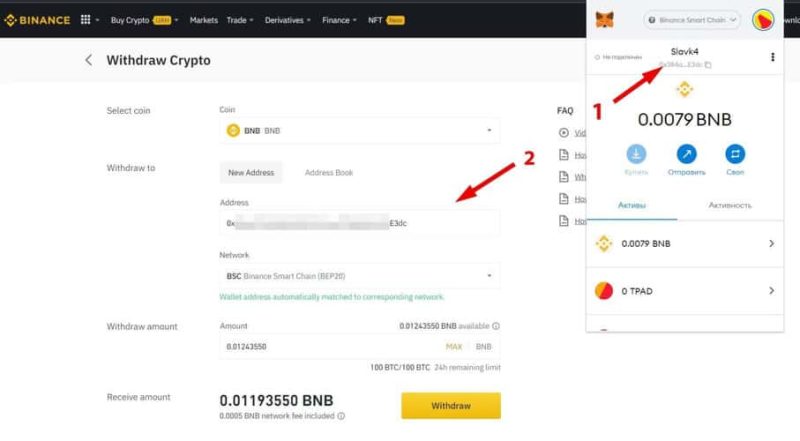

We see the same 0.0079 BNB. Coins (tokens) for the new device must also be added manually, their balance is synchronized from the network automatically.

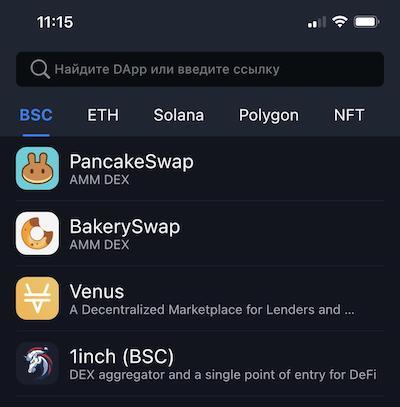

All cryptocurrency transactions that require a Metamask connection are conducted only through the app’s internal browser.

In general, having synchronization with your phone is not only convenient, but often necessary, for example, to buy up on a sharp drop. We’ll talk about how to set up notifications for the right coins later.

Add balances to wallet

Register on Binance if you haven’t done it already.

First, we need to fund Metamasc account with about $10 in BNB, which will be used for payments and exchanges (usually it will be something like 0.0008 BNB per transaction).

To do this, we buy a BNB on the binance, copy the address of his wallet (1) and paste it when withdrawing at the exchange (2).

Network BEP20 should be defined automatically.

When the withdrawal is once again will ask whether BEP20 is selected correctly. Click “Confirm” and send. In a minute we check, whether money reached the balance of a purse in the browser. In the same way we check whether this balance is synchronized in the application on the phone.

You can deposit money to Binance directly from Visa/Mastercard. In my case it is 0.8% for deposit and 0% for withdrawal. Commissions in other countries may be different and it might be cheaper to buy USDT (TRC-20) at one of the local crypto-exchangers to Binance account.

The address of your wallet for replenishment on the exchange can be found next to each coin, top menu Wallet -> Fiat and Spot -> Deposit (next to the name and balance). USDT is most profitable to deposit via Tron network, respectively, if you buy via exchanger choose TRC-20 network.

Please note that BUSD stabelcoin in Binance Smart Chain (BSC) network is transferred between accounts without commissions.

We buy BUSD and Binance without commissions, put them into a wallet in Metamask and for them already buy coins through exchangers (swap dealers), paying transactions in BNB. This is one of the most profitable options today.

It sounds confusing at the moment, but after the first couple of purchases everything will fall into place.

Tasks:

1) Install the Metamask wallet ta your phone and work computer.

2) Deposit some money in Binanace and buy BNB.

3) Add Binance network in Metamask on your phone and browser.

4) Send BNB (for $10-20) to Metamask account.

Adding a Polygon network and watching the first lunchpad

Just like we did with Binance Smart Chain, we will add a Polygon (Matic) network. We will need it for participating in some IDOs and buying coins, which work exactly on Polygon.

Likewise, it’s worth keeping the main MATIC coin for $5-10 for transactions. You can buy and transfer directly from Binance. Settings of the network itself take only from the official site – here.

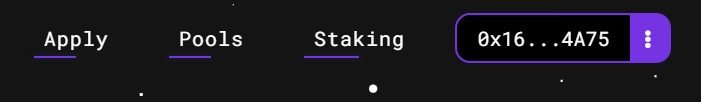

Check if everything is set up correctly by connecting the wallet to the lunchpad on Polygon – https://moonedge.finance. This is not the most popular platform, but let’s take it as an example, all lunchpads work the same way.

If the wallet address pops up at the top, it means it’s done correctly. If not, you will see a connection error either to the network itself or to the application (site):

Let’s take a look at the past launches on this site in the bookmark. We are primarily interested in the pre-sale price.

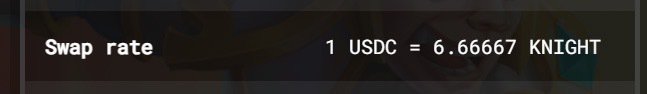

Let’s take the Forest Knight project (https://moonedge.finance/#/pools/forestknight) as an example. The current price (at the time of writing) on the market $0.34, or 3 coins for $1 (ie, only x2 of the sale). Capitalization of 42 million.

A good deal and not a bad entry point, considering that we did not have to invest and freeze money in MoonEdge technical tokens, there was no buy limit (allocation) and other risks.

That said, it’s worth bearing in mind that projects that have already collected investments at IDO have often passed certification (from CertiK in this case) and expertise from investment funds that have invested live money in them in the early stages. Let’s bookmark it for now, and later add it to the list of potential coins we’ll keep an eye on.

With money/stablecoins in hand, there’s no rush. It makes sense to set a lower bar and wait for an interesting price.

Let’s make some first purchases

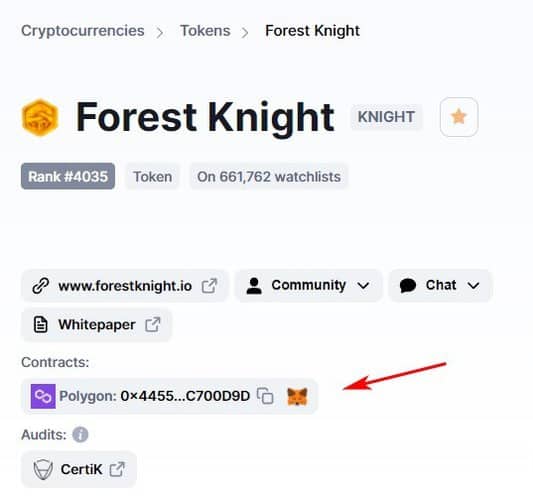

Let’s find a smart contract of the same coin from the last sale – Forest Knight on CoinMarketCap (type the name in the search) and add it to your wallet: https://coinmarketcap.com/currencies/forest-knight/.

Click on the metamask icon, a line with a new coin appears.

Then we have a choice, or connect the wallet to one of the exchangers, or change immediately inside the wallet by pressing “Swap”. Let’s see what exchangers are available for this coin:

So, we can register at Gate.io exchange and buy it there, or we can take it from exchanger right now by connecting purse to QuickSwap (Metamask in automatic exchange most likely will buy it there too).

I exchanged immediately inside the wallet, it looked something like this (made a test screenshot, because I bought it a little earlier).

Now let’s try an exchange in another network. Now it’s not so important what kind of coin to take, the main thing is to understand the principle of purchase. Let’s switch to Binance Smart Chain network in Metamask.

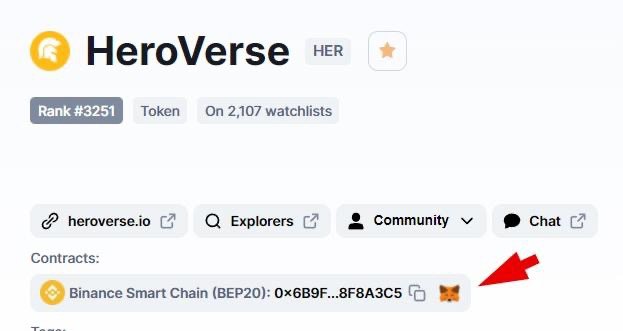

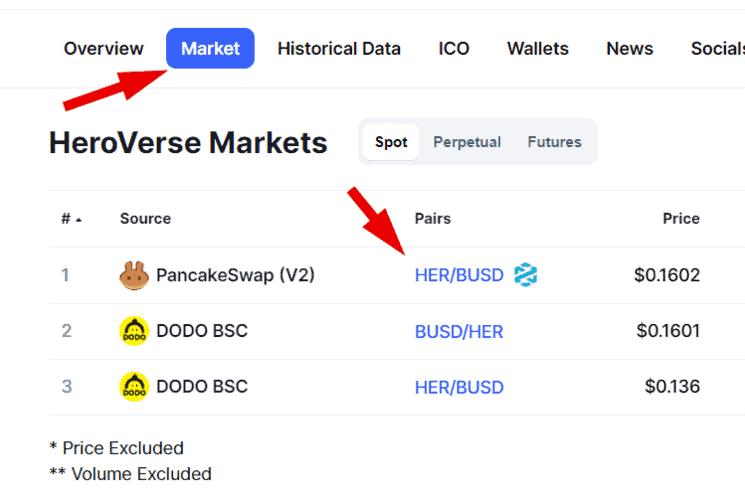

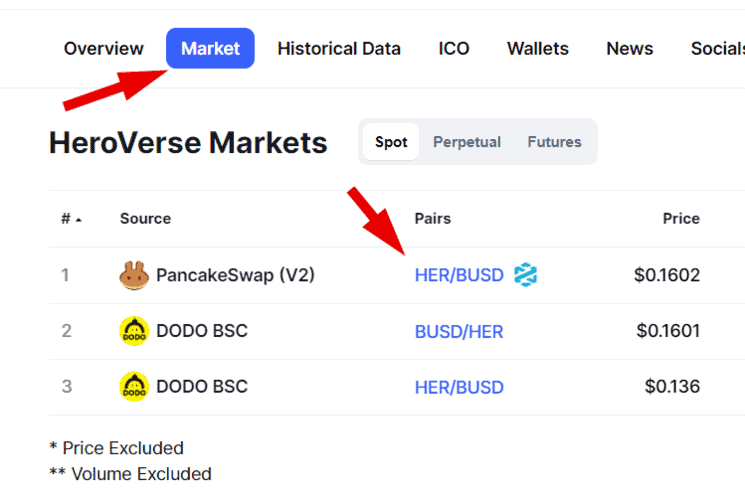

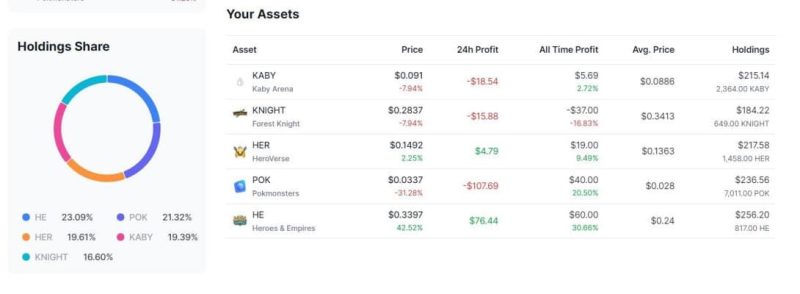

I took the Heroverse (HER) coin from the Game-DeFi sector as an example.

So the coin: https://coinmarketcap.com/currencies/heroverse/. Similarly, we add a smart contract to the wallet:

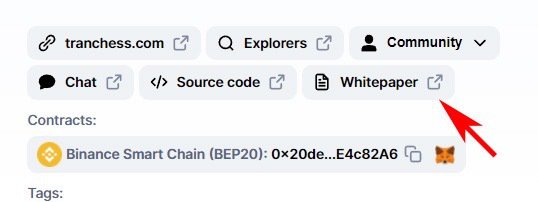

And look at which sites it can be bought. Important – never add smart contracts from unverified sources and always check with CoinMarketCap or CoinGecko. Most of the sad stories of Metamasca scams are the result of buying coins from fake smart contract addresses. Always be very careful where and what contract you add to your wallet and where you make the exchange.

We go straight from there by the link with HER/BUSD to PancakeSwap exchanger and choose what (BUSD) and what (HER) we will buy from. We see that the second coin is not found by default search. We insert the address of our smart contract and import the coin for exchange.

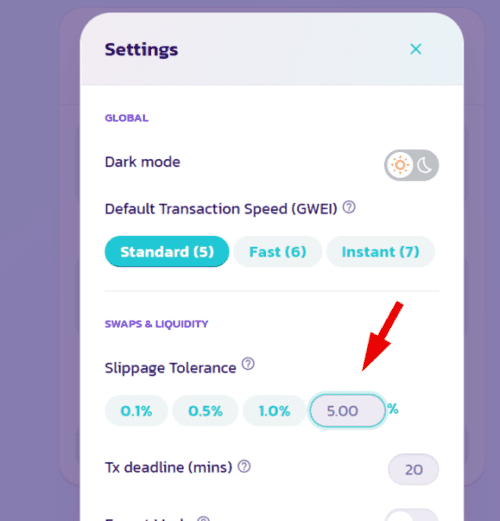

Then we need to enter the amount and confirm the current rate. If we get a message like Insufficient liquidity for this trade (this can happen because we buy coins for which there is not a large volume of trades), then we need to increase the slippage in the settings.

That is, make more marginal difference in the price at exchange. You can do this by clicking on the gear in the corner. 3-5% in most cases is enough.

Confirm the exchange and see that the coins were in the wallet:

I suggest you allocate, say, $10 and buy some coins from different networks (Polygon and BSC). Amount is catchy, you can reduce or increase it, but be sure to conduct operations to understand how the purse and exchangers work.

Tasks:

1) Add network and buy tokens on BSC.

2) Add a network and buy tokens on Polygon.

CoinMarketCap has a convenient sorting by ecosystem – BSC and Polygon.

What if we need to transfer from one network to another?

How do we then transfer coins from one network to another. If, say, we want to sell KNIGHT or MATIC and get back USDT seblecoins on Binance (from which we can then withdraw to the card)?

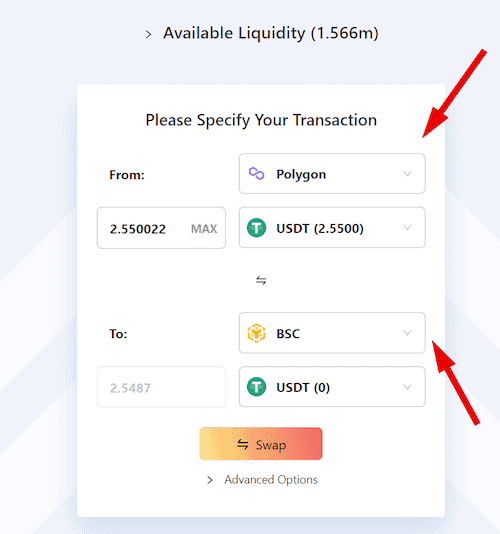

To do that we need a Polygon – BSC bridge https://www.xpollinate.io. It works the same way as the exchanger. Connect your wallet, select exchange networks, press Swap and wait for network confirmation.

If it seems complicated, then just change inside the wallet back to MATIC and withdraw them back to Binance, where you can already change to Stable Coins or withdraw back to the card in the local currency. Commissions in the network are small.

Now you can buy any coins in Etherium, Binance Smart Schain and Polygon networks, knowing the addresses of smart contracts independently of the listings on exchanges!

You can track the price history for unlisted coins using https://www.dextools.io.

For example, for a Heroverse coin: https://www.dextools.io/app/bsc/pair-explorer/0x9c6919cc72b532b944e9daef6c82805e69d05875

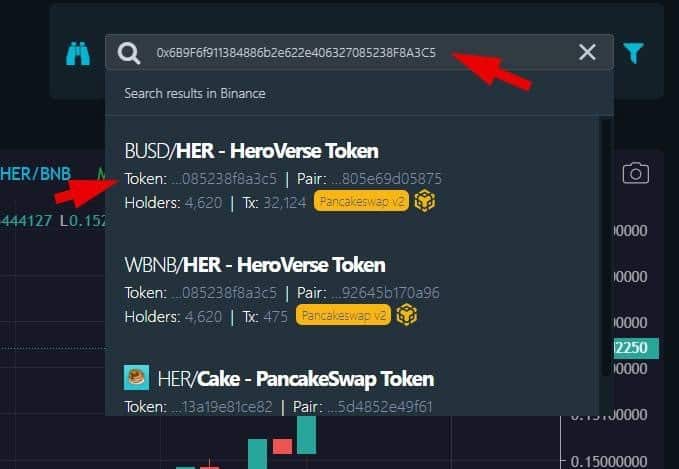

Be sure to check the contract address if you search by name, or better yet, directly insert the correct smart-contract address into the search:

The Dextools search is a breeding ground for scammers trying to sell tokens with similar names based on their fake smart contracts. Always copy addresses from either official sources or CoinMarketCap.

Working on the other blockchains

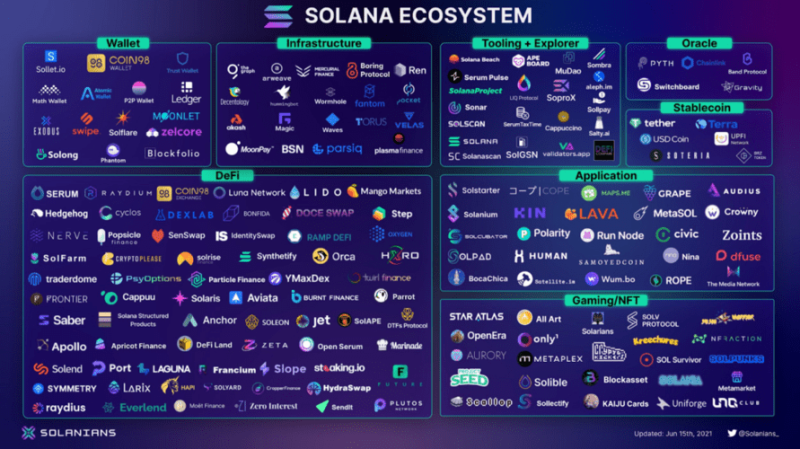

Not all networks are supported by Metamasc, but also blockchains that develop their own wallets and ecosystems separately – Solana, Near, Avalanche, Cosmos, Polkadot, etc. For example, the current composition of the Solana ecosystem:

And the composition of the Binance Smart Chain ecosystem:

That is, when we switch networks in Metamask, we are essentially moving from one ecosystem to another. You need to understand this when buying tokens for projects on one of the networks.

For the same Solana, we have to put our own wallet, the Phantom Wallet.

Generally speaking, the more projects with high capitalization working on each of the networks – the higher the value of the main token (in this case SOL). Buying tokens of projects on the SOL blockchain, such as Star Atlas, is as simple as we did before.

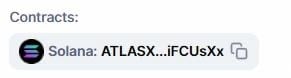

We set up a wallet, generate a secret phrase, add a smart contract to it, and make an application at available exchanges:

If previously we used PancakeSwap, the most popular exchanger on solana is Raydium. The principle will be the same.

Why is it important to know how to use it? Being able to choose projects on less popular networks you are already in more advantageous position than the majority of cryptocurrency buyers on the market, who sit and wait for new coin listings on exchanges like Binance or Huobi.

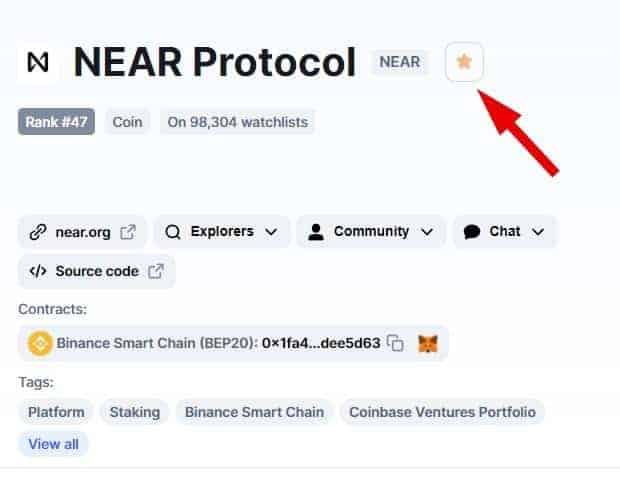

From personal recommendations – I prefer blockchains Near Protocol and Solana, and I’m getting their tokens bit by bit.

NEAR is an ecosystem that is actively developing now. Wallet on NEAR – here, the main exchanger (ref.finance) – here. Feature, by the way, is that wallets have addresses username.near. It is convenient.

Tasks:

1) Start a wallet on NEAR or Solana. Add $10 worth of basic coins (NEAR or SOL) for transactions.

2) Buy some coins of new projects on Near or Solana.

Cold wallets

Let’s not dwell here in any detail. Let’s say that if you came to crypto not for short-term speculation – get a cold wallet.

Personally, I recommend and use SafePal. Yes, it takes a long time to deliver, but all very well done and the wallet itself and the application + you can order a metal plate to save the passphrase. No fakes and marriage. A device which is a pleasure to own and worth the wait. If you do not hurry anywhere – choose it.

Among other things, support for BSC, ETH, Polygon, Solana networks. All of these are easy to buy, change, and store on the fly:

An alternative is Ledger (Nano X or Nano S). When buying, be sure to contact the official dealer – https://www.ledger.com/reseller. Alas, but this is the most popular device for fakes and phishing attacks. Choose a company on the official website, buy, check the packaging/holograms, only then connect and configure.

As you have already understood working with Metamask – the funds are not stored on a physical medium, program or browser. Tokens are stored inside the blockchain itself, and it is these tokens that are already accessed by a hardware or software wallet.

All important data for accessing your funds is inside the wallet, not the actual number of coins. Having a hardware wallet protects access to your assets in the first place.

Even if the wallet itself is physically lost or destroyed, we can restore the assets with a secret phrase by importing it into another “browser”-wallet.

Market and Expectations

What’s x2-x5 on the waiting list at x100 after the release of the game itself, given the current hype on NFT and Play-to-Earn? Picking up an interesting project at a market price after the boom, the first “candle” has passed, and the release is scheduled for the near future is a good idea.

It’s not about running out and picking up “at all” something specific, but rather about the logic of what and how we look for and buy.

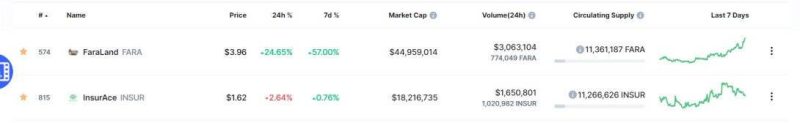

We need potentially strong projects with marketplaces, low current capitalization (up to about 10M) and daily volume (up to 2M), normal investors, understandable teams. In a marketplace where the price has already settled after the first trade and speculation, and the project itself has a launch and marketing routine underway.

To buy this or that coins in the portfolio just in the moment, where it isn’t interesting for anybody now.

But let’s take the opposite example, the super successful game Axie Infinity (AXS, one of the first play-to-earn games). Let’s find it on CoinMarketCap and select ALL (all-time price chart):

The token of the game originally went on the market on the lunchpad from Binance – here. The price on 2020-11-04 was 1 AXS = 0.00377358 BNB. Let’s look at how much BNB was worth then and convert to dollars per coin. $29 per BNB coin, or about $0.11 per token at the start.

After the Launchpad, anyone could buy them in any quantity at up to $0.5 per coin for the next three months and up to $1 for six months.

The current value of AXS at the time of writing (late 2021) is $120. That is, even if we missed the pre-sale, missed the first bidding, but decided to enter the project at x5 of the starting price, say $200 (that would be 100 $0.5 coins), we would have $12,000 on our balance today. Yes, twelve thousand dollars on an investment of $200. In less than a year.

That’s the way the crypto market is – high risks and high profits.

In general, we have three main ways of selecting projects – re-selling and buying at the current market price, participation in pre-sales before the market entry (IDO) and buying by the analysis based on the trading history, which has already been in the market.

Capitalization Analysis

Let’s talk in general about the analysis of tokens, as well as what to pay attention to first. The principle will be the same for all categories – finances, games, security, wallets, launchpads, etc.

For investment with the purpose of “getting X” (to multiply invested), we are interested in young projects, approximately up to 10M capitalization (Market Cap aka MCAP) and in the area of 0.5-2M daily trading volume (Volume 24h).

The logic is very simple. Let’s open one of the categories, for example, exchangers/farmers – https://coinmarketcap.com/view/decentralized-exchange/. Well-liked Pancake has capitalization of $4.5 bln, and similar in functionality, but working faster and more stable – 1inch – estimated at $580 mln and $3.2 per coin.

That is, reaching a similar capitalization of $4.5 billion. 1inch should be worth $28 per coin (about 30% more), which means it is undervalued against a similar top project, right now. The figures are approximate, but can be calculated more accurately. Accordingly, to take 1inch in the hope of growth of 15-25% – a normal, working idea.

Market Cap (MCAP) – the number of issued coins multiplied by the current price.

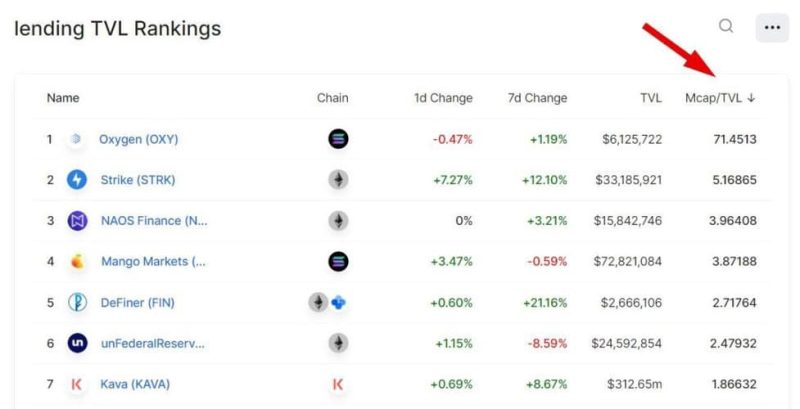

Total Value Locked (TVL) – dollar amount of assets that are locked as collateral (farming, staking, rewards, etc.).

The MCAP/TVL ratio of projects is best viewed at https://defillama.com/.

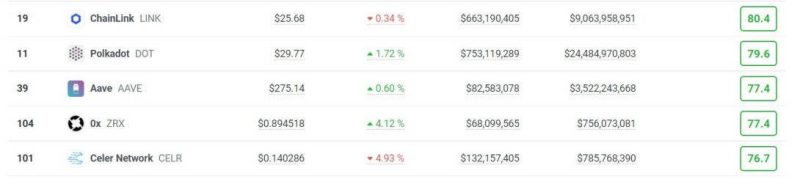

As an example, below is one of the samples from https://twitter.com/Gems_Radar. You can clearly see how different the market capitalization (MCAP) of even new projects in the financial sector can be from the total value of the assets in them (TVL).

Correlation of low capitalization with high value of assets frozen in it is a sign of a project where money is being poured in. And where the money goes, that’s where the growth is. Why money goes to this project and not to another needs to be understood and analyzed in each case.

Tasks:

1) Sign up for CoinMarketCap.

2) Add the first 5 coins to the Watchlist (asterisk next to the name).

Technical analysis

It is convenient to use TradingView for technical analysis. Always use support and resistance levels and mark critical levels.

The levels will help you determine the optimal buying zones. Don’t rush to buy right away, draw levels, look at the zones, wait for the price and get to the right amount for each position in the portfolio.

Tasks:

Go to the Trading View website, learn the interface. Learn to draw levels.

How to make research coins and projects?

Where to look and what to read first? The Whitepaper is basically the first place to start. And the more technologically advanced a coin is, the harder it will be to get into its fundamentals.

Let’s compare the whitepaper of Karura and the whitepaper of Plant vs Undead. We should at least understand what the idea behind the project is, what benefits it has, and why it’s needed at all.

If it’s a swappable, then try to change something on it. There is a game in development – look at the gameplay, assess the overall technical level. If the wallet, then put it on and try it yourself. Often at this stage you can see how raw the product is and whether it exists at all. Too often it happens that everything looks much better on paper.

Be sure to check out the official telegram, Twitter, and announcements. It’s not so much the numbers as the activity itself, both developers and people who are interested in this project.

Try to find an alternative opinion or a cross-section of the market and sectors. For example, I have a subscription ($39/month) at baserank.io, which generate rankings based on analytics from several companies. The second rating worth following is SIMETRI (their free newsletter is also worth subscribing to).

Investigate what crypto funds are investing in. Such as Spartan Capital, Alameda or Grayscale. If you see that a coin entered the market with the funds’ support, google who they are, what niches and projects they invest in, look at other projects. Even if you build a portfolio right now from Spartan’s investment list, it will be as good as the top youtube investors at the distance.

Large fund portfolios:

AU21

ArkStream

Basics

Brotherhood

CryptoDorm

CSPDao

DutchCrypto

Tasks:

Walk through the projects in which large funds have invested. Try to analyze the release dates, current prices, relevance and degree of readiness of some of them.

Staking

Almost all coins that were picked up at an early stage of product development can be sent to steaking (interest bearing deposit). The terms and duration of steaking are always stipulated in advance. In different spheres, the interest on invested money may differ at times.

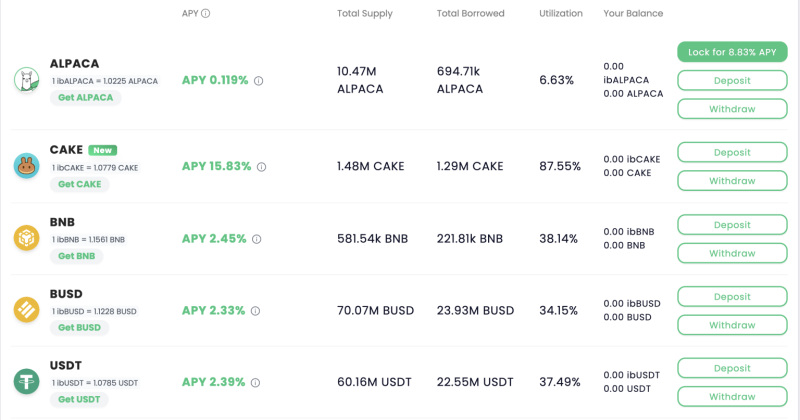

For example, the staking percentage at AlpacaFinance.org. Taking into account fluctuations in the exchange rate of the token, this is not much at all.

What is the difference between an APR and an APY, let me quote google a little bit:

APR is the annual rate charged for receiving or borrowing money. An APY takes into account compound interest, while an APR does not. The more often interest is compounded, the greater the difference between APR and APY. Investment firms usually advertise APYs and lenders usually advertise APRs.

The gaming (GameDefi, Play-to-Earn) sector has different risks and different percentages. And since we were picking up such coins, it’s logical to see what percentages are given here. You shouldn’t take a coin just for the sake of putting it into stacking at high interest rate. It’s more of a nice bonus if we plan to keep it in months rather than days.

In general, everything is very simple, we have a coin (whether ALPACA or POK). Find the site of the project tab Farm or Pool, connect a wallet and put it on deposit. Accrued on top will be the same coin at a specified rate. In this case, at 80% APR.

TVL – the dollar equivalent of the amount already in the pool for this particular position. Is it a lot, or not, on the background of the fact that the daily rate of the coin may do +-20% the question is open. In any case, it’s better than just keeping tokens.

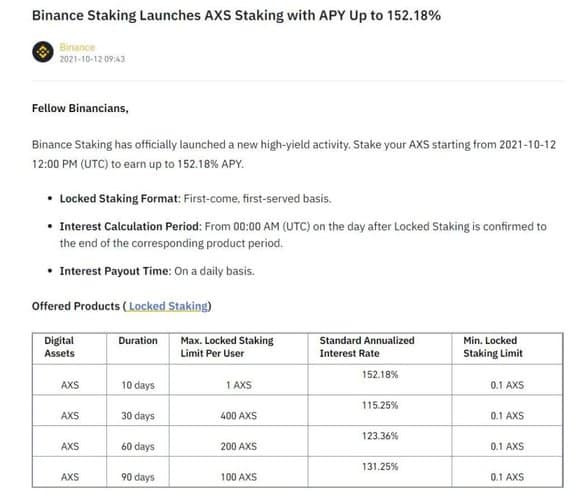

Or here is an example of how Binance hype on popular AXS coin, offering it in stacking at 152% APY. A very good offer if we hold Axie Infinity for the long term. And this is what their native stacking looks like – here.

If you have set a minimum period of shaking (24 hours or 10 days, etc.), and you need the coins sooner, the withdrawal will most often happen without interest, or with a penalty of some percentage.

Always look carefully at the terms of accrual and penalties for early withdrawal.

In general, the “acceptability” of interest in staking is very much dependent on how long you’re willing to hold the coins.

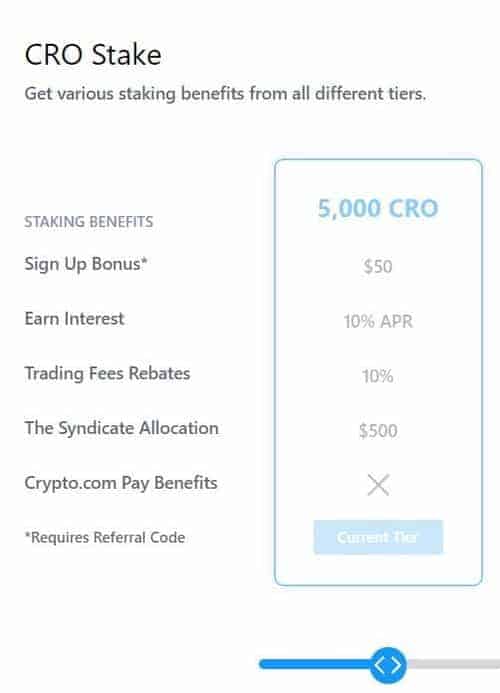

Let’s take a more serious example. I have CRO coins locked up (if I’m not mistaken for three months) at 10% APR and I don’t see a problem with low interest rates, and I’ll keep extending them anyway, since I’m keeping them for a year, two months, and beyond.

Why not if crypto.com is a global project that works on bringing crypto to the masses and has F1 and UFC as partners and quite good prospects in general. Overall, a separate portfolio of tokens from major CEX exchanges (centralized) and DEX swaps (decentralized) is a very logical idea.

I hope it is clear with the steaking, in fact, it is a deposit with a floating interest, which depends on the number of coins in the staking.

Tasks:

Put any of the coins you bought earlier into the staking.

Farming

Similar to staking, but with different terms and interest. We maintain the liquidity of new coins, receiving a reward in return. The terms and conditions are often much better than Stacking, but you’ll need more Stablecoins (to provide that very liquidity).

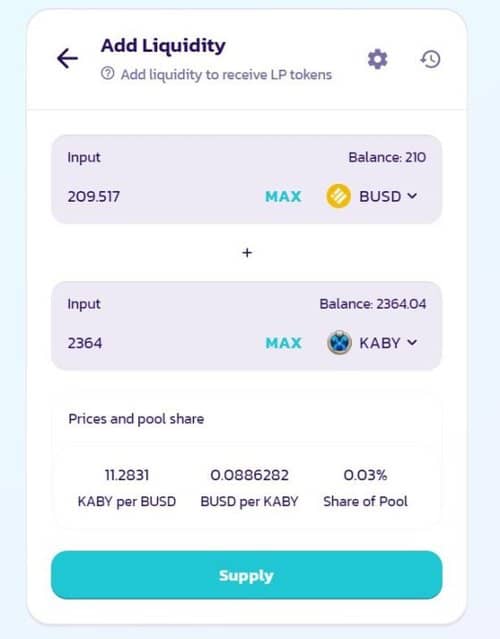

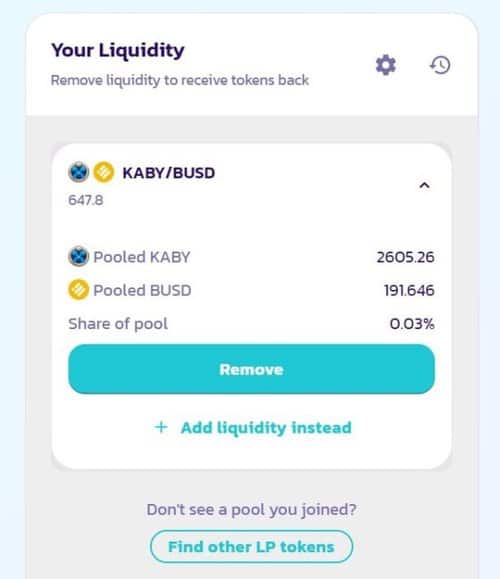

Let’s look at the example of Kaby Arena Coin, which I took earlier. The principle will be the same everywhere. We add a bunch of two coins, often a project token and sablecoin (KABY-BUSD), and get LP (Liquidity Provider) token from exchanger (eg PancakeSwap), which we add back to farm in stacking. It seems a bit complicated, but in fact it is quite simple.

Go to the site. Go to the App and see what the farm offers (LP Farm).

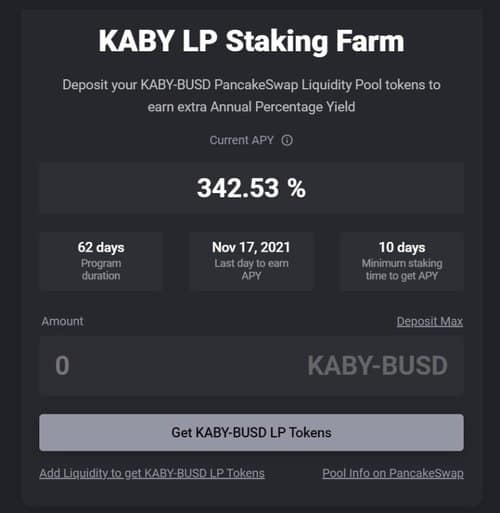

Conditions for participation:

We are offered to put KABY tokens secured by BUSD Stablecoin at 342% APR until November 17, 2021 (the last day of farming). The minimum term of staking is 10 days.

Correspondingly, if we bought KABY tokens for $200, we would need $200 more to secure them in BUSD in order to get LP-tokens for staking at specified percentage.

Absolutely the same will work for all pools and lunch pads that need liquidity. It is needed to exclude price jumps and complicate speculation for big players on the market, which is especially important for coins which just enter the market.

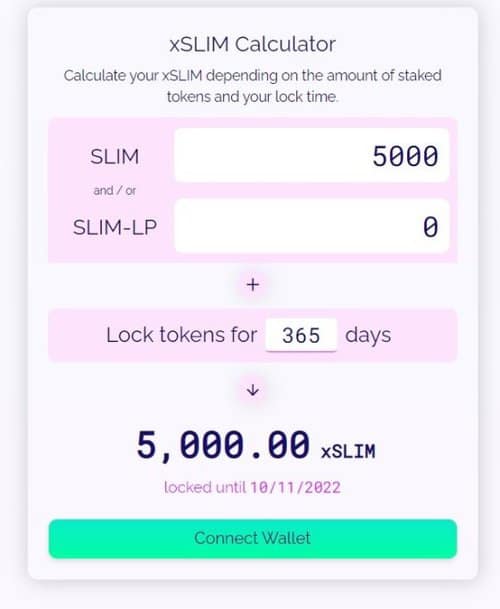

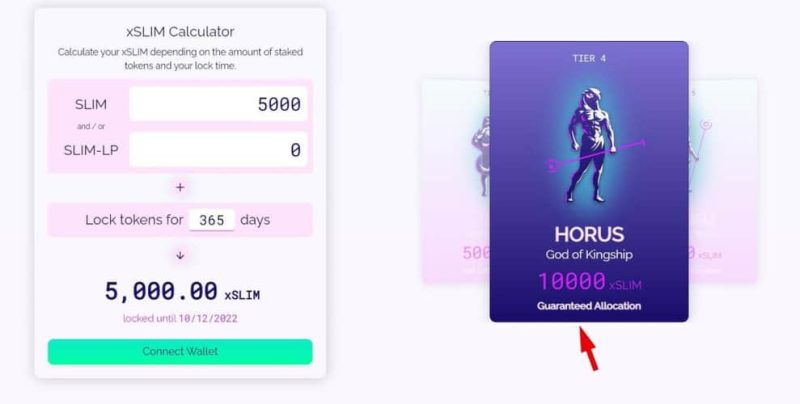

Another example from Solanium.io Lunchpad. By adding liquidity tokens (SLIM-LP, that’s SLIM+SOL locked to Raydium, analog of PancakeSwap for Solanium network) we get an increased amount of base deposit.

In any other network – NEAR, Solana, Polygon – everything will work exactly the same. Once you understand the mechanics of BSC and pancake, you can add liquidity to any project or network.

Let’s go back to the KABY site and click on “Get KABY-BUSD LP Tokens”, after which we will be redirected to the pancake:

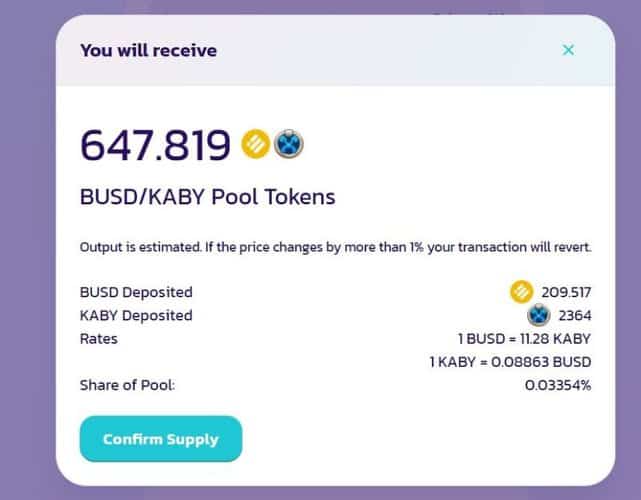

We equalize the amount of BUSD and click Supply. Confirm the transaction and we get Cake-LP tokens which we only need to add to the pool.

We return them back in the same way, take them out of farming and take the liquidity through the pancake.

This is what I got after a few days (the Withdraw & Harvest button is also here). Plus +139 coins in 5 days. Pretty good, considering that anyway I wouldn’t sell them until the game comes out (where the main pamp will be). In general, it makes no sense to withdraw them from there until the end of farming November 17.

If you take something in your portfolio, check to see if you can put it in steaking/farming. It’s a real bargain at a distance.

Tasks:

Create an LP token for a small amount and try putting it in a farming.

Participation in presales and IDOs

By now we should be able to buy and resurrect coins, add them to stacking/farming, and understand liquidity and LP-tokens. There’s still talk about pre-sales and IDOs, where we can buy coins even before smart contracts are in place. These are the earliest stages where the biggest money is made.

The mechanics are quite simple. There are platforms (lunchpads) that collect investments for the launch of new projects. This money most often goes to maintain the liquidity of the tokens at launch. The volume (allocation) per user is calculated from the number of lanchpad coins they hold.

The scheme is as follows:

1) We buy lunchpad coins.

2) Get the level (Tiers or Levels) and the volume, which we can redeem (allocation) according to the number of these coins.

3) Redeem coming to market projects.

4) Sell at the start (usually about x3-x10 from invested), or hold the coin, and wait when the price will go higher.

The usual practice is to buy token at presale for $0.01 and give it away at the market for $0.1.

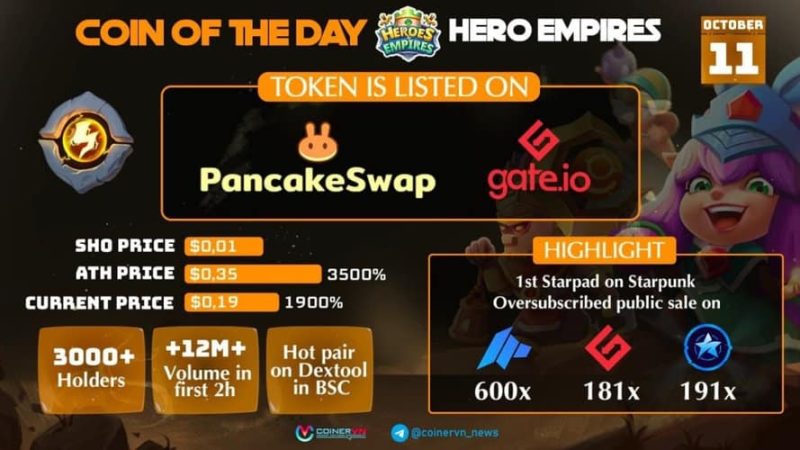

Example of such start – presale price $0.01, exit price at PancakeSwap & Gate.io reached $0.035, the average price is $0.19. I think, you don’t need calculator to calculate a yield. The current market price is https://coinmarketcap.com/currencies/heroes-and-empires/. I took it “off the market” after IDO at $0.24.

It all sounds megaprofitable, just until you go to see how much the lunchpad tokens cost and what the minimum allocation conditions are.

Good stats on sites are collected here – https://cryptorank.io/fundraising-platforms, start there. The ATH ROI (All-time high Return of Investmens) column shows the average peak returns for completed projects. Current ROIs are average “X’s” at current prices, TGEs are the number of projects released.

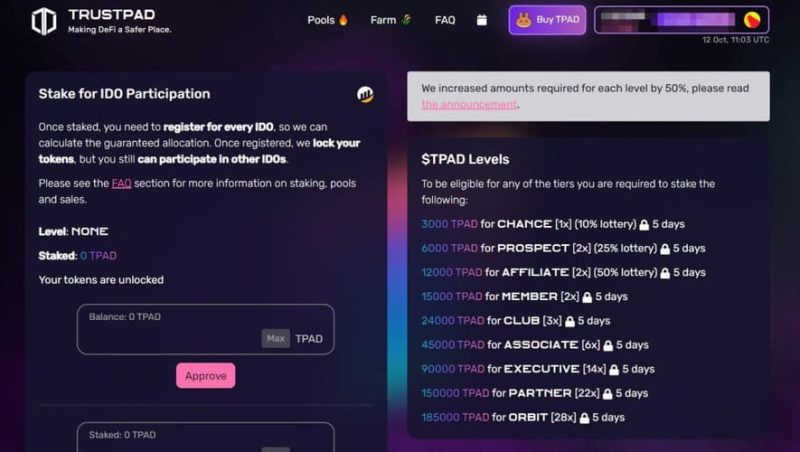

Let’s take TrustPad.io as an example. The principle is the same everywhere and at the same time we will talk about where it is too late to go, where you should wait and what is just “on the rise”. We go to the main page, we see active and upcoming Sales, as well as Levels and Pools sections on top.

I should say at once – to reserach projects that go to IDO only if there are plans to keep the tokens of these projects for a long time. If the goal is to make x3-x10 and go back to seybolcoins before the next sale, then you can take anything you have enough allocation for.

Also, I advise you to calculate how many coins you need to buy to get a guaranteed allocation. Basically, it makes no sense to invest in Lunchpad tokens by flying past seals, participating in the lottery.

So, the Levels tab.

From it we understand that we need to give a certain amount of TPAD coins to the steaking and get a level (Levels). Respectively, if we now go to the pancake and buy, say, 12000 TPAD coins and put them into the shaking, then our level will be AFFILIATE and we will qualify for x2 allocation with a 50% chance of getting into the sale (50% lottery). That is 50/50 – we may or may not get into a presale.

That’s why there’s such a thing as a guaranteed allocation at every launchpad. Here it starts at 15000 TPAD and MEMBER level.

On Solanium.io launchpad, guaranteed allocation starts at 10,000 SLIM coins. Always look for conditions by level and allocation before you buy launchpad coins.

But let’s continue about the allocation, you can see it by going to the questionnaire of one of the sales:

To participate in some sales you will need to KYC (upload your passport photo), often to confirm that you do not reside in a country excluded from the seals.

Base Allocation: 1x = $46, this is the amount which will be available to those who want to buy mini-level coins. If we bought 15000 TPAD (that is 0.4*15000=6000$ at the moment of writing), we can buy x2 or 46*2=92$ worth of new coins. The advantage is always with those who hold more luncheapad coins.

From here on, everything happens exactly the same way. We pay the allocation, add a smart contract in Metamask, and get coins for it. We sell the coins on Pankake (or other swap market where the listing will take place) at the time of launch.

This is roughly how it works when no one wants the project on the market:

On the Pancake they add liquidity and all sell by fixing the X’s with the first candle. Who coins came earlier to x10, who later around x3. There is always time to give to the market and the only question is how much yield is obtained.

If we see that the project is interesting, has prospects and it was undeservedly rolled by speculation – pick up at the bottom of x2-x3 candles from presale. This is also normal practice.

Many launchpad tokens are now overvalued and extremely expensive to enter. The same SLIM (https://solanium.io) is now worth about $2 per token or $20000 for a guaranteed allocation. As of this writing, I personally hold tokens from nftpad.fi (from TrustPad founders), a site which is just starting up and already made its first sales.

What to look out for when you have the budget:

1) https://polkastarter.com/

2) https://www.solanium.io/

If you’re not sure or it’s hard to figure out, go to Polkastarter (POLS). It’s the gold standard for launchpads right now. For relatively small budgets of $1-5K, there are great options too. Yes, it’s not the most promoted sites now, but the projects are still giving “x’s” and while there is an opportunity to go inexpensive, you need to use.

The equivalent in dollars for a minimum guaranteed allocation is given at the time of writing:

1) https://tronpad.network/ – 50,000 TRONPAD or about $3,000

2) https://launchpad.seedify.fund/ – 1000 SFUND or about $3,800

3) https://bullperks.com/ – 1000 BLP or about $300

4) https://bulknetwork.xyz/– 10000 BULK or about $250

Be sure to see which network is running the token sale. If you have a $50 allocation and your token is issued on Ethereum network, you may have a situation where the commissions for buying and selling these tokens will exceed the value of the allocation itself.

Transactions on ether are very expensive now, try to opt for BSC, SOL, Polygon coins.

Having some money in IDO is the right decision. Even with basic tokens and allocations. First of all, tokens of popular sites are growing in value, and secondly, it’s an opportunity to pick up coins much lower than the market with minimal risks.

Portfolio separation

To begin with (if you haven’t already) be sure to register on https://coinmarketcap.com and also put the app on your phone. I like to put all coins in one portfolio to keep track of their total value, and I also keep a Watchlist where I add the coins whose prices I’m keeping track of.

Create a new watchlist and now the coins that are marked with an asterisk will be placed in it:

Portfolio and watchlist are synchronized with the coinmarket app on your phone and now we’ll get notifications when the price of the coins we’re interested in changes drastically. That’s handy.

I don’t think we need to go into detail here. You create your first portfolio and first watchlist, and add a few coins to see how it all works.

Next, go ahead and register at https://dropstab.com/. Here you can create portfolios and share them separately via a link. In general, I prefer to keep track of all the portfolios by sector there.

Similarly for other sectors – games, finance, wallets, blockchains, lunchpads, technology. Below I’m only making recommendations for my portfolios to start with, and if you want to build something similar, be sure to recertify and remember that the crypto market is extremely volatile and the responsibility for certain investments always lies only on you.

How to fix profits?

I prefer the following options, especially on portfolios from the red zone that move very quickly and sharply in token prices. If we see that the portfolio sharply made x2 – sell half of it and return that portion back to stack coins.

That’s it, now we consider that we got the rest of the coins for free, and it’s basically the same whether they fly away or sink to the bottom.

If it makes x3 – sell 2/3. We return one part of it to Stable Coins (USDT/BUSD/USDC), and rebalance one part by buying tokens from “green” portfolios, which are less volatile and more profitable over long periods of time.

We don’t sell at all, full HODL – we wait until one of the projects flies an ace and pays off at all ten times. That’s also quite likely.

In general, we always try to go from more risk to less risk, not the other way around. Do not forget to fix profits – growth is not eternal. Just as there is no such thing as a complete breakdown. The spot market will always forgive even bad deals and entry points, the main thing is to have a little bit of self-control.

What risks should be considered when investing in crypto?

I prefer the following options, especially on portfolios from the red zone that move very quickly and sharply in token prices. If we see that the portfolio sharply made x2 – sell half of it and return that portion back to stack coins.

That’s it, now we consider that we got the rest of the coins for free, and it’s basically the same whether they fly away or sink to the bottom.

If it makes x3 – sell 2/3. We return one part of it to Stable Coins (USDT/BUSD/USDC), and rebalance one part by buying tokens from “green” portfolios, which are less volatile and more profitable over long periods of time.

We don’t sell at all, full HODL – we wait until one of the projects flies an ace and pays off at all ten times. That’s also quite likely.

In general, we always try to go from more risk to less risk, not the other way around. Do not forget to fix profits – growth is not eternal. Just as there is no such thing as a complete breakdown. The spot market will always forgive even bad deals and entry points, the main thing is to have a little bit of self-control.

What cryptocurrencies can I buy now?

BNB

A top-3 coin (after bitcoin and ether). Unlike ether, this crypto is actively developing in all directions.

Binance has long been building an ecosystem in which everyone will find useful for themselves: an exchange, passive income, DApps.

In addition to its fundamental value, Binance Coin has a number of manipulative mechanisms:

Conducting Launchpad. Provokes investors to buy BNB and hold it on their balance sheet. The mechanism is well established, especially during periods of market volatility. As soon as Binance clicks the “launch a new Launchpad” button – a buyer of the coin appears on the market.

Binance Coin goes up, investors count the profits (especially the head of Binance – CZ, whose fortune is estimated at $96 billion).

Aggressive burning of BNB. Perhaps the mechanism will soon replicate ether’s (discussions are underway)

Binance is actively pushing ether. Funds to develop new projects on the BSC network are a prime example. BNB coin has excellent prospects.

Ethereum

The second system coin on the list. Ethereum is a key coin for many projects. There are many applications running on this platform. The BSC is essentially a fork of the Ethereum network.

Ether as well as bitcoin can act as an indicator of the crypto market. It is often used to evaluate the altseason (ETHDOM index).

The project has built an ecosystem around itself, which supports it and helps in periods of cryptozyme

The coin already has a capitalization of $300+ billion. ETH’s role in many DApps makes the coin a safe investment. However, of the reasons that could affect ether’s growth in 2022 – the Eth 2.0 update stands out.

Ether Outlook:

Update 2.0. Transition to PoS, no mining. This will speed up the network.

This update is the one they are betting on. One whale has tens of billions of dollars worth of ether locked up in his wallet, which is not available until the release of the Ethereum 2.0 update.

Tough community. The ether community can be compared to the bitcoin community. The two are developing in parallel, though ETH is focused on the DApps sector. The coin has good levels of exchange rate support as well as a strong developer community (this is more important than investors in the long run).

The development of the network will allow the crypto to stay afloat and gradually move towards the cherished goal of $10,000 per coin.

Ether is fat. The top cryptocurrency, which has already shown that it can handle competitors (among which EOS, in 2018-2019, stood out the brightest). In the long run, ether looks solid.

It is unlikely that anything will move this coin from the top 3 cryptocurrencies. Competition between BSC and ETH is possible, but the top three are likely to remain the same

Risks of investing in ETH:

The failure of ether 2.0. There is no guarantee that the update will be successful. Its release could be delayed again. This is a major step for the project and failure on Eth 2.0 could be critical

Competition with BSC and other projects. Although it has been able to deal with these threats for a long time – ether and BSC have a lot in common. Technically and marketing-wise, BSC looks even better.

But ether was the first among effective DApps solutions, and therefore it will remain so in the minds of users. This follows from the main law in marketing: the law of leadership.

DOT

The project is focused on the creation of a parachain network, working in the Web 3.0 segment. Polkadot is one of the “ether killers,” which is unlikely to become a killer, but will still occupy its niche.

Polkadot’s prospects:

Network expansion. It is built on the principle of auctions. The entire community takes part in the voting. If the project you voted for gets

PolkaDot power – expect a reward in the form of tokens from the winning project.

New projects will appear on DOT’s parachain capacity. The more interesting and promising the projects in this network – the higher the interest of investors in the DOT native token.

Risks of investing in DOT: Cryptowinter. Projects in the DApp segment may be particularly affected.

Competitive struggles. Competition is particularly intense in this sector of the crypto economy. A team misstep can destroy a project.

ETH 2.0 would render DOT useless. Competitor projects will survive for a while and give X’s to their investors, but globally it’s a road to nowhere.

LINK

Chainlink connects blockchains and other data hubs from different domains so that this data can be put to work. LINK works on the principle of oracles

LINK Perspectives:

Expanding partnerships. The most important thing about the project, as partners act as “data providers.” Partnerships with the financial monster SWIFT are important, as is the Google Cloud.

Growing business interest in blockchain. LINK can act as an ideal “bridge” for the transition to the world of cryptocurrency. Easily integrating and transferring data from different systems is a promising direction for the entire 21st century.

In addition to the correct use of the data – it has to be mined initially. LINK makes it possible to get any information (from offline and online)

The risks of investing in LINK: Competition from other projects. For example DIA. Plus, related projects.

NEAR

Another platform for launching applications. The team, by the way, is also from the CIS. The much-talked-about project of the second part of 2021.

NEAR Protocol prospects:

Top crypto funds in the project.

Own stimulus funds for the development of applications on the network.

Technical development (from the last one – new steaming model).

Marketing activity.

Risks of investing in NEAR:

Active development is underway right now, but whether the project will maintain its momentum is a question. Smaller projects are known to be easier to scale. NEAR already has a large capitalization of $12 billion

Competition.

CAKE

The native token of the PancakeSwap platform. Used on the platform for lotteries, NFT, voting for project development.

CAKE Prospects:

Growth of the platform as well as the DeFi segment. One of the most profitable trends in crypto in 2021.

PancakeSwap’s working platform is a quality product that enjoys

Binance support. At least indirectly, as BSC network coins are traded on Pancake.

Risks of investing in CAKE:

DeFi trend breakdown.

Competition. Much depends on the struggle between ether 2.0 and Binance Smart Chain.

FIL